Ratio Analysis Summary Checklist

advertisement

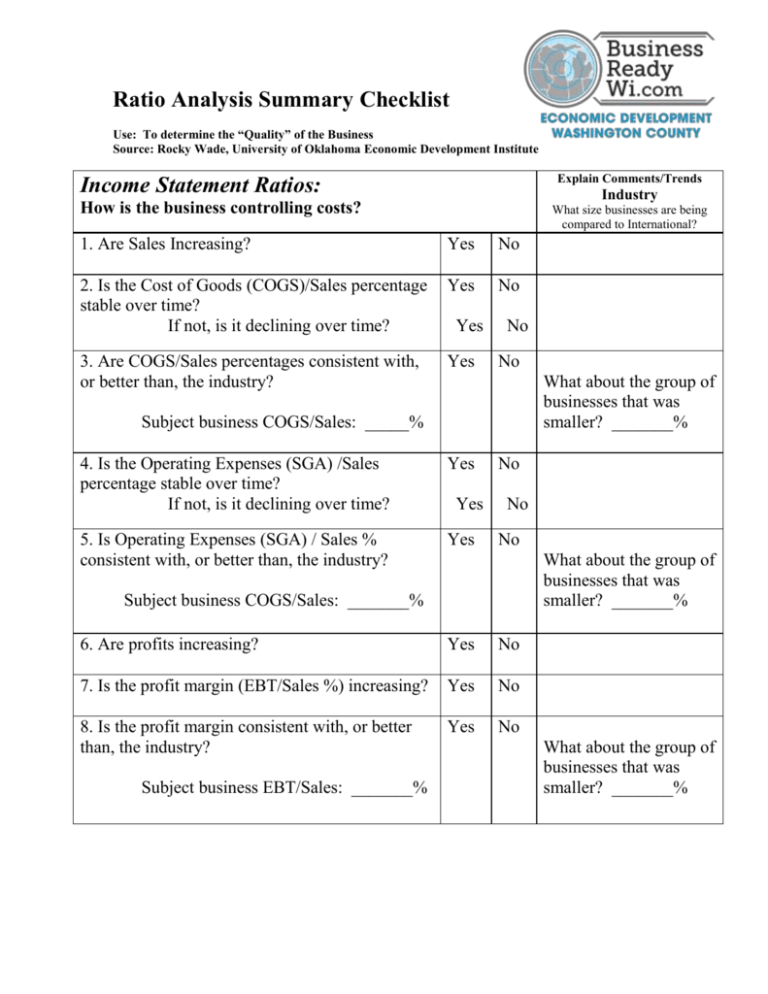

Ratio Analysis Summary Checklist Use: To determine the “Quality” of the Business Source: Rocky Wade, University of Oklahoma Economic Development Institute Explain Comments/Trends Income Statement Ratios: Industry How is the business controlling costs? What size businesses are being compared to International? 1. Are Sales Increasing? Yes No 2. Is the Cost of Goods (COGS)/Sales percentage stable over time? If not, is it declining over time? Yes No 3. Are COGS/Sales percentages consistent with, or better than, the industry? Yes Yes No No What about the group of businesses that was smaller? _______% Subject business COGS/Sales: _____% 4. Is the Operating Expenses (SGA) /Sales percentage stable over time? If not, is it declining over time? Yes 5. Is Operating Expenses (SGA) / Sales % consistent with, or better than, the industry? Yes Yes No No No What about the group of businesses that was smaller? _______% Subject business COGS/Sales: _______% 6. Are profits increasing? Yes No 7. Is the profit margin (EBT/Sales %) increasing? Yes No 8. Is the profit margin consistent with, or better than, the industry? Yes No Subject business EBT/Sales: _______% What about the group of businesses that was smaller? _______% Explain Comments/Trends Balance Sheet Ratios: How liquid is the business? 9. Is the Current Ratio at least 1:1? 10. Is the Current Ratio consistent with, or better than, the industry? Subject business Current Ratio: ___/___ Industry Yes No Yes No High ____ Med ____ Low ____ 11. Is the Quick Ratio stable? If not, is it declining? 12. Is the Quick Ratio consistent with, or better than, the industry? Subject business Current Ratio: ___/___ High ____ Med ____ Low ____ 13. Is the Debt/Equity ratio stable? If not, is it declining? 14. Is Debt/Equity ratio consistent or better than the industry? Subject business Debt/Eq: ____/_____ Yes No Yes No Yes No High ____ Med ____ Low ____ 15. Is working capital positive? Yes No Explain Comments/Trends Operating Cycle Ratios: How is cash used in the business operations? 14. Are Days Receivable stable? If not, are they declining? 15. Are Days Receivable consistent with or better than, the industry? Subject business D/R: ______Days 16. Are Days Inventory stable? If not, are they declining? 17. Are Days Inventory consistent with or better than, the industry? Subject business D/I: _____Days 18. Are Days Payable stable? If not, are they declining? 19. Are Days Payable consistent with or better than, the industry? Subject business D/P: _____ Days 20. Is the Operating Cycle stable? If not, is it declining? 21. What is the total Operating Cycle? Subject business OC: ____ days Industry/RMA Yes No Yes No Yes No Best ____ Med ____ Worst ____ Yes No Yes No Yes No Best ____ Med ____ Worst ____ Yes No Yes No Yes No Best ____ Med ____ Worst ____ Yes No Yes No TOTAL _________ Note: Can’t determine total from RMA