Click here to full press release

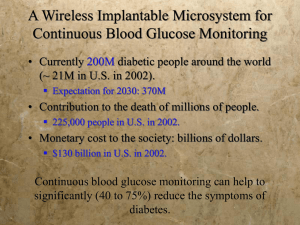

advertisement

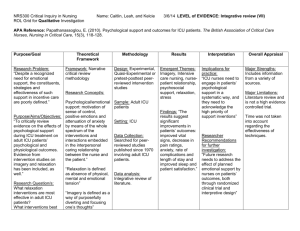

GLYSURE COMPLETES SERIES C SECOND CLOSING FOR A TOTAL OF £8.5 MILLION Funding will support completion of clinical trials and regulatory submission of its continuous blood glucose monitoring system Wednesday, November 28, 2012: Oxfordshire, England: GlySure Limited, developer of in-hospital continuous blood glucose monitoring systems, today announced that it has completed the second close of its Series C financing round for a total of £8.5 million. GlySure will use this funding to complete clinical trials in support of U.S. and European regulatory clearance. Series C investors included Amadeus Capital Partners, Chester Investments, Delta Partners, Morningside Ventures and Frank Bonsal, Jr. Since its founding in May 2006, GlySure has raised £14 million in venture capital funding to support development of its continuous glucose monitoring (CGM) technology, which is designed to facilitate Tight Glycemic Control (TGC) in the intensive care unit (ICU). “For over a decade, Tight Glycemic Control has held the potential to reduce morbidity, mortality and the cost of care for ICU patients, but the technology to provide a cost-effective, accurate and easy-to-use solution has been elusive, until now,” said Bill Moffitt, GlySure Chairman. “GlySure’s system was designed from the ground up to meet the rigorous demands of the ICU and enable wide-spread adoption and implementation of this clinical practice. I’m excited to work with GlySure as it completes its regulatory trials and delivers the solution to address this critical but currently unmet need in healthcare.” Clinical trials conducted to date in over 120 ICU patients have demonstrated that the GlySure system can accurately measure glucose levels across the entire human physiological range with an extremely high degree of accuracy and repeatability, which is key to effectively implementing TGC. “This has been an exciting and productive year for GlySure as we’ve seen positive results from our human use trials, significantly strengthened our intellectual property portfolio, expanded our senior management team and positioned the company for commercialization,” said Chris Jones, GlySure CEO. “We look forward to providing clinicians with an effective tool to help them realize the patient benefits of TGC.” To address the growing interest in TGC, the company has launched a redesigned website to provide in-depth information on GlySure’s technology, progress to date and glycemic control. Visit www.glysure.com. ###Ends### Company Contact: Chris Jones, CEO, Glysure. Tel: +44(0)1235 462 870. cjones@glysure.com Media Contact: Bruce Dodworth, Sea Glass PR. Tel: +44 (0)1780 758555. bruce@seaglasspr.com Notes to Editors About GlySure: GlySure has developed a continuous intravascular glucose monitoring system using a proprietary optical fluorescence sensor to meet the $2B+ worldwide demand for implementation of Tight Glycemic Control (TGC) in the hospital Intensive Care Unit (ICU). The company has demonstrated through ICU testing highly accurate sensors, which can provide continuous glucose readings throughout the length of a patient’s stay in the ICU. GlySure was founded in 2006, it is based in Abingdon, Oxfordshire, England and it has 20 employees. The company’s products are not approved for use in the U.S. or Europe. www.glysure.com About Tight Glycemic Control (TGC): In 2001 Greet Van den Berghe demonstrated that controlling patient glucose levels in the ICU within tight normal ranges yielded significant improvements in patient outcomes including a 46 per cent reduction in incidence of sepsis, 41 per cent reduction in renal failure, 50 per cent reduction in blood transfusions, and 34 per cent reduction in mortality. This study created a new field of medical research with over 100 publications in the past decade including two showing a financial benefit to the hospital in savings of $1,580 to €2,638 per patient. The challenge for hospitals is that few ICU’s have the resources available to draw blood and perform glucose measurements at the frequency required to safely maintain patients within the target glucose range. About Amadeus Capital Partners: Amadeus Capital Partners is one of Europe's leading technology venture capital firms, with £500m under management. Since its inception in 1997, the firm has backed over 80 companies in industries that include communications and networking hardware and software, cleantech, medical technology, computer hardware and software, media, and ecommerce. Major businesses built by the firm include CSR plc (LSE: CSR), the leading producer of single chip Bluetooth radios for short range connections; retinal imaging company, Optos plc (LSE: OPTOS); Solexa Ltd, the developer of next generation genetic analysis systems, merged into Illumina, Inc. (ILMN) to create the world-leader in genesequencing technology; and Transmode, a networking solutions business that had an oversubscribed IPO on NASDAQ OMX Stockholm in May 2011. www.amadeuscapital.com About Delta Partners: Delta Partners is among the most active early-stage venture capital investors in Europe. Established in 1994 and with €250 million under management in 70 companies, the firm focuses on investing in early-stage technology companies across ICT and healthcare, primarily medical technology. Current investments include Miracor Medical Systems GmbH, Genable Technologies Ltd., SpineGuard S.A., Neoss Ltd., Accunostics Ltd., and Advanced Surgical Concepts Ltd. The partners’ backgrounds in start-ups, operations, strategy and finance complement the drive and ambition of entrepreneurial management teams. www.deltapartners.com About Morningside: Morningside is a diversified investment group founded in 1986 by the Chan family of Hong Kong. It is engaged primarily in private equity and venture capital investments. The group has investments in North America, Europe, across Asia-Pacific, and since 1992, in mainland China. Morningside was one of the earliest institutional investors in China’s internet industry and in recent years has been an active investor in China’s emerging biotechnology sector. www.morningside.com.