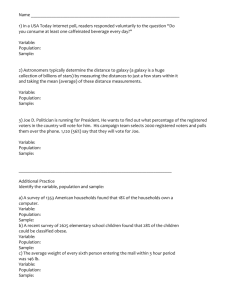

Senior Housing Market Demand & Business

Model Analysis & Report

Prepared For:

Quattro Road Development, LLC

1200 Quattro Road

Burlington, Texas 77799

(499) 555.1212

October 2010

October 2010/April 2011 Forecast Period

Prepared By:

Rainmaker Marketing Corporation, Inc.

15519 Dawnbrook Drive

Houston, Texas 77068-1919

(281) 537.1200

www.rainmakermarketing.com

©Copyright 2010, Rainmaker Marketing Corporation, Inc. All

rights reserved.

October 2010

1

5

6

7

8

9

10

11

12

13

14

15

16

Burlington, Texas Sub-Market Senior Housing Industry Report

OVERVIEW OF REPORT

T

2

he purpose of this memorandum (the

THIS IS A SENIOR HOUSING

3

“Report”) is to illustrate certain aspects of the

MARKET ANALYSIS REPORT

4

senior housing industry’s commercial real

COVERING

A

5-YEAR

estate development potential for a defined market

FORECAST PERIOD FOR NEW

surrounding a proposed project site located as shown

CONSTRUCTION

DEMAND

on the market area map on page 13 – the “Site”).

OWING TO INDEPENDENT,

The Report presents three (3) component market

ASSISTED AND DEMENTIA

analyses that are used for the purposes of

CARE HOUSING PROGRAMS.

determining the potential for entrenched demand for

the development of various classes of new senior

housing living commercial real estate properties that were calculated upon markets that were

geographically defined based upon non-peak travel distances, to wit:

Drive Time: 25 minutes (the “Inner Market Area”).

Drive Time: 30 minutes (the “Middle Market Area”).

Drive Time: 35 minutes (the “Outer Market Area”).

17

18

19

20

The market demographics analysis was prepared by Rainmaker Marketing Corporation, Inc.

(”RMC”), a senior housing development industry consulting firm that serves all of North America

and the Caribbean Basin. RMC’s findings presented in this Report are based upon a three-step

analysis process:

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

An initial analysis of key population demographic points for the purposes of demonstrating

anecdotal evidence of long-term market support based upon the growth patterns of certain

demographically-significant, senior/elderly-related datasets. The information was collected

for all three (3) of the assumed marketing area geographies and included population,

households, families, household counts based upon householder living status, household

and family incomes and measures of net worth and disposable incomes sufficient to

demonstrate the long-term market support potential for the various classes of senior

housing under consideration; then

A new construction demand model was created by RMC and populated with demographic

information (provided by third-party demographics vendors) based upon a screening

process that conforms to commercial construction financing underwriting industry

benchmarks and expectations, and include approval threshold measurements regarding the

statistical likelihood of a senior householder to require housing and related lifestyle and selfcare support within the context of an organized, large-scale commercial real estate-based

enterprise. This analysis is populated for a period of time that would be expected to

correspond to the entry and stabilization of a new property. RMC’s resulting demand model

spreadsheets provide qualified/limited net buildable demand computations for all classes of

living units for the entry-fee Independent Living Facility (“ILF”), rental ILF, rental Assisted

Living Care Facility (“ALCF”) and rental Alzheimer’s/Dementia Assisted Living Care Facility

Copyright 2010, Rainmaker Marketing Corporation, Inc. All rights reserved.

2

October 2010

Burlington, Texas Sub-Market Senior Housing Industry Report

1

2

3

4

5

6

7

(“ALZ/ALCF”) asset classes that include congregate living and multi-level care program

property designs. All demand model calculations are made, cet. par., for a for-profit

endeavor versus a not-for-profit venture; then

A final set of computations was created to provide price point guidelines based upon crossmatching senior households with their component net worth and disposable incomes in

order to project baseline sustainable rate information on a median facility basis for all four

(4) classes of senior housing analyzed in this Report.

8

9

10

The document also includes an appendix section that offers a listing of additional spreadsheets

that, for the purposes of brevity, were not included in the body of the Report and a glossary

section that provides a schedule of the terms and definitions used in the Report.

11

12

Exhibit 1: Pie Chart Presentation of Net Buildable Demand by Housing Class by Percentage of

Total Senior Housing By Assumed Marketing Area Geography

13

14

15

16

17

RMC finds there to be an expectation of entrenched demand supporting the near-term and

long-term development and operating forecast windows subject to the limiting conditions set

forth in this Report for each class of senior housing for 2010 (the most likely calendar year of

project entry) as follows:

18

19

20

21

Age-Restricted Multifamily Net Buildable Demand of 423 units for the Inner Market Area

PMA. This represents a market penetration rate of 10.00%, while the same unit count

represents a market penetration rate of 7.04% for the assumed Middle Market Area PMA

and a market penetration rate of 5.21% for the assumed Outer Market Area PMA.

Copyright 2010, Rainmaker Marketing Corporation, Inc. All rights reserved.

3

October 2010

Burlington, Texas Sub-Market Senior Housing Industry Report

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

Entry-Fee ILF Net Buildable Demand of 204 living units for the Inner Market Area PMA. This

represents a penetration rate of 10.00%, while the same unit count represents a

penetration rate of 7.52% for the Middle Market Area PMA and a penetration rate of 5.41%

for the Outer Market Area PMA.

Rental ILF Net Buildable Demand of 238 living units for the Inner Market Area PMA. This

represents a penetration rate of 10.00%, while the same unit count represents a

penetration rate of 7.54% for the Middle Market Area PMA and a penetration rate of 3.45%

for the Outer Market Area PMA.

Rental ALCF Net Buildable Demand of 83 living units for the Inner Market Area PMA. This

represents a penetration rate of 10.00%, while the same unit count represents a

penetration rate of 7.53% for the Middle Market Area PMA and a penetration rate of 5.66%

for the Outer Market Area PMA.

Rental ALZ/ALCF Net Buildable Demand of 48 living units for the Inner Market Area PMA.

This represents a penetration rate of 10.00%, while the same unit count represents a

penetration rate of 7.29% for the Middle Market Area PMA and a penetration rate of 5.37%

for the Outer Market Area PMA.

17

18

19

20

21

The results of the market demand analysis were also interpreted in terms of the expected

limitations that market conditions are likely to impose upon the costs of development and the

maximum expected lending and investment limits the market area may impose on any proposed

project based upon an analysis of the subject marketing area’s reported disposable income and

net worth. This analysis was undertaken for the following program types:

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

ILF Rental Housing Program. A total of xx units of rental program independent living facility

housing being assumed to be built out using the Inner Market Area demographics.

ALCF Rental Housing Program. A total of xx units of rental program assisted living care

facility housing being assumed to be built out using the Inner Market Area demographics.

ALZ/ALCF Rental Housing Program. A total of xx units/beds of rental program

dementia/Alzheimer’s being assumed to be built out using the Inner Market Area

demographics.

Rental CCRC Housing Program. Continuing Care Retirement Communities (CCRCs) offer

independent living facility accommodations in conjunction with assisted living and dementia

care. Prior to the changes in the Medicare system (i.e.: reimbursement being provided for

home health care services by a home health care provider), the typical CCRC included a

skilled nursing unit. Today, the final component of supportive care can be provided by the

home health agency so the prototypical rental program CCRC includes rental independent

living, rental assisted living and rental dementia/Alzheimer’s care assisted living housing.

Using the Inner Market Area demographics, this resulted in a maximum of xx housing units

being assumed to be built out in all (xx ILF units, XX ALCF units and xx ALZ/ALCF Units).

Rental Congregate Living Housing Program. Congregate living housing programs are those

programs that combine rental independent living facility accommodations with standard

rental assisted living housing program services. Using the Inner Market Area demographics,

Copyright 2010, Rainmaker Marketing Corporation, Inc. All rights reserved.

4

October 2010

1

2

3

4

Burlington, Texas Sub-Market Senior Housing Industry Report

this resulted in xx housing units being assumed to be built out in all (xx ILF units and xx ALCF

units).

Exhibit 2: Line Graph Presentation of Expected Maximum Sustainable Costs of Development

Per Living Unit by Program Type: Inner Market Area

5

6

7

8

9

10

11

12

13

The resulting analysis was undertaken based upon using a weighting approach that focuses on

market income and net worth demographics – the only true metric that demonstrates the

consumer’s buying power that would be expected to be expressed in terms of the housing

program the market can actually afford to support. This metric expresses the resulting limits in

terms of the expected Current Year Household Disposable Income and Current Year Household

Net Worth estimates for the Households Aged 75 and Older within the assumed Inner Market

PMA. This metric incorporates institutional underwriting benchmarks as the basis to “reverse

engineer” the result.

14

15

The Inner Market PMA geography demonstrates the following support levels for development

budgeting purposes:

16

17

18

19

The ILF program is expected to support an average of $188,784 per living unit development

cost.

The ALCF program is expected to support an average of $191,987 per living unit

development costs.

Copyright 2010, Rainmaker Marketing Corporation, Inc. All rights reserved.

5

October 2010

1

2

3

4

5

6

7

Burlington, Texas Sub-Market Senior Housing Industry Report

The ALZ/ALCF program is expected to support an average of $213,752 per living unit

development costs.

The rental CCRC program is expected to support an average of $193,816 per living unit

development costs.

The congregate living program is expected to support an average of $200,119 per living unit

development costs.

Exhibit 3: Project Development Budget Analysis by Program Type: Inner Market Area

8

9

10

11

12

13

Once the total development budget limitations (on a per living unit basis) were extrapolated

from the income and wealth data, the maximum amount of debt service was computed on the

basis of the estimated operating income the maximum facility development program profile

would be reasonably expected to support. As a result, Rainmaker estimates the following

limitations to apply to the development programs:

14

15

16

17

18

19

20

For the ILF development program (stand-alone basis) the program presents a maximum of

160 units being developed. This would result in a Total Development Cost (TDC) of

$30,205,468 and a supportable construction mortgage debt (current market conditions

assumed) of $25,372,593 for the project (or $158,579 per living unit).

For the ALCF development program (stand-alone basis) the program presents a maximum of

80 units being developed. This would result in a TDC of $15,358,936 and a supportable

construction mortgage debt of$12,594,327 for the project (or $157,429 per living unit).

Copyright 2010, Rainmaker Marketing Corporation, Inc. All rights reserved.

6

October 2010

Burlington, Texas Sub-Market Senior Housing Industry Report

1

2

3

4

5

6

7

8

9

10

For the ALZ/ALCF development program (stand-alone basis) the program presents a

maximum of 48 units/beds being developed. This would result in a TDC of $10,201,220 and

a supportable construction mortgage debt of$8,160,976 for the project (or $171,002 per

living unit/bed).

For the rental CCRC development program, the program presents a maximum of 288 units

being developed. This would result in a TDC of $55,765,624 and a supportable construction

mortgage debt of $46,127,896 for the project (or $162,805 per living unit).

For the congregate living facility development program, the program presents a maximum

of 128 units being developed. This would result in a TDC of $25,560,156 and a supportable

construction mortgage debt of$20,755,303 for the project (or $162,500 per living unit).

11

12

Exhibit 4: Bar Chart Comparison of Expected Financial Investment Leverage of Capital Account

Investments by Type of Long-Term Financing Vehicle

13

14

15

16

17

18

The final aspect of the attending development program costs analysis was to compare the

relative levels of financial investment leverage that would be theoretically available for each

class of stand-alone project assets that may be given due consideration by the project developer

using institutional underwriting benchmarks and Rainmaker Marketing Corporation’s

proprietary software modeling program. This produced the following results:

19

20

21

HUD/FHA Loan Insurance Programs. Using the Section 221(d)(4) and Section 232 Loan

Insurance Program underwriting and mortgage processing guidelines set forth under the

Multifamily Housing Processing Handbook (4610.1), the expected total financial leverage

Copyright 2010, Rainmaker Marketing Corporation, Inc. All rights reserved.

7

October 2010

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

Burlington, Texas Sub-Market Senior Housing Industry Report

(LTV) for the ILF program was estimated as 86.77%, while the ALCF and ALZ/ALCF Programs

were estimated at 84.66% and 86.77%, respectively.

Conventional Mortgage Program. Using institutional underwriting benchmarks and current

capital market terms and pricing as a guide, the expected total financial leverage (LTV) for

the ILF program was estimated as 67.28%, while the ALCF and ALZ/ALCF Programs were

estimated at 65.64% and 67.28%, respectively.

Sale/Leaseback Program. Using institutional underwriting benchmarks and current capital

market terms and pricing as a guide, the expected total financial leverage (LTV) for the ILF

program was estimated as 85.42%, while the ALCF and ALZ/ALCF Programs were estimated

at 83.33% and 85.42%, respectively.

Fractional Real Estate (TIC Plan) Financing Program. Using the Rainmaker Marketing

Corporation proTIC fractional real estate sales plan financing program terms and pricing as a

guide, the expected total financial leverage (LTV) for the ILF program was estimated as

96.92%, while the ALCF and ALZ/ALCF Programs were estimated at 96.64% and 95.00%,

respectively.

16

ABOUT THE REPORT

20

21

22

23

24

17

he Report is based upon a comparative analysis approach where identical analysis steps

18

are used for the demographic data developed for each of the assumed drive-time limited

19

areas. This creates the potential for a lot of reporting errors and confusion for the

reader. Accordingly, all spreadsheets and charts based upon the Inner Market Area have red

borders; all of the spreadsheets and charts based upon the Middle Market Area have green

borders; and, all of the spreadsheets and charts based upon the Outer Market Area have blue

borders. These elections conform to the computer’s projected geographical area coverage for

each of the drive-time based market areas used in this Report (see map on page 13).

25

26

27

28

29

30

31

32

The Report has been prepared by RMC using information and data that is deemed to be reliable

information in the case of each data vendor and/or informational story, listing, database or

other information repository that eventually provided information used in this Report. RMC

assumes no responsibility for reporting errors beyond the reasonable commercial control of

RMC. All assumptions as to the number of market residents that may in fact choose to occupy a

housing dwelling unit within the defined market areas over the course of the forecast period

require verification in the field, as RMC’s data is limited to searchable databases and reports

made to regulatory bodies that may bear upon the information analysis process.

33

34

35

All senior housing development programs should have a complete, full-scope market feasibility

analysis report prepared for the purposes of substantiating the client’s due diligence burden for

satisfying construction financing underwriters.

36

{REMAINDER OF PAGE INTENTIONALLY LEFT BLANK}

T

Copyright 2010, Rainmaker Marketing Corporation, Inc. All rights reserved.

8

October 2010

Burlington, Texas Sub-Market Senior Housing Industry Report

CONTENTS

Overview of Report .......................................................................................................................... 2

About the Report .............................................................................................................................. 8

Table of Exhibits ............................................................................................................................... 9

Report Preparation Means & Methods ..........................................................................................12

The Client, the Project & Project Site .............................................................................................12

The Macro Analysis.........................................................................................................................15

Populations, Households & Families Indicators ........................................................................ 17

Income & Wealth indicators ...................................................................................................... 23

Housing Stock ............................................................................................................................ 29

Site-Based Senior Housing New Construction Demand Analysis ...................................................32

Age-Restricted Rental Multifamily Housing New Construction Demand.................................. 32

Entry-Fee Independent Living Facility New Construction Demand........................................... 34

Rental Independent Living Facility New Construction Demand ................................................ 37

Rental Assisted Living Care Facility New Construction Demand ............................................... 39

Rental Alzheimer’s Assisted Living Care Facility New Construction Demand ........................... 42

Project Price Points.........................................................................................................................44

Conclusions of the Site-Based Senior Housing New Construction Demand Analysis ....................45

About Rainmaker Marketing Corporation......................................................................................48

Glossary of Terms ...........................................................................................................................49

Appendix Section ............................................................................................................................52

TABLE OF EXHIBITS

EXHIBIT 1: PIE CHART PRESENTATION OF NET BUILDABLE DEMAND BY HOUSING CLASS BY PERCENTAGE OF TOTAL SENIOR

HOUSING BY ASSUMED MARKETING AREA GEOGRAPHY..................................................................................... 3

EXHIBIT 2: LINE GRAPH PRESENTATION OF EXPECTED MAXIMUM SUSTAINABLE COSTS OF DEVELOPMENT PER LIVING UNIT BY

PROGRAM TYPE: INNER MARKET AREA ........................................................................................................... 5

EXHIBIT 3: PROJECT DEVELOPMENT BUDGET ANALYSIS BY PROGRAM TYPE: INNER MARKET AREA ...................................... 6

EXHIBIT 4: BAR CHART COMPARISON OF EXPECTED FINANCIAL INVESTMENT LEVERAGE OF CAPITAL ACCOUNT INVESTMENTS BY

TYPE OF LONG-TERM FINANCING VEHICLE ....................................................................................................... 7

EXHIBIT 5: PROJECT SITE MAP W/DRIVE-TIME MARKET BOUNDARIES SHOWN ............................................................. 13

EXHIBIT 6: COLUMNAR CHART DISTRIBUTION OF PROJECTED POPULATION BY YEAR BY MARKETING AREA GEOGRAPHY ........ 16

EXHIBIT 7: DISTRIBUTION OF TOTAL POPULATION BY AGE GROUP SPREADSHEET; INNER MARKET ..................................... 17

Copyright 2010, Rainmaker Marketing Corporation, Inc. All rights reserved.

9

October 2010

Burlington, Texas Sub-Market Senior Housing Industry Report

EXHIBIT 8: CHART PRESENTATION OF PROJECTED HOUSEHOLDS BY AGE GROUP BY REPORTING YEAR; INNER MARKET AREA . 18

EXHIBIT 9: BAR CHART PRESENTATION OF DISTRIBUTION OF CURRENT YEAR/5-YEAR HOUSEHOLDS BY AGE GROUP BY

EXPECTED ANNUAL GROWTH RATE .............................................................................................................. 20

EXHIBIT 10: DISTRIBUTIONS OF FAMILIES BY FAMILY INCOME BY REPORTING YEAR SPREADSHEET; INNER MARKET AREA ...... 22

EXHIBIT 11: DISTRIBUTION OF HOUSEHOLDS BY AGE BY INCOME SPREADSHEET; INNER MARKET AREA .............................. 23

EXHIBIT 12: 5-YEAR DISTRIBUTION OF HOUSEHOLDS BY AGE BY INCOME SPREADSHEET; INNER MARKET AREA ................... 24

EXHIBIT 13: DISTRIBUTION OF HOUSEHOLDS BY DISPOSABLE INCOME BY AGE SPREADSHEET; INNER MARKET AREA ............. 25

EXHIBIT 14: BAR CHART COMPARISON OF DISTRIBUTION OF MEDIAN HOUSEHOLD INCOME BY AGE GROUP; INNER MARKET

AREA VS. U.S. NATIONAL MARKET .............................................................................................................. 26

EXHIBIT 15: CURRENT YEAR HOUSEHOLD NET WORTH; INNER MARKET AREA .............................................................. 27

EXHIBIT 16: PIE CHART OF HOUSING OCCUPANCY BY OCCUPANT TYPE DISTRIBUTION; INNER MARKET AREA ..................... 28

EXHIBIT 17: HOUSING STOCK ANALYSIS BY PRICE BRACKET; INNER MARKET AREA ......................................................... 30

EXHIBIT 18: AGE-RESTRICTED RENTAL MULTIFAMILY DEMAND SPREADSHEET; INNER MARKET AREA ................................ 33

EXHIBIT 19: ENTRY-FEE ILF DEMAND ANALYSIS SPREADSHEET; INNER MARKET AREA .................................................... 36

EXHIBIT 20: RENTAL ILF DEMAND ANALYSIS SPREADSHEET; INNER MARKET AREA ........................................................ 38

EXHIBIT 21: RENTAL ALCF DEMAND ANALYSIS SPREADSHEET; INNER MARKET AREA ..................................................... 41

EXHIBIT 22: RENTAL ALZ/ALCF DEMAND ANALYSIS SPREADSHEET; INNER MARKET AREA.............................................. 43

EXHIBIT 23: BAR CHART OF DISTRIBUTION OF NEW CONSTRUCTION NET DEMAND BY CLASS OF SENIOR HOUSING .............. 46

EXHIBIT 24: CHART PRESENTATION OF EXPECTED MAXIMUM SUSTAINABLE FHA/HUD MORTGAGE PER LIVING UNIT BY

PROGRAM TYPE........................................................................................................................................ 53

EXHIBIT 25: SYNDICATION COSTS ANALYSIS SPREADSHEET – FRACTIONAL REAL ESTATE FINANCING PLAN .......................... 54

EXHIBIT 26: DISTRIBUTION OF TOTAL POPULATION BY REPORTING YEAR BY AGE SPREADSHEET; OUTER MARKET AREA ........ 55

EXHIBIT 27: DISTRIBUTION OF TOTAL POPULATION BY REPORTING YEAR BY AGE SPREADSHEET; MIDDLE MARKET AREA....... 56

EXHIBIT 28: DISTRIBUTION OF FAMILY HOUSEHOLDS BY REPORTING YEAR BY INCOME BRACKET SPREADSHEET; OUTER MARKET

AREA ...................................................................................................................................................... 57

EXHIBIT 29: DISTRIBUTION OF FAMILY HOUSEHOLDS BY REPORTING YEAR BY INCOME BRACKET SPREADSHEET; MIDDLE

MARKET AREA ......................................................................................................................................... 58

EXHIBIT 30: DISTRIBUTION OF HOUSEHOLDS BY AGE BY INCOME BRACKET (CURRENT YEAR) SPREADSHEET; OUTER MARKET

AREA ...................................................................................................................................................... 58

EXHIBIT 31: DISTRIBUTION OF HOUSEHOLDS BY AGE BY INCOME BRACKET (CURRENT YEAR) SPREADSHEET; MIDDLE MARKET

AREA ...................................................................................................................................................... 59

EXHIBIT 32: DISTRIBUTION OF HOUSEHOLDS BY AGE BY INCOME BRACKET (5-YEAR) SPREADSHEET; OUTER MARKET AREA... 59

EXHIBIT 33: DISTRIBUTION OF HOUSEHOLDS BY AGE BY INCOME BRACKET (5-YEAR) SPREADSHEET; MIDDLE MARKET AREA . 60

EXHIBIT 34: HOUSEHOLD NET WORTH (CURRENT YEAR) DISTRIBUTION SPREADSHEET; OUTER MARKET AREA ................... 61

EXHIBIT 35: HOUSEHOLD NET WORTH (CURRENT YEAR) DISTRIBUTION SPREADSHEET; MIDDLE MARKET AREA .................. 62

EXHIBIT 36: CURRENT YEAR DISTRIBUTION OF HOUSEHOLDS BY DISPOSABLE INCOME BRACKET BY AGE GROUP SPREADSHEET;

OUTER MARKET AREA ............................................................................................................................... 63

EXHIBIT 37: CURRENT YEAR DISTRIBUTION OF HOUSEHOLDS BY DISPOSABLE INCOME BRACKET BY AGE GROUP SPREADSHEET;

MIDDLE MARKET AREA.............................................................................................................................. 64

EXHIBIT 38: HOUSING BY OCCUPANT TYPE & HOUSING UNIT VALUE CLASS SPREADSHEET: OUTER MARKET AREA .............. 65

EXHIBIT 39: HOUSING BY OCCUPANT TYPE & HOUSING UNIT VALUE CLASS SPREADSHEET: MIDDLE MARKET AREA ............ 66

EXHIBIT 40: RENTAL AGE-RESTRICTED MULTIFAMILY DEMAND SPREADSHEET; OUTER MARKET AREA ............................... 67

EXHIBIT 41: RENTAL AGE-RESTRICTED MULTIFAMILY DEMAND SPREADSHEET; MIDDLE MARKET AREA ............................. 68

EXHIBIT 42: RENTAL ILF DEMAND ANALYSIS SPREADSHEET; OUTER MARKET AREA ....................................................... 69

EXHIBIT 43: RENTAL ILF DEMAND ANALYSIS SPREADSHEET; MIDDLE MARKET AREA ...................................................... 70

EXHIBIT 44: ENTRY-FEE ILF DEMAND ANALYSIS SPREADSHEET; OUTER MARKET AREA ................................................... 71

Copyright 2010, Rainmaker Marketing Corporation, Inc. All rights reserved.

10

October 2010

Burlington, Texas Sub-Market Senior Housing Industry Report

EXHIBIT 45: ENTRY-FEE ILF DEMAND ANALYSIS SPREADSHEET; MIDDLE MARKET AREA ................................................. 72

EXHIBIT 46: RENTAL ALCF DEMAND ANALYSIS SPREADSHEET; OUTER MARKET AREA .................................................... 73

EXHIBIT 47: RENTAL ALCF DEMAND ANALYSIS SPREADSHEET; MIDDLE MARKET AREA .................................................. 74

EXHIBIT 48: RENTAL ALZ/ALCF DEMAND ANALYSIS SPREADSHEET; OUTER MARKET AREA............................................. 75

EXHIBIT 49: RENTAL ALZ/ALCF DEMAND ANALYSIS SPREADSHEET; MIDDLE MARKET AREA ........................................... 76

Copyright 2010, Rainmaker Marketing Corporation, Inc. All rights reserved.

11

October 2010

1

REPORT PREPARATION MEANS & METHODS

T

2

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

Burlington, Texas Sub-Market Senior Housing Industry Report

2.

3.

4.

5.

he Report has been prepared based upon the following defined processes:

3

1.

Initial site analysis – the proposed project site is analyzed in terms of potential

4

traffic patterns and population density to determine the applicability of certain

5

assumptions pertaining to the primary marketing area geography; then

Collection of demographic information – the means of the Report analysis. RMC collected

various databases of demographic information for the purposes of this analysis and

presentation. These databases included population-based demographic information,

housing-based demographic information, microeconomic and macroeconomic information

and site mapping information. Some information was readily available on the Internet while

other databases required the payment of a fee in order to access the requested

information; then

Initial Macroeconomic Indicators Demographics Analysis. This technical analysis is for the

purposes of determining developing trends relative to various population groupings,

household groupings, family groupings, wealth and income groupings to determine the

potential for long-term market support based upon the supposition that a growing and

expanding market population will continue to support the construction of new senior

housing facilities of various classes within the given market area; then

Site-based senior housing new construction demand analysis – the primary marketing area

population demographics information is used to generate specific demand models for

forecasting the demand for senior housing new construction at the independent living,

assisted living and dementia assisted living care program levels.

RMC has no securities (equity, debt or hybrid) interest in Client and is acting as an

independent consultant to Client for the purposes of producing this Report. Likewise, RMC

owns no real property interest in the proposed Project or the Proposed Project Site, nor

does RMC own an option to purchase same on any terms not offered to the general public.

This is a fee-for-services market research report and opinion.

28

THE CLIENT, THE PROJECT & PROJECT SITE

32

33

34

35

29

his Report was ordered for the Quattro Road Developers, LLC (the “Client”) who is

30

engaged in the business of developing, capitalizing, constructing, marketing, operating

31

and otherwise promoting commercial real estate properties within the senior housing

industry. The Client has selected a parcel of real property located at 1200 Quattro Road,

Burlington, TX in (the “Site”) as the physical address where it is assumed that the proposed

senior housing project will be constructed, marketed and operated on a proprietary basis (the

“Project”).

T

Copyright 2010, Rainmaker Marketing Corporation, Inc. All rights reserved.

12

October 2010

1

Burlington, Texas Sub-Market Senior Housing Industry Report

Exhibit 5: Project Site Map w/Drive-Time Market Boundaries Shown

2

3

4

5

6

7

8

The goal of this Report is to describe certain demographic data analyses for the purposes of

demonstrating the potential near-term market demand for the various classes of senior housing

programs that are commonly (and successfully) developed on properties essentially similar

(demographically speaking) to that of the proposed Project Site; and in addition, present

anecdotal evidence as to the potential long-term market demand/support for senior housing

industry businesses in general.

9

10

11

12

13

14

15

For the purposes of this Report, the proposed Project Site is further defined in terms of the

projected geographical area within which the proposed Project would be expected to garner at

least 75% of its ongoing sales revenues – an area defined as the “geographical primary

marketing area” or “primary marketing area”. The primary marketing area for senior housing

properties is elastic, in that, as an area becomes increasingly populated, the primary marketing

area geography for that senior housing facility will contract to a certain extent. Generally, the

process of defining the primary marketing area of a senior housing property is based upon the

Copyright 2010, Rainmaker Marketing Corporation, Inc. All rights reserved.

13

October 2010

Burlington, Texas Sub-Market Senior Housing Industry Report

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

distance that can be traveled in an automobile during non-peak travel times. The more urban

areas have (prototypically) the smallest areas (with drive-time boundaries as small as 25

minutes, or even less as population density increases) while the prototypical urban project

would be expected to have a primary marketing area of 30 minutes and can be even greater in

certain circumstances based upon the relative saturation level of the surface highway system

within the market. Rural projects tend to have greatly expanded primary marketing areas with

expectations exceeding 45 minutes travel time for destination class properties and extreme

rural areas. The drive-time analysis is important in that it provides the opportunity to create

databases of demographic information based upon records that, more or less, mimic

consumer/end-user buying preferences leading to the hypothesis that the drive-time based

market geography projection system is a superior method versus the old donut and radii

demographic analysis approaches championed in the 1980s and early 1990s. For the purposes

of conducting an analysis that would be considered by reasonable third-party observers to be a

reasonable and conservative estimate of the market potential for new construction senior

housing projects, RMC projects/defines the primary marketing area of senior housing facilities in

accordance with the following schedules:

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

Urban Projects. For projects located in and around major urban areas, the following

assumptions shall be used:

Outer Drive-Time Boundary – represents the prototypical senior housing catchment

area and all spreadsheets for this level of market area are presented in the Appendix

Section (see page 52). This geographical market area is demarked with a blue border on

the site locator map and all spreadsheets and graphics at this level of geography have a

blue background and/or blue border bars based upon a drive-time marketing area

assumed to be limited to 35 minutes from the Site.

Middle Drive-Time Boundary – represents the prototypical senior housing catchment

area for a mature market area and/or a market area with slightly higher than typical

population density. All spreadsheets for this market area are presented in the Appendix

Section (see page 52). This assumed geographical market area is demarked with a green

border on the site locator map and all spreadsheets and graphics at this level of

geography have a green background and/or green border bars based upon a drive-time

marketing area assumed to be limited to 30 minutes from the Site.

Inner Drive-Time Boundary – represents the prototypical senior housing catchment area

for a mature market that is highly urbanized in character, presenting the highest

concentrations of resident populations and congested road net. All spreadsheets for

this market area are presented in the body of the Report because they represent the

most conservative market potential of the forecast. This assumed geographical market

area is demarked with a red border on the site locator map and all spreadsheets and

graphics at this level of geography have a red background and/or red border bars based

upon a drive-time marketing area assumed to be limited to 25 minutes from the Site.

Rural/Destination Area Projects. For projects located in lightly populated, rural areas,

the assumptions used shall be:

Copyright 2010, Rainmaker Marketing Corporation, Inc. All rights reserved.

14

October 2010

Burlington, Texas Sub-Market Senior Housing Industry Report

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

35-Minute Drive-Time Boundary – represents the prototypical senior housing

catchment area and all spreadsheets for this level of market area are presented

in the Appendix Section (see page

52). This geographical market area is

demarked with a blue border on the

The prototypical senior housing

site locator map and all spreadsheets

and graphics at this level of property has a geographical

geography have a blue background marketing area defined by the

expected

average

driving

and/or blue border bars.

40-Minute Drive-Time Boundary – distance (non-peak) a family

represents the prototypical senior would be likely to accept. This is

housing catchment area for a mature typically around 30 minutes

market area and/or a market area driving distance from the site to

with slightly higher than typical the family home for urban areas

population density. All spreadsheets

to as much as 60 minutes for

for this market area are presented in

rural/destination

area

the Appendix Section (see page 52).

properties.

This assumed geographical market

area is demarked with a green border on the site locator map and all

spreadsheets and graphics at this level of geography have a green background

and/or green border bars.

45-Minute Drive-Time Boundary – represents the prototypical senior housing

catchment area for a mature market that is highly urbanized in character,

presenting the highest concentrations of resident populations and congested

road net. All spreadsheets for this market area are presented in the body of the

Report because they represent the most conservative market potential of the

forecast. This assumed geographical market area is demarked with a red border

on the site locator map and all spreadsheets and graphics at this level of

geography have a red background and/or red border bars.

30

31

In the case of the proposed Project Site (the subject of this market analysis report – “Site 1” or

“Subject Site” identified in various spreadsheets) the urban area boundary sets will be used.

32

THE MACRO ANALYSIS

36

37

38

39

33

he typical full-scope senior housing market feasibility analysis attempts to reconcile

34

developer-driven project development plans with the expected population of seniors the

35

project’s marketing area is likely to serve. The resulting analysis is limited to a forecast

period of five (5) years – the near-term market window wherein a project would be expected to

be developed, constructed, marketed and operated to a point of reaching a self-sustaining (and

profitable) operating capacity. The long-term window market window is typically not given due

consideration due to the propensity for changing market populations that may be driven by a

T

Copyright 2010, Rainmaker Marketing Corporation, Inc. All rights reserved.

15

October 2010

Burlington, Texas Sub-Market Senior Housing Industry Report

1

2

variety of elements and issues that would be expected to skew populations in an unexpected

manner.

3

4

5

6

7

8

9

Historically, this has meant that market feasibility consultants have relied upon certain

macroeconomic measures to provide anecdotal evidence that would tend to either support or

repudiate the developer’s assumption that the market conditions will continue to provide

sufficient support for the project to warrant investment and development. These anecdotal

measures are important in that consumer choices/actions may be more limited in a given

market if the market population is contracting, the median household income is contracting or

household wealth is not sufficient to support the proposed development.

10

11

Exhibit 6: Columnar Chart Distribution of Projected Population by Year by Marketing Area

Geography

12

13

14

The resulting demographics analysis (the “Macro Analysis”) is set forth in the following subheadings and covers:

15

16

17

18

19

20

21

6. Population – Total Population and Population by Age Group.

7. Households – Total Households, Family Households, Non-Family Households, Households by

Age Group and Households by Income.

8. Families – Total Families, Total Families by Age Group and Families by Income.

9. Income & Wealth – Total Household Income, Per Capita Income, Median Household Income,

Disposable Income, Median Disposable Household Income, Total Net Worth, Net Worth by

Age and Median Net Worth.

Copyright 2010, Rainmaker Marketing Corporation, Inc. All rights reserved.

16

October 2010

Burlington, Texas Sub-Market Senior Housing Industry Report

1

2

10. Housing – Total Housing Units, Total Owner-Occupied Housing Units, Total Renter-Occupied

Housing Units, Median Housing Unit Values and Housing by Values.

3

Exhibit 7: Distribution of Total Population by Age Group Spreadsheet; Inner Market

4

5

9

10

P O P U L A T I ON S , H O U S E HO L D S & F A M I L I E S I N D I C A T O R S

T

6

he measurement of market populations, household counts and family counts provides

7

insight into both the current household demographics that would demonstrate the depth

8

of current demand that may exist for the benefit of the developer’s proposal, but these

measurements may also provide evidence as to the potential impact the next generation may

have on the long-term market prospects of the site.

Copyright 2010, Rainmaker Marketing Corporation, Inc. All rights reserved.

17

October 2010

1

2

Burlington, Texas Sub-Market Senior Housing Industry Report

Exhibit 8: Chart Presentation of Projected Households by Age Group by Reporting Year; Inner

Market Area

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

RMC’s analysis included the following elements:

11. Population. Changes in the total population of the area and changes in certain sub-groups

within the total population serve as bellwethers for the overall health of the local economy

that would be expected to support the development of the property. The most important

population age groupings that are important for the purposes of this Report are:

11.1.

Adult Children. The Total Population Aged 45-64 represents a secondary level of

market support that would not otherwise be reflected in a demand analysis based upon

picking the primary demographic profile of the prototypical consumer/end-user for

senior housing income-producing commercial real estate properties. This secondary

level of market support consists of two (2) components: participation in the placement

decision-making process (especially for demented elders or where the senior’s funding

resources are insufficient for living expenses); and, providing the demand for sustaining

long-term occupancy prospects of the proposed project as citizens in this Adult

Children age bracket continue to age in place. The Adult Children Population is further

delineated into the following sub-categories:

11.1.1. Populations Aged 45-49. The Current Year Population Age 45-49 is estimated at

71,363 for 2010, is expected to contract at the rate of (1,395)people per annum

over the forecast window to 64,386 people (an annual growth rate of -1.96% vs.

the 0.45% national rate) by the end of 2015 (note chart on previous page). This

Copyright 2010, Rainmaker Marketing Corporation, Inc. All rights reserved.

18

October 2010

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

Burlington, Texas Sub-Market Senior Housing Industry Report

population is part of a larger grouping known as the Adult Children cohort

grouping that serves to provide secondary resident market support within a given

geographical operating market area that includes Population Aged 45-64 (below).

11.1.2. Populations Aged 50-54. The Current Year Population Aged 50-54 is estimated

at 64,974 for 2010, is expected to

expand at the rate of 296 people per

annum over the forecast window to

66,454 people (an annual growth rate

TO THE EXTENT POPULATION

of 0.46% vs. the 2.00% annual national

GROWTH

OUTPACES

THE

growth rate for this age group) by the

NATIONAL

AVERAGES,

THIS

end of 2015.

HIGHER THAN AVERAGE GROWTH

11.1.3. Populations Aged 55-59.

The

RATE WOULD SUGGEST A STRONG

Current Year Population Aged 55-59 is

AND GROWING UNDERLYING

estimated at 54,530 for 2010, is

LOCAL MARKET ECONOMY THAT

expected to expand at the rate of

WOULD TEND TO SUPPORT

1,224 people per annum over the

ADDITIONAL INCOME-PRODUCING

forecast window to 60,652 people (an

REAL PROPERTY DEVELOPMENTS .

annual growth rate of 2.25% vs. the

3.50% annual national growth rate for

this age group) by the end of 2015.

11.1.4. Populations Aged 60-64. The Current Year Population Aged 60-64 is estimated

at 44,200 for 2010, is expected to expand at the rate of 1,193 people per annum

over the forecast window to 50,164 people (an annual growth rate of 2.70% vs.

the 4.48% annual national growth rate for this age group) by the end of 2015.

11.2.

Seniors. The Total Population Aged 65 and Older represents the primary pool of

prospects that would be expected to populate the proposed senior housing project

over the near-term forecast window. The Total Population Aged 65 and Older is further

delineated into the following sub-categories:

11.2.1. Populations Aged 65-69. The Total Population Aged 65-69 is part of the

“Youngest-Old” (Total Population Aged 65 to 74) cohort grouping having a Current

Year Population Aged 65-69 estimated at 31,025 people for 2010, is expected to

expand at a rate of 1,992 people per annum over the forecast window to 40,984

people (an annual growth rate of 6.42% vs. the 4.27% annual national growth rate

for this population grouping) by the end of 2015.

11.2.2. Populations Aged 70-74. The Total Population Aged 70-74 is part of the

Youngest-Old cohort grouping having an estimated 23,207 people for 2010, is

expected to expand at a rate of 1,009 people per annum over the forecast window

to 28,251 people (an annual growth rate of 4.35% vs. the 2.04% annual national

growth rate for this age group) by the end of 2015.

11.2.3. Populations Aged 75+. The Total Population Aged 65-69 is part of the “OldestOld” (Total Population Aged 75+) cohort grouping having a Current Year

Copyright 2010, Rainmaker Marketing Corporation, Inc. All rights reserved.

19

October 2010

Burlington, Texas Sub-Market Senior Housing Industry Report

1

2

3

4

Population Aged 75+ estimated at 19,074 people for 2010, is expected to expand

at a rate of 247 people per annum over the forecast window to 20,063 people (an

annual growth rate of 0.50% vs. the 1.42% annual national growth rate) by the end

of 2015.

5

6

7

8

RMC’s conclusion pertaining to the population sub-sets for the primary marketing area is that

these populations are consistent with those populations in other markets wherein there was

consistent entrenched demand for senior housing of a nature that supported new construction

over the long-term market window.

9

10

Exhibit 9: Bar Chart Presentation of Distribution of Current Year/5-Year Households by Age

Group by Expected Annual Growth Rate

11

12

13

14

15

16

17

18

19

20

21

22

11.3.

Households. The population residing within the primary marketing area is

enclosed within the “Households” demographic grouping. Households are delineated

into “Family Households” (households where the residents are related by blood or

marriage) and “Non-Family Households” (households where the residents are not

related by blood or marriage). Changes in the number of households within a given

market area demonstrate potential for future demand based upon the theory that a

growing market population will also increase its household wealth and income at

approximately the same rate and this often the case. Of particular interest will be the

households where the householder is age 45 or older as these households (up to age

65) represent the secondary market pool of future residents. Households where the

householder is a senior aged 65 or older are the primary pool of near-term resident

Copyright 2010, Rainmaker Marketing Corporation, Inc. All rights reserved.

20

October 2010

Burlington, Texas Sub-Market Senior Housing Industry Report

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

prospects. The following household age group counts (Inner Market Area PMA) were

presented for analysis:

11.3.1. Households Aged 45-54. There were

75,499 Current Year (2010) estimated

GROWTH

OF

Households Aged 45-54 in the primary THE

marketing area.

This category of HOUSEHOLDS - AND TO A

Households is expected to contract at a rate LESSER EXTENT, FAMILIES –

ADDITIONAL

of -0.92% per annum (vs. the 0.96% per PROVIDES

annum national growth rate for this cohort ANECDOTAL EVIDENCE AS TO

grouping) totaling some (696)households THE HEALTH AND PROSPECTS

per annum over the next five (5) years to OF THE PROPOSED NEW

72,020 Total Households Aged 45-54 at the CONSTRUCTION BASED UPON

THE UNDERLYING ECONOMIC

end of 2015 (note chart exhibit below).

11.3.2. Households Aged 55-64. There were CONDITIONS OF THE MARKET.

33

34

35

36

RMC’s conclusion pertaining to the household population sub-sets for the primary

marketing area is that these sub-sets are consistent with those sub-sets of other senior

housing project development programs that found the resulting market niche to be

sustainable in the near-term and long-term market windows.

55,296 Current Year (2010) estimated

Households Aged 55-64 in the primary marketing area. This category of

Households is expected to expand at a rate of 2.23% per annum (vs. the 3.64% per

annum national growth rate for this cohort grouping) totaling some 1,234

households per annum over the next five (5) years to 61,466 Total Households

Aged 55-64 at the end of 2015.

11.3.3. Households Aged 65-74. There were 31,885 Current Year (2010) estimated

Households Aged 65-74 in the primary marketing area. This category of

Households is expected to expand at a rate of 5.31% per annum (vs. the 3.01% per

annum national growth rate for this cohort grouping) totaling some 1,693

households per annum over the next five (5) years to 40,349 Total Households

Aged 65-74 at the end of 2015.

11.3.4. Households Aged 75+. There were 28,156 Current Year (2010) estimated

Households Aged 75+ in the primary marketing area. This category of Households

is expected to expand at a rate of 0.25% per annum (vs. the 1.36% per annum

national growth rate for this cohort grouping) totaling some 69 households per

annum over the next five (5) years to 28,502 Total Households Aged 75+ at the

end of 2015.

Copyright 2010, Rainmaker Marketing Corporation, Inc. All rights reserved.

21

October 2010

1

2

Burlington, Texas Sub-Market Senior Housing Industry Report

Exhibit 10: Distributions of Families by Family Income by Reporting Year Spreadsheet; Inner

Market Area

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

11.4.

Families. Families typically account for the majority of households. The growth

of families within a given geographical marketing area provides anecdotal evidence of

market support based upon the maturation of the underlying workers’ productivity and

earnings potential that, in the United States, are intrinsic to the creation of family

wealth. A comparatively strong earnings growth potential for a given market will

inevitably impact area senior housing properties because senior housing is a privatepay market. This leads to the discussion of family incomes and wealth:

11.4.1. Out of the 356,638 in Total Households, there are 226,138 Family Households

estimated for the Current Year (2010). The Family Households are expected to

grow by 1,494 families per annum to a total of 233,606 Family Households over

the forecast period. This represents an annual growth rate of 0.66% versus the

1.07% annual national growth rate for all U.S. Families for the same period.

11.4.2. The Current Year Median Family Income is estimated at $57,696 versus the

Current Year Median Family Income for the entire U.S. market of $63,907. The

local market Median Family Income is expected to expand over the next five years

to $63,858 (a growth rate of 2.14% per annum vs. the national growth rate of

3.53% to an expected U.S. Median Family Income of $75,173 for 2015).

21

22

RMC’s conclusion pertaining to the analysis of certain sub-sets of family households for the

primary marketing area is that these sub-sets are consistent with those sub-sets pertaining

Copyright 2010, Rainmaker Marketing Corporation, Inc. All rights reserved.

22

October 2010

Burlington, Texas Sub-Market Senior Housing Industry Report

1

2

to other senior housing project development programs that found the resulting market

niche to be sustainable in the near-term and long-term market windows.

3

I N C O M E & W E AL T H I N DI C AT O R S

T

7

8

4

he distribution of household income, disposable household income and net worth for

5

Households Aged 45+ is of critical importance in the determination of both near-term

6

new construction demand as well as long-term new construction demand for all classes

of senior housing living units, including independent living, assisted living and dementia assisted

living care programs and projects.

9

10

11

12

Household Income is recorded based upon the surveyed findings of the Year 2000 decennial

census, the Current Year (2010) estimated distribution of household incomes by age group and

the projected 5-Year forecasted distribution of household income (net worth and disposable

incomes can only be measured on a Current Year basis).

13

Exhibit 11: Distribution of Households by Age by Income Spreadsheet; Inner Market Area

14

15

16

17

18

19

20

21

22

23

24

Of particular interest are the household incomes measured for the age groups that are at least

$75,000 because Households Aged 75+ would theoretically require a Current Year Household

Income of at least $75,000 in order to offset the costs of living at a senior housing facility at the

independent living facility program level because; seniors are expected to utilize up to 70% of

their household income to pay for housing and lifestyle management activities. On this basis,

the $75,000 household income minimum represents support for up to $3,000 per month in ILF

program fees – a demographic touchstone that RMC would expect to be supported in most

North American markets. In terms of the overall strength of the underlying Age 75+

demographic, the Average Household Income is the first level of support that is reviewed, to

wit:

Copyright 2010, Rainmaker Marketing Corporation, Inc. All rights reserved.

23

October 2010

Burlington, Texas Sub-Market Senior Housing Industry Report

1

2

3

4

5

12. Households Aged 75-79: The Current Year Average Household Income for this cohort was

recorded as $48,448 for the Inner Market Area, suggesting up to $2,826 per household, per

month of senior housing “buying power” is being demonstrated for this cohort grouping. In

all, there are 2,179 households of this age grouping having Current Year Household Incomes

of $75,000 or more.

6

7

Exhibit 12: 5-Year Distribution of Households by Age by Income Spreadsheet; Inner Market

Area

8

9

10

11

12

13

14

15

16

17

18

13. Households Aged 80-84: The Current Year Average Household Income for this cohort was

recorded as $43,388, suggesting up to $2,531 per household, per month of senior housing

buying power is being demonstrated for this cohort grouping. In all, there are 1,334

households of this age grouping having Current Year Household Incomes of $75,000 or

more.

14. Households Aged 85+: The Current Year Average Household Income for this cohort was

recorded as $43,587, suggesting up to $2,543 per household, per month of senior housing

buying power is being demonstrated for this cohort grouping. In all, there are 1,340

households of this age grouping having Current Year Household Incomes of $75,000 or

more.

19

20

21

22

23

24

25

The next level of analysis focuses on the “true buying power income” of the Senior Households

and Adult Children Households; the Current Year Household Disposable Income. Disposable

household income measures the given household’s (or grouping of households’, as the case may

be) after tax buying power – the only real income the household would have available to offset

the living expenses associated with residency in a group quarters senior housing facility (ILF,

ALCF, ALZ/ALCF, etc.). Disposable income is only measured on a Current Year basis because the

future impact of taxation policies are not known until the total household income is also known.

Copyright 2010, Rainmaker Marketing Corporation, Inc. All rights reserved.

24

October 2010

1

2

Burlington, Texas Sub-Market Senior Housing Industry Report

Exhibit 13: Distribution of Households by Disposable Income by Age Spreadsheet; Inner

Market Area

3

4

5

6

The disposable income analysis is stratified for both the near-term primary user profile cohort

(i.e.: Households by Age Group 65+) and the long-term primary user cohort and secondary

payment source profile cohort (i.e.: Adult Children Households by Age 45-64), to wit:

7

8

9

10

11

12

13

14

15

16

17

18

19

15. Median Household Disposable Income/Households Aged 45-54: was measured as $50,121

for a total of 75,499 households, while the number of households having disposable

incomes of at least $100,000 per annum for this age group was recorded as 10,193

households and the number of households for this age group having disposable incomes of

at least $150,000 per annum was record as 3,476 households.

16. Median Household Disposable Income/Households Aged 55-64: was measured as $44,874

for a total of 55,296 households, while the number of households having disposable

incomes of at least $100,000 per annum for this age group was recorded as 6,985

households and the number of households for this age group having disposable incomes of

at least $150,000 per annum was record as 2,462 households.

17. Median Household Disposable Income/Households Aged 65-74: was measured as $33,901

for a total of 31,885 households for this age group. The total number of households with

disposable incomes of at least $50,000 per annum recorded as 10,545 households, while the

Copyright 2010, Rainmaker Marketing Corporation, Inc. All rights reserved.

25

October 2010

Burlington, Texas Sub-Market Senior Housing Industry Report

1

2

3

4

5

6

7

total number of households for this age group with disposable incomes of at least $75,000

per annum was recorded as 4,724 households.

18. Median Household Disposable Income/Households Aged 75+: was measured as $26,938 for

a total of 28,156 households for this age group. The total number of households with

disposable incomes of at least $50,000 per annum recorded as 7,148 households, while the

total number of households for this age group with disposable incomes of at least $75,000

per annum was recorded as 3,125 households.

8

9

Exhibit 14: Bar Chart Comparison of Distribution of Median Household Income by Age Group;

Inner Market Area vs. U.S. National Market

10

11

12

13

14

15

16

17

18

19

20

21

The final measure of household wealth is the estimated Current Year Net Worth. Net worth

measurements provide anecdotal evidence as to the depth of support a given geographical

marketing area may in fact be able to provide with respect to the calculation of entry-fee price

points for entry-fee CCRCs and entry-fee lifestyle amenity property development programs.

Historically, the youngest-old have been willing to (on average) liquidate up to half of their net

worth for the purposes of paying the required entry fee at a senior community, while the oldestold senior households have been willing to liquidate nearly all of their estates to pay for both

residency and health care services. By the same token, Adult Children Households have been

willing to provide a much smaller percentage of their household wealth for the purposes of

providing payment for an elder’s entry fee requirement in order to have the family member

migrate to the Adult Child’s area and take up residency.

Copyright 2010, Rainmaker Marketing Corporation, Inc. All rights reserved.

26

October 2010

1

Burlington, Texas Sub-Market Senior Housing Industry Report

Exhibit 15: Current Year Household Net Worth; Inner Market Area

2

3

4

5

6

There were 356,638 households in the Inner Market Area surveyed and the Median Household

Net Worth for these householders was estimated at $47,825 for the Current Year.

Approximately 76,871 of these households had a net worth of at least $250,000, while 44,048

households had a net worth estimated to be at least $500,000.

7

8

9

Net worth measurements for Adult Children Households, Senior Households and their

associated impact in terms of demonstrating additional anecdotal evidence of support for new

living unit construction were as follows:

10

11

12

13

14

15

16

17

18

19

20

19. Households Aged 45-54/Current Year Net Worth: the “youngest” Adult Children Households

recorded a Median Household Net Worth of $78,660 for 75,499 total households for the age

group, suggesting the top 50% - some 37,750 households having at least $78,660 in net

worth available to help offset senior housing care costs for a senior family member.

Approximately 19,208 households for this age group have a net worth in excess of $250,000.

Historically, the youngest Adult Children Households have sharply limited the availability of

net worth for payment of entry-fees, meaning there would be an empirical

assumption/expectation of no more than ten percent (10%) of the total household’s net

worth that would be made available for the payment of an entry-fee for a senior family

member. Using the Median Household Net Worth as a baseline, this would suggest that a

minimum of $7,866 would be available and added to the baseline entry-fee computation

Copyright 2010, Rainmaker Marketing Corporation, Inc. All rights reserved.

27

October 2010

Burlington, Texas Sub-Market Senior Housing Industry Report

1

2

pertaining to senior households based upon a basket of the top 50% of the youngest Adult

Children Households.

3

Exhibit 16: Pie Chart of Housing Occupancy by Occupant Type Distribution; Inner Market Area

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

20. Households Aged 55-64/Current Year Net Worth: the “oldest” Adult Children Households

recorded a Median Household Net Worth of $139,826 for a total of 55,296 households for

the age group, suggesting the top 50% - some 27,648 households having at least $139,826 in

net worth available to help offset senior housing care costs for a senior family member.

Approximately 19,605 households for this age group have a net worth in excess of $250,000.

Historically, Adult Children Households have limited the availability of net worth for

payment of entry-fees, meaning there would be an expectation of no more than twenty

percent (20.00%) of the total household’s net worth that would be made available for the

payment of care and housing costs of a senior family member. Using the Median Household

Net Worth as a baseline, this would suggest that approximately $27,965 would be available

and added to the baseline entry-fee computation pertaining to senior households based

upon a basket of the top 50% of the oldest Adult Children Households. In all, Adult Children

Net Worth measurements demonstrate a total of $35,831 per unit in additional entry-fee

pricing support for the entry-fee CCRC market segment – or an imputed $4,299,744 in

potential capital financing being present for said entry-fee CCRC project capital financing

structure.

Copyright 2010, Rainmaker Marketing Corporation, Inc. All rights reserved.

28

October 2010

1

Burlington, Texas Sub-Market Senior Housing Industry Report

H OUSI N G ST OC K

A

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

2

cursory examination of the housing stock

3

(both single-family housing and multifamily

4

housing stocks) was undertaken in order to

THE MARKET DIVIDES HOUSING

provide a basis for determining the potential price

OCCUPANCY

INTO

OWNERpoints for entry-fee independent living facility new

OCCUPIED, RENTER-OCCUPIED AND

construction programs. Historically, entry fees were

VACANT

HOUSING

UNITS.

calibrated solely based upon the developer’s capital

GENERALLY

SPEAKING,

ANY

finance plan requirements and project development

VACANCY RATE OF LESS THAN 10%

IS CONSIDERED EVIDENCE OF

yield requirements. This approach worked as long as

ENTRENCHED DEMAND FOR NEW

there were large-scale in-fill property development

HOUSING CONSTRUCTION THAT

opportunities available to the developer where there

WOULD INCLUDE SENIOR HOUSING

was significant entrenched demand for the

LIVING UNITS CONSTRUCTION.

development of new senior housing stocks that

would support entry fees in the $500,000+ class,

allowing senior housing developers to go for the “cream of the market”. By the end of the mid‘90’s this practice had largely come to an end as more and more publicly-traded senior housing

companies developed more and more senior housing throughout North America – to a point

where it was no longer advisable or practical to use arbitrary entry-fee pricing for CCRCs and

other entry-fee communities. The practice of developing high-end CCRC properties is now

limited to a decreasing base of destination-class locations and properties.

22

23

The first area of inspection of the housing stock will be the occupancy rates and it will be

followed by a housing price matrix analysis.

24

25

The estimated market occupancy for the proposed Project Site is divided into three (3) basic

classes (note chart exhibit on previous page):

26

27

28

29

30

31

Owner Occupied – a total annual average of 47.0% of dwellings (some 200,164 housing

units: Inner Market Area) are expected to be occupied by their owners of record.

Renter Occupied – a total annual average of 36.7% of dwellings (some 156,474 housing

units) are expected to be occupied by renters.

Vacant Units – a total annual average of 16.3% of dwellings (some 69,453 housing units)

are expected to be vacant this year.

32

33

34

35

36

37

38

39

This analysis is based upon a housing development forecast that estimates there are 426,091

units of housing in the housing inventory for the Current Year (Inner Market Area). This stock is

expected to increase at a rate of 1.63% per annum (some 6,947 new housing units each year) to

460,826 total housing units by the end of 2015. These gains in housing units suggest a total

penetration rate of 3.45% being required in any one (1) 12-month period in order to fill the

prototypical 240-unit ILF program to full capacity. The current market occupancy of 83.7% is

expected to fall somewhat to 80.9% over the near-term forecast period. Tightening market

occupancies provide further anecdotal evidence support as to the demand for housing (in

Copyright 2010, Rainmaker Marketing Corporation, Inc. All rights reserved.

29

October 2010

Burlington, Texas Sub-Market Senior Housing Industry Report

1

2

general) within a given marketing area, while falling occupancy trends reflect a market that

would not be expected to show support for new housing construction demand.

3

Exhibit 17: Housing Stock Analysis by Price Bracket; Inner Market Area

4

5

6

7

8

9

RMC uses a demand model that bases the entry-fee price range based upon the following

factors:

Measurements of Senior Household Income.

Measurements of Senior Household Net Worth.

Measurements of Market Pricing for Housing Stock.

Copyright 2010, Rainmaker Marketing Corporation, Inc. All rights reserved.

30

October 2010

Burlington, Texas Sub-Market Senior Housing Industry Report

1

2

3

4

5

6

7

8

9

Senior household income and net worth measurements are discussed above (see page 23). The

distribution of household net worth is important to the calculation of potential entry-fee price

points because a senior household typically liquidates their household net worth in order to pay

for their end of life care and housing needs (such as is commonly found in senior housing

properties). This means that consideration has to be given to both the entry-fee payment and

the ongoing monthly basic services rental fees and additional services fees the senior consumer

would be expected to be able to pay. This leads to certain empirical assumptions that must be

made based upon the practical experience of the senior housing industry being applied to the

various classes of senior housing, to wit:

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

Entry-fee ILFs – a senior resident can be expected to use up to 70% of their disposable

household income to pay for room, board, utilities and lifestyle management requirements

(i.e.: IADL support with transportation services added) that are in addition to the payment of

the entry-fee. Furthermore; the nature of the contract between the property and the

resident has to be given consideration with respect to the use of the entry-fee (as prepaid

rent, as to its potential for being refunded to the senior and as to whether or not a portion

will be applied to the future care requirements of the senior ala’ life care).

Rental ILFs – a senior resident can be expected to expend up to 75% of their disposable

household income to pay for room, board, utilities and lifestyle management requirements

as would be offered at the prototypical independent living property in the market today.

Rental ALCFs – a senior resident can be expected to expend up to 80% of their disposable

household income to pay for room, board, utilities, lifestyle management requirements and

self-care requirements as would be offered at the prototypical assisted living facility

property in the market today.

Rental ALZ/ALCFs – a senior resident can be expected to expend up to 90% of their

disposable household income to pay for room, board, utilities, lifestyle management

requirements, supervision and self-care requirements as would be offered at the

prototypical secured dementia care assisted living property in the market today.

28

29

30

31

32

33

The entry-fee must be computed based upon assumptions as to the consumer market’s

responsiveness to the offered housing. This means the property has to have a readily