Finally, given that the ASX corporate governance principles are a

advertisement

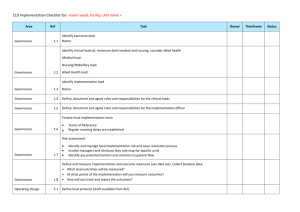

Company characteristics and compliance with ASX corporate governance principles Authors: Tek Lama and Warwick Anderson (corresponding author) [This is a final pre-publication draft deposited to meet University of Canterbury requirements. The paper may be read in its finalized format in The Pacific Accounting Review volume 27, issue 3 pp373392] Abstract Purpose: This study examines whether company characteristics determine the structure and composition of a company’s board. In particular, it investigates the three board-design choices that Australian listed companies make in the context of ASX corporate governance principles (published in 2003) where they are allowed to depart from the recommended best-practice board structure if the departure better serves their unique board and governance requirements. Design/Methodology: A logistic regression is performed on a cross-section of data, averaged over the years 2004 to 2007, for 258 ASX listed companies, employing the company variables of size, age, leverage, ownership concentration, profitability, liquidity, price-earnings ratio, market-to-book ratio and cross-listing. Findings: The study finds that size has a strong, statistically significant impact on all three principles. Ownership concentration, price-earnings ratio and age have statistically significant impacts on the likelihood of compliance with at least one principle, but have no consistent influence on the remaining principles. This finding supports the underlying philosophy of the ASX Corporate Governance Principles that flexible guidelines serve companies better than inflexible rules. Originality/Value: This study breaks new ground in empirically investigating the effect of company variables on compliance with the ASX’s Principles of 2003, which are new for Australia in requiring an ‘if not, why not’ response from companies. Keywords: Corporate Governance Principles, Compliance, Australian Stock Exchange, Board of directors, Company Characteristics Article classification: Research paper 1 1. Introduction In March 2003 the Australian Stock Exchange (ASX) introduced a set of corporate governance principles with the underlying objective of setting out best practice in corporate governance. These guidelines, released in a document titled ‘Principles of Good Corporate Governance and Best Practice Recommendations,’ have not attracted much scholarly attention despite having been viewed as the most significant governance reform in Australia (Du-Plessis et al., 2005) and there has been little research into reporting practices under the ‘if not, why not’, corporate governance regime. This study aims to fill that gap by examining whether company-level factors have influenced reporting practices, in particular, compliance with ASX principles regarding the composition of boards of directors. The key feature of the 2003 corporate governance principles was an ‘if not, why not’ clause under which companies had the option either to follow the recommended best practices or to provide reasons why the departure from them was necessary. The clause was very much like the concept of ‘comply or explain’ introduced by the United Kingdom (UK) Cadbury Committee in 1992, in response to a series of corporate scandals in that country (Cadbury, 1992). Today, this system of corporate governance has been adopted by many countries, and has become the benchmark approach for regulating listed companies around the world (Wang and Ong, 2005). The ‘if not, why not’ approach to governance is characterised by voluntary compliance with the recommended best practice principles, together with mandatory disclosure of any departure from compliance along with reasons for any such departure. The underlying purpose of this is to increase transparency and foster greater managerial accountability without compromising the need for flexibility. The purpose is consistent with the generally accepted view that corporate governance is not a ‘one-size-fits-all’ concept (La Porta et al., 2002; Arcot et al., 2010). There is a growing 2 perception that ‘one size fits all’ creates a burden for smaller companies by placing them on an unequal footing with their bigger counterparts. PricewaterhouseCoopers (2012) noted that ‘one size fits all’ is unduly restrictive on business and makes a country a less attractive place for foreign companies. This is particularly important in the case of Australia as the Australian market is populated by smaller companies, in contrast to the US where large companies dominate the market. Mitigation of the compliance burden on smaller companies was the determining factor behind the ASX Corporate Governance Council’s (ASXCGC) decision to opt for disclosure-based principles premised on the ‘if not, why not’ concept (Hamilton, 2003). This form of governance allows companies to have the right balance between the costs and benefits, considering all the circumstances (Nedelchev, 2013) by tailoring their compliance choices to meet their actual operational requirements. The principles have had their critics. It was argued that they were not prescriptive enough to change directors’ unethical behaviour, which was considered to be a major contributing factor to corporate scandals (Proimos, 2005). Some critics also questioned the economic value of the principles, citing an increased compliance burden and the potential for expanded liability for corporate officers (Coulton and Taylor, 2004). Further, there is the view that if the recommended practice is best practice, then it should be followed. Accordingly, a failure to do so could lead investors to draw negative conclusions (Zadkovich, 2007; Fleming, 2003). This implies a connection between compliance and good governance in the minds of at least some investors and board members. This raises two key questions. First, do company characteristics influence a company’s decision to follow the best practice recommendations, or does the firm, free of any systematic bias, use the flexibility given in the principles to tailor its corporate governance structure to suit its own needs? This study argues that an answer is vital for assessment of the practical value of the governance principles. Second, is there an economic argument that prompts a 3 firm with specific characteristics to make predictable choices? Our results suggest the answer is yes, and that it amounts to the pursuit, by firms, of a least-cost strategy. The paper is laid out as follows. In Section 2, the key board structure requirements are stated, while Section 3 reviews prior research. This is followed in Section 4 by the research hypotheses. Section 5 discusses data and the research method, Section 6 reports the results and Section 7 contains some checks for robustness. Section 8 concludes, acknowledges key limitations and outlines future research possibilities. 2. ASX corporate governance recommendations principles and best practice The ASX guidelines lay out 10 principles and 28 recommendations. While all of these are important, we believe that Principle 2, ‘Structure the board to add value’ and its associated recommendations are especially worthy of research attention as they sit at the core of a company's corporate governance mechanism. This principle states the recommended practices regarding the structure of the boards of Australian listed companies. It describes an effective board as “one that facilitates the efficient discharge of the duties imposed by law on the directors and adds value in the context of the particular company’s circumstances” (ASXCGC, 2003, p. 19). Principle 2 contains three recommendations which relate to the structure of boards. They are: 2.1: 2.2: 2.3: A majority of the board should be independent directors The chairperson should be an independent director The roles of chairperson and chief executive officer should not be exercised by the same individual. The objective of having a board comply with these recommendations is to ensure independent decision-making occurs at board level. According to agency theory, corporations are characterised by the ‘separation of ownership and control’, goal divergence and conflict of interest that is complicated by information asymmetry and self-serving human behaviour (Berle and Means, 1932; Jensen and Meckling, 1976). Corporate executives and managers 4 need monitoring and controlling to ensure their decision-making is in alignment with shareholders’ interests. An independent board is necessary to ensure this oversight is provided effectively. Table 1 presents the extent of compliance with the board-related ASX recommended best practice recommendations during the study period. As the variables in the table are all binary, the means are a measure of the proportion of the sample which is compliant with each measure. Except in the case of recommended practice 2.3, where the figures climb from 78 percent to 81 percent, compliance with the board-related recommended best practice among sample companies is less than 50 percent. This seems low, given that the option to depart from compliance should be used only in exceptional and justifiable circumstances; but it does suggest that companies are making use of the flexibility provided. 5 Table 1: Mean of all dependent variable measures Dependent Variable A majority of the board should be independent directors (Measure 2.1) The chairperson should be an independent director (Measure 2.2) The chairperson should not also be the chief executive officer (Measure 2.3) All three measures jointly (2.1 and 2.2 and 2.3) The two independence measures jointly (2.1 and 2.2) The two chairperson measures jointly (2.2 and 2.3) All years 2004 2005 2006 2007 0.3924 0.3798 0.3566 0.4109 0.4225 0.4864 0.4806 0.4922 0.4884 0.4845 0.7955 0.7791 0.7946 0.8023 0.8062 0.2868 0.2791 0.2713 0.3023 0.2946 0.2878 0.2829 0.2713 0.3023 0.2946 0.4855 0.4767 0.4922 0.4884 0.4845 The mean of each of these binary variables can be interpreted as the probability of a "1" (compliance) occurring in the sample. These figures are used in the results section to compute the percentage change in probability of compliance associated with a one percent increase in a given independent variable, holding all else constant. Rates of non-compliance are not shown in this table, but can be calculated by subtracting the figures above from 1.0. 3. Literature A large number of papers have been published in the field of corporate governance. Important themes include the link between quality of governance and better organisational performance (Bhagat and Black, 2002; Lawrence and Stapledon, 1999; Baliga et al., 1996; Brickley et al., 1997; Gompers et al., 2003; Larcker et al., 2005; Love, 2012 among others) and examination of variables that might influence a company’s choice of board structure (Hermalin and Weisbach, 1988; Gillan and Starks, 2003; Boone, Field, Karpoff and Raheja, 2007; Linck, Netter and Yang, 2008; and many more). As discussed in Section 4, some of these papers furnish variables used here. However, research concerning ‘comply or explain’-based governance practice is relatively sparse. In the UK context, where this system has been in operation since 1992, Seidl, Sanderson and Roberts (2009) comment that very little is known about the way it functions in practice. This problem is likely to be very much the case in Australia, where it was 6 introduced in 2003. With respect to ‘comply or explain’ anywhere in the world, there appears to be very little written about ‘comply’. We start with an overview. Rules-based theorists have argued that a governance system should be regulated through law and uniformly applied to safeguard the public interest (Tricker, 2008). However, companies come in various shapes and sizes and it is practically impossible to have one system that equally suits all. The ‘comply or explain’ system of governance approach offers elements that can satisfy both points of view. It requires that companies have the necessary governance structure, while recognising they need to have flexibility to depart from certain recommended best practices in order to run efficiently and profitably. A system usually gains popularity if users find it simple, easy and convenient. But a firm’s corporate governance is a complex matter; and regulation that is apparently simple, easy and convenient may not always work. In addition, where there is flexibility, there is also potential for abuse. For example, a company may choose to depart from best practice simply because there is no external authority enforcing the requirement for an explanation, or monitoring what is provided. There are a number of cases in Australia where companies have neither followed the recommended practice nor disclosed an explanation (Lama, 2013). The presence (or absence) of market enforcement is an important matter. Market enforcement relies on the assumption that investors will judge a company’s governance practice by its rate of compliance. Lack of compliance may signal that management do not take their governance responsibilities seriously and the company will be punished by the investors through reduction of the stock price (Steeno, 2006). However, this assumption is valid only to the extent that investors assess the governance practices of firms they might invest in (or divest from). In reality however, the market is made up of investors who are active information seekers and many who are not. 7 What limited research has been carried out in the UK has provided mixed results. In a comprehensive analysis of 245 UK non-financial companies between 1998 and 2004, Arcot and Bruno (2006) found an increase in the rates of compliance with the Combined Code (1998)1. However, their analysis also revealed a systematic tendency among companies to give uninformative explanations when departing from best practice. In the UK, MacNeil and Li (2006) found that only 34% of companies were fully compliant. This study, on a sample of 522 FTSE All Share companies between 1 July 2003 and 30 June 2004, argued that the UK market is not concerned about non-compliance given there are no credible sanctions. Arcot et al. (2010) argued that companies view the ‘comply or explain’ system as being too prescriptive and that shareholders would only be interested in ticking the comply box. In the Australian context, the ASX has been reporting on firms’ level of compliance with the guidelines on an annual basis since 2004. The compliance levels for the 2004, 2005, 2006 and 2007 financial years were reported as being 68, 74, 75 and 74 percent respectively. However, the surveys have remained silent on what drives these rates. The second set of surveys, conducted by the accounting firm, KPMG examines the levels of disclosure under the ASX guidelines in 2003 and again in 2004 (KPMG, 2004; KPMG, 2005). However, the 2004 survey examines only five principles (2, 4, 7, 8 and 9) because the 2003 survey found that most companies disclosed appropriate information on principles 1, 3, 5, 6 and 10. The findings revealed considerable diversity in the form and quality of disclosure. However, only a small sample of companies was examined – 68 companies in 2003 and 55 in 2004. Only 20 companies included in the 2003 study were from outside the top 50 listed in the S&P/ASX All Ordinaries Index. Neither survey examines companies which are not included in the top 500. Given that the ‘if not, why not’ reporting system is designed to 8 prevent smaller companies from being subjected to unnecessary compliance burdens, a constituency of smaller companies may provide a better context for examining these issues. By focusing narrowly on rates of compliance, none of the studies reviewed above examine why companies follow or depart from the recommended principles. This is a significant gap in the research record. Our research question is, do company characteristics (e.g. size, ownership structure) determine firms’ decisions to follow or depart from particular recommended principles? Our study will address this. 4. Hypotheses Do company characteristics explain a company’s compliance decision concerning board structure? Linck, Netter and Yang (2007) found that firms design their boards to optimise the trade-off between the costs and benefits that the monitoring and advisory services boards provide. It follows that firms are likely to employ a least-cost approach to compliance which entails not complying unless it in their best interest to do so. The cost associated with achieving compliance is a monetary one, while that of non-compliance is, in the first instance, reputational, but has a consequent capacity to become monetary. Firms’ with higher non-compliance costs are more likely to comply than those which have lower costs. The costs are likely to be lower for well established firms that are highly profitable, have low leverage and face a low degree of public scrutiny. They will be higher for firms that are not quite so profitable, have more leverage and receive more public attention. Larger companies are a case in point. Given that they fall under the scrutiny of financial analysts, they are more likely to opt for a board structure that is perceived to be credible by investors. They also tend to be more complex and need the specialist expertise provided by outsider directors (Boone et al., 2007). There are two further reasons why large companies are more likely to comply. First, their more diffuse ownership structure and the absence of 9 shareholders large enough to exercise a degree of control increases the need for board oversight to reduce agency problems (Demsetz and Lehn, 1985; Crutchley, Garner and Marshall, 2004; Lehn, Patro and Zhao, 2005). Second, larger companies are more likely to be able to meet the monetary cost of achieving compliance (Krishnan et al., 2008; D’Aquila, 2004). It is hypothesized that: H1: The likelihood of a company complying with board-related best practice recommendations is an increasing function of size. The second hypothesis concerns concentration of ownership. When the largest shareholders have shareholdings sufficient in size to exert significant control, both the monetary and reputational costs, to a company, of non-compliance diminish. The presence of large shareholders on a board raises management turnover and tightens executive remuneration, which suggests they provide a monitoring function (Kaplan and Minton, 1994; Bertrand and Mullainathan, 2001; Gillan and Stark, 2003). However, large shareholders may place a higher value on making the firm’s governance less transparent to the remaining shareholders. In both cases, companies with large shareholders are less likely to adopt governance mechanisms such as having a board majority of independent directors. From this, the following hypothesis can be drawn: H2: The likelihood of a company complying with board-related ASX best practice recommendations is a decreasing function of ownership control proxied by the percentage of shares held by the top twenty shareholders. However, a second potential influence by a large shareholder may well work in the opposite direction. Large institutional shareholders are more likely to prefer good governance to be in place and require that it be seen to be in place, as they are, in turn, responsible for their investment decisions to their own shareholders. 10 The third hypothesis concerns leverage, which is generally viewed as a monitoring mechanism. The more debt a firm holds, the greater will be the performance pressure on the firm’s management to meet interest and repayment obligations (Jensen, 1986). High leverage also implies greater risk exposure as it amplifies losses and a levered company may face insolvency during a business downturn. It may therefore be important to demonstrate to investors and creditors that the firm’s corporate governance system is credible and that the decision to take on high leverage is strategic and in investors’ best interest. H3: The likelihood of a company complying with board-related ASX best practice recommendations is an increasing function of leverage. The same argument may be applied to high levels of liquidity risk. This gives rise to: H4: The likelihood of a company complying with board-related ASX best practice recommendations is an increasing function of liquidity risk However, there is a counter-argument that applies to both leverage and liquidity risk. The monitoring by investors that high leverage (and liquidity risk) brings may provide an already sufficient incentive for a board of directors to focus on optimising company performance rather than incur more costs by opting for compliance. If this counter-argument is correct (and sufficiently influential), then one would expect the coefficient associated with leverage in the results to be significant and negative. Alternatively, the two effects will cancel each other out. The literature examining the relationship between company profitability and compliance with best practice has furnished conflicting results. MacNeil and Li (2006) speculate that investors may routinely tolerate non-compliance to the extent that the firm is performing well. It is possible the company views this tolerance as a factor in favour of non-compliance. Conversely, poor performance tends to motivate a firm to increase its number of independent 11 directors as they bring specialist expertise with them (Hermalin and Weisbach, 1988; Boone et al., 2007). This line of thinking yields the hypothesis: H5: The likelihood of a company complying with the board-related ASX recommended best practice recommendations is a decreasing function of profitability. Older companies are more likely to be confident of their corporate reputations and less eager to make changes to their established governance structure. In addition, with respect to the roles of board chair and CEO, Brickley, Coles and Jarrell (1997) found it had been common practice for a CEO to be given the chair role as part of their contract, which is now no longer in accordance with recommended best practice. This gives rise to the hypothesis: H6: The likelihood of a company complying with the board-related ASX best practice recommendations decreases with company age. ASX companies may also have secondary listings on overseas stock exchanges. Coffee (2002) argues that one reason companies choose to cross-list is to commit themselves to higher standards of corporate governance. Consistent with this, Arcot and Bruno (2006) report a significant difference between the governance practices of cross-listed and noncross-listed UK companies. In monetary terms, the cost of compliance with respect to the Australian recommendations drops to zero if the cost is already being met with what are basically the same recommendations that are in force in overseas jurisdictions. This leads to the following hypothesis: H7: The likelihood of a company complying with the board-related ASX best practice recommendations is greater for companies which also have a secondary listing. Two share-price ratios are included in the study. Linck et al. (2008) consider the market-tobook equity ratio, (a diagnostic of market confidence in the value of the firm) to be a 12 reasonable proxy for monitoring costs. A high M/B ratio implies a low monitoring cost, which, in turn, lowers the cost of compliance. The price-earnings ratio is arguably a similar proxy. Firms with good future prospects will have relatively high P/E and M/B ratios, but only if investors have confidence in the quality of firm management. The hypothesis here is: H8: The likelihood of a company complying with the board-related ASX best practice recommendations is an increasing function of measures of market confidence in the firm. 5. Data and research method The study uses data provided by a sample of 258 companies listed on the ASX with the reporting periods ending 2004–2007. This limits the study to the lifespan of the first edition of the ASX best practice recommendations introduced in 20032. Selection was by stratified random sampling3, given one caveat. For inclusion in the sample a firm needed to have an annual report available for each of the four years. There was no requirement that companies be over a certain size. The aim was to provide a representative sample of companies that were neither fresh start-ups nor in the process of leaving the market. The sample had to be large enough to be adequate for statistical processing while being small enough to collect, given that aspects of it had to be gathered by hand. Initially, 272 firms were collected, but fourteen were dropped because insufficient data was available, or because they had negative equity throughout the four years. The 258 firms yield 1032 company/year observations; and the sample contains 26 percent of the companies continuously listed on the ASX throughout the period and a smaller percentage of all companies listed. Corporate governance data were collected from annual reports sourced from the Aspect Huntly Annual Reports Online and financial data were collected from Aspect Huntly FinAnalysis Database. For all eight hypotheses, the analysis is performed with a binary logistic regression in which the dependent variable takes the value ‘1’ if the company is compliant and ‘0’ if otherwise for 13 a particular year. There is a separate dependent variable for each individual or combination of recommendations. Some companies comply with all three recommendations. A variable called ‘all measures collectively’ takes the value ‘1’ if a firm complies with all three recommendations and ‘0’ if otherwise. Second, two of the three recommendations form a natural pair in that they both deal with independence (either board member or chairperson). A variable called ‘board independence measures’ takes the value ‘1’ if a company complies with both of these recommendations and ‘0’ otherwise. In the third case, another natural pair is furnished by the two chairperson-related recommendations. The variable, ‘chairperson measures’ takes the value ‘1’ if the chairperson is an independent director and not the CEO. Nineteen company factors are included as predictor (independent) variables in the data analysis. They are defined and approximated as follows: Size – (factor 1) The natural log of total assets of the company as of its reporting date, based on the balance sheet figure in millions of dollars. An alternative measure is the natural log of market capitalisation (LnMCap) used in robustness testing. Ownership concentration – (factor 2) The percentage of common shares held by the top twenty shareholders, irrespective of whether these shareholders are individuals or institutional shareholders. It is a measure of how closely held the firm is. A more complex related formulation proposed by Demsetz and Lehn (1985) is used in robustness testing. This is the natural log of the ratio formed by the above percentage divided by 100 minus itself. Leverage – (factor 3) The company’s level of leverage is calculated by dividing the company’s total debt by its total assets. Liquidity – (factor4) The firm’s current assets divided by its current liabilities. 14 Profitability – (factor 5) The average of changes in the firm’s before-tax operating income over the four years, where each year’s operating income is scaled by total assets. This variable is based on a measure of unexpected income used by Hermalin and Weisbach (1988). The difference between their measure and ours is that they subtracted the market average (which was a constant) which means the two measures are perfectly correlated (and produce similar results). We also use net profit after tax scaled by total assets as a robustness check. Age – (factor 6) Number of years a firm is listed on the ASX. Cross-listing – (factor 7) A binary variable coded ‘1’ if the company is also listed on an overseas stock exchange and ‘0’ otherwise. P/E Ratio– (factor 8) The simple price-earnings ratio M/B Ratio – (factor 9) The ratio of share price to book value of equity per share. The variables above relate directly to the eight hypotheses. In addition, the study employs a number of extra variables. The first of these is Institutional (5%). This is a binary variable coded ‘1’ if there are one or more institutional shareholders each with 5% or greater ownership holdings and ‘0’ otherwise. This variable is a proxy for institutional ownership control. Its purpose was to explore the caveat mentioned with respect to ownership concentration, that the presence of institutional investors might improve rather than impede compliance. The variable was derived from the annual list of each firm’s twenty largest shareholders. The study also employs a set of dummy variables to model systematic compliance behaviour that might arise from a firm’s belonging to a particular industrial sector, given that within a 15 sector, firms face similar market conditions and use similar production technologies (Boone et al., 2007). The sectors are: 1. Energy 2. Material 3. Industrial 4. Consumer Discretionary 5. Consumer Staples 6. Healthcare 7. Financial 8. Information Technology 9. Telecommunication 10. Utilities 24 firms 76 firms 30 firms 30 firms 10 firms 26 firms 33 firms 22 firms 5 firms 2 firms The last dummy variable (Utilities) is dropped from the statistical calculations to keep the model of full rank. The model contains a constant term, thus the effects estimated for the dummy variables are interpreted as being relative to the effect of the Utilities sector. Panel A of Table 2 furnishes the properties of the main predictor variables. These figures are derived from the 1032 data-points collectively available on each variable (258 for each year). The range of Age is from 2 years in 2004 to 46 years in 2007. The median value of zero for Cross-listing indicates that most of the firms were not cross-listed. The negative minimum for Size is due to the underlying size measure being in millions of dollars and a few companies are very small. The maximum Leverage figure indicates that the particular firm had negative equity in the year concerned. Information concerning industry sector dummies has not been included in this table because variables furnished only one result that was merely weakly significant, as discussed later with respect to Table 4. Also omitted from the table are ancillary variables used in robustness testing.4 In Panel B, the main predictor variable means are furnished for subsamples of compliant and noncompliant firms. Size, Leverage, Price-earnings ratio and Market-to-book ratio all have consistently higher means for the compliant subsample, while Ownership 16 concentration and Profitability display consistently lower means. Age, Cross-listing and Liquidity show no consistent pattern. Panel C shows the Pearson’s correlation coefficients. While some are strongly significant, none are over 0.5. The largest two positive correlations are between Size and Leverage (0.367) and between Ownership concentration and Leverage (0.184). The two highest negative correlations are between Leverage and Liquidity (-0.178), and Market-to-book ratio and size (-0.163). All four of these are significant at the one percent level. Three further variables have correlations with Size that are significant at the one percent level with coefficients around 0.100 level (Ownership concentration, Age and Cross-listing) while two have similar strongly significant correlations with the Market-to-book ratio (Age and Leverage). For the purpose of analysis, the data-points are averaged for each firm over the four available years to give a sample of 258 independent observations on each variable to which a logistic function is fitted for each of the six dependent variables, which are similarly averaged. The reason for this is that there is little change in compliance levels from year to year, as shown in Panel A of Table 3: Clearly most companies did not change from their initial position over the four-year period. A close scrutiny of the ‘no change’ row indicates a monotonic rise in the number of firms compliant with the recommendation that the chairperson not be the same person as the firm’s chief executive officer (recommendation 2.3). The other two recommendations show swings over time. Panel B shows the pattern of multiple changes that individual companies made in given years. Again, the net changes per year are dwarfed by the size of the no-change category. 17 Table 2: Characteristics of the main predictor variables Panel A: General properties Distributional Characteristic Mean Median Maximum Minimum Standard Deviation Count Proportion of sample Size (LnTA) Owner. Conc. 3.854 3.463 10.542 -3.219 2.253 0.635 0.647 0.996 0.070 0.202 Leverage 0.348 0.330 1.370 0.000 0.251 Profitability Liquidity 0.101 0.000 28.958 -17.496 2.389 8.261 2.240 481.580 0.060 32.152 P/E Profitability Liquidity P/E 9.375 5.491 9.388 5.474 8.573 7.931 9.838 5.821 8.588 7.916 10.633 7.652 -7.443 10.967 -7.451 10.926 -6.882 2.840 -5.098 2.382 -6.893 2.832 -18.722 2.093 Liquidity P/E -2.163 7.445 466.670 -2812.500 139.276 M/B 3.265 1.945 84.300 0.110 4.727 Age 14.969 13.000 45.000 2.000 9.772 Cross-listing 0.120 0.000 1.000 0.000 0.325 124 0.120 Panel B: Means for compliant and non-compliant companies Dependent variable and compliance status MeasureAll Measure12 Measure23 Measure1 Measure2 Measure3 Size (LnTA) 0 1 0 1 0 1 0 1 0 1 0 1 3.459 4.836 3.460 4.827 3.444 4.287 3.266 4.763 3.447 4.283 2.954 4.085 Owner. Conc. 0.649 0.599 0.650 0.599 0.654 0.615 0.645 0.619 0.655 0.614 0.664 0.628 Leverage 0.331 0.388 0.331 0.389 0.329 0.367 0.322 0.387 0.329 0.367 0.300 0.360 0.175 -0.084 0.176 -0.083 0.215 -0.020 0.186 -0.030 0.216 -0.020 0.385 0.028 M/B Age 3.068 3.758 3.071 3.747 3.018 3.528 3.123 3.487 3.023 3.522 3.229 3.275 15.029 14.821 15.044 14.785 15.791 14.098 14.514 15.674 15.813 14.078 17.517 14.314 M/B Age -0.096 *** -0.008 -0.003 Cross-listing 0.113 0.139 0.113 0.138 0.092 0.150 0.124 0.114 0.092 0.149 0.095 0.127 Panel C: Pearson's Correlations Independent Variables Ownership concentration Leverage Profitability Liquidity P/E M/B Age Cross-listing Size (LnTA) 0.094 *** 0.367 *** -0.019 -0.024 0.055 * -0.163 *** 0.117 *** 0.100 *** Owner. Conc. 0.184 *** -0.059 * 0.035 -0.001 -0.014 0.074 ** 0.037 Leverage 0.068 ** -0.178 *** 0.064 ** 0.094 *** -0.026 0.024 Profitability -0.002 -0.005 0.005 -0.014 0.031 0.014 -0.045 0.022 0.043 -0.041 -0.054 * -0.010 The SIZE variable used in the analysis is the natural log of total assets (book value in millions of dollars). OWNERSHIP CONCENTRATION (factor 2) is the proportion of ordinary shares held in total by the top twenty shareholders. PROFITABILITY is the average change in before-tax operating profit scaled by total assets. LIQUIDITY is the ratio of current assets over current liabilities. P/E is the price-earnngs ratio and M/B is the price per share divided by the book value of equity per share. AGE is in years and CROSS-LISTING is a binary variable that takes the value "1" if the firm is listed on a second stock exchange. In Panel B, compliant companies are in the rows coded '1' and non-compliant firms are in rows coded '0'. Panel C shows Pearson correlation coefficients. *** indicates significance at the one percent level, ** at the five percent level and * at the ten percent level. 18 Table 3 Yearly changes in compliance PANEL A: Changes in compliance with individual recommendations A majority of directors to be independent (2.1) Action taken by firm Removed Rule No Change Added Rule 2004-2005 13 238 7 2005-2006 8 228 22 2006-2007 9 237 12 The chair to be an independent director (2.2) 2004-2005 2005-2006 2006-2007 6 243 9 10 239 9 7 245 6 The chair not to be the same person as the CEO (2.3) 2004-2005 5 244 9 2005-2006 2006-2007 3 250 5 1 255 2 PANEL B: Changes in compliance across all three recommendations collectively Action taken by firm Removed 3 Rules Removed 2 Rules Removed 1 Rule No Change Added 1 Rule Added 2 Rules Added 3 Rules 2004-2005 1 4 13 217 21 2 0 2005-2006 0 5 11 213 24 3 2 2006-2007 1 0 14 225 16 2 0 For each of the recommendations, the pattern of changes is shown within the four-year period. "Removed rule" indicates that a company ceased to comply, while "Added rule" indicates a shift to compliance. Net changes in all periods are small relative to the number of "No changes". There are 258 companies. 19 6. Results Table 4 shows the results of the binomial logistic regressions. The most striking feature is that Size (natural log of total assets) has a positive coefficient that is strongly significant in all six procedures. This supports Hypothesis H1 and accords with the findings of Linck et al (2008) on U.S. data both before and for two years following the Sarbanes-Oxley Act (2002). While the logistic regression output reports β coefficients, these cannot be directly interpreted as the change in probability of compliance brought about by a change in the explanatory variable. Instead, this is measured by scaling the coefficients by p(1-p) to assess their effect on the probability scale. 5 For Size in Procedure 1 (dependent variable ‘All measures collectively’), we scale the coefficient 0.3275 by the proportion of compliance, 0.2868 reported in Table 1: 0.3275 0.2868 1 0.2868 0.0939 Since Size is measured on the logarithmic scale, a one percent increase in the size of a firm is estimated to result in a 0.094 percent increase in the probability of compliance when “All measures collectively” is considered. Put more emphatically, if a firm with total assets of $10 million doubles them to $20 million, the percentage increase in the probability of compliance becomes 9.4 percent. With respect to the two independence recommendations jointly in Table 4 (coefficient 0.3259), a one percent rise in firm size is associated with a 0.094 percent rise in the probability of compliance. For the two chairperson recommendations jointly (coefficient 0.2121), this drops to a 0.053 percent increase in probability. In procedure 4, the first single 20 recommendation (that a majority of directors be independent directors, coefficient 0.4132) a one percent increase in size is associated with a 0.099 percent rise in the probability of compliance. For the second and third recommendations (coefficients 0.2115 and 0.2957), the rise in probabilities are 0.053 percent and 0.048 percent respectively. Hypothesis 2 (Ownership concentration) is also well supported across the six procedures, twice at the one percent level of significance, twice at the five percent level and twice at the ten percent level. The relationship is negative as hypothesized. With respect to procedure 5 (the chair to be an independent director, coefficient -1.7218) a one percent rise in Ownership concentration is associated with a 0.091 percent fall in the probability of compliance. Hypothesis 6 (a negative relationship with Age) is also supported but only in procedures 3, 5 and 6, all of which relate to the nature of the board chair. While the statistical significance in procedures 3 and 5 (sharing a focus on chair independence measures) is only at the ten percent level, recommendation 2.3 (separation of the roles of chair and CEO, procedure 6) is significant at the five percent level. Hypothesis 8 (investor confidence) is also supported but not universally. Procedures 1,2 3 (the collective and joint measures) and 5 (chairperson independence) furnish results that show a high market-to-book ratio (as a measure of investor confidence) is associated with a greater propensity to comply. This is further supported in the case of procedures 1 and 2 only, by the price-earnings ratio furnishing results significant at the five percent level. However, neither measure of investor confidence has any impact on recommendations 2.1 (independent directors) and 2.3 (chair and CEO role separation). 21 Table 4: Logistic Regressions on averaged data for the 4 years 2004 to 2007 Procedure number: Dependent variables [1] All measures collectively (2.1, 2.2, and 2.3) β p-value [2] Board independence measures jointly (2.1 and 2.2) β p-value [3] Chair measures jointly (2.2 and 2.3) β p-value [4] A majority of directors to be independent (2.1) β p-value [5] The chair to be independent (2.2) β p-value [6] The chair and CEO not to be the same person (2.3) β p-value PANEL A: Main explanatory variables Constant Size (lnTA) Ownership conc. Leverage Age Cross-listing Market-to-book Price-earnings Liquidity Profitability -0.5870 0.3275 -2.3399 0.6958 -0.0065 -0.2731 0.0853 0.0096 -0.0076 -0.0944 0.7165 0.0003 *** 0.0088 *** 0.4714 0.6973 0.5788 0.0968 * 0.0427 ** 0.4620 0.3576 -0.5676 0.3259 -2.3402 0.6771 -0.0070 -0.2700 0.0857 0.0096 -0.0077 -0.0942 0.7254 0.0003 *** 0.0086 *** 0.4827 0.6703 0.5827 0.0947 * 0.0430 ** 0.4600 0.3580 0.0801 0.2121 -1.7121 0.2654 -0.0276 0.4035 0.0821 0.0024 -0.0054 -0.0657 0.9588 0.0082 *** 0.0271 ** 0.7487 0.0661 * 0.3619 0.0941 * 0.2937 0.3653 0.3494 -0.8925 0.4132 -1.4103 0.5744 0.0108 -0.6519 0.0533 0.0005 -0.0032 -0.0588 0.5674 0.0000 *** 0.0778 * 0.5043 0.4899 0.1719 0.2738 0.8037 0.6243 0.4571 0.0972 0.2115 -1.7218 0.2528 -0.0280 0.4055 0.0827 0.0025 -0.0054 -0.0657 0.9501 0.0083 *** 0.0262 ** 0.7602 0.0619 * 0.3596 0.0919 * 0.2935 0.3627 0.3492 0.8636 0.9640 0.2086 0.6172 0.8347 0.7714 0.3957 0.4970 0.5857 -0.2674 0.0677 -1.9256 -0.7653 -0.3429 -0.4540 -1.3240 -1.0848 -1.0234 0.8637 0.9640 0.2279 0.6203 0.8393 0.7704 0.3980 0.4962 0.5859 0.1676 0.4770 -0.3990 0.2031 2.9988 0.5223 -0.0197 -0.8709 -0.3313 0.9109 0.7423 0.7887 0.8911 0.1154 0.7265 0.9894 0.5662 0.8499 -0.7061 -0.1179 -1.7705 -0.7417 -1.2666 -0.5663 -1.4444 -0.5039 -0.8922 0.6391 0.9354 0.2413 0.6181 0.4391 0.7067 0.3362 0.7385 0.6142 0.1661 0.4761 -0.3582 0.2068 3.0079 0.5188 -0.0176 -0.8736 -0.3324 0.9117 0.7428 0.8098 0.8891 0.1144 0.7283 0.9905 0.5651 0.8494 -0.0557 0.2957 -1.6922 0.6443 -0.0402 0.4033 0.0049 0.0035 -0.0068 -0.0887 0.9730 0.0058 *** 0.0814 * 0.5267 0.0245 ** 0.4980 0.9312 0.1203 0.3010 0.1779 Panel B: Industry sector variables Energy Material Industrial Consumer Disc. Consumer Staple Healthcare Financial Information Tech. Telecommunications -0.2676 0.0677 -2.0159 -0.7721 -0.3528 -0.4521 -1.3304 -1.0829 -1.0243 Tjur Coeff. of Discrimination P-value of Goodness of Fit test 0.1127 0.0000 0.1119 0.0000 0.1279 0.0011 0.1079 0.0001 0.1268 0.0012 1.6151 2.1522 1.2416 2.1282 3.6110 2.6060 2.0327 1.8086 1.0688 0.2951 0.1484 0.4139 0.1714 0.0818 * 0.1029 0.1860 0.2448 0.5674 0.2435 0.0153 In this table, six logistic regressions have been performed on measures of compliance. For each procedure, the values of both the dependent and independent variables have been averaged across the four years of data (2004-2007) for each of the 258 ASX-listed companies in the sample. Coefficients and p-values are provided for all independent variables. ***, ** and * designate significance at the one percent, five percent and ten percent levels respectively. 22 The remaining main variables, Leverage, Cross-listing, Liquidity and Profitability have no significant impact in any procedure. Hypotheses 3, 4, 5 and 7 are not supported. In the case of leverage, this may be because a pressure to comply (as posited in the formulation of H3) has perhaps been negated by the belief that such compliance is unnecessary given the extra monitoring that leverage brings. In Panel B, one industrial sector (Consumer Staple) is weakly significant with respect to recommendation 2.3 (chair and CEO role separation). This finding may have been driven by three factors. Nine of the sample’s ten companies in the sector complied; the ten had an average Size (LnTA) of 5.53 which is above the sample average for complying firms given in Table 2; and their average age was 19.3 which is above average for all firms and goes against the trend of older companies being less compliant. But apart from Consumer Staple, the sectors have turned out to be of little interest. 7. Robustness checks Since the two most important results have been the positive association of Size and a negative association between Ownership concentration and compliance, the robustness testing sets out mainly to determine if there is any change in the importance of these two variables.6 In the case of Size, the log of total assets was replaced by the log of market capitalisation and the six binary logistic regressions were re-performed. The pattern of statistically significant results versus statistically insignificant ones remained unchanged from that stated in Table 4. Similarly, an alternative formulation of Ownership concentration employed by Demsetz and Lehn (1985) made no change to the results. The variable Institutional(5%) was added into the logistic regressions to see what impact this would have on the role of Ownership concentration and hypothesis H2. When the existing variable for Ownership concentration was left in place, Institutional(5%) did not achieve statistical significance and made no 23 significant change to the pattern of other results. Also, it was insignificant when used as a replacement for Ownership concentration. With respect to Profitability, an alternative measure, return on assets (ROA) was employed, albeit with the knowledge that its numerator (net profit after tax) takes the dollar impact of leverage into account. ROA failed to achieve significance for Profitability and did not substantially change the nature of other results. 8. Conclusions, caveats and future research This study examined whether companies simply follow the ASX recommended board practices or take into account company characteristics in determining their corporate governance systems with regard to board structure. The results provide statistically significant and robust evidence that they do. The findings are consistent with the assumption underlying the ASX governance principles that companies differ in size and diversity and thus have different governance needs. The findings are also consistent with firms being motivated by least cost. The two characteristics influencing compliance most consistently are company size (positively) and the degree of ownership concentration (negatively). In addition, it was found that measures of investor confidence are positively associated with compliance on joint measures, but not with two of the three individual measures. The positive coefficients of the two variables, market-to-book ratio and price-earnings ratio, may indicate the presence of low monitoring costs. Further, it was found that age had a negative impact with respect to recommendations focusing on the nature of the board chairperson. This may be a function of unwillingness to change pre-existing practices associated with CEO appointments. When viewing these conclusions, several caveats must be kept in mind. First, the paper does not furnish evidence showing a causal connection between compliance and good governance 24 per se. While this would have been interesting to investors and banks, it is beyond the scope of the present paper. Second, while just nine major company attributes have been used to test the company’s response to the ASX with respect to adopting (or departing) from recommended best practice principles, others not included in the model (or variables created from combinations of them) might also be important. Finally, research in social science often tends to suffer from the use of personal judgement in estimating and approximating variables, and this study is no exception. In the present paper, the hand gathering of institutional block holding data entailed making judgement calls on whether an investor listed in the company financial reports as one of its twenty largest was an institutional investor or a private investor. The rule of thumb was that limited liability companies were more likely to be institutional investors rather than private investors. This study offers a number of possible future research avenues. For example, the ASX Corporate Governance Council released significantly revised principles (2nd edition) in 2007 which became effective from the financial period ending 2008. The current study could be extended using the companies’ compliance data under this revised regime. An unstated aim of any governance regulation is to help companies to manage risk properly to ensure adequate investor protection in times of crisis. An examination of the effectiveness of the ASX principles during the Global Financial Crisis is another interesting future research proposition. Finally, given that the ASX corporate governance principles are a two-pillar regulatory regime consisting of compliance and an explanation for non-compliance, it is important that the explanation pillar is examined too. This offers another avenue for future research. References 25 Arcot, S. and Bruno, V. (2006), “In letter but not in spirit: an analysis of corporate governance in the UK”, Working Paper no.031, http://www2.lse.ac.uk/fmg/research/RICAFE/pdf/RICAFE2-WP31-Arcot.pdf (accessed 22 October 2010). Arcot, S., V. Bruno, V. and Faure-Grimaud, A. (2010), “Corporate governance in the UK: is the comply or explain approach working?” International Review of Law and Economics’, Vol. 30 No. 2, pp. 193-201. Australian Stock Exchange Corporate Governance Council (ASXCGC) 2003, Principles of Good Corporate Governance and Best Practice Recommendations, downloaded on 5 January 2009, http://www.asx.com.au/documents/about/principles-and-recommendations- March2003.pdf. Baliga, R.B., Moyer, C.R. and Rao, R.S. (1996), “CEO duality and company performance: what's the fuss?” Strategic Management Journal Vol. 17 No. 1, pp. pp. 41-53. Berle, A. and Means, G. (1932), The Modern Corporation and Private Property, Macmillan Publishing, New York. Bertrand, M. and Mullainathan, S. (2001), “Are CEOs rewarded for luck? The ones without principles are”, Quarterly Journal of Economics, Vol. 116, pp. 901-932. Bhagat, S. and Black, B.S. (2002), “The non-correlation between board independence and long-term performance”, The Journal of Corporate Law, Vol. 27, pp. 231-274. Brickley, J.A., Coles, J.L. and Jarrel, G.A. (1997), “Leadership structure: separating the CEO and Chairman of the board”, Journal of Corporate Finance, Vol. 3 No. 3, pp. 189-220. Boone, A. L., Field, L. C., Karpoff, J. M. and Raheja, C. G. (2007), “The determinants of corporate board size and composition: an empirical analysis”, Journal of Financial Economics, Vol. 85, pp. 66-101. Cadbury, A. (1992), The Committee on the Financial Aspects of Corporate Governance, Gee and Company, London. Coffee, J.C. (2002), “The impact of cross-listing and stock market competition of international corporate governance”, Columbia Law Review, Vol. 102, pp. 1757-1831. Coulton, J. and Taylor, S. (2004), “Directors' duties and corporate governance: have we gone too far?”, Australian Accounting Review, Vol. 14 No. 32, pp. 17-24. Crutchley, C., Garner, J. and Marshall, B. (2004), “Does one size fit all? A comparison of boards between newly public and mature firms”, Working Paper, Drexel University. D’Aquila, J.M. (2004), “Tallying the cost of the Sarbanes-Oxley Act”, The CPA Journal, November issue, http://www.nysscpa.org/cpajournal/2004/1104/perspectives/p6.htm (accessed 15 April 2012). Demsetz, H. and Lehn, K. (1985), “The structure of corporate ownership: causes and consequences” Journal of Political Economy, Vol. 93, pp. 1155-1177. 26 Du-Plessis, J., McConvill, J. and Bagaric, M. (2005), Principles of Contemporary Corporate Governance, Cambridge University Press, Cambridge. Fleming, G. (2003), “Corporate governance in Australia”, Agenda, Vol. 10 No. 3, pp. 95-212. Gillan, S. and Starks, L. (2003), “Corporate governance, corporate ownership, and the role of institutional investors: A global perspective”, Working Paper WP 2003-01, John Weinberg Center for Corporate Governance, University of Delaware. Gompers, P.A., Ishii J.L. and Metrick, A. (2003), “Corporate governance and equity prices”, Quarterly Journal of Economics, Vol. 118 No. 1, pp.107-156. Hamilton, K. (2003), “If Not, Why Not?: in conversation with Karen Hamilton, Chairperson, ASX Corporate Governance Council”, Keeping Good Companies (Monthly journal of the Governance Institute of Australia) No 3, April, p. 218. Hermalin, B. and Weisbach, M. (1988), “The determinants of board composition”, RAND Journal of Economics Vol. 19, pp. 589-605. Jensen, M. C. (1986), “Agency Costs of Free Cash flow, Corporate Finance and Takeovers”, American Economic Review, Vol 72 No. 2, pp. 323-329. Jensen, M.C. and Meckling, W.H. (1976), “Theory of company, managerial behaviour, agency cost and ownership structure”, Journal of Financial Economics, Vol. 3 No. 4, pp. 305-360. Kaplan, S. and Minton, B. (1994), “Appointments of outsiders to Japanese boards: determinants and implications for managers”, Journal of Financial Economics, Vol. 36, pp. 225-258. KPMG (2004), Early Reporting Trends: A Survey of Early Reporting Trends Under the ASX Corporate Governance Council Guidelines. KPMG, Melbourne, Australia. KPMG (2005), Reporting against ASX Corporate Governance Council Guidelines: A shift towards Performance, KPMG, Melbourne, Australia. Krishnan, J., Rama, D. and Zhang, Y. (2008), “Costs to comply with SOX Section 404”, Auditing: A Journal of Theory and Practice, Vol. 27 No. 1, pp. 169-186. Lama, T. (2013), An investigation of the application of the ‘if not, why not’ form of corporate governance in Australia, PhD Thesis, University of Western Sydney, Sydney. La Porta, R., Lopez-de-Silanes, F., Shleifer, A. and Vishny, R.W. (2002), “Investor protection and corporate valuation”, Journal of Finance, Vol. 57 No.3, pp.1147-1170. Larcker, D., Richardson, S. and Tuna, I. (2005), “Ratings add fire to the governance debate”, http://www.ft.com/cms/s/2/ffa3156c-cdd2-11d9-9a8a-00000e2511c8.html#axzz1zFTdOqhw (accessed 27 September 2010). Lehn, K., Patro, S. and Zhao, M. (2005), “Determinants of the size and structure of corporate boards: 1935-2000”, Working Paper, University of Pittsburgh. 27 Linck, J. S., Netter, J. M. and Yang, T. (2008), “The determinants of board structure”, Journal of Financial Economics Vol. 87, pp. 308-328. Lawrence, J. J. and Stapledon, G. (1999), “Is board composition important? A study of listed Australian companies”, Working paper, http://papers.ssrn.com/sol3/papers.cfm?abstract_id=193528 (accessed 22 August 2011). Love, I. (2012), “Corporate governance and performance around the world: what we know and what we don't”, The World Bank Research Observer, Vol.26 No.1, pp. 42-70. MacNeil, I. and Li, X. (2006), “Comply or explain: market discipline and non-compliance with the combined code”, Corporate Governance: An International Review, Vol. 14 No. 5, pp. 486-496. Nedelchev, M. (2013), "Good practices in corporate governance: one-size-fits-all vs. complyor-explain", International Journal of Business Administration, Vol. 4, No. 6, pp. 75-81. PricewaterhouseCoopers. (2012), 'Switzerland: Proposal affecting executive compensation, downloaded on 14 March 2014, https://www.pwc.ch/user_content/editor/files/publ_hrs/pwc_news_alert_2012-10a_e.pdf. Proimos, A. (2005), “Strengthening corporate governance regulation”, Journal of Investment Compliance, Vol. 6 No. 4, pp. 75-84. Seidl, D., Sanderson, P. and Roberts, J. (2009), “Applying 'comply-or-explain': conformance with codes of corporate governance in the UK and Germany”, Working Paper No. 389, http://www.cbr.cam.ac.uk/pdf/WP389.pdf (accessed 30 May 2010). Steeno, A. (2006), “Note: corporate governance: economic analysis of a ‘comply or explain' approach”, Stanford Journal of Law, Business and Finance, Vol. 11 No. 2, 387-408. Tricker, B. (2008), Corporate Governance: Principles, Policies and Practices, Oxford University Press, Oxford. Wang, D. and Ong, C.H. (2005), “Board structure, process and performance: evidence from public-listed companies in Singapore”, Corporate Governance: An International Review, Vol. 13 No. 2, pp. 277-290. Zadkovich, J. (2007), “Mandatory requirements, voluntary rules and 'please explain': a corporate governance quagmire”, Deakin Law Review, Vol. 12 No. 2, pp. 23-39. 28 Endnotes 1 The Combined Code is described as the UK's supercode. It is comprised of the recommendations of three major committees - (i) Cadbury - 1992, (ii) Greenbury - 1995 and (iii) Hampel - 1998. 2 The revised ASX Corporate Governance Principles and Recommendations (second edition) was introduced in August 2007 and became effective for the financial year beginning January 2008. The changes included removal of the term 'best practice' from the title and reducing the principles to 8 from 10. The researchers do not believe the changes were significant enough to influence companies' compliance behaviour in anticipation of the changes. 3 Stratified random sampling was done by membership of industry, based on the two digit Global Industry Classification Standards (GICS) code, to ensure coverage across sectors. The overall population was 991 potentially eligible companies. Each industry (stratum) was polled using Stattrek’s (http://www.stattrek.com) random number generator. 4 The ancillary variables used for robustness checking had the following correlations with the appropriate main variable: LnMCap to LnTA 0.901 significant at the one percent level, Institutional block-holding (5% or more) to Ownership concentration 0.355 (significant at the one percent level), ROA to profitability -0.027 (not significant) and Hermalin & Wesibach’s (1988) profitability variable to Profitability 1.00 (significant at the one percent level) which is unsurprising given that the difference is merely that the current study drops their subtraction of overall mean scaled change in EBIT from the measure. 5 On the logit scale, ln(p/(1-p)) = α+βx + … where β is a parameter estimated for an independent variable x in Tables 5 through 7. It follows that dp/dx = p(1-p)β. 6 No tables are provided in the paper for these, but they are available from the corresponding author on request. 29