INTRODUCTION TO ACCOUNTING 2 MID TERM EXAMINATION

advertisement

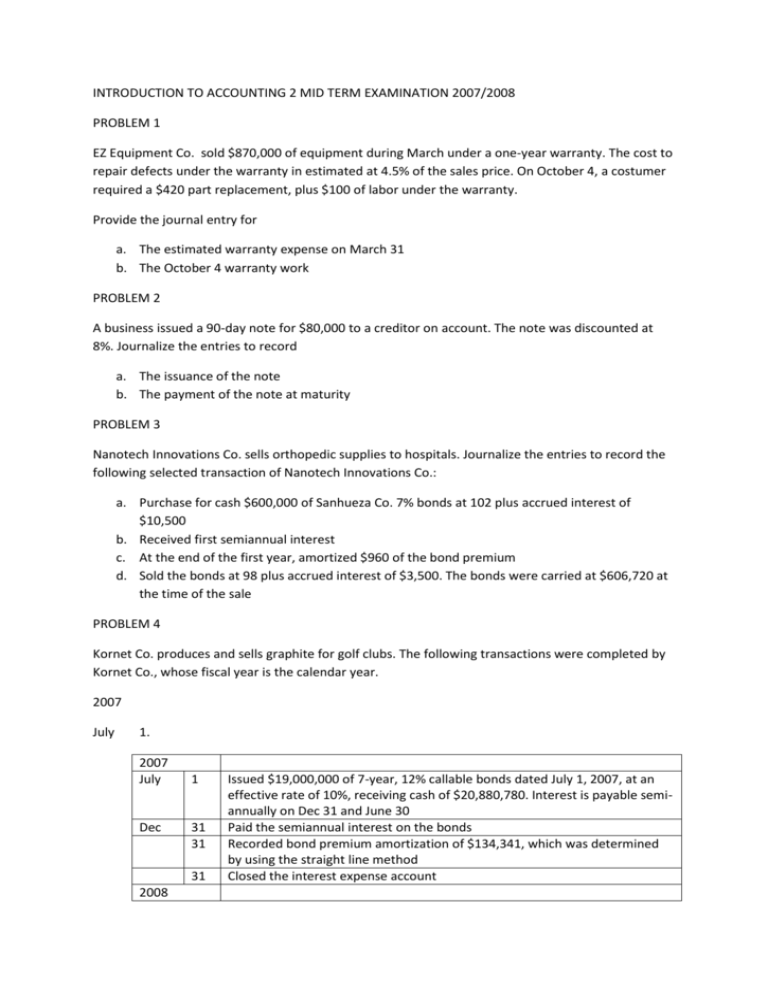

INTRODUCTION TO ACCOUNTING 2 MID TERM EXAMINATION 2007/2008 PROBLEM 1 EZ Equipment Co. sold $870,000 of equipment during March under a one-year warranty. The cost to repair defects under the warranty in estimated at 4.5% of the sales price. On October 4, a costumer required a $420 part replacement, plus $100 of labor under the warranty. Provide the journal entry for a. The estimated warranty expense on March 31 b. The October 4 warranty work PROBLEM 2 A business issued a 90-day note for $80,000 to a creditor on account. The note was discounted at 8%. Journalize the entries to record a. The issuance of the note b. The payment of the note at maturity PROBLEM 3 Nanotech Innovations Co. sells orthopedic supplies to hospitals. Journalize the entries to record the following selected transaction of Nanotech Innovations Co.: a. Purchase for cash $600,000 of Sanhueza Co. 7% bonds at 102 plus accrued interest of $10,500 b. Received first semiannual interest c. At the end of the first year, amortized $960 of the bond premium d. Sold the bonds at 98 plus accrued interest of $3,500. The bonds were carried at $606,720 at the time of the sale PROBLEM 4 Kornet Co. produces and sells graphite for golf clubs. The following transactions were completed by Kornet Co., whose fiscal year is the calendar year. 2007 July 1. 2007 July Dec 1 31 31 31 2008 Issued $19,000,000 of 7-year, 12% callable bonds dated July 1, 2007, at an effective rate of 10%, receiving cash of $20,880,780. Interest is payable semiannually on Dec 31 and June 30 Paid the semiannual interest on the bonds Recorded bond premium amortization of $134,341, which was determined by using the straight line method Closed the interest expense account June Dec Dec 30 31 31 31 2009 July 1 Paid the semiannual interest on the bonds Paid the semiannual interest on the bonds Recorded bond premium amortization of $268,682, which was determined by using the straight line method Closed the interest expense account Recorded the redemption 50% of the bonds, which were called at 101.5. the total balance in the bond premium account is $1,343,416 after the payment of interest and amortization of premium have been recorded. (Record the redemption only) Instruction: 1. Journalize the entries to record the foregoing transaction 2. Indicate the amount of the interest expense in (a) 2007 (b)2008 3. Determine the carrying amount of the bonds as of December 31, 2008 PROBLEM 5 Eureka Enterprises Inc. manufactures bathroom fixtures. The stockholders’ equity accounts of Eureka Enterprises Inc., with balances on January 1, 2008 are as follows: Common stock, $10 stated value (500,000 shares authorized, 380,000 shares issued) Paid-in capital excess of stated value Retained earnings Treasury stock (25,000 shares at cost) $3,800,000 $760,000 $4,390,000 $500,000 The following selected transactions occured during the year: Jan 10 Mar 3 May 21 July 1 Aug 15 Sep 30 Dec 27 Dec 31 Paid cash dividends of $0.20 per share on the common stock. The dividend had been properly recorded when declared on December 30 of the preceding fiscal year for $71,000 Issued 20,000 shares of common stock for $460,000 Sold all of the treasury stock for $660,000 Declared a 3% stock dividend on common stock, to be capitalized at the market price of the stock, which is $30 per share Issued the ceriticates for the dividends declared on July 1 Purchase 10,000 shares of treasury stock for $220,000 Declared a $0.25 pershare dividend on common stock Closed the credit balance of the Income Summary account, $639,500 Closed the two dividends accounts to retained Eranings Instruction: a. Journalize the entry to record the transactions b. Prepare the stockholders’ equity section of the Dec 31, 2008; balance sheet