Global Growth - Application Form

advertisement

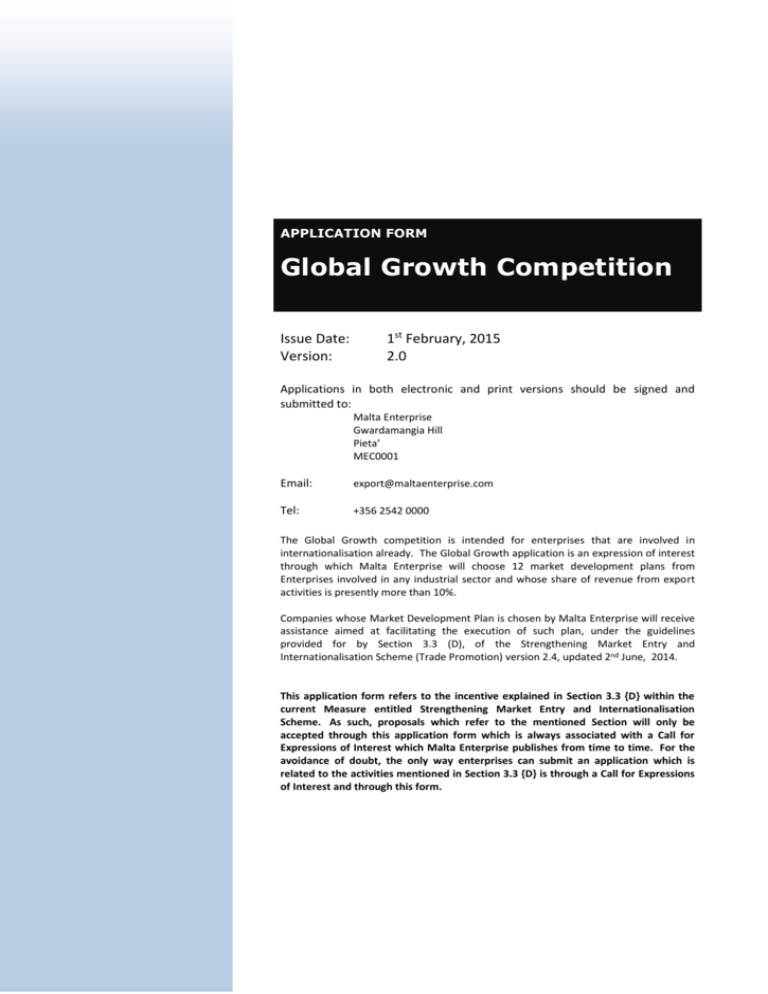

APPLICATION FORM

Global Growth Competition

Issue Date:

Version:

1st February, 2015

2.0

Applications in both electronic and print versions should be signed and

submitted to:

Malta Enterprise

Gwardamangia Hill

Pieta’

MEC0001

Email:

export@maltaenterprise.com

Tel:

+356 2542 0000

The Global Growth competition is intended for enterprises that are involved in

internationalisation already. The Global Growth application is an expression of interest

through which Malta Enterprise will choose 12 market development plans from

Enterprises involved in any industrial sector and whose share of revenue from export

activities is presently more than 10%.

Companies whose Market Development Plan is chosen by Malta Enterprise will receive

assistance aimed at facilitating the execution of such plan, under the guidelines

provided for by Section 3.3 (D), of the Strengthening Market Entry and

Internationalisation Scheme (Trade Promotion) version 2.4, updated 2nd June, 2014.

This application form refers to the incentive explained in Section 3.3 {D} within the

current Measure entitled Strengthening Market Entry and Internationalisation

Scheme. As such, proposals which refer to the mentioned Section will only be

accepted through this application form which is always associated with a Call for

Expressions of Interest which Malta Enterprise publishes from time to time. For the

avoidance of doubt, the only way enterprises can submit an application which is

related to the activities mentioned in Section 3.3 {D} is through a Call for Expressions

of Interest and through this form.

INTRODUCTION

This application should be compiled for the Market Development Plan within the Global Growth Competition.

The application is divided into eight parts:

Part 1 – Details of Business and Promoters

Part 2 – Project/Plan Details

Part 3 – Market

Part 4 – Competition and Positioning

Part 5 – Managing the Process

Part 6 – Action Plan

Part 7 – Annexes

Part 8 – Declaration by Applicant

Please note that:

The scope of this application form is to ensure that all applicants submit at least the minimum required

information. Companies are however encouraged to submit additional information, in any format they prefer, to

substantiate or elaborate on what is declared in this form.

When compiling this application, it is recommended to:

Provide specific details;

Provide realistic projections, milestones, and deliverables;

Invest adequate time and effort to compile and complete the application;

Add supplementary documentation in cases where the space provided is not sufficient, and

Demonstrate why the application should be approved

Personal Data Protection

Personal information collected in this form will be processed in accordance with the Data Protection Act, Cap 440 of the Laws of Malta and

shall be treated in the strictest confidence. Information provided in this form will be processed by Malta Enterprise to assess your

eligibility, approve or otherwise assistance under this scheme, to monitor implementation of aid granted and for other processing related

thereto.

Malta Enterprise Corporation guarantees fair processing in respect of your personal information.

Confidentiality

Malta Enterprise undertakes appropriate efforts to maintain the confidentiality of any information provided through this Market

Development Plan and assures that moreover, the documents submitted will be kept under ‘lock and key’. Only the members of the

Adjudication Committee will have access to the documents.

1|P a g e

PART 1 – DETAILS OF BUSINESS AND PROMOTERS

The form is meant to facilitate communication between the applicant and Malta Enterprise.

The spaces are meant to be indicative and clients are encouraged to elaborate either in

the provided space or through supporting documentation.

1.1

Applicant’s business name, address, and basic details

Details of the enterprise submitting this application.

a. Registered Name1

Click here to enter text.

Choose an item.

b.

Type of Enterprise

In case of Other, please state:

c.

Click here to enter text.

If, as may be indicated in (b) above, the applicant is quoted on a Stock Exchange, name the

Stock Exchange:

Click here to enter text.

1

d.

Registration Number

Click here to enter text.

e.

Year Established

Click here to enter text.

f.

Contact Address

Click here to enter text.

g.

Website Address

Click here to enter text.

h.

Telephone Number

Click here to enter text.

i.

VAT Number

Click here to enter text.

j.

Income Tax Number

Click here to enter text.

k.

Bankers

Click here to enter text.

Registered Name: Make sure that the company name is the exact registered name (as defined in the Memorandum and Articles).

In the case of partnerships and co-operatives, the name outlined in the deed of partnership should be used in this section. In the

case of Self Employed person, the name of the sole trader shall be inserted. If the business trades under a different name, please

also provide this name. If the application relates to a business that is still in formation, the details of the parent company or the

main promoter should be entered.

2|P a g e

1.2

Contact person

Contact details of the person to whom communication regarding this application should be addressed.

1.3

a. Contact Name & Surname

Click here to enter text.

b. Designation

Click here to enter text.

c. Telephone Number

Click here to enter text.

d. Mobile Number

Click here to enter text.

e. Email Address

Click here to enter text.

Enterprise Structure

Details of the ownership and control structure of the Enterprise submitting this application.

a. Does the applicant enterprise form part of a group?

Choose an item.

If Yes, please attach an Organisation Chart of the Group Structure in Annex 8 – Additional

Documentation.

b. Does the applicant enterprise or any of its directors or shareholders

have any controlling interest in any other business?

Choose an item.

If Yes, please elaborate. The details provided below should reflect the details provided in Annex

1 - Enterprise Size Declaration.

Click here to enter text.

3|P a g e

1.4

Current Business Activity – Provide a brief history of the business and describe the current

activity in terms of the enterprise’s current products, services, and markets. Please describe

the share in percentage points of export revenue (if any) at present for each product or

service. Describe the present business model and the company’s position in the market

(even if domestic) today, as well as the main competitors. Also describe whether the

company exports already, how much and to which markets. Briefly describe the key

strategic challenges that the company faces today.

(Include main sectors in which the company is involved).

Click here to enter text.

NACE Code (This can be confirmed with the National Statistics Office (NSO)): Click here to enter text.

4|P a g e

PART 2 – PROJECT OR PLAN DETAILS

Description – Describe the proposed project or plan, elaborating on the project’s objectives

2.1

and expected benefits to the company. The description should include:

-

Key product/service being positioned for export;

Target market/s and rationale based on market research on the possible demand for the

product/service in that market; and

Objectives of the plan (e.g. expand sales to increase company turnover to €9 million by 2016

and achieve a profit of €1.8 million).

Click here to enter text.

5|P a g e

Expected Results – Financial Performance (Additional turnover in years 1-2-3)

2.2

i.

Describe and justify the expected project or plan results and projections illustrated in Annex 7

– Projected Profit & Loss Statement, clearly explaining the expected additional turnover

expected to result from the new activity in years 1, 2 and 3. Clearly list any assumptions

made.

Click here to enter text.

6|P a g e

2.3

Expected Results – Employment (Additional employment in years 1-2-3)

Elaborate on the contribution of the project or plan to the human resources of the enterprise.

a. Report on the expected increase in employment over the 3 year period.

Click here to enter text.

7|P a g e

2.4

Markets

a. Provide an indicative breakdown of the current and projected turnover by geographic region

within three years. The total turnover levels in the table below should match the total

turnover levels in Annex 7 – Projected Profit & Loss Statement.

Market

Malta

Target Market 1

Annual turnover as per

latest Audited/

management accounts

Forecasted turnover for Year 3

€ 0.00

€ 0.00

€ 0.00

€ 0.00

€ 0.00

€ 0.00

€ 0.00

€ 0.00

€ 0.00

€ 0.00

€ 0.00

€ 0.00

(please specify)

Click here to enter text.

Target Market 2

(please specify)

Click here to enter text.

Target Market 3

(please specify)

Click here to enter text.

Other markets

TOTAL

8|P a g e

PART 3 – MARKET

Yes/No answers should be avoided in this section and applicants are encouraged to

elaborate on how the highlighted issues will be addressed. Questions that are not

relevant to the applicant should be marked as N/A.

a.

Which law would typically govern commercial agreements in the target market and

how does the company intend addressing any legal issues?

Click here to enter text.

b.

Can there be an issue with intellectual property (IP)? If so, how does the company intend

addressing any IP issues?

Click here to enter text.

c.

Is there a language barrier which needs to be addressed?

Click here to enter text.

d.

Is the service/product price competitive considering available alternatives in the target

market?

Click here to enter text.

9|P a g e

e.

Will the product/ service require significant modifications for the target market?

Click here to enter text.

f.

Are the transport links by air and sea between Malta and the target market sufficient?

Click here to enter text.

g.

Are there specific packaging and marking requirements in the target market?

Click here to enter text.

h.

Are there VISA or other travel restriction issues with the target market?

Click here to enter text.

i.

How many times have you visited the target market on business?

Click here to enter text.

10 | P a g e

j.

SWOT - Include a detailed analysis of the Strengths and Weaknesses that the company

has vis a vis the target market as well as the Opportunities and Threats based on

appropriate market research (Applicants may attach an Appendix with a full SWOT if the

space is not sufficient)

Click here to enter text.

11 | P a g e

k.

Unique Selling Proposition (USP) - Include an analysis of what makes your

product/service offering unique when compared to alternative offerings already

available in the target market?

Click here to enter text.

l.

Is the uniqueness of the product/service based on the company’s strengths and is there

a link between such strengths and the market opportunities identified?

Click here to enter text.

12 | P a g e

PART 4 – COMPETITION AND POSITIONING

a. Which are the key competitors for your product/service in the target market or region?

Click here to enter text.

b. What is the likely USP of each competitor?

Click here to enter text.

c. What kind of market share do they command in the target market?

Click here to enter text.

13 | P a g e

d. How will the company position the product/service against these competitors? And what

market share does the company envisage to command at the end of the 3 years?

Click here to enter text.

e. What kind of business model or Market Entry Strategy will the company adopt in the target

market? (e.g. selling through distributors, strategic alliances, selling direct to customers,

direct contracting with corporate clients)

Click here to enter text.

f.

Further to question (e) above, what is the typical profile of the company/ies purchasing the

product/service, be they agent/s, distributor/s or end user/s? What is its/their typical

employment level and turnover?

Click here to enter text.

14 | P a g e

PART 5 – MANAGING THE PROCESS

a. Will the company dedicate a person to lead the export process? If yes, will this person work

full time on export?

Click here to enter text.

b. If there is no employee to be fully engaged with the export activity, how many hours can the

person responsible for the export-related tasks dedicate per week?

Click here to enter text.

c.

To what extent can the below risks effect the successful execution of the plan?

Country

To what extent can changes in the broad political and

economic situation in the target market affect the

project?

Choose an item.

Financial

standing

What would be the impact of other risks, particularly

commercial ones, on the financial standing of the

company?

Choose an item.

Commercial

Assessment of creditworthiness, contingencies for nonperformance such as default, refusal to accept goods,

insolvency etc. - How much is this a risk in the case of the

target market?

Contingencies for maintenance of value (e.g. contractual)

- Is there a risk of exchange rate fluctuations?

Choose an item.

Internal

Contingencies for ensuring adequate manpower skills and

availability control over production and distribution costs

- What is the risk of the company failing to deliver

because of capacity and internal issues?

Choose an item.

Project

Is there a risk of failure due to any ‘show-stopping’ or key

elements that need to be in place for the plan to succeed

and on which the whole plan is dependent (these can be

a particular legal hurdle, a permit to increase capacity,

specific financing facility etc.)?

Choose an item.

Currency

Choose an item.

15 | P a g e

PART 6 – ACTION PLAN

In this section, the company should elaborate on the actions that it will be taking over the next 12

months. When describing actions, companies should be in a position to mark which of the actions

qualify for assistance under the Market Entry & Internationalisation Scheme (the Guidelines of the

scheme is attached with this application form for ease of reference). Whether in the provided space

or in additional space, the company should include a list of actions, how much each action will cost

and whether it is a qualifying activity according to the mentioned scheme.

In this section, whether in the provided space or in additional space, the company should also

provide a Gantt Chart with the action plan.

Action

Month

Cost

Qualifying cost or not

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

Click here to enter text.

16 | P a g e

PART 7 - ANNEXES

This section outlines the Annexes required for the complete submission of this application form.

(Annex 1 to 5 are mandatory) .

Annex 1

– Enterprise Size Declaration. If the applicant is part of a group (linked or partnered to

another business), the applicant must submit the declaration which can be

downloaded by clicking here

Annex 2

De Minimis Declaration. Any aid granted through this incentive is approved under

the de minimis rules. The applicant is therefore required to attach the declaration

which can be downloaded by clicking here

Annex 3

VAT compliance certificate. Attach a clean VAT compliance certificate issued by the

VAT department confirming that the applicant has no liabilities in respect of income

tax or is otherwise honouring an agreement for settling any outstanding amounts.

The certification should have been issued in the six (6) months preceding the

submission of this application form.

Income tax compliance certificate. Attach a clean certificate issued by the Inland

Revenue Department confirming that the applicant has no liabilities in respect of

income tax or is otherwise honouring an agreement for settling any outstanding

amounts. The certification should have been issued in the six (6) months preceding

the submission of this application form.

Final Settlement and Social Security Contributions compliance certificate. Attach a

clean certificate issued by the Inland Revenue Department confirming that the

application has no liabilities in respect of the Final Settlement System (FSS) and of

Social Security Contributions (SSC) or is honouring an agreement for settling any

outstanding amounts. The certification should have been issued in the six (6)

months preceding the submission of this application form.

Annex 4

Annex 5

Annex 6

Audited/Management Accounts – In case of registered companies or other business

organisation, full & complete Audited Financial statements (not abridged version) for

the previous one year are to be attached, as well as appropriate Management

Accounts up to the date of submission. In case of self-employed applicants, a copy

of the latest three Income Tax Returns, as well as appropriate Management

Accounts up to the date of submission is to be attached.

Annex 7

Budget for the Market Development Plan and Projected Profit & Loss Statement.

Annex 8

Additional documents. These can include presentations, plans or other documents

that serve to further illustrate the information submitted.

17 | P a g e

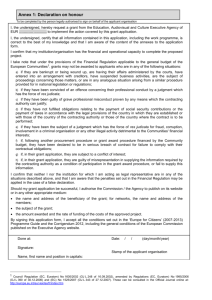

PART 8 – DECLARATION BY APPLICANT

Has any Director/ Shareholder ever been personally declared bankrupt

and subject to any formal insolvency procedure?

Has any Director/ Shareholder ever been the proprietor, Director, or

Shareholder of a business that has been subject to a bankruptcy

procedure or to an investigation or sanctioned under any financial

regulatory framework?

Choose an item.

Choose an item.

If you answered Yes to any one of the above statements, kindly attach a separate document providing

details and clarifications.

I, the undersigned, do hereby declare that the information being submitted with regards to this

application is correct.

I also confirm that the costs on which the aid is being claimed are not recoverable in any way from

other sources and that there are no arrears with respect to VAT, Income Tax, Social Security and/or

rental payments to the Government of Malta in relation to this business activity.

I also confirm that, I and the company I represent, will be willing to submit all the necessary

information requested by Malta Enterprise at any time in the future, with regards to the results

attained by the company during and following the execution of this plan.

Click here to enter text.

Name of Applicant (full legal name)

Click here to enter text.

Authorised Signatory

Designation

Date

Click here to enter text.

Click here to enter a date.

Signature

18 | P a g e