Geographic Restrictions - Sierra Pacific Mortgage

advertisement

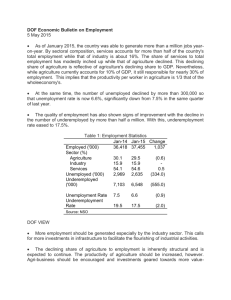

Products 1 State Geographic Restrictions Table2 Restriction ALASKA ARIZONA CALIFORNIA Properties located in the state of Alaska are not eligible for financing Declining Counties identified. Mandatory 5% LTV reduction. See Declining Counties Exhibit JUMBO CALIFORNIA Declining Counties identified. Mandatory 5% LTV reduction. See Declining Counties Exhibit Earthquake coverage for Condominiums: Loans on condominiums must comply with Fannie Mae’s salability requirements. JUMBO JUMBO COLORADO D.C. FLORIDA Declining Counties identified. Mandatory 5% LTV reduction. See Declining Counties Exhibit Declining Counties identified. Mandatory 5% LTV reduction. See Declining Counties Exhibit ALL JUMBO STD/STD CLUES & MCM STATED/ STATED CLUES See Exhibit “A” for SPECIFIC restrictions Wholesale loans are not eligible Dade County – The following restrictions apply for loans secured on properties located in Dade County: Condominiums and attached PUDs: projects must be review for right of first refusal. Maximum LTV for condominiums must be reduced by 10% For properties other than condo’s: Declining Counties identified. Mandatory 5% LTV reduction. See Declining Counties Exhibit Wholesale loans are not eligible Retail Only: Title V states that dwellings with individual sewage disposal systems, new and existing, must be inspected by a DEP approved inspector and, where repairs are indicated, be repaired prior to loan closing for all purchase transactions. Specific procedures must be followed in the event that the inspection and/or repairs cannot be completed prior to closing. JUMBO FLORIDA STATED/ STATED CLUES MASSACHUSETTS ALL MASSACHUSETTS MARYLAND MICHIGAN MISSOURI Declining Counties identified. Mandatory 5% LTV reduction. See Declining Counties Exhibit MONTANA No loan may be secured by property of more than 40 acres. NEVADA Clark County: Loans secured on properties located in Clark County are subject to additional appraisal requirements. Refer to Exhibit “B” below for details. NEVADA NEW HAMPSHIRE NEW JERSEY NEW YORK OHIO PENNSYLVANIA RHODE ISLAND TEXAS Cash-out (a)(6) Declining Counties identified. Mandatory 5% LTV reduction. See Declining Counties Exhibit Declining Counties identified. Mandatory 5% LTV reduction. See Declining Counties Exhibit West VIRGINIA VIRGINIA Loans secured by properties located in the state of West Virginia are not eligible ALL ALL STATED/ STATED CLUES STATED/ STATED CLUES STATED/ STATED CLUES JUMBO ALL ALL ALL ALL ALL ALL ALL ALL ALL Declining Counties identified. Mandatory 5% LTV reduction. See Declining Counties Exhibit Declining Counties identified. Mandatory 5% LTV reduction. See Declining Counties Exhibit St. Louis, Green Jade Estates Subdivision: Financing is not allowed. Declining Counties identified. Mandatory 5% LTV reduction. See Declining Counties Exhibit Loans secured by properties located in the state of New York are not eligible. Loans secured by properties located in the state of Ohio are not eligible. Loans secured by properties located in the state of Pennsylvania are not eligible. Declining Counties identified. Mandatory 5% LTV reduction. See Declining Counties Exhibit Cash-out refinance transactions (a)(6) loan transactions (when permitted) must meet applicable state law requirements in addition to specific product restrictions. Refer to applicable product guidelines FOR SPECIFIC RESTRICTIONS. Loans secured by properties located in the state of Virginia are not eligible Please Note: 1 “ALL” means all products offered by Sierra Pacific Mortgage, excluding Government Loans and First House. 2 If a property has been identified as being in a declining market, whether by the appraiser or appraisal review, a minimum of 5% reduction from maximum allowable financing is required. Geographic Restrictions Table 1 Revised 10-24-07 Exhibit “A” – State of California The following restrictions apply to properties located in the state of California: o Big Rock Mesa (Malibu) and Castellamare (Pacific Palisades)- All of the following conditions apply to any loan if the subject property is located in the Castellamare area of Pacific Palisades or on the following streets in the Big Rock Mesa Area (Malibu): o o Big Rock Drive Piedra Chica Road Rockport Way Cool Oak Way Pinnacle Way Royal Stone Drive Inland Way Roca Chica Drive Seaboard Way Little Rock Way Rockcroft Drive Seamore Drive McAnany Way Rockpoint Way Whitecap Way Due to earth slippage and land slides, the following conditions apply: Verify soil engineer’s report stating soil is stable and not subject to future expansion, slippage or slide activity. Verify structural engineer’s report confirming dwelling and any outbuildings or garages have not been affected by soil expansion, slippage or land slides and are in, at least, good conditions. Homes on septic system are not acceptable. Borrowers must sign a Borrower Property Indemnification Certification. For more specific location information, the referenced streets may be located in the most current copy of the Thomas Bros. Guide for Los Angeles County Oakley, Contra Costa County: Purchase transactions only — The Dupont Chemical Plant, located at 6000 Bridgehead Street, Oakley, CA is considered a potential environmental hazard site. The appraiser is responsible for making appropriate comments on the appraisal report regarding the potential hazard. If the appraiser determines that the property is located within one (1) mile of the site or any impact is noted on the appraisal, the borrowers are required to sign the Notice to Prospective Buyers of Properties form acknowledging that the property is near a source of potential hazard La Conchita Area (San Buena Ventura) - this area is known to have experienced earth slippage and landslide problems. All of the following conditions apply to any loan if the security property is located in these areas Clear soil engineer’s report stating that the subject soil is stable and not subject to future expansion, slippage, or slide activity. Clear structural engineer’s report confirming that the subject dwelling and any outbuildings, garages, etc. have not been affected by soil expansion, slippage, or landslides and are in at least good condition. Borrowers are required to sign the La Conchita Area (San Buena Ventura) Borrower Property Condition Indemnification Certificate. The properties located on the following streets in the La Conchita area are subject to all three conditions above: Vista Del Rincon Drive San Fernando Avenue Carpinteria Avenue West Surfside Street Zelzah Avenue Santa Paula Avenue Bakersfield Avenue Santa Barbara Avenue North Sunland Avenue Fillmore Avenue Ojai Avenue Oxnard Avenue All properties are a portion of Sections 1 and 12 of La Conchita Del Mar No. 2, Book Page 31. La Conchita is an unincorporated area of Ventura County, CA. Geographic Restrictions Table 2 Revised 10-24-07 Exhibit “B”- Nevada The following restrictions apply to properties located in Clark County, Nevada: Exhibit “B” Additional Appraisal Requirements for properties located in Clark County, Nevada Appraisal Company LandSafe® Services Inc Company other than LandSafe Services, Inc. Geographic Restrictions Table No additional requirements apply. Option 1 / Additional Appraisal Requirements: The appraisal must comply with the following additional requirements: The most recent data available must be used for the comparable sales. At least two of the comparable sales should have closed within 30 days of the effective date of the appraisal. One current listing must be from the immediate subject neighborhood and representative of competitive properties in the neighborhood. Caution is requested to not use the highest listing available, but the listings most likely to sell (excluding the distressed listings). When reconciling the final value, emphasis should be placed on the most current data, as well as the comparables and listings most similar in location and other physical aspects to the subject property. Additional Guidelines for New Construction: o When appraising new construction, both the contract/sales date (when the buyer entered into the contract with the builder), and the closing date must be reported and analyzed. o Differences in market conditions between the contract/sales date and the effective date must be analyzed. o The appraiser must provide the builder names of the subject property, and the comparables (if new construction also). o The appraiser should provide at least one sale from within the subdivision and one sale from outside the subdivision. Option 2 / Full Appraisal with LandSafe Review: In lieu of the additional requirements above, non-LandSafe appraisals may be submitted with a LandSafe review. The review appraisal may be a desk review, field review or a LandSafe Appraisal Review Analysis (LARA) that receives a quality rating of 3,4, or 5 3 Revised 10-24-07 State AL AZ CA CO DC FL MA MD MI NH NJ NV RI IDENTIFIED DECLINING/SOFT MARKETS (Mandatory 5% LTV reduction is required, regardless of Appraiser’s comments or lack thereof) Counties Bullock, Macon Maricopa, Pinal Alameda, Contra Costa, El Dorado, Fresno, Humboldt, Imperial, Kern, Kings, Merced, Monterey, Orange, Placer, Riverside, Sacramento, San Bernardino, San Diego, San Joaquin, San Luis Obispo ,Santa Barbara, Solano, Sonoma, Stanislaus, Sutter ,Tulare, Ventura ,Yolo , Yuba Adams District of Columbia Brevard, Broward, Charlotte, Citrus, Collier, Escambia, Hernando, Hillsborough, Indian River, Lee, Manatee, Martin, Monroe, Okaloosa, Palm Beach, Pasco, Pinellas, Santa Rosa, Sarasota, St. Lucie, Volusia Berkshire, Essex, Middlesex, Plymouth, Worcester Calvert, Charles, Prince George’s Lapeer, Livingston, Macom, Oakland, St. Clair, Washtenaw Hillsborough Cape May Clark, Storey, Washoe, Nassau, Suffolk, Tompkins Bristol. Kent, Newport, Providence, Washington Geographic Restrictions Table 4 Revised 10-24-07