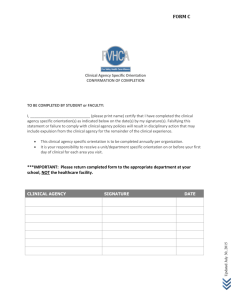

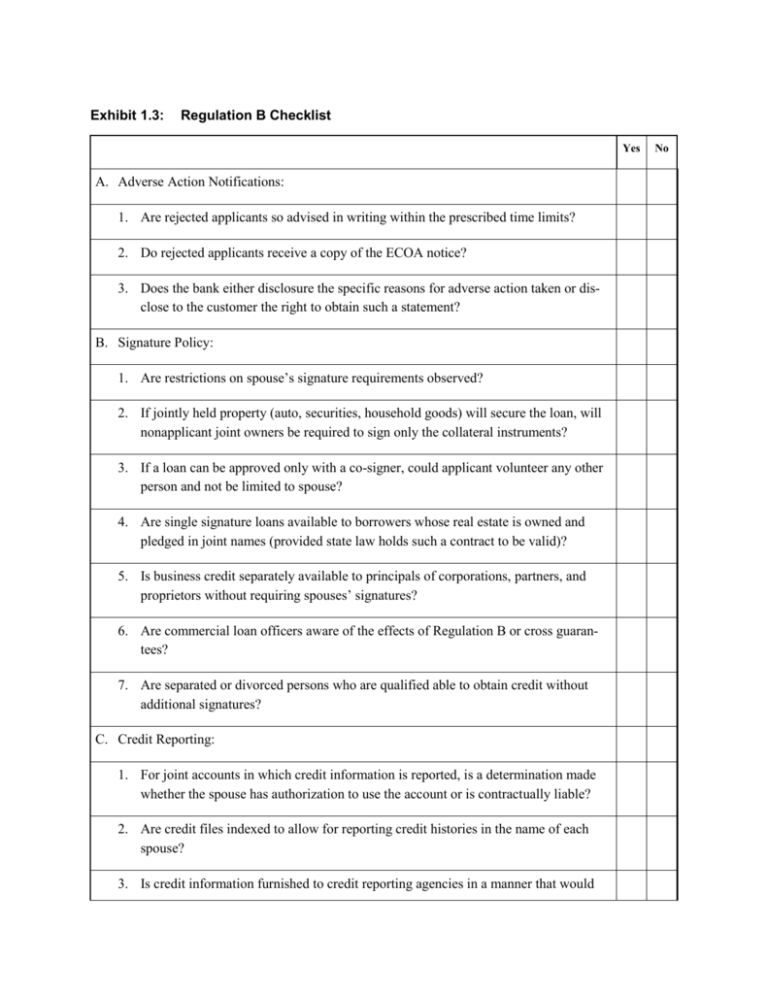

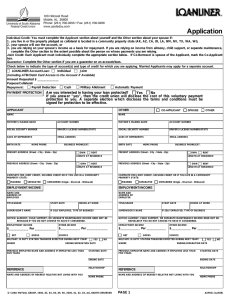

Exhibit 1.3: Regulation B Checklist Yes No A. Adverse Action

advertisement

Exhibit 1.3: Regulation B Checklist Yes A. Adverse Action Notifications: 1. Are rejected applicants so advised in writing within the prescribed time limits? 2. Do rejected applicants receive a copy of the ECOA notice? 3. Does the bank either disclosure the specific reasons for adverse action taken or disclose to the customer the right to obtain such a statement? B. Signature Policy: 1. Are restrictions on spouse’s signature requirements observed? 2. If jointly held property (auto, securities, household goods) will secure the loan, will nonapplicant joint owners be required to sign only the collateral instruments? 3. If a loan can be approved only with a co-signer, could applicant volunteer any other person and not be limited to spouse? 4. Are single signature loans available to borrowers whose real estate is owned and pledged in joint names (provided state law holds such a contract to be valid)? 5. Is business credit separately available to principals of corporations, partners, and proprietors without requiring spouses’ signatures? 6. Are commercial loan officers aware of the effects of Regulation B or cross guarantees? 7. Are separated or divorced persons who are qualified able to obtain credit without additional signatures? C. Credit Reporting: 1. For joint accounts in which credit information is reported, is a determination made whether the spouse has authorization to use the account or is contractually liable? 2. Are credit files indexed to allow for reporting credit histories in the name of each spouse? 3. Is credit information furnished to credit reporting agencies in a manner that would No Yes enable the agencies to report information in the requested name? D. In connection with an application for consumer credit relating to the purchase of residential real property, does the creditor request as part of any written application the information required by Section 202.13(a) when the credit is to be secured by a lien on such property? E. Record Retention: 1. Is any application form, financial statement, credit worksheet, or written or recorded material used in evaluating an application retained for at least twenty-five months after the credit decision is made? 2. Is a copy of the notice of adverse action, reasons for adverse action, and any written statement submitted by the applicant alleging discrimination retained for at least twenty-five months? No

![(NPD-60) []](http://s3.studylib.net/store/data/007320126_1-47edb89d349f9ff8a65b0041b44e01a8-300x300.png)