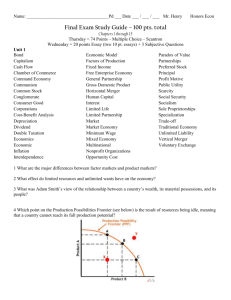

Final Exam Study Guide

advertisement

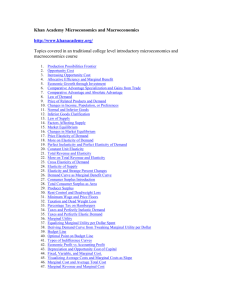

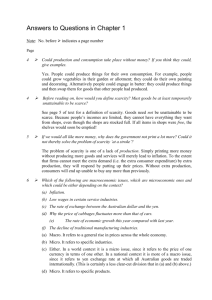

Chapter 1 Vocab List: Section 1: Scarcity factors of production (land, labor, capital, entrepreneur) Gross Domestic Product Production Durable Good non-durable good Section 2: service Good capital goods consumer good utility market productivity specialization Section 3: Opportunity Cost standard of living Power Points: Resource Marginal decisions Marginal analysis Incentive Equilibrium Externalities Model Production possibility frontier (PPF) Household Firm Factor market Forecast Normative economics Positive economics General terms to know: Microeconomics Macroeconomics Chapter 2 Vocab List Section 1: Economic system traditional economy command economy market economy mixed economy stagnation Section 2: social security minimum wage inflation deflation fixed income Section 3: Free enterprise Voluntary exchange capitalism private property rights profit profit motivation competition consumer sovereignty Other Notes Strong command Moderate command Planned economy Socialism Communism Privatization Chapter 3 -sole proprietorship partnership limited partnership bankruptcy corporation charter stock dividends bond merger depreciation horizontal merger vertical merger conglomerate multinational non-profit organization cooperatives Chapter 4 demand Law of demand Demand schedule Demand curve Market demand curve marginal utility diminishing marginal utility change in quantity demanded income effect substitution effect change in demand substitutes complements elasticity demand elasticity elastic inelastic unit elastic Power Point Notes: Quantity demanded Perfect substitutes Inferior good Normal good Household demand Market demand Price elasticity Chapter 5 Study Guide supply law of supply subsidy supply elasticity production function short run long run total product marginal product raw materials diminishing return fixed cost overhead variable cost total cost marginal cost marginal analysis Quantity supplied Total revue Marginal revenue Power Point Notes Supply schedule Supply curve Input Market supply Equilibrium Surplus Shortage Chapter 6 Price Rationing Ration coupons Rebate Price ceiling Minimum wage Price floor Target price Nonrecourse loan Deficiency payment Conservation Reserve Program Chapter 7 Vocab List Market structure Perfect competition Imperfect competition Monopolistic competition Product differentiation Collusion Government monopoly Geographic monopoly Natural monopoly Oligopoly Technological monopoly Price-fixing Monopoly Nonprice competition Market failure Public goods Externality Negative externality Positive externality Public goods vs private goods Price discrimination Trusts Public disclosure Chapter 9: Incidence of a tax Individual income tax sin tax sales tax progressive tax regressive tax proportional tax IRS indexing FICA Medicare estate tax gift tax custom duties intergovernmental revenue property tax flat tax excise tax user fees alternative minimum tax capital gains corporate income tax Value Added Tax Chapter 10 Vocab List Pork Public sector Private sector Transfer payment Grant-in-aid Subsidy Distribution of income Mandatory spending Discretionary spending Fiscal year Appropriations bill Budget deficit Budget surplus Medicare National debt Medicaid Balanced budget amendment Intergovernmental expenditures Trust funds Per capita Crowding-out effect Line-item veto Entitlements Spending caps Chapter 11: Saving Savings Certificate of deposit Coupon rate Financial assets Financial system Financial intermediaries Finance company Pension Bond Coupon rate Municipal bond Corporate bond Government bond Treasury notes Treasury bills Treasury bonds IRA Capital Market Money Market Equities Portfolio diversification Mutual fund Securities exchange Over the counter market Dow Jones Industrial Average Standard and Poor’s 500 Bull Market Bear Market Roth IRA Liquidity Rule of 72 New York Stock Exchange American stock Exchange Nasdaq Chapter 13 Vocab List Business cycle Recession Peak Trough Expansion Trend line Depression Leading economic indicator Econometric model Inflation Deflation Price index Market basket Consumer Price Index Creeping inflation Hyper inflation Stagflation Demand-pull inflation Cost-push inflation Underemployed Frictional unemployment Structural unemployment Technological unemployment Cyclical unemployment Seasonal unemployment Misery index Possible Essay Questions: -Name the three major types of economic systems and discuss the advantages and disadvantages of each. Lastly, which type of economic system is the United States most like? Support your answer with examples. -What is competition? What are the positives and negatives of competition for consumers. Lastly, how do businesses compete? Support every aspect of your answer with examples. -Name and explain the three main types of income taxes. Which system is used and the United States and do you agree with it. Support your answer. What factors can change shift demand and supply? Give examples. Possible Short Answer Topics Chapter 1: What are the three basic economic questions that must be answered? Name and explain the four factors of production. What is the circular flow of economics? What is the difference between the product market and the factor market? Chapter 2: Three main types of economies -advantages and disadvantages Name and briefly explain the 7 economic goals? Name and explain the 5 characteristics of a free enterprise economy? What is the role of the government in a free enterprise economy? What is the role of the consumer in a free enterprise economy? Chapter 3: What are the advantages and disadvantages of the different types of business structures? Why do business merge? Give an example of a horizontal merger and a vertical merger. What is conglomerate? Chapter 4: What is the difference between a change in the demand and a change in quantity demanded? Name the factors that can change the demand for a product? Give a specific example of each. Describe the three determinates of elasticity. What are inelastic and elastic products? Give examples. Chapter 5: What is the difference between a change in the supply and a change in quantity supplied? What is the difference between a fixed cost and a variable cost? Give examples. Name and explain the stages of production. What is marginal analysis? Name and explain the factors that can shift supply. Chapter 6: What are the four advantages of price? What is rationing and what are its disadvantages? Give examples of price ceilings and price floors. What are the problems with rationing? Chapter 7: Name the four market structures. What are the four main types of monopolies Name the Five factors that can cause markets to fail. What are externalities? Give examples. What are public Goods? Chapter 9: Name and explain the three criteria for effective taxes. Name and explain the two principles of taxation. Name and explain the three main types of taxes. Largest sourcses of revenue for the different units of government. What will cause future tax reform? Chapter 10: Explain the two types of spending. What is the difference between the national deficit and the national debt? Largest sourcses of spending for different units of government. What are the impacts of the national debt? Chapter 11: What factors need to be considered when investing? Types of bonds Investment options. Difference between Roth and 401K IRA’s. What is the rule of 72 What are the most risky and least risky investment options Chapter 13: Name three causes of the Great Depression. Name and explain the 5 types of unemployment. Name 4 causes of inflation. What are the stages of the business cycle? What are the results of inflation? Name the four possible causes of changes in the business cycle? What got us out of the Great Depression? Name two factors. What is the Consumer Price Index?