The Company structure survey

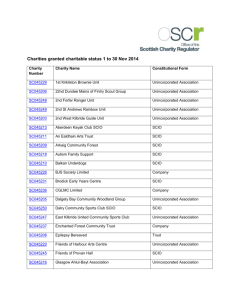

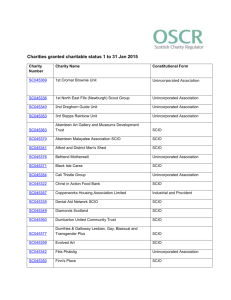

advertisement

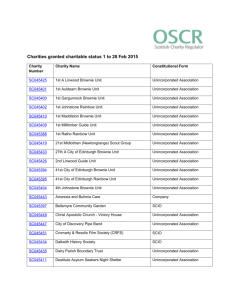

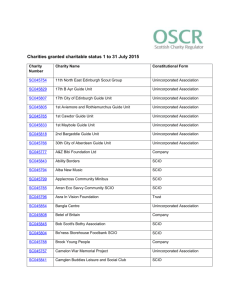

CULTURAL ASSEMBLY Survey to determine company structure A strategic action plan for culture, heritage and arts has been prepared following formal commissioning by Argyll and Bute Council with Highlands and Islands support. In June a meeting of the Cultural Assembly (a gathering of people working and volunteering in the sector) met in Dunoon and debated the role of the Cultural Assembly in delivering the strategy and benefits to the sector as well as the best company structure. The meeting agreed that the company structure should be decided first, before elections are held to a board, and that everyone working in the sector across Argyll and Bute should be given the opportunity to voice their preference about what sort of company should be set up. This survey describes the three options and asks you to agree which you think might be most appropriate. The Cultural Assembly will establish a structure and delivery mechanism that: encourages local engagement supports local development of the creative industries mobilises local people to take a pan-Argyll and Bute approach to priorities and actions. Identify funds to deliver key priorities, including support staff. The role of the board of the Cultural Assembly will be to manage day to day activities and act as a voice for the sector. Company structure There are three options: (all three minimise the risk of everyone involved) Company Limited by Guarantee The CLG is a widely recognised and flexible structure for social enterprises. It offers limited liability for its members and Directors so long as they are acting in accordance with the duties for directors as set out in company law. It has a separate legal personality so that contracts/leases etc can be entered into in the name of the organisation rather than the individual board members therefore you minimise the risk to those individuals. This is a private limited company, regulated by Companies House, but unlike a conventional company it does not have any shareholders. Its members enjoy the benefits of limited liability, and the organisation has corporate status so it can Page 1 enter into contracts and own property in its own name. Members guarantee a fixed sum towards the debts of the company should it go bust: usually a nominal £1. While the simple CLG is a very common legal form for voluntary organisations, small co-operatives and social enterprises, it is not always attractive to potential funders because there is little protection for the principles upon which the organisation was established. The members of a CLG can at any time vote to change its constitution and turn it from a not-for-profit into a for-profit, or from a social enterprise into a private business. This won’t happen if a majority of the members are opposed to it, of course, and there are many examples of CLG not-for-profits/social enterprises that have flourished successfully for many years without compromising their principles; but it can still make some funders a little wary. Also some funders are restricted to funding registered charities and couldn’t give money to a non-charity CLG in any case. When setting up a CLG, it is necessary to draft the articles of association in such a way that clearly shows that you are a social enterprise. Operating as a social enterprise and you will be re-investing the profits (surplus) back into the business for future development or in the beneficiary community – the profits will not be distributed to owners/members/investors. The asset lock means that upon dissolution of the company the assets are re-directed to another social enterprise, charity or asset locked body so that social aims are still met and that assets are not sold and distributed to the members of the company. The asset lock is a fundamental part of your constitution especially when you are pursuing grant funding. To set up the CLG, it is necessary to draft and submit the memorandum and articles of association and incorporation form to Companies House. I mention the CLG as if you decided to opt for a charitable company it would be a CLG underneath so it is good to understand the structure. SCIO/Charitable Companies Charitable status is a badge that an organisation can wear that brings with it some benefits. It is not a structure in itself; it is added as an extra layer on a CLG. The SCIO is however, a structure in its own right making it a novel addition to the choices available. To acquire charitable status or to incorporate as a SCIO status it is necessary to prove (in simplified terms) that the activities you carry out are purely charitable and are for public benefit, independent of government, non-party political and not for private gain. The activities must further a purpose and be for the public benefit with any private benefit arising from the activities being necessary or incidental. Page 2 The advantages of being a charity are numerous, and include corporation and capital gains tax relief, wider fundraising opportunities and potentially greater public trust. A charity may also claim for business rates relief on their premises and will receive at least 80% relief (20% is discretionary) on their rates. A further advantage is that there is the ability to attract donations which will be eligible for gift aid. The flipside is similar to incorporation, with governing body members legally bound to act responsibly and obliged to report to the Office of the Scottish Charity Regulator (OSCR) and you are restricted in the type of trading you can do i.e. only for the advancement of a purpose. Being incorporated as a SCIO also means that you get the benefits of a separate legal personality (similar to CLG). It is incorporated but not a company. Members and the board have limited liability and are not personally liable for any debts of the organisation (as long as they are acting in a legal way and not in breach of the duties). Once of the benefits of being a SCIO is that you are only accountable to OSCR rather than Companies House. The Members of the SCIO are also accountable for their actions and have a duty of care towards the charity which does not exist within the CLG. The SCIO’s existence depends entirely on its charitable status and once established it may only be dissolved or amalgamate with another SCIO. As a SCIO you will have less onerous accounting procedures as you have to be earning over £250K before it is necessary to complete fully accrued accounts that require to be audited. To apply for charity status or incorporation as a SCIO, it is necessary to prepare the SCIO, SCIO application form and trustee declaration forms and submit to OSCR. For a charitable company, the articles of association must be sent to OSCR along with the application form and trustee declaration forms. You then wait to hear if you have been successful then incorporate the company using Companies House’s usual procedure. With any charitable application it is a 90 day turnaround once OSCR receive it. The SCIO or charity will not exist until OSCR confirm that you pass this test. Community Interest Company (CIC) A CIC can be limited by guarantee or shares as it is fundamentally a limited company with an extra layer of community interest. A CIC would have to pass the community interest test and we would have to demonstrate what activities the CIC would propose to do and how they would be of benefit to the community. It will also be necessary each year to demonstrate what the CIC has done each year to benefit the community as outlined as well as the usual accounting/reporting requirements. Another key feature of the CIC structure is the asset lock which protects the assets so that they cannot be sold for less than their market value and so that on dissolution those assets would be transferred to another asset locked body so that Page 3 the community always benefits from them. On dissolution of a CIC any surplus assets must be transferred to another asset locked body. The Asset Lock is a fundamental feature of CIC’s and therefore has a permanent long-term consequence. The Asset Lock is designed to ensure that the assets of the CIC (including any profits or other surpluses generated by its activities) are used for the benefit of the community. This means that, subject to the CIC meeting its obligations, its assets must either be retained within the CIC to be used for the community purposes for which it was formed, or, if they are transferred out of the CIC, the transfer must satisfy one of the following requirements: It is made for full market value so that the CIC retains the value of the assets transferred; It is made to another asset-locked body (a CIC or charity, a permitted industrial and provident society or non-UK based equivalent) which is specified in the CIC’s Articles of Association; It is made to another asset locked body with the consent of the Regulator; or It is made for the benefit of the community. Provision to this effect must be included in a CIC’s Articles. The transfer of assets at less than market value must be given a wide interpretation and it should always be remembered that cash is often an organisation’s main asset. Payments for services etc must represent full market value. This means, for example, that payments to staff and directors must not be disproportionately high in relation to their abilities and the services they perform. Similarly management, or other service charges (particularly if provided by associates who are not asset locked bodies), must represent value for money. The CIC Regulator ensures that a CIC must fulfil its obligations to reinvest 65% of its profits and 35% may be paid to the shareholders (in a shares model) or available for outside investment (in a guarantee model). To incorporate a CIC, it is necessary to prepare the memorandum and articles of association, IN01 form and Community interest statement (CIC36 form) to Companies House. Page 4 Which company structure do you consider most appropriate for the Cultural Assembly? Please note that in order to vote you must have completed and submitted a ‘contact form’ Remember – This is the structure for the Cultural Assembly and does not affect the status of the Assembly’s constituent members. YES NO NOT SURE Company Limited by guarantee A Scottish Charity Incorporated Organisation Community Interest Company (CIC) Name Organisation Are you interested in becoming a member of the company, when formed? YES NO NOT SURE This information sheet can be returned either by mail or email with your vote to: Aileen MacLennan Argyll and Bute Council Burnet Building St John Street Campbeltown PA28 6BJ aileen.maclennan@argyll-bute.gov.uk Or you can use Survey Monkey. Please forward this survey and link - https://www.surveymonkey.com/s/JZYQ6VP to others you work with or may be interested in the Cultural Assembly and the health of the culture, heritage and arts sectors in Argyll and Bute. Page 5