A Theoretical and Historical Perspective

advertisement

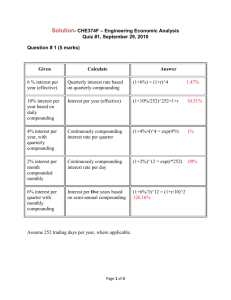

A Theoretical and Historical Perspective The S&P 500 in the first quarter was up 1.75% including dividends. After a barnburner 2013, we consider a modestly up quarter a solid performance. It is nice to have the market consolidate by moving moderately higher rather than going down. Even though this quarter was not down, there will certainly be down quarters and maybe even down years before we reach our current target of Dow 50,000 including the reinvestment of dividends by the end of 2025. To assuage the inevitable down periods, let me succinctly state the forces that make the stock market a long-term winners' game, and provide some historical perspective on stock market volatility. To counter-balance all of the poor paragraphs we have written, we like the following nine lines: The Wealth Formula = Exponentially Compounding Knowledge + the Stock Market -- The long-term stock market is a function of the economy. -- Our economy is increasingly a knowledge-based economy. -- Knowledge is compounding exponentially. -- Exponentially compounding knowledge generates Increases in Productivity. -- Increases in Productivity must improve consumer satisfaction, raise real wages and/or raise earnings and dividends. -- These three factors are the Mother's Milk of an expanding economy. -- An expanding economy drives earnings, dividends and the stock market ever higher. If you prefer just one sentence: The long-term stock market rests on the future growth of Knowledge/Productivity -- and Knowledge is compounding exponentially. In writing about stocks or the stock market, one is never supposed to use the word "guarantee." However, we can "guarantee" that the stock market will be volatile. Based on the data from the last thirty years (1984-2013), we can make these historical statements: The Odds of a Time Period being Up Data: 1984 - 2013 90% 80% 70% 60% 50% 40% Day Month Quarter Half Year Despite brutally torturing the data, we cannot find any pattern(s) where knowing the last period(s) provide any unfair advantage towards knowing the next period. Our most reliable indicator continues to be "This Time will be Different." We believe Human Nature drives the market irregularly but resolutely over roughly a 30-year period from an Extreme Low to an Extreme High and back again -- we call this a Generational Cycle. We reached the Extreme Low on March 9, 2009. By our research, this Generational Bull Market has another 15 or so years to run. It will end when the common refrain is "This Time will be Different." Those key five words are not being uttered today. Four observations stand out from analyzing this data: 1) Even if you knew ahead of time that the year would be up, only 56% of the days are up. On the other side of the coin, if you knew ahead of time that the year would be down, 49% of the days would still be up. As much as we would like every day to be up, such is not the way of the real stock market. The so-called Equity Premium (the dividend yield) is the additional payment that equity investors receive for enduring the volatility. 2) Even in the last Bear Market (2000-2008), five of the nine years were up. 3) The difference between the big positive years and the big negative years is not so much the percentage of up days, but the ratio of the big positive days to the big negative days. (The distribution of the daily, monthly ... annual returns does not follow a bell-shaped curve -- a normal distribution; there are simply too many data points in the tails of the distributions.) 4) The financial press and the stock market television shows are loaded with pundits who make projections on the next week, month, quarter or six months. They always give their projections with a great deal of conviction. However, over the last thirty years, if one knew ahead of time if the year was going to be up or down and just sat out the negative years, his or her portfolio would have compounded at 14.8% versus 11.1% for a buy and hold portfolio. In dollar terms, an initial investment of $100,000 would have turned into $6.3 million versus the buy and hold portfolio of $2.4 million. Since a record of compounding at 14.8% for thirty years is as rare as a quadruple play in baseball, call us a "Doubting Thomas" when someone attempts to call the next week, month, or quarter. Inevitable down periods lie ahead, but the long-term stock market rests on the future growth of Knowledge/Productivity -- and Knowledge is compounding exponentially. Peace be with you and your portfolio, Skip Wells WellsAssetManagement.com April 7, 2014: S&P 1845