Preparing, reviewing and approving IRIS Policies and Procedures

advertisement

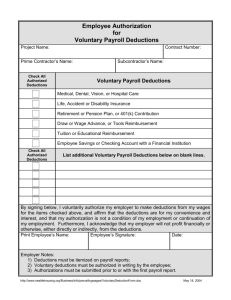

Policy Title Policy Number Version Contact Effective Date Approved By Payroll 313 DRAFT 0 Candy Shin, Chief Financial Officer Payroll Policy IRIS employees are paid semi-monthly and encouraged to enroll in direct deposit of paychecks to a financial institution. Payroll entries must be c Purpose The purpose of this policy is to ensure that all IRIS employees are paid correctly and timely. Scope Responsibilities Definitions Procedures F.2. Handling Of Payroll Deductions The Business Office, together with Administaff, processes mandatory deductions from employees’ paychecks in compliance with government regulations and/or other applicable laws, and processes voluntary deductions in accordance with employee election or instructions. Special deductions are processed as appropriate based on the circumstances. F.2.a. Mandatory deductions: IRIS, through Administaff, withholds from the paycheck of each employee all applicable statutory tax deductions. These include, but are not limited to the following: Federal and State Income Tax Withholding: Deductions are determined by 1 filing status as provided by the employee on his/her W-4. Amount withheld is determined by graduated tables provided by the Federal and state governments. Social Security and Medicare Tax: Deductions are based on certain percentage rates set by the federal government from time to time. Annual maximums are set by the Social Security Administration for both Social Security and Medicare subject wages. F.2.b. Voluntary Deductions: Voluntary deductions are recorded upon evidence of the employee’s authorization for such deductions. IRIS sponsors, from time to time, certain employee benefit plans, in which employees may opt to participate. In cases where employee contributes to the cost of the benefit, that contribution will be withheld from the employee’s paycheck, in accordance with the employee’s signed enrollment form. These deductions may include any or all of the following: Health, Dental, and/or Vision Insurance premiums; Health Care Flexible Spending Account Plan contributions; 529 College Savings Plan contributions; Commuter Benefits Program purchases; and/or Voluntary Life, Personal Accident and Disability Insurance premiums. Such voluntary deductions may be on a pre- or post-tax basis, depending on the details of the specific benefit plan. F.2.c. Special Deductions: As required by law, IRIS will deduct all legal wage assignments, such as tax levies, garnishments, bills of child support or other courtordered wage attachments. Such deductions will be deducted in the payroll cycle immediately following receipt of the paperwork, or as instructed in the document. F.2.d. Remittance of Withheld/Deducted Amounts: The Business Office, with Administaff, ensure timely disbursement of amounts withheld from employee paychecks to governmental or other agencies, or benefit providers, in accordance with statutory regulations or executed agreements. 2