Questionnaire for Tangible-Assets-Only Valuation

advertisement

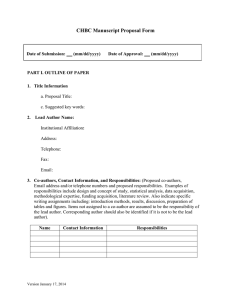

Professional Management & Marketing 3468 Piner Rd•Santa Rosa•CA•95401-3954 Ph 707-546-4433 • Fax 707-546-4437 Email: Appraiser@MedicalPracticeAppraisal.com Data Request for Tangible-Assets-only Valuation I suggest a valuation “as-of date” for which complete data is available (not too recent). For example, the end of the last year or last quarter or last month for which reports are complete. (If for litigation, ask your attorney for the “effective date”; such as “date of separation” or “date closest to trial”, or both.) 1. A list of the equipment, furniture, and major instrumentation, room by room. Use one of the forms at http://www.medicalpracticeappraisal.com/questionnaire if possible. Please provide purchase-data on any item estimated to be over $500 in value –if possible and not too much work– (purchase date and purchase price are often available on the tax return depreciation schedule). Do not list consumable supplies or non-electronic hand instruments unless of significant value (such as vaccines, antigens, Botox™, excess radiology supplies), or unless of greater than one month's supply and of significant value. I will assign a value of one-month's cost as current supplies value unless instructed otherwise. If there are more than $1,000 worth of non-electronic small surgical hand-instruments, please provide an estimated current “used” (ie “eBay”)value. 2. Last year’s tax return (Federal only), entire 1120 for incorporated practices, Schedule C, Form 4562, and attachments for unincorporated practices, Form 1065 for partnerships. 3. Prior year Financial Statements (P&L & Balance Sheet) from the computer, bookkeeper or CPA 4. A year-to-date (as of the valuation Effective Date) Financial Statement from the computer, bookkeeper or CPA 5. A completed Questionnaire for Practice Valuation (below) 6. If accounts receivable is to be valued, provide an aging report as of the valuation date (single page summary report w/o patient names, ie 30-60-90-120+) 7. A copy of the office lease if there are leasehold/tenant-paid improvements to be valued. 8. A copy of any instrumentation leases 9. A copy of any prior valuation reports Thank you for your assistance. Call or email me with any questions. Keith Borglum CBB, CHBC, appraiser Name, email & phone number of person I am to contact with any of my questions: Page 1 of 4 © www.MedicalPracticeAppraisal.com 1983-current v040815 Keith Borglum CHBC CBB Lic#s:CA-00767129 FL-BK3206346 Professional Management & Marketing 3468 Piner Rd•Santa Rosa•CA•95401-3954 Ph 707-546-4433 • Fax 707-546-4437 Email: Appraiser@MedicalPracticeAppraisal.com Questionnaire for Tangible-Assets-Only Valuation Please answer as of the effective date of the appraisal, which is to be (typically the end of the last month or quarter for which data is available, not the date on which you are completing this questionnaire or the date of site visit by the appraiser. If the appraisal is for a divorce, ask your attorney). Please write "no" or "n/a" (for not applicable) or "d/k" (for don't know) answers rather than leaving blanks. Blanks are interpreted as overlooked and may result in a follow-up call. You may use the back or this page or a separate page if needed to expand on answers. PLEASE PRINT LEGIBLY – DIGITAL COMPLETION PREFERRED 1) Legal name of practice: 2) The practice name if different from the legal name: 3) Owner(s’) names and % of ownerships. 4) Address(es) of practice: 5) Phone number of practice, website address: 6) Do you believe tenant improvements have significant value to be appraised? (Y /N) If so: Installation date? Cost? Were they at tenant or landlord expense? (Data may be on your Balance Sheet or Tax Return.) If the tenant improvements are older but “like new” or recently refurbished, and there are at least 5 years remaining on the lease (including contracted renewals available), you may wish to have a local building contractor provide a written opinion of current replacement value if you wish that value included. 7) What is the legal status of the business entity (sole proprietor, partnership, S Corp, C Corp, etc) 8) Is the practice a "going concern", meaning in normal day-to-day operation, and if not, why not? Page 2 of 4 © www.MedicalPracticeAppraisal.com 1983-current v040815 Keith Borglum CHBC CBB Lic#s:CA-00767129 FL-BK3206346 9) What is the specialty? 10) If AR is to be valued and sold, do any providers have claims against AR –and if so– please provide details (for example if an associate is paid as a % of collections, some of the collections already belong to the associate). Any accounts payable past-due or unpaid in dispute? 11) Any pre/post paid capitation, bonuses, risk pools or withholds outstanding to be valued? If so, send dollar amounts, accounting, contracts. 12) If you use EMR, do you own it, or is it rented? If owned, send version and EMR-company contact for current value and ability to transfer licenses. 13) Does the practice accept liens and –if so– what is the amount & age of liens outstanding? What is the historical collection ratio on liens-alone? 14) Will the buyer obtain the practice website? If so, provide a receipt for cost of creation, or an estimate. 15) Is any equipment or instrumentation owned by another entity controlled by the seller or seller's family and leased to the practice? If so, please describe. Page 3 of 4 © www.MedicalPracticeAppraisal.com 1983-current v040815 Keith Borglum CHBC CBB Lic#s:CA-00767129 FL-BK3206346 LIABILITIES 16) Are there any agreements restricting, limiting, or in any other way influencing the sale or right to sell, purchase, or encumber ownership transfer of any assets? If so, please provide copies of the agreements 17) Any loans owed –or secured by– any practice assets, that will not be paid off in transfer of ownership? 18) Any equipment leased, with any residual (buyout) value? (please list and provide copies of lease) 19) Do you do your own accounting and taxes instead of using a CPA? 20) Are there any other issues of any kind that you think might affect the value of the transferred assets? Please send completed Questionnaire to appraiser with the assembled data and documents. Please do not send any original documents (copies are preferred). Statement by Owner: The information furnished in this questionnaire and any documents provided are materially accurate and complete to the best of my knowledge. By my signature below I authorize my accountant and/or my attorney to answer your questions and furnish you with relevant documents. Signature Date Accountant name and phone number and/or email address: Attorney name and phone number and/or email address: Page 4 of 4 © www.MedicalPracticeAppraisal.com 1983-current v040815 Keith Borglum CHBC CBB Lic#s:CA-00767129 FL-BK3206346