KeyBanc Capital Markets Internship

advertisement

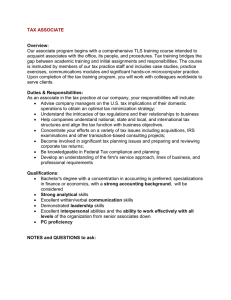

JOB TITLE: KeyBanc Capital Markets Institutional Bank Summer Associate ABOUT THE JOB (JOB BRIEF) The Investment Banking Summer Associate Program is a 10-week program designed to offer our Summer Associates a real life experience and a comprehensive overview of what investment banking involves. Summer Associates will be placed in one of the following industry or product groups: Industrial, M&A, Healthcare, Technology, Energy/Power, Consumer, Real Estate, Public Finance, Leveraged Finance, Equity Capital Markets, Debt Capital Markets. Reporting to the Summer Associate Program Manager and the Industry/Product Group Segment Head, with daily direction provided by industry/product segment junior banker(s), the Summer Associate plays a key role in supporting the day-to-day operations within KeyBanc Capital Markets (“KBCM”). The responsibilities of a Summer Associate are similar to that of a fulltime associate, working on a variety of client and deal assignments throughout the summer. The on-the-job training will be complemented by a formal 1 day training program, final case study presentation and social events that will help our Summer Associates to develop a broad range of relevant investment banking skills and knowledge of KBCM. Summer Associates in KBCM act as the day-to-day leaders for analytical support, including financial statement analysis and model development; valuation analysis; industry research; and the preparation of various presentations and documents including descriptive memoranda and management presentations. Summer Associates interact daily with other bankers and clients, prospective buyers/money sources, attorneys and accountants. ESSENTIAL JOB FUNCTIONS Build a trusted relationship within the assigned group and with other product partners within the organization. Develop junior bankers by serving as a teaching resource and through the delegation of appropriate work streams. Review, edit and refine financial models through a demonstrated proficiency in corporate finance and accounting theory. Perform valuation analyses on public and private companies by using public comparable company analysis, precedent transaction analysis, leveraged buy-out analysis and discounted cash flow analysis. Work with corporate finance investment bankers and product partners on M&A, strategic corporate finance and capital raising transactions. Prepare and present marketing materials used in client meetings, covering topics such as strategic alternatives, capital markets activity and general corporate finance. Take responsibility for pitch book and presentation development; develop persuasive arguments based on the data gathered by analysts, both conceptually and through client presentations. Generate ideas and analytical materials under the guidance of senior bankers. Maintain communications with team members and product partners. Demonstrate the Key Values - Teamwork, Respect, Accountability, Integrity and Leadership. QUALIFICATIONS Currently completing an MBA from a leading program. 2-3+ years of investment banking, transaction support services, consulting or private equity industry experience. Undergraduate degree in Business (Accounting, Finance, Business Admin, Economics, etc.). Strong quantitative and analytical skills, including financial modeling and financial statement analysis. Exceptional written and verbal communication skills with specific ability to communicate concepts and ideas concisely. Team player with a positive can-do attitude and desire to be part of a close-knit group operating in a stimulating and fast paced environment. Ability to comfortably interact with clients in a professional and mature manner. Highly organized, detail oriented, proactive and resourceful. Exceptional critical thinking, problem solving ability and detail orientation. Proficiency in Microsoft Office Suite (Excel, PowerPoint and Word). KeyCorp Internal