First Baptist Church

advertisement

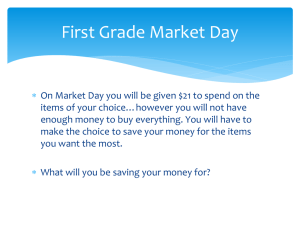

FIRST BAPTIST CHURCH OF DeSOTO, MISSISSIPPI: A CASE OF EMBEZZLEMENT Introduction Dr. Patrick O’Hara, pastor of the First Baptist Church of DeSoto, Mississippi, sat alone in his office feeling exhausted and emotionally drained. He had just completed the most difficult task in his 33 years as a minister. In a special Sunday evening business meeting, Dr. O’Hara and Mr. David Channel, the church treasurer, had just informed the congregation of the First Baptist Church of DeSoto that during the last three years, one of their fellow church members had embezzled more than $700,000 from the church. The initial reaction of the congregation had been one of shock and anger. The business meeting lasted more than two hours, but the church had failed to come to any agreement regarding how to deal with the situation. Dr. O’Hara was beginning to think that the congregation might be split over whether to press charges against the perpetrator of this crime. He was also beginning to think that the best option for his career would be to try to find another church to pastor. The last few days had been very trying and difficult. Dr. O’Hara was becoming a firm believer in the old saying that an ounce of prevention was worth a pound of cure. He wished there were a real cure for his church. He wished even more that the church had implemented some controls that could have helped to prevent this tragedy from occurring. Background DeSoto, Mississippi is the county seat of Delta County. The First Baptist Church of DeSoto is the largest church in Delta County. Dr. O’Hara has been the pastor of the church for fourteen years. He is one of three full-time ministers employed by the church. The other ministers are Rev. Bob White, the minister of music and youth, and Rev. Mark Dickerson, the minister of Education. Mrs. Lynda Easterling is employed as the receptionist and secretary of the church. Mrs. Trudy Able has served as the financial secretary of the church for the past four years. In 1996, the First Baptist Church of DeSoto had about 1,800 total members and 1,100 resident members. The church had an average attendance in Sunday School of about 425 during 1996. Cash receipts for the years in question follow: Year 1994 1995 1996 Undesignated Donations $620,000 690,000 800,000 Total Donations $735,000 900,000 1,000,000 Total Receipts $915,000 1,000,000 1,000,050 First Baptist Church of DeSoto currently has no outstanding debt and is not required to issue financial statements to any external parties (as an unincorporated nonprofit organization). 1 The church has never had an external audit. Mr. David Channel, the church treasurer, is a local CPA who has a private practice. Mr. Channel and the other members of the finance committee never thought that the church needed to waste money on an audit. The Embezzlement Process Mrs. Trudy Able became the financial secretary for the First Baptist Church of DeSoto in 1993. The previous financial secretary had worked for the church for eight years. Mrs. Able was a native of DeSoto and both she and her husband had been members of the First Baptist Church since they were children. When Mrs. Able was hired by the church, she had two sons in college. Her oldest child, Rita, was married and had two young children. Shortly after Mrs. Able began working for the church, Rita’s husband left Rita and the children. In 1994, the Ables found themselves in financial trouble. They were trying to support their two sons who were attending college as well as their daughter and two grandchildren. Without permission from anyone at the church, Mrs. Able began to borrow money from the church from time to time to help the family get through their hard times. The church had very few internal controls in place, so she found ways to take cash without being discovered. At first Mrs. Able planned to repay the amounts that she had taken, but after a few months, she began to justify her actions. Mrs. Able thought that she was underpaid for the amount of work that she did. She also knew that the Bible stated that churches should help orphans and widows. Some of the money that she took was being used to help support her daughter and grandchildren and she rationalized that this was the responsibility of the church. In addition, one of her sons wanted to become a preacher. If Mrs. Able could not help him finish college and seminary, he would never be able to become a minister. She believed that God wanted her son to enter the ministry, and she rationalized that the church should help him get the necessary education. The first time Mrs. Able took money from the church was in February 1994. Every Sunday, the church counting committee would count the offerings and prepare a contribution report and a bank deposit slip which were forwarded to Mrs. Able. The money was then placed in the church safe. On Monday morning, Mrs. Able deposited the Sunday offerings at the Bank of DeSoto. Ms. Kellie Satcher, a teller at the Bank of Desoto, was a personal friend of Mrs. Able. Mrs. Able almost always went to the window of Mrs. Satcher when she made the Monday morning deposit. One Monday, Mrs. Able requested $500 cash to take back to the church to use for petty cash. Ms. Satcher gladly granted this request and noted on the deposit slip the amount of cash that Mrs. Able kept. Mrs. Able kept this cash and used to pay some of her delinquent bills. In order to get the books to balance, Mrs. Able later debited various expense accounts for $500 of phony expenses and she credited the cash account to reduce the general ledger account balance to equal the amount in the bank account. She could not simply record a debit to the cash account for the net amount of the 2 deposit, because subsidiary contribution records were maintained for church members. Contribution notices were mailed out at the end of the year, and the total amount of the deposits would need to equal the total of the subsidiary contribution records. Therefore, Mrs. Ables expensed the amount of the cash that she took. When the bank statement came to the church each month, Mrs. Able was the individual who prepared the bank reconciliation. Because no audit procedures were ever conducted, no one other, than Mrs. Able ever examined the bank reconciliation or the deposit slips. She filed the counting committee’s collection reports on a weekly basis, and no one ever compared the collection reports with the deposit slips. The Ables continued to need extra money to support their children. Because it was so easy to take money in this fashion, Mrs. Able began to take cash from the Monday deposit on a weekly basis. She always went to Ms. Satcher’s window to make the deposit, and Ms. Satcher never questioned the practice of Mrs. Able taking cash back to the church to use for various needs that would arise during the week. Some weeks Mrs. Able would request a few thousand dollars in cash, but she always had a good reason as to why the cash was needed. Sometimes she would say that the church was having a banquet. Other times she would mention that the church was undertaking a special mission project or helping needy families. While the Ables were in the worst part of their financial difficulties, Mrs. Ables began to look for another way to take cash from the church. After serving as the church financial secretary for a few months, Mrs. Able knew that she was the only person at the church that ever examined the monthly bank statements. Every week Mrs. Able used an electric typewriter to prepare checks for Mr. Channel, the church treasurer, to sign. Mr. Channel would usually sign the checks on Wednesday night before the weekly prayer meeting. After Mr. Channel signed the checks, Mrs. Able would put the checks in the church safe and mail them on Thursday morning. One week after Mr. Channel signed the checks in his usual manner, Mrs. Able altered a check that was made payable to “MBCB” (Mississippi Baptist Convention Board). Each week First Baptist Church of DeSoto would send a portion of the total offerings to the state convention board as a Cooperative Program contribution. The Cooperative Program is the agency that funds the mission agenda of the Southern Baptist Convention. To alter the check, Mrs. Able placed the check into the electronic typewriter and erased the letters “MBCB” and replaced them with “CASH.” The next day she deposited the check into her personal account at a bank in a nearby city. When the cancelled check was returned to the church with the monthly statement, Mrs. Able used the electric typewriter to remove the letters “CASH” and she retyped the letters “MBCB.” Mrs. Able then prepared the monthly bank reconciliation and placed the bank statement and cancelled checks in the appropriate file. Because the church’s donations to the Cooperative Program are voluntary contributions, no one ever noticed that these funds did not arrive at their intended destination. As the months passed, the Ables used church funds to alleviate their financial problems. Mrs. Able continued, however, to take cash from the church. She continued to deposit the full 3 amount of the offerings received and request cash from the teller to take back to the church office. She always expensed the amount taken, so the books always balanced. Mrs. Able prepared the financial statements that were distributed to the congregation at the regularly scheduled business meetings. Somehow, no one ever noticed the large amounts of cash that Mrs. Able was taking. Mrs. Able began to enjoy her new wealth. She told friends that she had inherited a large amount of money from a relative. Mr. and Mrs. Able were two of the most faithful members of the First Baptist Church of DeSoto and they had always been well respected in the community. During the summer of 1995, in order to further endear herself to the church congregation, Mrs. Able purchased a new grand piano for the sanctuary. Mrs. Able also told the congregation that because of the large sum of money she had inherited, she no longer needed the income from her position as financial secretary of the church. She did, however, want to continue serving the church, so she stopped accepting a salary for her work as the financial secretary. Shortly after this, the Ables purchased a new home for their daughter and grandchildren. Later that same year, they purchased a small townhouse for the two sons to occupy until they finished college. By this time, the congregation of the First Baptist Church of DeSoto considered the Ables to be two of the most generous and wonderful people in the community. The Discovery of the Embezzlement In March of 1996, Mrs. Able became ill and had to miss work for several days while she recovered. During her illness, Mr. Channel took the weekly offering to the bank to be deposited. He happened to go to the window of Ms. Satcher to make the deposit. After receiving collections proceeds and the deposit slip, Ms. Satcher asked Mr. Channel how much cash he needed to take back to the church. Mr. Channel was in a foul mood that day, because this was his busy season and he was having to spend time doing the work of the financial secretary of the church. In a rather terse manner he replied that the church did not need any cash and he instructed Ms. Satcher to please hurry with the processing of the deposit. Ms Satcher remarked defensively that Mrs. Able almost always took cash back to the church on Mondays. On the way back to his office, Mr. Channel began to think about what the bank teller had said about Mrs. Able almost always taking cash from the weekly deposit to the church. When he reached the office, Mr. Channel called Dr. O’Hara and asked if he knew anything about cash being used for expenses at the church. Dr. O’Hara had never wanted to know much about the financial operations of the church. He did not have any formal training in finance and accounting, and left that part of the operations of the church to other people. Dr. O’Hara told Mr. Channel that he knew nothing about cash being kept at the church for weekly operations. Mr. Channel then went back to the bank and began to ask Ms. Satcher about her statement concerning Mrs. Able taking cash to the church almost every Monday. Ms. Satcher explained that almost every week Mrs. Able came to her window to deposit the church’s Sunday offerings and that Mrs. Able almost always kept a large amount of cash for the church to use 4 during the week. Mr. Channel then asked to see Mr. Joe Laird, the president of the Bank of DeSoto. Mr. Channel explained to Mr. Laird that there could be a problem. Mr. Laird had his internal audit staff begin to investigate the matter that afternoon. The auditors began to examine each deposit slip from First United Baptist Church of DeSoto. They quickly found that almost every deposit slip on record since 1994 showed that cash had been retained by the depositor. Mr. Laird informed Mr. Channel of the findings of the bank’s internal auditors. Mr. Channel then informed Dr. O’Hara that it appeared that thousands of dollars had been taken from the church. Dr. O’Hara asked if Mr. Channel could perform an audit to determine the financial condition of the church. Mr. Channel informed Dr. O’Hara that he was not an independent party and could not actually conduct an independent audit. Mr. Channel and another CPA who was a member of the church agreed to perform some audit procedures to try to determine what irregularities had occurred. In the course of their investigation, the two CPAs discovered that the amount reported as received by the Mississippi Baptist Convention Board for the past two years did not agree with the amount of the Cooperative program contributions in the church’s accounting records. The records of the church showed that for each of the past three years, the church had contributed at least $50,000 more to the Cooperative Program than the amount reported as received by the Mississippi Baptist Convention Board. This amount combined with the amount that the bank’s internal auditors found to be missing totaled about $700,000 of cash that could not be accounted for during a period of about three years. This represents about 23.6% if the total cash receipts for the three year period. Once they had determined that a theft of this magnitude had occurred, Dr. O’Hara and Mr. Channel had to determine how to proceed in dealing with the matter. The First Baptist Church of DeSoto is incorporated and the constitution and by-laws of the church name the Board of Deacons as the governing board of the church. The Board of Deacons, therefore, was the first body to hear the report of Mr. Channel. Mr. Channel suspected that Mrs. Able had embezzled $700,000 from the church between 1994 and 1996. He explained how cash had been taken from the deposit almost every week during this time period. He also stated that the church’s accounting records show contributions to the Cooperative Program of $50,000 more than the record of the Mississippi Baptist Convention Board, the recipient of these contributions. Despite concerns of the possible liability associated with wrongful accusation, the Board of Deacons decided to confront Mrs. Able about these allegations. Many of the deacons did not believe that Mrs. Able would ever steal money from the church. When she was confronted with the allegations, Mrs. Able burst into tears and admitted that she had in fact been taking cash from the church. Once she admitted that she had committed this act of embezzlement, the church had to decide what actions to take. Almost all of the money that Mrs. Able had taken had been 5 spent. The only assets that could be sold to repay a significant amount of the embezzled funds were the house that had been purchased for her daughter and the townhouse in which her two sons were living while attending college in another part of the state. Word of the embezzlement began to spread through the small city of DeSoto. Many church members wanted to prosecute Mrs. Able while others wanted to try to hide the incident from the public to avoid further embarrassment to the church and to the Christian faith in general. The Board of Deacons decided to let the congregation decide how to proceed with the matter. They decided to let Dr. O’Hara and Mr. Channel present the matter to the church in a special business meeting on Sunday night. There were several things that needed to be considered. The church had a bonding insurance policy that would probably cover part of the loss. In order to collect on the policy, however, the church would have to press charges against Mrs. Able. The deacons were unsure what actions the insurance company might try to take against the individuals in the church that should have discovered that the embezzlement was taking place at an earlier point in time. They feared that the insurance company might seek to recover some of the funds from either the church staff or the Board of Deacons based on negligence. The church did not have any significant debt outstanding and the leaders had never noticed that the money had been taken. Pressing charges against Mrs. Able would probably draw national attention to the church – the type of attention that no church would want to have. Some individuals felt that the church should be forgiving based on various passages in the Bible. In addition, Mrs. Able had many friends in the church, and some of these people just wanted the incident to be forgotten The Sunday evening business meeting was a disaster. There were two hours of very heated arguments as to what to do. Some members blamed the church staff, the church treasurer, and finance committee for letting this event occur. Others put the blame entirely on Mrs. Able, and some of these individuals wanted to see her taken away by the police in handcuffs that very night. The meeting was ended by the Chairman of the Board of Deacons after two hours when shouting and name-calling had become the main method of communication. The church had failed to reach a consensus as to how to proceed at this point in time. The Dilemma Dr. O’Hara now sat in his office faced with a dilemma. He wished that the church had taken precautions to prevent this situation, but it would do no good at this point to sit around and think “if only.” There were many pressing questions that the church was facing. The preliminary question was what action to take against Mrs. Able. This would bring a tremendous amount of negative attention to the church that most church members would want to avoid. Should the church refrain from pressing charges to avoid the negative publicity and the unavoidable damage to the reputation of the church? Will members of the congregation be able to forgive Mrs. Able? Will the congregation have faith in its current staff to run the day-to-day operations of the church in the future? Could the current 6 leadership in the church survive this scandal? Would the church be split over the question of whether to continue support of the current staff? The church must also consider implementation of internal controls to help prevent irregularities in the future. Implementation of controls will probably create another round of dissension because of the inconveniences that will be created by the controls that need to be put in place. Dr. O’Hara remembered being in a meeting one time when someone said that it was better for a church to burn to the ground than to experience embezzlement. The individual said that when a church burns, the congregation unites and usually becomes stronger. When a church experiences embezzlement, however, the church almost always divides. Now Dr. O’Hara was realizing the truth of the statement. Epilogue The congregation of the First Baptist Church of DeSoto decided not to press charges against Mrs. Able. The majority of the congregation wanted to avoid the widespread negative publicity that the church would receive if this case became public information. The church, therefore, decided not to attempt to collect on the bonding policy that was in place. Mrs. Able is no longer a member of the church and she no longer works for the church. A few months after the embezzlement was discovered, Dr. O’Hara decided that it was time for him to retire. He has not served as the pastor of a church since he resigned from his position at the First Baptist Church of DeSoto. Many church leaders in Mississippi have heard about this case and have attempted to strengthen the system of internal control in their own churches. The Mississippi Baptist Convention Board now freely distributes a publication entitled Safeguarding Your Church Offerings which is designed to help churches evaluate and improve their accounting systems. 7 Discussion Questions 1. Obviously, internal controls should have been in place at the First Baptist Church of DeSoto. What kinds of internal controls should be put in place now that the embezzlement has taken place? 2. How often should an independent audit take place? 3. Who or what group of people has responsibility for enacting internal controls? 4. What might be some of the fallout from an incident like this in an organization, especially a nonprofit organization? 5. Do you consider Mrs. Able to be the only one who should be dealt with concerning the acts of embezzlement? 5. What action, if any, should have taken place against Mrs. Able? 6. Who is the First Baptist Church of DeSoto accountable to? 7. Do you think this church (or any church) should be have a strategic plan? 8. Would the IRS have any interest in this situation? 8