2015 October HM Treasury Consultation response Reforming the

advertisement

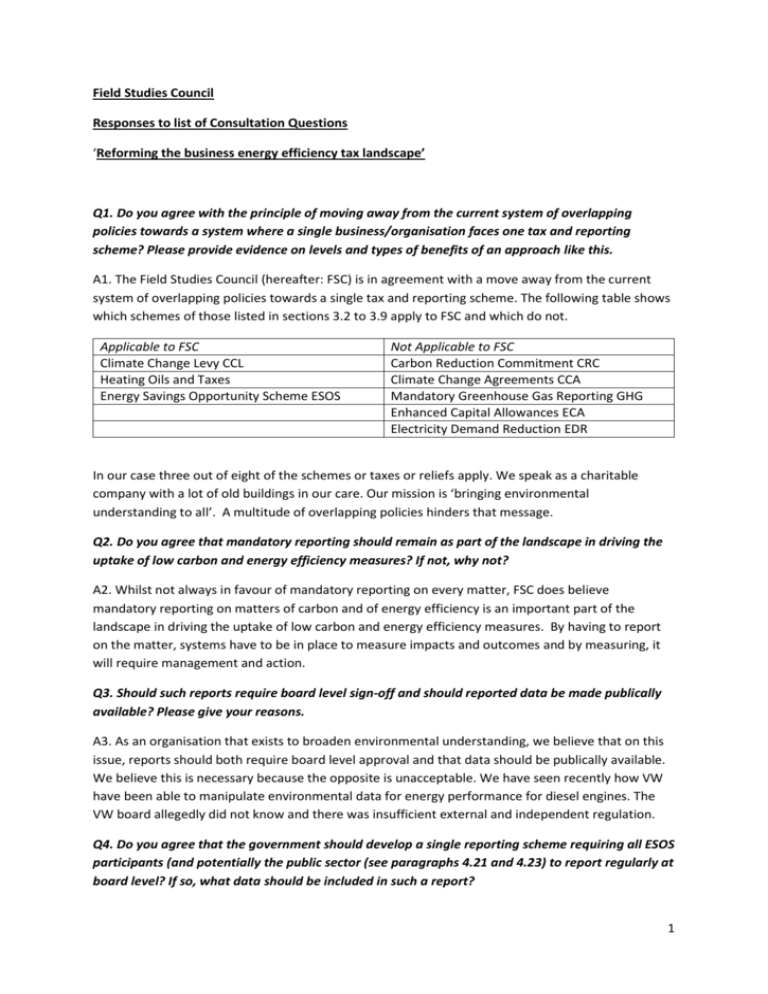

Field Studies Council Responses to list of Consultation Questions ‘Reforming the business energy efficiency tax landscape’ Q1. Do you agree with the principle of moving away from the current system of overlapping policies towards a system where a single business/organisation faces one tax and reporting scheme? Please provide evidence on levels and types of benefits of an approach like this. A1. The Field Studies Council (hereafter: FSC) is in agreement with a move away from the current system of overlapping policies towards a single tax and reporting scheme. The following table shows which schemes of those listed in sections 3.2 to 3.9 apply to FSC and which do not. Applicable to FSC Climate Change Levy CCL Heating Oils and Taxes Energy Savings Opportunity Scheme ESOS Not Applicable to FSC Carbon Reduction Commitment CRC Climate Change Agreements CCA Mandatory Greenhouse Gas Reporting GHG Enhanced Capital Allowances ECA Electricity Demand Reduction EDR In our case three out of eight of the schemes or taxes or reliefs apply. We speak as a charitable company with a lot of old buildings in our care. Our mission is ‘bringing environmental understanding to all’. A multitude of overlapping policies hinders that message. Q2. Do you agree that mandatory reporting should remain as part of the landscape in driving the uptake of low carbon and energy efficiency measures? If not, why not? A2. Whilst not always in favour of mandatory reporting on every matter, FSC does believe mandatory reporting on matters of carbon and of energy efficiency is an important part of the landscape in driving the uptake of low carbon and energy efficiency measures. By having to report on the matter, systems have to be in place to measure impacts and outcomes and by measuring, it will require management and action. Q3. Should such reports require board level sign-off and should reported data be made publically available? Please give your reasons. A3. As an organisation that exists to broaden environmental understanding, we believe that on this issue, reports should both require board level approval and that data should be publically available. We believe this is necessary because the opposite is unacceptable. We have seen recently how VW have been able to manipulate environmental data for energy performance for diesel engines. The VW board allegedly did not know and there was insufficient external and independent regulation. Q4. Do you agree that the government should develop a single reporting scheme requiring all ESOS participants (and potentially the public sector (see paragraphs 4.21 and 4.23) to report regularly at board level? If so, what data should be included in such a report? 1 A4. Our first impression of ESOS was not favourable and seen as a piece of EU bureaucracy. However once we understood that ESOS required reporting of total energy consumption and that we had the required data, we became very early adopters. We are still considering the future impact of ISO500014 but in our experience ESOS over-rode our initial plans for energy performance certificates. We would not object to the Government designing a single reporting mechanism for ESOS participants – and this should include the public sector. The data to be included should be simple but comprehensive – total energy consumption is not a bad indicator. Q5.The government recognises the importance of ensuring market actors have access to transparent, reliable and comparable information to support financing and investment in energy efficiency and low carbon measures. How best can a streamlined report achieve this? To what extent does your response apply to other companies (as defined in the Companies Act) that are not listed companies? A5. The key words here are transparent, reliable and comparable. We noted above in Q4 that we believed total energy consumption is the simplest but most comprehensive measurement. It is measureable and done so regularly. Every organisation uses energy – from the tiniest business to gigantic multi-national organisations and this makes no distinction between public and private sector. The test of any report: is it transparent? Is it reliable? Is it comparable? Q6. Do you agree that moving to a single tax would simplify the tax system for business? Should we abolish the CRC and move toward a new tax based on the CCL? Please give reasons. A6. Tax simplification is wonderful in theory but very difficult to implement in practice. Currently FSC is not involved with CRC. It only pays CCL incidentally as a charity. We would want to ensure that our energy tax burden was not unfairly and disproportionately increased as a result of any reform. Q7. How should a single tax be designed to improve its effectiveness in incentivising energy efficiency and carbon reduction? A7. Any tax should in theory be progressive, rather than regressive. The principle underlying it must be – does this reduce carbon footprint or does it not? Even simple taxes can be extremely complicated. If it reduces carbon footprint there should be an element of relief. If it increases carbon footprint there should be an element of taxation. Q8. Should all participants pay the same rates (before any incentives/reliefs are applied) or should the rates vary across different businesses? For example, do you think that smaller customers and at risk Energy Intensive Industries (EIIs) should pay lower rates? A8. As above, even simple taxes can be extremely complicated. In theory there should be one starting rate. In practice rates may vary across businesses. Why should a small retail business pay on the same level as an oil multinational? There may be an element of small business relief common across other taxes. What is the definition of an at-risk Energy Intensive Industry? Apply the Q7 test. Q9. Do we currently have the right balance between gas and electricity tax rates? What are the implications of rebalancing the tax ratio between electricity and gas? What is the right ratio between gas and electricity rates? 2 A9. Section 4.9 correctly identifies that CCL bears disproportionately on electricity rather than gas and that various bodies have noted that there might be more even de-carbonisation if that burden were to shift. In FSC’s experience, three-fifths of our energy usage and cost had been electricity, with the rest being mains gas, LPG and various heating oils. We knew that the way to de-carbon would be to replace all those electricity outlets with gas ones. We have not been able to as our sites are remote to mains gas. We have therefore sought other routes e.g. biomass/solar panels. The test is surely to reward investment in the more carbon friendly gas and not to reward investment in the less carbon friendly electricity. Q10. Do you believe that the CCA scheme (or any new scheme giving a discount on the CCL or any new tax based on the model of the CCL) eligibility should only focus on industries needing protection from competitive disadvantage? If so, how should government determine which sectors are in need of protection? A10. In purist economically liberal terms there should be no protection and the market should rule. The practical answer here ought to emphasise that relief or discount should be given with a good deal emphasis on the carbon performance rather than other economic factors. Energy intensive industries can always use less energy. Q11. Do you believe that the CCA scheme (or new scheme) eligibility should focus only on providing protection to those EIIs exposed to international competition and at risk of carbon leakage? If so, how should the government assess which sectors are at risk of carbon leakage? A11. As above even the most energy intensive industry can use less energy. If the government wishes to assess which sectors are at risk of carbon leakage, it should ensure carbon data is the main criteria. Q12. Do you believe that the targets set by the current CCA scheme are effective at incentivising energy efficiency? Do you believe that the current CCA scheme is at least as effective, or more effective, at incentivising energy efficiency than if participants paid the full current rates of CCL? How could CCAs be improved? Are there alternative mechanisms that may be more effective? A12. Section 4.14 outlines mixed views on the effectiveness of the current CCA system. FSC has no direct experience of CCA but sees them as negotiated reliefs with energy intensive industries. Negotiated reliefs can be distortive and it may be that by shielding those with CCA from the CCL, energy efficiency may not have been maximised. Q13. Do you agree that incentives could help drive additional investment in energy efficiency and carbon reduction? Please explain why you agree or disagree. A13. Again there is a difference between practical experience and theoretical ideals. In recent years we have seen a large industry grow in the provision of solar panels (Feed –In Tariffs) and biomass boilers (Renewable Heat Incentives). Both of these were admirable in seeking forms of alternative lower-carbon schemes. FSC has examples of both. However the finance began to drive behaviour and that was a distortion of what was originally intended. Incentives can be useful to kick-start but there has to be an adequate exit strategy. 3 Q14. What is the best mechanism to deliver incentives for investment in energy efficiency and carbon reduction (e.g. tax reliefs, supplier obligations, grants, funding based on competitive bidding)? Are different approaches needed for different types of business? If so, which approaches work for different business types? What approaches should be avoided? A14. The current system has shown a variety of approaches. It may be hard to generalise that different approaches are needed for different businesses. As noted above, the finance – be it relief, grant or funding – must not drive the underlying carbon behaviour. It should support it. Q15. What impact would moving to a single tax have on the public sector and charities? A15. As noted at the beginning FSC is not widely affected by CCL as it pays energy VAT at 5%. In any new single tax FSC would emphasise that carbon performance was as important as ownership structure. Both public sector and charities would want to ensure no additional tax burden unless a worsening carbon performance warranted it. Q16. How should the merged tax be designed to improve its effectiveness in driving energy and carbon savings from the public sector and charities? A16.The primary focus should be on carbon performance. If you become more energy efficient then there is relief and reward. If you become more carbon inefficient there is penalty. Ownership structure should make no significant difference. Q17. Should a reporting framework also require reporting by the public sector? A17.Yes. It should be applicable to private companies and charities and the public sector. Richard Walker Director of Finance Field Studies Council Preston Montford Shrewsbury SY4 1HW 4