LAB4_answers

advertisement

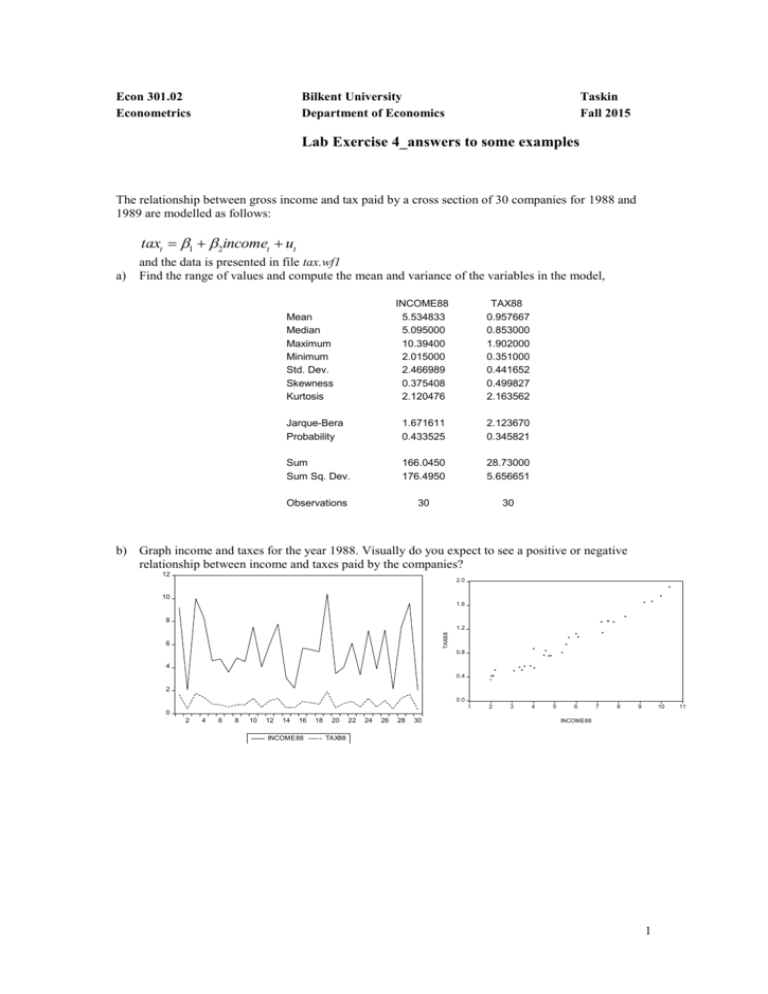

Econ 301.02 Econometrics Bilkent University Department of Economics Taskin Fall 2015 Lab Exercise 4_answers to some examples The relationship between gross income and tax paid by a cross section of 30 companies for 1988 and 1989 are modelled as follows: taxt 1 2incomet ut a) and the data is presented in file tax.wf1 Find the range of values and compute the mean and variance of the variables in the model, INCOME88 5.534833 5.095000 10.39400 2.015000 2.466989 0.375408 2.120476 TAX88 0.957667 0.853000 1.902000 0.351000 0.441652 0.499827 2.163562 Jarque-Bera Probability 1.671611 0.433525 2.123670 0.345821 Sum Sum Sq. Dev. 166.0450 176.4950 28.73000 5.656651 Observations 30 30 Mean Median Maximum Minimum Std. Dev. Skewness Kurtosis b) Graph income and taxes for the year 1988. Visually do you expect to see a positive or negative relationship between income and taxes paid by the companies? 12 2.0 10 1.6 8 TAX88 1.2 6 0.8 4 0.4 2 0.0 1 2 3 4 5 6 7 8 9 10 0 2 4 6 8 10 12 14 16 INCOME88 18 20 22 24 26 28 30 INCOME88 TAX88 1 11 c) Estimate the above tax function for the year 1988. Dependent Variable: TAX88 Method: Least Squares Date: 10/05/05 Time: 05:45 Sample: 1 30 Included observations: 30 Variable Coefficient Std. Error t-Statistic Prob. C INCOME88 -0.018003 0.176278 0.035678 0.005904 -0.504586 29.85734 0.6178 0.0000 R-squared Adjusted R-squared S.E. of regression Sum squared resid Log likelihood Durbin-Watson stat 0.969547 0.968460 0.078436 0.172260 34.83107 2.442251 Mean dependent var S.D. dependent var Akaike info criterion Schwarz criterion F-statistic Prob(F-statistic) 0.957667 0.441652 -5.026615 -4.933202 891.4607 0.000000 d) The fitted (estimated) tax relationship for 1988. Compute the fitted values of taxes. taˆxt ˆ1 ˆ2incomet taˆxt 0.018 0.176incomet e) The plot (graph) of the actual, fitted values of taxes for 30 companies and the residual values. Which company’s tax value is explained the best and which one’s tax values are explained the worst by the estimated equation? What are special for these observations? (What are the stylized facts?) f) The sum of squared residuals=0.172260 and R2=0.9695 of the regression 2 g) The estimated unbiased variance of the error term, ie. ˆ =(0.078436)2 h) The 95% confidence interval for the marginal tax rate , b̂ 2 . Pr éëb̂2 - ŝ b̂ .ta /2,d. f . £ b2 £ b̂2 + ŝ b̂ .ta /2,d. f . ùû =1- a 2 2 Pr0.176 (0.0059)(2.048) 2 0.176 (0.0059).(2.048) 1 0.05 Pr0.176 (0.01208) 2 0.176 (0.01208) 1 0.05 Pr0.1639 2 0.1881 0.95 i) Test the following hypothesis H o : 0.2 H A : 0.2 at the 5% significance level. The test statistic which has a student’s t distribution is t _ stat ˆ 2 2 ˆ ˆ 2 This test statistic will have the t _ stat ˆ2 0.2 0.176 0.2 4.065 value. ˆ ˆ 0.005904 2 If the null hypothesis is supported by the sample data then this test statistic ie. t-stat should conform to a t-distribution. This means that 2 Pr t / 2,d . f . t _ stat t / 2,d . f . 1 So we need to check whether this in fact is true. Is t-stat follows the below inequality; Pr2.048 t _ stat 2.048 0.95 The answer is NO, since it is not in the t_stat interval. Hence we can reject the null hypothesis j) Test the significance of the income variable. Ho : b = 0 HA : b ¹ 0 For this null hypothesis t stat ˆ2 0.176 29.857 . If this ˆ ˆ 0.005904 t-stat conform to the 2 below inequality then we can not reject the null hypothesis. Pr t / 2,d . f . t _ stat t / 2,d . f . 1 or Pr2.048 29.857 2.048 0.95 The interpretation is that is unlikely that the sample is drawn from a population with the Hence, Income is a statistically significant variable in explaining the tax values. b̂2 = 0.0 . (Note: Student’s t value for 0.025 significance level and 28 degrees of freedom (n-2) is equal to 2.048) 3