FIRE POLICY This Insurance policy protects Your property (i.e.

advertisement

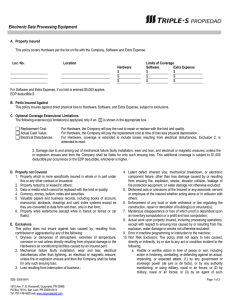

FIRE POLICY This Insurance policy protects Your property (i.e. buildings, stock, contents, furniture, fixtures & fittings, etc…) from any physical loss or damage caused by or as a direct consequence of the following insured perils: Fire whether resulting from explosion or otherwise. Lightning directly striking the insured property or damage caused by striking power supplies away from the situation. Explosion of boilers used for domestic purposes only or in a building of gas used for domestic purposes or used for lighting or heating the building, but not being part of a gas works. Storm & Tempest and or Rainwater Wind Water bursting, leaking or overflowing from water tanks, hot water systems & solar panels, pips and/or other parts of the building designed to contain or carry water or liquids such as sinks, basins & cisterns. Additional Benefits to this Insurance policy include: Architect, Other Fees & Extinguishment Costs; and Extra Cost of Reinstatement. Optional Benefits under this Insurance policy include: Earthquake, Subterranean Fire or Volcanic Eruption (but excluding situations nominated in East New Britain & North Solomon’s Province); and Riot Strikes & Civil Commotion & Malicious Damage. (Additional premium is charged should you wish to take out an Optional Benefit cover) * The Fire policy is suitable for Small to Medium size businesses and domestic. WORKERS COMPENSATION POLICY This Insurance policy covers the Employer’s legal liability under the Workers Compensation Act of Papua New Guinea and at Common Law if applicable for: Personal Injuries and/or Death sustained by Employees in the course of their employment; or Any order, decision or award made against the Employer by a Court of the Independent State of Papua New Guinea. INDUSTRIAL SPECIAL RISK (ISR) POLICY The Industrial Special Risk (ISR) policy protects the Insured from any physical loss or damage caused by or as a direct consequence of the following insured perils: Fire resulting from explosion or otherwise. Lightning directly striking the insured property or damage caused by striking power supplies away from the situation. Explosion of boilers used for domestic purposes only or in a building of gas used for domestic purposes or used for lighting or heating the building, but not being part of a gas works. Storm & Tempest and or Rainwater Wind Water bursting, leaking or overflowing from water tanks, hot water systems & solar panels, pips and/or other parts of the building designed to contain or carry water or liquids such as sinks, basins & cisterns. This Insurance policy has two (2) Sections and they are: 1. Material Damage - Building, Stock, Contents, Furniture, Fixtures & Fittings. - Removal of Debris. 2. Business Interruption - Gross Profit, Payroll, Loss of Rent, Additional Increased Cost of Working, Claims Preparations Costs & Professional Fees. Other covers under this Insurance policy, referred to as Sub-limits, include: Accidental Damage; Money; Burglary/Theft; Plate Glass; and Fusion. * This policy is suitable for major Corporate Businesses or Companies.