Consequently, given General robust shale gas project

advertisement

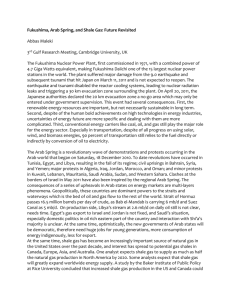

MODERN DAY SHALE GAS LEASES FOR LAND AND ROYALTY OWNERS How to Negotiate for Better Bonus, Royalty and Delay Rentals (Why 25%+ Royalty and >$5,000/acre Bonus Are Justifiable) By… Les R. Wrights and Roy T. Ohner1 (2012) Summary When Oil Companies and their landmen negotiate bonus, royalty and delay rental terms – the more significant commercial benefits to be enjoyed by the royalty owner and land owners – don’t be misled by landmen negotiation tactics that such terms need to be at a certain ‘low’ level because the lease being negotiated and the risks associated with hydrocarbon discovery success by the Oil Company are not in balance. In other words, the ‘high risk assumed by the Oil Company means low reward to the royalty owner’ negotiations tactics… Ask yourself…Since exploration is a risk game, how can the landman be so sure of the riskreward balance at the early stage of negotiations or even before there is production? The answer: She or he can’t! So what do you do? This short discussion on oil and gas economics and commercial tools you have available, will provide the necessary support to you, your lawyer and other advisors, to improve your negotiations position and success in achieving a higher reward rightfully due you. How an Oil Company Values a Lease The ‘value’ of a lease to the Oil Company is primarily determined by the Oil Company and their expert economists (and lawyers, tax advisors, finance team, engineers, geologists, cost estimators and a whole host of other support personnel), preparing and analyzing commercial and economic assumptions about the lease they are interested. This team considers such things as: 1 How much shale gas (and possibly oil) may be underground and on the lease or surrounding area (more commonly referred to as the recoverable reserves) and how efficiently and quickly they can produce those reserves (more commonly referred to as the production stream)?; Non-profit counselors whose mission is to assist land and royalty owners and their lawyers and advisors, to improve their economic success when negotiating oil and gas mineral leases with Oil Companies. What price the Oil Company may receive for gas (and oil) should they find those reserves and produce and sale them? If any of us could accurately predict what future oil and gas prices will be, we would all be zillionaires.; How much will it cost in both terms of wells, equipment, roads and pipelines (the ‘capital’ expenses) and operating costs to develop and produce the reserves?; How much royalty and taxes will the Oil Company have to pay? By multiplying guesstimated natural gas production rates (produced from the estimated reserves in the ground) times estimated future sales gas price, the Oil Company analyst determines the revenue or gross income that might occur from the project. Then by deducting from the revenue such things as estimated capital costs, operating costs, taxes and royalty, the analyst can determine the (after tax) cash flow of the project. By applying what economist call ‘discounted cash flow’ analysis, the analyst can determine anticipated Rates of Return (ROR) or Return on Investment (ROI) to determine if the project can be profitable to the Oil Company or not. Discounted cash flow analysis is not all that difficult to do, but it does take some effort to understand what assumptions are important and accurate that goes into the calculations. What follows are the tools that will help you to understand what goes into the Oil Company’s discounted cash flow analysis so you can be better equipped to defend the bonus, royalty and delay rental terms you want in your lease. The tools are based on information and data from gas shale projects in the Northeast, Rocky Mountains, Mid-continent and Gulf Coast areas of the United States. So the information is quite broad and applicable in almost any region in the U.S. (and possibly the West Coast and Canada as well). Definitions First some defined terms: Capex means capital costs. Those costs that for tax purposes normally have to be depreciated or amortized (spread out over time). Examples include pipelines, roads, gas plants, compressors, pumps. The tax auditors will not let you deduct all the costs in one lump sum when determining taxable income. You have to spread it out over time, which means you have to pay more taxes (when spread out, less to deduct, which means higher taxable income on which the tax rate is applied). Opex means operating costs. Those costs that for tax purposes are normally deducted 100% from revenue. Examples include labor, chemicals, repair costs, utilities. Bcf means billion cubic feet (of natural gas at atmospheric temperature and pressure conditions) mcf means one thousand cubic feet (of natural gas at atmospheric temperature and pressure conditions) mmscf/d means millions of standard cubic feet per day (of natural gas at atmospheric temperature and pressure conditions) Income or Revenue How much gas reserves are in the ground from which geologists and engineers can estimate production rates, is one of the most significant unknowns and risks. But as we all have read in the newspapers, advancement in technology has reduced the risk associated with exploration and production of shale gas reserves and created a brand new and growing industry. The shale gas business is so successful, that many billions of dollars are spent by Oil Companies (U.S. based as well as foreign owned) buying out other shale gas companies or their assets and huge compensation packages paid to the executives of these companies. Consequently, the existence of shale gas reserves is now proven and in plentiful supply and profitable. There is talk of a new energy independence in the U.S. because of shale gas, and even export of natural gas (produced from shale gas) as LNG (Liquefied Natural Gas) because of the bountiful supplies. In excess of 800 Trillion Cubic Feet of shale gas resource potential is available in the U.S., and growing. Engineers use various technical equations (so called ‘Arps Flow Rate Relations’, Exponential, Harmonic or the more commonly used Hyperbolic formulas) to estimate production rates of gas produced from estimated reserves. The use of the Arps formulas are standard practice and fairly reliable. Figure 1 illustrates typical production ‘Decline Curve Analysis’. As for price, in the U.S., ‘Henry Hub’ is used as the price marker for gas prices in the U.S. Figures 2 illustrates historical Henry Hub gas prices (in ‘Money of the Day; or nominal prices meaning the actual price paid for gas on the day with inflation built in. $ per Million BTU, assuming natural gas heating value of 1000 BTU per mcf, is the same as $ per mcf). Figure 2 Figure 3 illustrates a variety of future gas price assumptions (likewise in Money of the Day or nominal terms) based on U.S. Energy Information Agency, 2011 Annual Energy Outlook assumptions and other published gas price estimates. As shown, future forecasts of gas prices indicate an expected growth in gas prices. Growth in gas prices means higher profits to Oil Companies. Figure 4 below illustrates the ‘break-even’ oil and gas production costs which illustrates the ‘minimum’ oil and gas prices required to economically produce the asset. Consequently, given shale gas reserves are increasing, the U.S. natural gas resources are growing, production flow rate decline curves are reliable and gas price estimates from many sources show a consistent trend of escalating and increasing, Oil Company income and revenue expectations for shale gas projects will be robust which illustrates why such projects will be very profitable and why much higher bonus, royalty and rental payments are demonstrably the proper expectation of royalty and land owners. Shale Gas Play Costs Nationwide shale gas project capital costs (Capex/mcf) range from $0.7/mcf to over $3.0/mcf (with an indicative average of ~$1.4/mcf). (By multiplying this factor times the recoverable reserves, total Capital costs can be estimated). Nationwide shale gas project operating costs (Opex/mcf) range from $0.7/mcf to $2/mcf (with an indicative average of ~$1.2/mcf). (By multiplying this factor times the recoverable reserves, total Operating costs can be estimated). [Includes typical: Lifting costs range from $0.5$0.4/mcf ($0.25 avg); Processing costs range from $0.05-$0.3/mcf ($0.15/mcf avg); Gas pipeline tariffs of ~$0.25/mcf; Fixed operating cost per well ranging from $5000/year/well to over $25,000/year/well]. Each State will have a different tax structure, but typically a 35% federal income tax and where applicable, severance tax (typical 7.5%; $0.3/mcf), ad valorem tax (property tax, 1%-4%) and in some cases a State income tax ~8% (deductible from Federal tax). Typical Estimated Ultimate Recovery (EUR) per well (amount of gas expected to be produced by a single well – the quantity of which must be large enough to pay off the cost of the well and realize a profit after payment of other costs, such as taxes, royalty and operating costs) - ranges from 0.2 bcf/well to over 5 bcf/well (indicative average of ~1.2 bcf/well). The higher the number the better the recovery and reservoir from which gas is recovered. Typical initial gas flow rates from shale gas wells ranges from 0.2 mmscf/d to over 5 mmscf/d (same as 5,000,000 cubic feet per day of gas); (indicative average of over ~1 mmscf/d). Typical shale gas well costs (drilled and completed as a producer) ranges from $500,000/well to over $8,000,000 (indicative average of ~$3,500,000). Land costs (or bonus) can range from a few dollars per acre to over $10,000 per acre. Typical Shale Gas Projects Economics Typical shale gas project economics include: Profit to Investment Ratios (P/I; Net Present Value at specified discount rate divided by Capital investment costs) ranging from 1.0 to over 2. Anything above say about 0.75 is generally very good. Internal Rates of Return (after tax) ranging from less than 10% to generally over 25%. In today’s economy, generally any long term project having an IRR (or ROR) after tax in nominal (money of the day) terms over 14% is very good. Total Government Tax and Royalty takes ranges from 45% to over 60%. Most international oil and gas project outside the U.S. typically have overall government takes that regularly exceed 70%. Typical Net Present Value per mcf ($NPV/mcf) ranging from $0.75/mcf to over $1.5/mcf (indicative average of ~$1/mcf or higher). This ratio is a measure of profitability. (Historically, anything over about $0.75/mcf was considered good. o If the wellhead gas sales price is assumed to be $4/mcf, a $1/mcf NPV/mcf factor means out of the $4/mcf sales prices, all of the costs and taxes and royalty were paid and the Oil Company is left over with $1 out of the $4 as its profit! Quite a good deal! Generally means taxes were not high enough or royalty was too low). o Net Present Value or NPV is the present value of the discounted after tax cash flow. The discount rate used is important. Given today’s very low interest rates means typical discount rates should be lower because of lower borrowing costs (low interest rates). Historical discount rate typically used was 10%. However, today, lower discount rates should be used (perhaps even below 5%), which will cause Net Present Values to be much higher and thus better profitability to Oil Companies (and ability to pay higher royalty rates!). Nationwide royalty rates range from 10% to 30%, with an average of about 23%. Various estimates indicate that ‘break-even’ gas price (that gas price needed to give a $0 NPV/mcf, or no profit but pay off of all costs, taxes and royalty) is estimated at a little over $4/mcf. Figure 4 illustrates the economic sensitivities of various shale gas project economic variables. Sensitivity Of Various Shale Gas Variables Figure 4 55. 00 53. 00 51. 00 Production Sensitivity Index 49. 00 Price 47. 00 Capex 45. 00 Opex Tariff 43. 00 Royalty 41. 00 Bonus 39. 00 Delay Rental 37. 00 35. 00 -40% -30% -20% -10% 0% 10% 20% 30% 40% Range of Sensitivity Movement As illustrated, shale gas project economics are very much effected (sensitive to) changes in Production and Price (the more vertical or up and down the lines are on the graph, illustrates greater sensitivity). In contrast there is much less sensitivity from bonus or royalty or delay rental changes and impacts on project economics (near horizontal or flat graph lines). Consequently, given General robust shale gas project economics, Small if not insignificant impacts on shale gas project economics in regard to changes to bonus or royalty payments, and Relative low overall tax/royalty take compared to comparable foreign government takes Oil Company project economic expectations for shale gas projects will be robust and why higher bonus, royalty and rental payments are demonstrably the proper expectation of royalty and land owners. Don’t feel bashful about asking for a minimum 20% royalty, and in most cases 30% can be justified! If you can’t get a good bonus payment ($ per acre – at least $1000/acre but try for $10,000/acre) and have to settle on a lower bonus, do the following: Agree to a small initial bonus payment BUT in the event there is a o successful discovery on the lease (one in which one or more production wells are drilled and production is started) or o the lease is unitized or o included in pooled acreage, then on the first occurrence of any of those events, the Lessee will be obligated to pay a ‘success’ bonus or ‘ discovery’ bonus or ‘pool’ bonus or ‘unitization’ bonus. The size of such success case bonus should be quite large (especially as shown above since such bonus has little impact on Oil Company economics). You could even have separate and tiered bonus for each of the above events.