ABOUT THE SPEAKERS: - New Hampshire Bankers Association

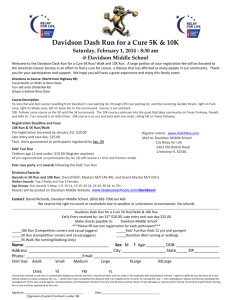

advertisement

MAINE BANKERS ASSOCIATION NEW HAMPSHIRE BANKERS ASSOCIATION VERMONT BANKERS ASSOCIATION, INC. PRESENT: 2015 ANNUAL TRI-STATE TRUST FORUM Monday, September 21, & Tuesday, September 22, 2015 Marriott Residence Inn Portsmouth, New Hampshire MEET THE SPEAKERS MONDAY, SEPTEMBER 21, 2015 RYAN SWEET Director of Real-Time Economics Moody’s Analytics Ryan Sweet is Director of real-time economics at Moody's Analytics. He is a member of the U.S. macroeconomics team in West Chester PA, which has received the Forecaster of the Month award from MarketWatch/Dow Jones on several occasions. The team also has been recognized by Bloomberg LP as the top forecaster for several economic indicators. Mr. Sweet is also editor-in-chief of and a regular contributor to the Dismal Scientist web site, where his analysis of global economic and financial market developments is posted throughout the business day. His research interests include macroeconomics, monetary policy, labor markets and financial markets. Mr. Sweet gives regular talks on the U.S. and global economic outlook and is frequently cited in international, national, and regional media outlets. He has appeared on MSNBC, Fox Business, Bloomberg TV and Nightly Business Report and various other national networks and news programs. He has also appeared on Bloomberg radio, WSJ radio and public radio's Marketplace. Mr. Sweet is also an adjunct professor in the Economics and Finance Department at West Chester University of Pennsylvania and was recognized by the Honors College as an outstanding faculty member. BRAD DAVIDSON Founder & Principal, Spardata Managing Partner, Unique Asset Partners LLC Brad Davidson is a recognized expert in valuing, administering and managing “unique assets” (such as real estate partnerships, privately-owned businesses, mineral interests, insurance policies, loans and notes, and collectibles). He is founder of and a Principal with Spardata, a unique asset valuation firm; and is Managing Partner of Unique Asset Partners LLC, a “one-stop shop” providing everything professional trustees and owners need to manage unique assets successfully. Page 1 of 4 Financial service providers currently using SPARDATA and/or Unique Asset Partners include PNC Bank, Fiduciary Trust, First Hawaiian Bank, Bank of the West, Farmers & Merchants Trust Company, Trustmark Bank, Key Bank and First National Bank of Omaha. The firm’s clients also include business owners; the advisors serving them (including financial advisors, trust officers, CPAs and attorneys) and government institutions. Organizations that have invited Davidson to lecture include the Internal Revenue Service, the Securities and Exchange Commission, the North American Securities Administrators Association, the Department of Labor, the Federal Financial Institution Examination Council, the Federal Reserve, numerous state banking associations and the American Society of Pension Actuaries. SPARDATA has been cited on numerous occasions by the Wall Street Journal, the Washington Post and other publications. In 1980 Davidson began his career in the financial services industry when he became a financial advisor with Merrill Lynch, where he was a “rookie of the year” in 1981. In 1984 he joined Prudential-Bache Investments as a vice president, leaving in 1986 to run an investment fund that bought and sold real estate limited partnership interests in the secondary market. In 1990 he became president of SPARDATA. Beyond financial analysis, Davidson has had a diverse array of work experiences. From 1977-1979 in his first job after college, he worked on Capitol Hill as a legislative assistant to a Texas Congressman from a rural district. (To this day he will discuss the Federal Insecticide, Fungicide and Rodenticide Act with anyone willing to listen.) Working on the Hill infected him with the political bug so in 1979 Davidson enlisted in the Maryland Army National Guard and was ordered to Ft. Sill OK for basic training. (Later he attended Officer Candidate School, was commissioned an infantry officer and retired in the late 1980s having achieved the rank of Captain in the United States Army Reserve.) Two years later Davidson became the “boy wonder” of Annapolis politics by becoming the youngest person ever elected to the Annapolis City Council; he was reelected without opposition in 1985. In 1987 Governor William Donald Schaefer appointed him Chairman of the State Commission on the Capital City, a position he held until 1996. Today Davidson serves on the boards of the Walters Art Gallery and the Bryn Mawr School in Baltimore, and the J. M. Kaplan Fund in New York City. From 1984 until 2002 Mr. Davidson was a Director of Microsemi Corporation of Santa Ana, California, a publicly-held manufacturer of electronic products where he served on the audit and compensation committees. He previously served on the boards of St. John’s College of Annapolis Maryland and Santa Fe New Mexico; the Historic Annapolis Foundation (where he was chairman for eight years), and North Country School in Lake Placid, New York. He lives in Annapolis Maryland with Lynne, his wife of 31 years. They have two grown children. Brad may be reached at bdavidson@spardata.com. TOM NELSON Chief Strategy Officer - Head of FDIC Insured Programs Reich & Tang Tom Nelson is Reich & Tang's Chief Strategy Officer and Head of FDIC Insured Programs. He works extensively with community bankers and trust/wealth management professionals to develop balance sheet management strategies, comprehensive funding programs, and FDIC insured investment solutions that increase profitability, minimize costs, and decrease investment portfolio risks while Page 2 of 4 increasing overall returns. Mr. Nelson previously served as the Director of Institutional Sales at IDC, where he was responsible for building its FDIC-insured deposit program and introducing it within the trust, bank, broker-dealer, and institutional markets. ROBERT L. BIXBY Executive Director The Concord Coalition Robert L. Bixby is executive director of The Concord Coalition, a nonpartisan organization that encourages fiscal responsibility in Washington and helps educate the public about the federal budget and the need to protect our children and future generations from excessive government debt. Bixby joined Concord in 1992 and served in several positions, including policy director and national field director, before being named executive director in 1999. He has served as a member of the Bipartisan Policy Center’s Debt Reduction Task Force (the Domenici-Rivlin commission), which produced a model plan for comprehensive fiscal reform. He frequently speaks around the country on the nation’s fiscal challenges and possible bipartisan solutions, including greater government efficiency, tax reform and improvements in the entitlement program. He has testified at congressional hearings and been interviewed by news organizations around the country. Bixby has appeared on ABC, NBC, CBS, PBS, CNN and Fox News. He and The Concord Coalition’s “Fiscal Wake-Up Tour” were also featured prominently in the critically-acclaimed documentary film “I.O.U.S.A.” Bixby has a bachelor's degree in political science from American University, a juris doctorate from George Mason University School of Law, and a master's degree in public administration from the John F. Kennedy School of Government at Harvard University. Before joining Concord, he practiced law and served as the chief staff attorney of the Court of Appeals of Virginia. TUESDAY, SEPTEMBER 22, 2015 PHOEBE A. PAPAGEORGIOU Vice President and Senior Counsel American Bankers Association As Vice President and Senior Counsel for the American Bankers Association’s Center for Securities, Trust & Investments, Phoebe Papageorgiou covers regulatory and legislative developments of interest to trust bankers. She manages the advocacy efforts of the ABA Trust Counsel Committee, ABA Trust Taxation Committee, as well as the ABA Collective Funds Task Force. She also is the Managing Editor of ABA Trust Letter, a newsletter for the trust and wealth management industry. Before joining ABA in 2005, Phoebe worked for the U.S. Department of the Treasury in the Office of Domestic Finance. She received her law degree from The George Washington University Law School and her undergraduate degree from Carnegie Mellon University. JUDITH WARD Senior Financial Planner & Vice President T. Rowe Price Investment Services Judith Ward is a senior financial planner and vice president of T. Rowe Price Investment Services. She provides guidance on personal finance and retirement-related issues and is responsible for developing a Page 3 of 4 broad range of financial planning products and services. Additionally, she provides T. Rowe Price perspectives to individuals, institutions, and the media and contributes to T. Rowe Price publications. She is also quoted in national news organizations' columns and websites. With the company since 1983, Judith earned a B.A. in economics and a certificate in finance from the University of Maryland, Baltimore County. She is a CERTIFIED FINANCIAL PLANNER™ certificant and is a Series 7 and Series 65 registered representative. ANNE FINK Executive Director J.P. Morgan Anne Fink, Executive Director, is a member of the Fixed Income Insights Team within the Global Fixed Income, Currency & Commodities (GFICC) group. Based in New York. Anne is responsible for developing fixed income thought leadership, marketing content, and executive communications. Throughout her career in the capital markets, she has been involved in client relationship management, marketing, sales, investor relations, research and product development. Before joining J.P. Morgan in 2013, Anne was at Brightwater Capital Management, the fixed income asset management subsidiary of WestLB AG, as the Head of Marketing & Investor Relations for Structured Finance investments. Prior to joining Brightwater, Anne held a similar position at the parent company, WestLB AG, as Executive Director responsible for Marketing & Investor Relations for the Asset Securitization business. Previously, Anne had a ten year career at Chase and its predecessor organizations serving as a Vice President at Chase Asset Management in Fixed Income Research as well as a Vice President at Chase Manhattan Bank in Capital Markets Credit. Anne holds an M.B.A. in finance from New York University and a B.S. in finance from Georgetown University. BARRY H. SACKS, J.D., PH.D. Saichek Law Firm Barry Sacks is a tax lawyer who has recently retired after a 42-year career in several prominent San Francisco law firms. His professional focus throughout his career was on the various tax-favored retirement plans, including 401(k) plans, Keogh plans, and Individual Retirement Accounts (“IRAs”). All of these plans are vehicle for accumulating wealth, to be ultimately distributed during retirement. As he developed his understanding of the accumulation process and the subsequent distribution process, he recognized that very often a personal residence is also a vehicle for accumulation of wealth. And, when properly used, the residence can also provide a source for wealth distribution during retirement. After studying some of the academic literature on the economics of retirement income, he developed the strategy of integrating the deferred repayment equity line (also known as a reverse mortgage credit line) with the retirement securities portfolio, as he will describe in his presentation. Barry is a graduate of Harvard Law School, a member of the California State Bar, and certified as a Specialist in Taxation Law by the California Board of Legal Specialization. He has been selected by his professional peers to be listed in “Best Lawyers in America” and in “Super Lawyers of Northern California.” Before his legal career, Barry studied physics at MIT, earned a Ph.D., and taught and did research at the University of California at Berkeley and at the University of Paris. Page 4 of 4