Failte Ireland Accommodation Occupancy Survey 2011-2013

advertisement

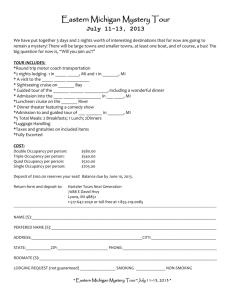

4. Methodology In order to address the terms of reference for the Accommodation Occupancy Survey 2011-2013 to be carried out on behalf of Fáilte Ireland, TDI proposes to employ the on-line, web-based methodology that is currently being employed for the Accommodation Occupancy Survey. In addition, telephone follow-up and telephone interviews will be used to facilitate respondent participation and the achievement of monthly quotas. 4.1 Sample 4.1.1 Sampling Frame / Total Population The sampling frame as provided by Fáilte Ireland is outlined in Table 1 below. The table includes the universe of business establishments (x sector) and target samples by month, quarter and full year. Table 1 - Accommodation Occupancy Survey 2011-2013 - Sample Details Total Population Proposed Monthly Sample Proposed Quarterly Sample Proposed Annual Sample Guesthouses B&Bs Hostels Self-catering Individual Group 303 2,246 130 1,700 1,480 220 150 440 75 125 60 65 450 1,320 225 375 180 195 1,800 5,280 900 1,500 720 780 Camping 95 4,474 40 830 120 2,490 480 9,960 Total * Source: Failte Ireland The contact database that is currently being used by Tourism Development International for the Accommodation Occupancy Survey 2011– 2013 contains contact details and valid e-mail addresses for establishments that are known to be actively trading and have been willing to participate in the survey in recent years. It is therefore proposed that this existing contact database should the starting point for inviting participation in the Accommodation Occupancy Survey 2011– 2013. The contact database has been updated monthly based on feedback from survey participants and annually based on information supplied by Failte Ireland. There will be an on-going requirement to ensure that the contact database is kept up to date. 4.1.2 Minimum Monthly Quotas In line with the target samples achieved in the 2010 Accommodation Occupancy Survey, TDI will conduct 830 monthly occupancy measurements. The response rates that have been achieved to date in 2010 are included below in Table 2. Table 2 - Accommodation Occupancy Survey 2010- Response Details January February March April May June July August September October (projected) November (projected) December (projected) Monthly Average Quarterly Total (Average) Average Total 71 70 72 80 69 81 72 68 78 62 Individual Selfcatering 57 59 58 56 58 48 51 56 55 62 Group Selfcatering 64 58 65 65 63 67 65 76 74 62 450 80 61 61 802 155 465 62 62 62 806 155 456 72 57 65 805 465 1,369 216 171 195 2,417 1,861 5,476 865 683 782 9,667 Guesthouses B&Bs Hostels 155 147 147 150 160 160 165 157 160 155 459 425 466 458 460 459 467 451 451 465 150 Total 806 759 808 809 810 815 820 808 818 806 * Source: Tourism Development International During 2010, the average monthly sample achieved has exceeded 800. TDI is therefore confident that with the inclusion of the caravan and camping sector, an average monthly sample of 830 will be achieved. 4.2 Questionnaire 4.2.1 Main Survey Consistent with the approach adopted for the Accommodation Occupancy Survey from the outset, the survey questionnaire will record information in relation to room and bed capacity and capacity utilisation for a particular night during the fieldwork period. (Note: There are variations in the standard questionnaire for hostels and self-catering). The questionnaire will incorporate the following questions: Confirmation of the premises name and location. Whether the premises was open on the night in question. Confirmation of the number of units/rooms/beds (as appropriate) available on the night in question. Number of units/rooms/beds occupied on the night. The number of guests staying at the premises that night broken down by country of residence. Whether country of residence data is based on records or respondent estimate. Modifications will be made to the questionnaire for administration to caravan and camping enterprises. It is recommended that ‘pitches’ be used as the unit of measurement for the caravan and camping sector. 4.3 Data Collection Tourism Development International will continue to use the approach that has been developed and refined in the course of conducting the Accommodation Occupancy Survey in recent years. 4.3.1 Method of drawing the sample On a monthly basis all of the establishments in the contact database are invited to participate in the Accommodation Occupancy Survey and respondents are asked to provide availability, occupancy and market demand data for a specific date in the month. These dates are also rotated each month using a statistical sampling routine in order to ensure that the sample is representative in terms of weeks and mid-week vs. weekend. 4.3.2 On Line Interviewing Key features of the on-line interview process are as follows: A simple email request is sent to each respondent, requiring no software or downloads from the respondent. No technical knowledge other than how to use a standard web browser is required. In the body of this e-mail is a unique link / URL that they- and only they - can use to complete the online survey. Automated checks are incorporated into the questionnaire design to ensure that responses are accurate and complete Reminder e-mails are also sent to participants that have not responded. The timing of these reminder emails will vary slightly depending on the date & day of the week of the original invitation. The guiding principles, however, are to ensure that respondents are given adequate time to respond to the initial invitation and to minimise the level of e-mail / telephone follow-up. 4.3.3 Telephone Follow-up / Interviews Telephone follow-ups are used to help achieve the desired response rates. This follow-up is also used to ensure that responses are evenly distributed within each month and that the sample is representative in terms of sector and region. Where respondents do not wish to use electronic means, the survey will continue to be administered in the form of a telephone interview. These responses are fed into the on-line, web-based system to ensure that data is down loaded from a single source each month. 4.4 Analysis and Reporting 4.4.1 Survey Analysis Tabulation and analysis of the downloaded responses will be undertaken in house by TDI using SNAP 10 professional analysis software, or equivalent software. Particular analysis requirements will be agreed in advance with Failte Ireland. 4.4.2 Reporting In line with current practice, Accommodation Occupancy Survey Reports will be supplied to Failte Ireland in the form of excel spreadsheets. The tabular reports incorporate the following information: Analysis of sample Capacity available (rooms/ beds/ units) Number of rooms/ beds/ units occupied Percentage occupancy (room, bed, unit) Guest profile (x market) The proposed reporting schedule for the Accommodation Occupancy Survey 2011-2013 will be as follows:Table 3 - Accommodation Occupancy Survey 2010- Reporting Schedule Table Frequency Results by sector Cumulative Occupancy (Year to date) Guest country of residence Results for NUTS 2 region x sector Results for sector x region Results by key destination Monthly Monthly Monthly Monthly Quarterly Quarterly Results of key destination x sector Quarterly