business case pro forma (Annex B)

advertisement

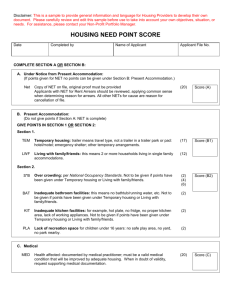

BUSINESS CASE PRO FORMA OFFICE ACCOMMODATION LEASES: NEW & RENEWAL This pro forma is designed to assist expenditure appraisal for accommodation projects, namely new or renewal of leasehold & freehold property. In such appraisals proportionate effort should be employed. The spaces and tables in this form should be enlarged or modified as required to accommodate all the necessary information. For detailed guidance on business cases and expenditure appraisal, consult the Northern Ireland Guide to Expenditure Appraisal and Evaluation (NIGEAE) at http://www.dfpni.gov.uk/eag or seek advice from your departmental economist. The details provided in this form will be used by Reform and Property Management (RPM) team to assess accommodation requirements, undertake property search and for landlord negotiations. It is essential that all accommodation needs are fully identified. Planned lead time on lease business cases should be a minimum of 1 year. Early engagement should be undertaken with departmental economists, Land and Property Services (LPS) and Reform of Property Management (RPM). PROJECT TITLE: PROJECT TYPE: □ NEW □ RENEWAL □CO-LOCATION □RELOCATION □Other, specify: ................................. PREFERRED OPTION LOCATION: SPONSORING DEPARTMENT: SENIOR RESPONSIBLE OFFICER: SIGNED: DATE: APPROVING OFFICER: SIGNED: DATE: Section 1.1: Summary of the Preferred Option 1 Section 1.2: Metrics of the Preferred Option Building Name (If Any) Address/Addresses Lease Term Lease Expiry Date Size (m2) Annual Rent Annual Running Costs (inc Rent) Annual Running Costs (inc Rent) per m2 Total Capital Cost Relocation Costs (if any) Total Project Cost (NPC) NPC per m2 Total FTE m2 per FTE Section 2.1: Project Background The Appraisal of Accommodation Projects in NIGEAE stresses that departments and public bodies must begin accommodation appraisals with analysis on the need for the service being provided. A list of the defects of current accommodation and space requirement is insufficient. Departments must firstly justify the need for continuation or development of the relevant service before accommodation options are considered. Explain the background to the proposal including justification for current and future service provision, current lease arrangements held by the organisation, strategic property management aims should be included, including car parking policy. 2 Section 2.2: Metrics of the Current Lease Current Lease Details Address/Addresses Commencement Date Lease Term Lease Expiry Date Lease Breaks Rent Review Dates Holding Over Arrangements (if Any) Repairs FRI or IRI Freehold/Leasehold Size (m2) Annual Rental Cost Rent per m2 Annual Running Costs (inc Rent) Annual Running Costs (inc Rent) per m2 Total FTEs m2 per FTE Section 3.1: Need Explain the nature of the needs/requirements that are to be addressed; this should include any location requirements. Detail any deficiencies in current provision. Include suitable quantification of needs/demands/deficiencies where possible for example current and future staff complement, where possible a schedule of accommodation should be included. 3 Section 3.2: Accommodation Requirements Accommodation Requirements Current FTEs FTEs to be Accommodated Current Headcount Required No of Workstations Future FTE Projections Required m2 per FTE Location Constraints Other Key Requirements (for example: number and size of meeting rooms, executive offices, space for specialist equipment, storage etc) How have the accommodation requirements been assessed? Has DFP RPM reviewed the accommodation requirements? □Yes □No If yes please indicate the Properties Division reference number or contact: Section 4: State Objectives and Constraints Explain and list the project objectives in specific including quantifiable targets e.g m2 per FTE, Cost per m2. Identify any likely constraints to the project e.g., timing issues, legal requirements, professional standards, planning constraints etc. Project Objectives Measurable Targets 1. 1.1 1.2 2. 2.1 2.2 3. 3.1 4. 3.2 4.1 4.2 Constraints Measures to Address 1. 2. 4 Section 5: Identify and Shortlist the Options In this section alternative solutions which achieve the objectives should be identified. The status quo option should be considered and this compared against other options. Accommodation options in the NDPB/Departmental Estate, the Properties Division Estate, the wider Public Sector Estate and the Private Sector should be considered as should options for co-location. Variations in location, scale, quality, timing may also prove useful. An initial ‘long list’ of options should be provided and these sifted against the objectives to develop a shortlist. All the options considered and the reasons for rejecting those not shortlisted should be recorded. Option Number/Description 1 Shortlisted(S) or Rejected(R) Reasons for Rejection Status Quo Address S Summary Initial Assessment 2 Address Summary Initial Assessment 3 Address Summary Initial Assessment 4 Address Summary Initial Assessment Section 6.1: Monetary Cost & Benefits of Shortlisted Options 1) 2) 3) 4) To enable the comparison of options the costs & benefits arising from the project should be monetised (as far as is possibly practical). These should include all costs and benefits to the public, private & third sectors. To aid this, the following cost check list has been provided, it should be noted that this check list is not comprehensive and effort should be made t ensure all costs and benefits are identified and included. A further checklist of typical costs can be found on the NIGEAE website Costs & benefits should be valued in economic terms, these are generally reflected in current market prices. All the assets and other resources employed by each option should be monetised and included, even if they have already been purchased. 5 Check List for Each Shortlisted Option Lease Term (No. Of Years) Lease Expiry Date Size (m2) m2 per FTE Revenue Costs Capital Costs Annual Rent Rent per m2 Capital Equipment Costs Annual Rates Rates per m2 Capital IT Costs Annual Service Charges Furniture Annual Maintenance Costs (Res) Capital Fit Out Costs Energy Costs Other Capital Costs Dilapidation Costs Opportunity Cost Other Costs (eg Security) Total Capital Costs Decant/Re-location Costs Total Revenue Costs Section 6.2: Net Present Cost (NPC) Calculation 1) 2) 3) 4) 5) 6) 7) Calculate the Net Present Cost (NPC) for each option: a. Use the NIGEAE NPC spreadsheet and append the NPC calculation for each option. b. In the simplest cases, the table below may be used. c. Create a table for each option, adjusting the no. of columns to reflect the years of the lease. Treat the current financial year as Year 0. Set out the expected capital costs and annual revenue costs for each option. Express the figures in real terms i.e. held constant at today’s prices. Financial savings arising from an option will be reflected in its lower costs compared to the Status Quo. Do not double count by also including them separately as benefits. For particularly uncertain cost assumptions, consider using sensitivity analysis to illustrate how NPCs and option rankings are affected by varying these assumptions. For more in-depth guidance, see Step 5 and Step 8 of NIGEAE. Option 1: Status Quo NPC Calculation: Yr 0 Yr 1 Yr 2 Yr 3 Yr 4 Yr 5 Revenue Costs (A) Total Revenue Costs Capital Costs (B) Capital Costs (C) Total Annual Costs (A + B) (D) Discount Factor (3.5% p.a.) 1.0000 0.9662 (E) Discounted Cash Flows (C * D) (F) NPC ( Total of E) 6 0.9335 0.9019 0.8714 0.8420 NPC Table Cost Assumptions: Section 7: Non-Monetary Impact Assessment List and describe the relevant non-monetary costs and benefits e.g. environment, transport, sustainability etc. Use a table such as the one below to show how each factor impacts on each option. Quantify the impacts if possible and highlight important differences between the options. For more detailed approaches see the NIGEAE section on multi-criteria analysis. Non-Monetary Factor Impact on Option 1 Impact on Option 2 Impact on Option 3 Impact on Option 4 1. 2. 3. 4. KEY (- - -) Extremely negative impact, (- -) Significantly negative impact, (/) No impact (+) Some positive impact, (+ +) Significant positive impact, (+ + +) Extremely positive impact Commentary: Section 8: Assessment of Risks & Uncertainties Identify and describe the risks. Explain how these compare under the various options. Identify measures to ensure that each risk is appropriately managed and mitigated. Explain any contingency allowances included for risks in the option costings. For further guidance see Step 6 of NIGEAE. Impact of Risk Risk Description Compare risks across options & Identify risk mitigations High / Medium / Low Option 1 Option 2 Option 3 1. 2. 3. 4. Overall Risk Level (High/Medium/Low) 7 Option 4 Section 9: Summarise the Option Comparisons and Identify a Preferred Option Summarise the differences between options, such as NPCs, non-monetary impacts, risks and other factors. Determine which is the preferred and provided justification for this decision. Section 10: Assess Affordability and Funding Arrangements Set out the annual capital & resource Departmental Expenditure Limit requirements for the preferred option Subtract existing DEL provision from total DEL required. Figures should allow for inflation, contingencies and (where relevant) optimism bias. Resource DEL figures should include appropriate allowance for depreciation/impairment. NB DEL differs from cash e.g. their timing may differ due to distinctions between accruals and cash accounting; and cash will exclude depreciation/impairment. This pro forma only requests the DEL figures but if require cash figures for cash accounting purposes, then adjust the DEL figures to cash separately. Yr 0 £000’s Yr 1 £000’s Yr 2 £000’s Yr 3 £000’s Totals £000’s Total DEL Required: Resource DEL (Non-Ring-Fenced) Resource DEL (Depreciation/Impairment) Capital DEL Existing DEL Provision: Resource DEL (Non-Ring-Fenced) Resource DEL (Depreciation/Impairment) Capital DEL Additional DEL Required: Resource DEL (Non-Ring-Fenced) Resource DEL (Depreciation/Impairment) Capital DEL Identify expected sources of funding and the degree to which each funder is committed. Funding Body Sum funded & % of total £ ( %) £ ( %) £ ( %) 8 Funding secured? Yes/No If not secured, indicate status of negotiations Section 11: Project Management Explain the proposed project management structure, key management personnel and project timetable. Identify any significant management issues e.g. legal, contractual, accommodation, staff or TUS issues. Section 12: Monitoring, and Evaluation Arrangements Indicate arrangements for the monitoring of the project’s progress. State proposed evaluation arrangements e.g. when they are due, who will do it, what factors will be evaluated? For further guidance see para 2.9.15 at Step 9 of NIGEAE. When there is an ongoing need for leased accommodation, an interim evaluation should be completed a minimum of 1 year before any break clause/ termination, to inform the required business case. Finally, remember that this is a general template and that the boxes and tables above may be enlarged or modified to suit the particulars of the case in hand. When necessary, refer to the NIGEAE website or seek advice from your departmental economist team. 9