CMS adopts policy and payment changes for outpatient care in

advertisement

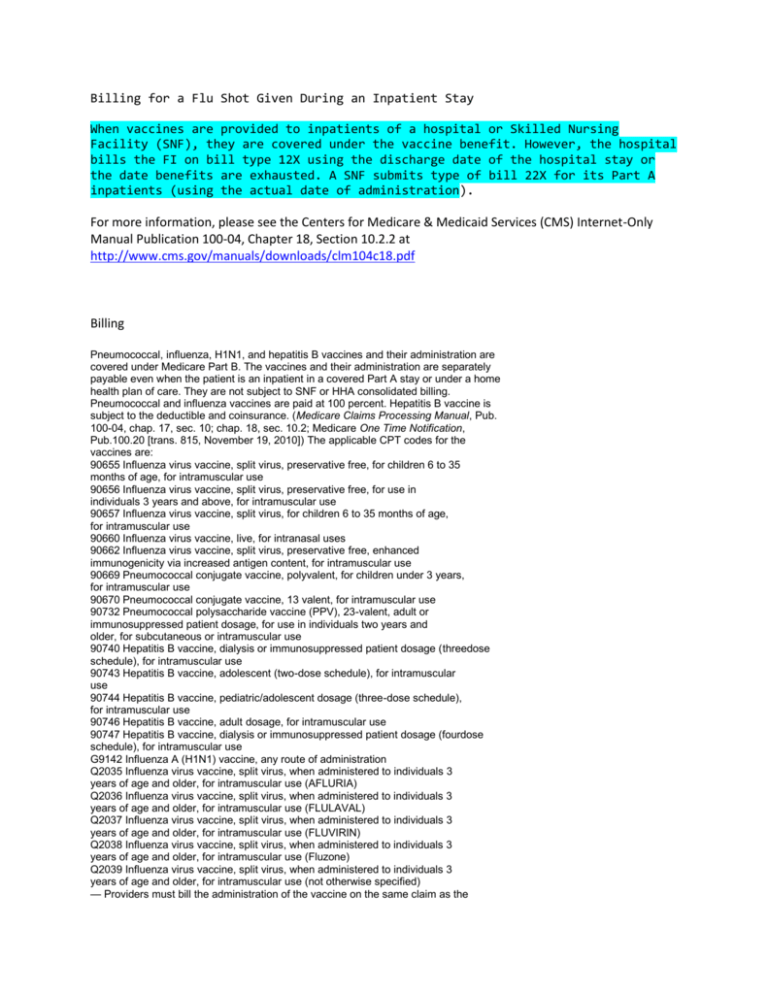

Billing for a Flu Shot Given During an Inpatient Stay When vaccines are provided to inpatients of a hospital or Skilled Nursing Facility (SNF), they are covered under the vaccine benefit. However, the hospital bills the FI on bill type 12X using the discharge date of the hospital stay or the date benefits are exhausted. A SNF submits type of bill 22X for its Part A inpatients (using the actual date of administration). For more information, please see the Centers for Medicare & Medicaid Services (CMS) Internet-Only Manual Publication 100-04, Chapter 18, Section 10.2.2 at http://www.cms.gov/manuals/downloads/clm104c18.pdf Billing Pneumococcal, influenza, H1N1, and hepatitis B vaccines and their administration are covered under Medicare Part B. The vaccines and their administration are separately payable even when the patient is an inpatient in a covered Part A stay or under a home health plan of care. They are not subject to SNF or HHA consolidated billing. Pneumococcal and influenza vaccines are paid at 100 percent. Hepatitis B vaccine is subject to the deductible and coinsurance. (Medicare Claims Processing Manual, Pub. 100-04, chap. 17, sec. 10; chap. 18, sec. 10.2; Medicare One Time Notification, Pub.100.20 [trans. 815, November 19, 2010]) The applicable CPT codes for the vaccines are: 90655 Influenza virus vaccine, split virus, preservative free, for children 6 to 35 months of age, for intramuscular use 90656 Influenza virus vaccine, split virus, preservative free, for use in individuals 3 years and above, for intramuscular use 90657 Influenza virus vaccine, split virus, for children 6 to 35 months of age, for intramuscular use 90660 Influenza virus vaccine, live, for intranasal uses 90662 Influenza virus vaccine, split virus, preservative free, enhanced immunogenicity via increased antigen content, for intramuscular use 90669 Pneumococcal conjugate vaccine, polyvalent, for children under 3 years, for intramuscular use 90670 Pneumococcal conjugate vaccine, 13 valent, for intramuscular use 90732 Pneumococcal polysaccharide vaccine (PPV), 23-valent, adult or immunosuppressed patient dosage, for use in individuals two years and older, for subcutaneous or intramuscular use 90740 Hepatitis B vaccine, dialysis or immunosuppressed patient dosage (threedose schedule), for intramuscular use 90743 Hepatitis B vaccine, adolescent (two-dose schedule), for intramuscular use 90744 Hepatitis B vaccine, pediatric/adolescent dosage (three-dose schedule), for intramuscular use 90746 Hepatitis B vaccine, adult dosage, for intramuscular use 90747 Hepatitis B vaccine, dialysis or immunosuppressed patient dosage (fourdose schedule), for intramuscular use G9142 Influenza A (H1N1) vaccine, any route of administration Q2035 Influenza virus vaccine, split virus, when administered to individuals 3 years of age and older, for intramuscular use (AFLURIA) Q2036 Influenza virus vaccine, split virus, when administered to individuals 3 years of age and older, for intramuscular use (FLULAVAL) Q2037 Influenza virus vaccine, split virus, when administered to individuals 3 years of age and older, for intramuscular use (FLUVIRIN) Q2038 Influenza virus vaccine, split virus, when administered to individuals 3 years of age and older, for intramuscular use (Fluzone) Q2039 Influenza virus vaccine, split virus, when administered to individuals 3 years of age and older, for intramuscular use (not otherwise specified) — Providers must bill the administration of the vaccine on the same claim as the vaccine. Report vaccine administration using HCPCS codes: G0008 Administration of influenza virus vaccine G0009 Administration of pneumococcal vaccine G0010 Administration of hepatitis B vaccine (for all providers except OPPS hospitals) G9141 Influenza A (H1N1) immunization administration (includes the physician counseling the patient/family) 90471–90472 Administration of hepatitis B vaccine (OPPS hospitals) — When billing influenza or PPV vaccine, report special program indicator A6 in FLs 18–28. — Hospitals report bill type 013X or 012X as appropriate; SNFs report bill type 022X or 023X as appropriate; swing-bed providers report bill type 012X; HHAs report bill type 034X; RDFs report bill type 072X; CORFs report bill type 075X; CAHs report bill type 085X. Indian Health Service (IHS) or tribally owned and/or operated hospitals and hospital-based facilities may report bill types 012X, 013X, 083X, and 085X as appropriate. — When billing hepatitis B vaccine, the NPI of the ordering physician must be reported in FL 76. When billing influenza vaccine, if a doctor of medicine or osteopathy does not order the influenza virus vaccine, report the provider’s own NPI in the NPI field for the attending physician (FL 76). — Payment for influenza and PPV vaccine and, is based upon reasonable cost for hospitals, HHAs, SNFs, CAHs, provider-based RDFs. Vaccines administered by CORFs, freestanding dialysis facilities, and IHS facilities are paid at the lower of charges or 95 percent of the AWP. — Payment for hepatitis B vaccine is under OPPS for OPPS hospitals and HHAs. Vaccine payment for CORFs and freestanding dialysis facilities is made at the lower of charges or 95 percent of the AWP. — Report the appropriate diagnosis for the immunization in FLs 67, 67A–Q: V03.82 PPV V04.81 Influenza V05.3 Hepatitis B V06.6 PPV and Influenza Use G9141 to report the administration of H1N1 influenza vaccine. OPPS providers must report the H1N1 vaccine reporting G9142 with the G9141 for the H1N1 vaccine administration. (Medicare Claims Processing Manual, Pub. 100-04, chap. 4, sec. 10.9 [trans. 1980, June 4, 2010]) ---------------------------------------------------------- New Influenza Virus Vaccine Code MLN Matters® Number: MM7580 Related Change Request (CR) #: 7580 Related CR Release Date: October 28, 2011 Effective Date: May 9, 2011 Related CR Transmittal #: R2337CP Implementation Date: April 2, 2011 Provider Types Affected Providers and physicians submitting claims to Medicare contractors (Fiscal Intermediaries (FIs), Part A/B Medicare Administrative Contractors (A/B MACs), and/or Regional Home Health Intermediaries (RHHIs)) for influenza vaccines provided to Medicare beneficiaries are affected by this article. What You Need to Know Effective May 9, 2011, claims with influenza virus vaccine code 90654 (influenza virus vaccine, split virus, preservative-free, for intradermal use, for adults ages 18 – 64) will be payable by Medicare for claims with dates of service on or after May 9, 2011, if submitted on or after April 2, 2012. HCPCS code 90654 was added to the 2011 HCPCS file effective January 1, 2011. However, 90654 didn’t become payable by Medicare until May 9, 2011. Please make sure your billing staff is aware of these changes. Medicare contractors will not adjust claims submitted prior to May 9, unless you bring such claims to their attention. Background Change Request (CR) 7580 advises that payment for this code to institutional providers is as follows: Hospitals (Types of Bill (TOB) 12X and 13X, Skilled Nursing Facilities (SNFs) (TOBs 22X and 23X), Home Health Agencies (HHAs) (TOB 34X), hospital-based Renal Dialysis Facilities (RDFs) (TOB 72X) and Critical Access Hospitals (CAHs) (TOB 85X) are paid on reasonable cost; Indian Health Service (IHS) hospitals (TOB12X and 13X) and IHS CAHs (TOB 85X) are paid based on the lower of the actual charge or 95% of the Average Wholesale Price (AWP); and Comprehensive outpatient rehabilitation facilities and independent RDFs (TOB 72X) are paid based on the lower of the actual charge or 95% of the AWP. Fiscal Intermediary Shared System (FISS) Claims Processing Updates For Ambulance Services MLN Matters Number: MM7557 Related Change Request (CR) #: 7557 Related CR Release Date: October 28, 2011 Effective Date: For UB-04 Hardcopy Claims, August 1, 2011. For NPI requirement changes, April 1, 2012 Related CR Transmittal #: R2336CP Implementation Date: April 2, 2012 Provider Types Affected Providers and suppliers submitting claims to Centers for Medicare & Medicaid Services (CMS) contractors (Fiscal Intermediaries (FIs) and/or Part A/Part B Medicare Administrative Contractors (A/B MACs) for ambulance services provided to Medicare beneficiaries. Provider Action Needed This article identifies two changes in ambulance claims submissions. The first applies to UB-04 hard copy claims beginning with dates of service on or after January 1, 2011, submitted August 1, 2011 and after. Mileage must be reported as fractional units. When reporting fractional mileage, providers must round the total miles up to the nearest tenth of a mile and the decimal must be used in the appropriate place (e.g., 99.9). For trips totaling less than 1 mile, enter a “0” before the decimal (e.g., 0.9). This applies on trips of up to 100 miles. The second change applies to claims with dates of service on or after April 1, 2012. Only non-emergency trips (i.e., Healthcare Common Procedure Coding System (HCPCS) codes A0426, A0428) require a National Provider Identifier (NPI) in the Attending Physician field. Entry of a NPI in the Attending Physician field is not required for emergency trips (i.e., HCPCS codes A0427, A0429, A0430, A0431, A0432, A0433, and A0434). For claims with dates of service on or after April 1, 2012, Medicare will assure that only non-emergency trips (i.e., HCPCS A0426, A0428) require an NPI in the Attending Physician field. Emergency trips do not require an NPI in the Attending Physician field (i.e., A0427, A0429, A0430, A0431, A0432, A0433, A0434). Payment for Multiple Surgeries in a Method II Critical Access Hospital (CAH) MLN Matters® Number: MM7587 Related Change Request (CR) #: CR 7587 Related CR Release Date: October 28, 2011 Effective Date: April 1, 2012 Related CR Transmittal #: R2333CP Implementation Date: April 2, 2012 Provider Types Affected Physicians, providers, and Method II Critical Access Hospitals (CAHs) submitting claims to Medicare contractors (Fiscal Intermediaries (FIs) and/or A/B Medicare Administrative Contractors (A/B MACs)) for services provided to Medicare beneficiaries are affected. Provider Action Needed This article is based on Change Request (CR) 7587 which implements the multiple procedure payment reduction policy for CAH Method II providers. CR 7587 updates the “Medicare Claims Processing Manual” (Chapter 4, Section 250). CR7587 is for clarification purposes only and does not introduce any policy changes. Background Medicare uses the payment policy indicators on the Medicare Physician Fee Schedule (MPFS) to determine if a multiple procedure is authorized for a specific Healthcare Common Procedure Coding System/Current Procedural Terminology (HCPCS/CPT) code. Physicians and non-physician practitioners billing on type of bill (TOB) 85X for professional services rendered in a Method II CAH have the option of reassigning their billing rights to the CAH. When the billing rights are reassigned to the Method II CAH, payment is made to the CAH for professional services (revenue code 96X, 97X, or 98X) based on the MPFS supplemental file. Multiple surgeries are separate procedures performed by a single physician or physicians in the same group practice on the same patient at the same operative session or on the same day for which separate payment may be allowed. Co-surgeons, surgical teams, or assistants-at-surgery may participate in performing multiple surgeries on the same patient on the same day. Medicare pays for multiple surgeries by ranking from the highest MPFS amount to the lowest MPFS amount. When the same physician performs more than one surgical service at the same session, the allowed amount is 100 percent for the surgical code with the highest MPFS amount. The allowed amount for the subsequent surgical codes is based on 50 percent of the MPFS amount. In addition, special endoscopic pricing rules are applied prior to the multiple surgery rules, if applicable. Claims lines containing CPT modifier 22 are excluded from the multiple surgery payment methodology. When the multiple surgery and/or special endoscopic payment methodologies are applied, the remittance advice notice will contain: Claim adjustment reason code 59 – “Processed based on the multiple or concurrent procedure rules” and Group code “CO” contractual obligation. Endoscopies If multiple endoscopies are billed, special rules for multiple endoscopic procedures apply. Medicare contractors will perform the following actions when multiple HCPCS/CPT codes with a payment policy indicator of ‘3’ (Special rules for multiple endoscopic procedures), with the same date of service, are present: 1. Identify if the billed codes share the same Endoscopic Base Code (using the Physician Fee Schedule Payment Policy Indicator File). 2. Pay the full value of the highest valued endoscopy (if the same base is shared), plus the difference between the next highest and the base endoscopy. Example: In the course of performing a fiber optic colonoscopy (CPT code 45378), a physician performs a biopsy on a lesion (code 45380) and removes a polyp (code 45385) from a different part of the colon. The physician bills for codes 45380 and 45385. The value of codes 45380 and 45385 have the value of the diagnostic colonoscopy (45378) built in. Rather than paying 100 for the highest valued procedure (45385) and 50 for the next (45380), pay the full value of the higher valued endoscopy (45385), plus the difference between the next highest endoscopy (45380) and the base endoscopy (45378). Medicare contractors: 1. 2. Assume the following fee schedule amounts for these codes: 45378 - $255.40; 45380 - $285.98; 45385 - $374.56; and Pay the full value of 45385 ($374.56), plus the difference between 45380 and 45378 ($30.58), for a total of $405.14. NOTE: If an endoscopic procedure with an indicator of ‘3’ (Special rules for multiple endoscopic procedures) is billed with other procedures that are not endoscopies (procedures with an indicator of ‘2’ (Standard payment adjustment rules for multiple procedures)), the standard multiple surgery rules apply. 3. Apply the following rules where multiple endoscopies are performed on the same day as unrelated endoscopies or other surgical procedures (indicator of ‘2’ (Standard payment adjustment rules for multiple procedures)): Procedure Performed Rules Applied Two unrelated endoscopies (e.g., CPT code Apply the usual multiple surgery rules. 46606 and 43217) Two sets of unrelated endoscopies (e.g., 43202 and 43217; 46606 and 46608) 1. Apply the special endoscopy rules to each series, then 2. Apply the multiple surgery rules. (Consider the total payment for each set of endoscopies as one service) Two unrelated endoscopies and a third, unrelated procedure Two related endoscopies and a third, unrelated procedure Apply the multiple surgery rules. 1. Apply the special endoscopic rules to the related endoscopies, then 2. Apply the multiple surgery rules. (Consider the total payment for the related endoscopies as one service and the unrelated endoscopy as another service.) You can review the multiple surgery and special endoscopic pricing rules in the Medicare Claims Processing Manual (Chapter 12 (Physicians/Nonphysician Practitioners), Section 40.6 (Claims for Multiple Surgeries)); see https://www.cms.gov/manuals/downloads/clm104c12.pdf on the CMS website). In addition, Chapter 12, Section 40.6.D addresses rare situations where the above payment rules may be bypassed using modifier 22 (Increased Procedural Services). Providers should be aware that CAH claims billed with CPT modifier 22 may be subject to medical review. Additional Billing Clarification for Positron Emission Tomography (PET) Positron Emission Tomography (PET) is a minimally invasive diagnostic imaging procedure used to evaluate metabolism in normal tissues and diseased tissues in conditions such as cancer, ischemic heart disease and some neurologic disorders. Coverage Guidelines The Centers for Medicare & Medicaid Services (CMS) coverage policies for PET indications are determined at a national level. On April 3, 2009, the CMS expanded coverage for initial diagnostic testing with PET in a National Coverage Determination (NCD) policy so that all Medicare beneficiaries with certain cancers will be able to receive Medicare coverage for at least one PET scan as prescribed by their physicians. The CMS PET coverage is documented in the Medicare National Coverage Determinations Manual 100-03, Chapter 1, Part 4, section 220.6 (PDF, 1.04 MB). Section 220.6 lists all Medicare-covered uses of PET scans except the area in cancer indications listed as 'Coverage with Evidence Development,' a particular use of PET scans that is not covered unless otherwise noted in this manual. Although Section 220.6 lists some non-covered uses of PET scans, it does not provide an exhaustive list of all non-covered uses. Billing instructions Complete billing instructions are available in the Medicare Claims Processing Manual 100-04, Chapter 13 - Radiology Services and Other Diagnostic Procedures, section 60 - Positron Emission Tomography (PET) Scans (PDF, 368 KB). Claims reporting PET scans are edited for appropriate CMS billing and coverage requirements. Palmetto GBA assigns PET scans the Fiscal Intermediary Shared System (FISS) reason code series 7PET1 through 7PET9 for claim processing purposes. The following CPT codes are applicable for all cancer categories: CPT Code Descriptor 78811 PET imaging, limited area (e.g. chest, head/neck) 78812 Skull base to mid-thigh 78813 Whole body 78814 PET with concurrently acquired computed tomography (CT) for attenuation correction and anatomical localization imaging; limited area (e.g. chest, head/neck) 78815 Skull base to mid-thigh 78816 Whole body Please note: When reporting 'V' diagnosis codes on a claim, a primary diagnosis is required. Additional information for cancer diagnoses should be reported in the remarks field. The following chart may be used to determine if special instructions apply when submitting a PET claim. Site Special Instructions Reference Colorectal V code must be billed with a primary diagnosis National Coverage Determinations (NCD) Manual 100-03, Chapter 1, Part 4, section 220.6.4, 220.6.17 Esophagus V code must be billed with a primary diagnosis NCD Manual 100-03, Chapter 1, Part 4, section 220.6.3, 220.6.17 Head and Neck Not Central V code must be billed with a primary diagnosis Nervous System or Thyroid Cancers NCD Manual 100-03, Chapter 1, Part 4, section 220.6.7, 220.6.17 Lymphoma NCD Manual 100-03, Chapter 1, Part 4, section 220.6.5, 220.6.17 Non-Small Cell Lung V code must be billed with a primary diagnosis V code must be billed with a primary diagnosis NCD Manual 100-03, Chapter 1, Part 4, section 220.6.2, 220.6.17 CMS IOM, 100-04, Chapter 13, §60.7 V code must be billed with a primary diagnosis NCD Manual 100-03, Chapter 1, Part 4, section 220.6.14, 220.6.17 Myeloma N/A NCD Manual 100-3, Chapter 1, Part 4, section 220.6.17 Brain V code must be billed with a primary diagnosis NCD Manual 100-3, Chapter 1, Part 4, section 220.6.14, 220.6.17 Cervical Nationally non-covered FDG for the initial diagnosis of cervical cancer r/t initial treatment strategy. All other indications for initial treatment strategy for cervical cancer are nationally covered. Ovarian NCD Manual 100-03, Chapter 1, Part 4, section 220.6.14, 220.6.17-2d,e,4 CMS IOM, 100-04, Effective for claims with dates of service on or after Chapter 13, §60.13, November 10, 2009, contractors shall accept FDG PET §60.17 oncologic claims billed to inform initial treatment strategy; specifically for staging in beneficiaries who have biopsy-proven cervical cancer when the beneficiary’s treating physician determines the FDG PET study is needed to determine the location and/or extent of the tumor as specified in NCD Manual 100-03, section 220.6.17. V code must be billed with a primary diagnosis. Only covered with Coverage Evidence Development (CED) for subsequent treatment. Small Cell Lung V code must be billed with a primary diagnosis. Additional information should be included in the Remarks field that the primary diagnosis is ‘small cell lung cancer.’ NCD Manual 100-03, Chapter 1, Part 4, section 220.6.14, 220.6.17 Soft Tissue Sarcoma V code must be billed with a primary diagnosis NCD Manual 100-03, Chapter 1, Part 4, section 220.6.12, 220.6.17 Pancreatic N/A NCD Manual 100-03, Chapter 1, Part 4, section 220.6.14, 220.6.17 V code must be billed with a primary diagnosis NCD Manual 100-3, Chapter 1, Part 4, section 220.6.14, 220.6.17 Testicular Nationally non-covered for initial diagnosis and initial staging (196.3, 196.8) of Axillary Nodes. Breast Female/Male Cover FDG PET for the initial treatment of male and female breast cancer only when used in staging distant metastasis. V code must be billed with a primary diagnosis. Add information to indicate subsequent in Remarks field. Melanoma Nationally non-covered for the evaluation and initial staging of regional lymph nodes. NCD Manual 100-03, Chapter 1, Part 4, section 220.6.10, 220.6.17 2b, 4 CMS IOM, 100-04, Chapter 13, §60.8 NCD Manual 100-03, Chapter 1, Part 4, section All other indications for initial treatment strategy are nationally covered. V code must be billed with a primary diagnosis. Prostate FDG (A9552) PET is nationally non-covered for initial anti-tumor treatment strategy for patients with Adenocarcinoma of the prostate. 220.6.6 and 220.6.17 2c, 4 CMS IOM, 100-04, Chapter 13, §60.7 NCD Manual 100-03, Chapter 1, Part 4, section 220.6, 220.6.17 2a V code must be billed with primary diagnosis. Nationally covered for subsequent treatment strategy of recurrent or residual thyroid cancer of follicular cell origin previously treated by thyroidectomy and radioiodine ablation and have a serum thyroglobulin > 10ng/ml and have a negative I-131 whole body scan. Thyroid All other indications for subsequent treatment for thyroid cancer are nationally covered under CED. Add information to indicate previous treatment (thyroidectomy and radioiodine ablation), serum thyroglobulin level and negative I-131 whole body scan in the Remarks field. NCD Manual 100-03, Chapter 1, Part 4, section 220.6.11 and 220.6.17, 4 CMS IOM, 100-04, Chapter 13, §60.10 V code must be billed with primary diagnosis. All other Cancers Not Listed N/A NCD Manual 100-03, Chapter 1, Part 4, section 220.6, 220.6.17 All other Solid Tumors Not Listed N/A NCD Manual 100-03, Chapter 1, Part 4, section 220.6, 220.6.17 Influenza Vaccine Payment Allowances: Annual Update for 2011-2012 Season MLN Matters® Number: MM7575 Related Change Request (CR) #: 7575 Related CR Release Date: October 27, 2011 Effective Date: September 1, 2011 Related CR Transmittal #: R2329CP Implementation Date: January 27, 2012 Provider Types Affected This article is for physicians and providers submitting claims to Medicare contractors (carriers, Fiscal Intermediaries (FIs), and/or Part A/B Medicare Administrative Contractors (A/B MACs)) for influenza vaccines provided to Medicare beneficiaries. Provider Action Needed The Centers for Medicare & Medicaid Services (CMS) issued Change Request (CR) 7575 in order to update payment allowances, effective September 1, 2011, for influenza vaccines when payment is based on 95 percent of the Average Wholesale Price (AWP). Be sure your billing staffs are aware of this update. Background CR7575 provides the payment allowances for the following seasonal influenza virus vaccines: Current Procedural Terminology (CPT) codes 90654, 90655, 90656, 90657, 90660, and 90662 and Healthcare Common Procedure Coding System (HCPCS) codes Q2035, Q2036, Q2037, Q2038, and Q2039 when payment is based on 95 percent of the AWP. The payment allowances for influenza vaccines are updated on an annual basis effective September 1 of each year. Effective for dates of service on or after September 1, 2011, (except payment is based on reasonable cost where the vaccine is furnished in a hospital outpatient department, a Rural Health Clinic, or a Federally qualified health center), the Medicare Part B payment allowance for: CPT 90655 is $15.705; CPT 90656 is $12.375; CPT 90657 is $6.653; HCPCS Q2035 (Afluria®) is $11.543; HCPCS Q2036 (Flulaval®) is $8.784 HCPCS Q2037 (Fluvirin®) is $13.652; and HCPCS Q2038 (Fluzone®) is $13.306 Note: The Medicare Part B payment allowance for HCPCS Q2039 (Flu Vaccine Adult - Not Otherwise Classified) will be determined by your local Medicare contractor. Hospital routine services under arrangement requirement On August 18, 2011, the Centers for Medicare & Medicaid Services (CMS) issued the fiscal year (FY) 2012 inpatient prospective payment system (IPPS) final rule. The final rule included a provision limiting the circumstances under which a hospital may furnish services “under arrangement.” Under the revised policy, only therapeutic and diagnostic services may be furnished outside of the hospital under arrangement; “routine services” (for example, bed, board, and nursing services) must be provided by the hospital. Under the policy, routine services that are furnished in the hospital to its inpatients are considered as being provided by the hospital. If services are provided outside of the hospital, the services are considered as being provided under arrangement. CMS recognizes that hospitals may need more time to restructure existing arrangements and establish operational protocols necessary to comply with the requirement that only therapeutic and diagnostic services may be furnished outside of the hospital under arrangement and that “routine services” must be provided by the hospital. CMS expects that during FY 2012, hospitals will work towards ensuring compliance with the new requirements. CMS will continue to work with these hospitals to communicate the requirements of this provision and to provide continued guidance. Beginning with the FY 2013, all hospitals will need to be in full compliance with the modified under arrangement provisions. CMS adopts policy and payment changes for outpatient care in hospitals and ambulatory surgical centers The Centers for Medicare & Medicaid Services (CMS) issued a final rule with comment period (final rule) that will update payment policies and payment rates for services furnished to Medicare beneficiaries in hospital outpatient departments (HOPDs) and ambulatory surgical centers (ASCs) beginning January 1, 2012. In addition to establishing payment rates for calendar year (CY) 2012, the final rule expands the measures to be reported under the hospital outpatient quality reporting program, creates a new quality reporting program for ASCs, and strengthens the hospital value-based purchasing (hospital VBP) program that will affect payments to hospitals for inpatient stays beginning Oct. 1 2012. CMS projects that total payments to more than 4,000 hospitals -- which includes general acute care hospitals, inpatient rehabilitation facilities, inpatient psychiatric facilities, long-term acute care hospitals, children’s hospitals, and cancer hospitals -- paid under the outpatient prospective payment system (OPPS) in CY 2012 will be approximately $41.1 billion. CMS also projects that payments to approximately 5,000 Medicareparticipating ASCs paid under the ASC payment system will be approximately $3.5 billion for CY 2012. “The CMS is committed to the goal of improving the quality and safety of care in all settings for all patients,” said CMS Administrator Donald M. Berwick, M.D. “Using the tools made available under the Affordable Care Act, CMS is moving aggressively to reform the payment and health care delivery systems to provide better care at lower costs through improvement.” The final rule also establishes an electronic reporting pilot that will allow additional hospitals, including critical access hospitals (CAHs), to report clinical quality measures in CY 2012 for purposes of participating in the Medicare electronic health record incentive program. Provisions affecting payments to hospital outpatient departments The final rule will increase payment rates under the OPPS by 1.9 percent in CY 2012. This increase is based on the projected hospital inpatient market basket percentage increase of 3.0 percent for inpatient services paid under the hospital inpatient prospective payment system (IPPS) minus the multifactor productivity adjustment of 1.0 percentage points and minus a 0.1 percentage point adjustment, both of which are required by the Affordable Care Act. The final rule also provides a payment adjustment for designated cancer hospitals as required by the Affordable Care Act. This payment adjustment is expected to increase payments to cancer hospitals by 11.3 percent (or approximately $71 million) over what they would have otherwise been paid. In response to concerns that Medicare’s requirement for direct physician supervision of outpatient hospital therapeutic services could hinder access for beneficiaries specifically in rural areas, the final rule establishes an independent advisory review process to consider requests that specific outpatient services be subject to a level of supervision other than direct supervision. Under this process, CMS will seek recommendations from Ambulatory Payment Classification (APC) Advisory Panel about appropriate supervision requirements. This panel was created to provide technical advice and recommendations to CMS about assigning items and services furnished in hospital outpatient departments to appropriate payment classifications. CMS will add two small rural PPS hospital members and two CAH members to represent their interests to the panel so that all hospitals subject to the supervision rules for payment of outpatient therapeutic services will be represented. Since CAHs are not paid under the OPPS, CAH representatives would not participate in deliberations about APC assignments. “The CMS is committed to ensuring that beneficiaries who are treated in small rural hospitals have access to high quality, safe therapeutic services in outpatient departments,” said Jonathan Blum, deputy administrator and director for CMS’s Center for Medicare. “We believe the process we have adopted will provide meaningful and transparent input from stakeholders to assist CMS in establishing appropriate supervision requirements.” In other provisions, the final rule will: • Pay for the acquisition and pharmacy overhead costs of separately payable drugs and biologicals, other than new drugs and biologicals that have pass-through status, at the average sales price (ASP) plus 4 percent. • Pay for partial hospitalization (PHP) services in hospital-based PHPs and community mental health centers (CMHCs) based on the unique cost-structures of each type of program. For both types of providers, CMS is proposing to finalize our proposal to update the four PHP per diem payment rates based on the median costs calculated using the most recent claims data for each provider type. • Increase the number of measures for reporting in CY 2012 and CY 2013 for purposes of the CY 2014 and CY 2015 payment determinations, and would modify the process for selecting hospitals for validating reported chart-abstracted measures that was adopted for CY 2012 in the CY 2011 OPPS rule. Provisions affecting payments to ambulatory surgical centers The final rule increases payment rates to ASCs by 1.6 percent in CY 2012. This reflects a consumer price index for all urban consumers estimated at 2.7 percent, minus a 1.1 percent productivity adjustment required by the Affordable Care Act. The final rule also establishes a quality reporting program for ASCs and adopts five quality measures, including four outcome measures and one surgical infection control measure beginning in CY 2012 for the CY 2014 payment determination. The final rule adds two structural measures for reporting beginning in CY 2013 for the CY 2015 and CY 2016 payment determinations -- one for safe surgery checklist use, and one for ASC facility volume data on selected ASC surgical procedures. Provisions affecting the hospital value-based purchasing program The hospital VBP, which was required by section 3001(a) of the Affordable Care Act, was initially established in a final rule published in May 2011. The final rule contained the measures, performance standards, and scoring methodology that would be used to determine the value-based incentive payments to hospitals in FY 2013. The final rule announced today addresses the program requirements for the FY 2014 program. These changes include: adding one clinical process measure to guard against infections due to urinary catheters; and, establishing the weighting, performance periods, and performance standards for the clinical process, patient experience, and outcomes measures for FY 2014. The final rule with comment period for the OPPS and the ASC payment system can be downloaded from: http://www.ofr.gov/inspection.aspx . It will appear in the November 30, 2011, Federal Register. CMS will accept comments on issues open for comment by January, 3, 2012, and will respond to them in the CY 2013 rule. The addenda to the final rule for the OPPS are available at: http://www.cms.gov/HospitalOutpatientPPS . The addenda to the final rule for the ASC payment system are available at: http://www.cms.gov/ASCpayment/ . A CMS fact sheet (November 1, 2011) providing more details on the final rule can be found at: http://www.cms.gov/apps/media/press/factsheet.asp?Counter=4145 . Skilled nursing facility claims hold The Centers for Medicare & Medicaid Services (CMS) has identified a claim processing problem impacting skilled nursing facility (SNF) type of bills 18x and 21x containing Healthcare Common Procedure Coding System (HCPCS) code AAAxx and revenue code 0022. CMS is holding these claims. As soon as a system fix is in place and successfully tested, these claims will be released for processing. CMS appreciates your patience and apologize for any inconvenience this may cause. What does attestation for the EHR incentive programs entail? Over 114,000 eligible professionals and hospitals have registered for the Medicare and Medicaid electronic health record (EHR) incentive programs. As more hospitals move towards meeting meaningful use and attesting, the Centers for Medicare & Medicaid Services (CMS) wants to make sure everyone understands what attestation entails. In order to attest, successfully demonstrate meaningful use, and receive an incentive payment under the Medicare EHR incentive program, eligible hospitals must indicate that they agree with several attestation statements. Eligible hospitals must agree that the information submitted: • Is accurate to the knowledge and belief of the hospital or the person submitting on behalf of the hospital • Is accurate and complete for numerators, denominators, exclusions, and measures applicable to the hospital • Includes information on all patients to whom the measure applies. • For clinical quality measures (CQMs), was generated as output from an identified certified EHR technology By agreeing to the above statements, the hospital is attesting to providing all of the information necessary from certified EHR technology, uncertified EHR technology, and/or paper-based records in order to render complete and accurate information for all meaningful use core and menu set measures except CQMs. Attesting to CQM data's validity CMS considers information to be accurate and complete for CQMs to the extent that it is identical to the output that was generated from certified EHR technology. In other words, the hospital is only attesting that what was put in the attestation module is identical to the output generated by its certified EHR technology. Therefore, the numerator, denominator, and exclusion information for CQMs must be reported directly from information generated by certified EHR technology. CMS, through meaningful use, does not require any data validation. Eligible hospitals are not required to provide any additional information beyond what is generated from certified EHR technology in order to satisfy the requirement for submitting CQM information, even if the reported values include zeros. If a hospital has concerns about the accuracy of its output, the hospital can still attest but should work with its vendor and/or the Office of the National Coordinator for Health Information Technology to improve the accuracy of the individual product and/or the level of accuracy guaranteed by certification. CMS recommends that hospitals print out or save an electronic copy of the CQM report used at attestation from their certified EHR. The eligible hospital should retain this copy for its records so that the hospital can show its numbers in the event of an audit. Upon audit, this documentation will be used to validate that the hospital accurately attested and submitted CQMs. For more information about the Medicare and Medicaid EHR incentive programs, please visit the CMS EHR website . Also, see the frequently asked questions page for answers on various topic areas of the programs. ------------------------------------------------------------ Medicare Changes to the 3-Day Payment Window Rule Impact Physician Billing in 2012 On November 1, 2011, the Centers for Medicare and Medicaid Services (CMS) issued its Calendar Year (CY) 2012 Medicare Physician Fee Schedule Final Rule (Final Rule) finalizing proposed changes that impact physician billing for services subject to a billing policy commonly known as the 3-Day Payment Window Rule (or 1-Day Payment Window Rule for certain non-IPPS hospitals). Earlier this year, in the Fiscal Year 2012 Inpatient Prospective Payment System (IPPS) Final Rule, CMS expanded the outpatient services that are subject to the 3-Day/1-Day Payment Window Rule (Payment Window Rule). These changes were further discussed under proposed changes to the CY 2012 Medicare Physician Fee Schedule (MPFS). (See Hall Render's Health Law News article dated August 8, 2011: http://www.hallrender.com/library/articles/887/080811HLN.html). Importantly, the effective date of the Final Rule is delayed until July 1, 2012. The delay is to allow hospitals and wholly owned or wholly operated entities more time to coordinate efforts in ensuring proper billing. Under the Payment Window Rule, all diagnostic services furnished to a Medicare beneficiary by a hospital (or entity wholly owned or wholly operated by the hospital) on the date of the beneficiary's inpatient admission, or during the 3 calendar days immediately preceding the date of the beneficiary's admission (1 day for certain non-IPPS hospitals, the "Payment Window"), must be billed by the hospital and included on the hospital's Part A claim for the inpatient stay. As further explained below, the most recent changes to the Payment Window Rule expand its application to non-diagnostic services. CMS stated that all "clinically related" outpatient non-diagnostic services (except for ambulance and chronic maintenance of renal dialysis services) provided by the hospital (or an entity wholly owned or wholly operated by the hospital) within the Payment Window must also be billed on the hospital's Part A claim for the inpatient stay. Any "unrelated" outpatient non-diagnostic services provided within the Payment Window may be billed separately, but there must be documentation in the medical record to support that the non-diagnostic services were not related. Previously, CMS's policy was that non-diagnostic services were included in the Payment Window only if there was an exact match in principal diagnosis codes. Whenever a physician furnishes services in a hospital, including an outpatient department of a hospital, Medicare pays the physician under the MPFS at a facility-based payment rate that is lower than the "nonfacility" payment rate in order to avoid duplication of payment for supplies, equipment and staff that are paid directly to the hospital by Medicare. Therefore, when physicians provide services during the Payment Window in a wholly owned or wholly operated entity, physicians should receive payment at the facility rate for related non-diagnostic services and receive payment for only the professional component of diagnostic services. Billing Changes: New Payment Modifier Beginning on January 1, 2012, new payment modifier "PD" will be available to wholly owned or wholly operated entities to identify a "diagnostic or related non-diagnostic item or service provided in a wholly owned or wholly operated entity to a patient who is admitted as an inpatient within 3 days, or 1 day." Even though compliance with the Final Rule is delayed until July 1, 2012, entities should begin using modifier PD on applicable claims as soon as possible. The PD modifier will signal claims processing to provide payment for the professional component only of CPT/HCPCS codes with a professional component and technical component (PC/TC) split and at the facility rate for non-diagnostic services when the services are provided within the Payment Window. Hospitals are required to include the technical component portion of all diagnostic and clinically-related non-diagnostic services furnished by wholly owned or wholly operated entities during the Payment Window on their cost reports. Hospitals are advised to "accumulate the costs incurred and the adjustments required for these services and report as costs with related organizations on the Medicare cost report." This step may prove challenging for hospitals and will require planning to ensure that the appropriate costs are reported. Further, the Payment Window may also overlap with a global surgical period that varies depending on the type of surgical procedure. If the surgical procedure occurs during the Payment Window, the Payment Window Rule applies and the wholly owned or wholly operated physician practice will bill for preadmission diagnostic and clinically-related non-diagnostic services with the new HCPCS modifier. If the surgical procedure occurs before the Payment Window, the Payment Window Rule does not apply. However, any service billed separately from the global surgical package will be subject to the Payment Window Rule. Applicability of Payment Window to Physician Services Furnished in Wholly Owned or Wholly Operated Entities If a physician practice is wholly owned or wholly operated by a hospital, that physician practice is subject to the Payment Window Rule and therefore impacted by these changes. But, CMS clarified that these changes also apply to entities besides physician practices. CMS is amending 42 C.F.R. §414.22(b)(5)(1)(A), which defines facility practice expense RVUs, to use the term "entity" instead of "physician practice" as was proposed. More fully, the regulation will state "the facility PE RVUs apply to services furnished to patients in places of service including, but not limited to, a hospital, a skilled nursing facility, a community mental health center, a hospice, or an ambulatory surgical center, or in a wholly owned or wholly operated entity furnishing preadmission services...." This decision was made to make the definition more broad and to eliminate any ambiguity that the statutory authority for the billing policy applies solely to physician offices or clinics. Therefore, hospitals need to review each wholly owned and wholly operated entity to determine the extent to which the Payment Window Rule applies to each type of entity. Even though they would be considered "entities" under the Payment Window Rule, CMS stated it is not applying the Payment Window policy to rural health clinics (RHCs) and federally qualified health centers (FQHCs). Medicare pays RHCs and FQHCs through an all-inclusive rate and it would be difficult to distinguish within the all-inclusive rate the amount of the payment that represents the professional portion versus the technical portion. Since the Payment Window Rule requires the hospital to include in its inpatient bill the technical portion of any outpatient diagnostic service and admission-related nondiagnostic service, the Payment Window Rule cannot practically be applied to RHCs and FQHCs. The Payment Window Rule could apply in the future if RHCs and FQHCs transition from an all-inclusive rate to a prospective or other payment system that would allow a distinction between professional and technical charges. However, if practitioners furnish additional services to beneficiaries during the visit, services that are not considered RHC/FQHC services, those additional services payable under Medicare Part B are subject to the Payment Window Rule. CMS reiterated its refusal to identify all non-diagnostic services that should be considered "clinically related." CMS reasoned that the determination of whether services are "clinically related" requires knowledge of specific clinical circumstances involved in a patient's inpatient admission and should be determined on a case-by-case basis. Identification of Wholly Owned or Wholly Operated Entities The longstanding definitions of "wholly owned" and "wholly operated" have not changed. If the hospital is the sole owner of the entity or the sole operator of the entity (i.e., if the hospital has exclusive responsibility for conducting and overseeing the entity's routine operations, regardless of whether the hospital also has policymaking authority over the entity), then services provided by the entity are subject to the Payment Window. With the Payment Window Rule expansion however, CMS is evaluating ways to determine which entities are wholly owned or wholly operated by a hospital. Hospitals face the challenge of identifying the services provided by their wholly owned and wholly operated entities that are subject to the Payment Window Rule and putting processes in place to ensure proper billing of both the facility claim and the claim for professional services. For example, if the services are billed on different billing systems, it may be difficult to identify the applicable services. Use of the "PD" modifier is new and will require education of billing staff submitting professional claims. The hospital must confirm that appropriate documentation is in the medical record when the claims are billed as unrelated. Finally, hospitals and their entities will need to communicate to ensure that patients who may have received preadmission services are identified at the time of the inpatient admission.