10 Mock Exam Mark Scheme (SL)

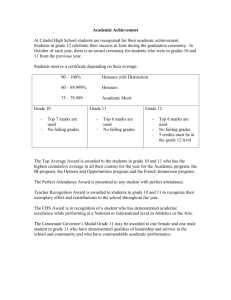

advertisement

BUSINESS AND MANAGEMENT – PAPER 1 CASE STUDY PACK STANDARD LEVEL MOCK EXAM – MARK SCHEME PAPER 1 CASE STUDY: ROYAL DANISH BEARINGS (RDB) For use in May and November 2013 TEACHERS’ NOTES These are suggested answers only Teachers should use their professional judgment in awarding answers that may not be included in this mark scheme Author: Paul Hoang © Tutor2u 2013 www.tutor2u.net SECTION A 1. (a) Define the following terms: (i) workforce planning (line 99). [2 marks] Workforce planning is the continual human resource planning process of aligning the needs and priorities of an organization with those of its workforce. It involves an examination of the current size and skills of the workforce with the organization’s future human resource needs. For RDB, this helps to ensure they get the right number of workers with the right skills and experiences at the right time Award [1 mark] for a basic definition that conveys partial knowledge and understanding of workforce planning. Award [2 marks] for a full, clear definition that conveys knowledge and understanding similar to the answer above. For only a relevant example or application to the RDB case study award [1 mark]. (ii) retrenchment (line 133). [2 marks] Also known as redundancy, retrenchment occurs when workers are legally dismissed because their job no longer exists, perhaps because of a restructuring of a company’s workforce to suit its revised operational objectives. Retrenchment would be inevitable if Anna Holstein sells the two RDB megafactories in northern Germany and Sweden. Award [1 mark] for a basic definition that conveys partial knowledge and understanding of retrenchment. Award [2 marks] for a full, clear definition that conveys knowledge and understanding similar to the answer above. For only a relevant example or application to the case study award [1 mark]. (b) With reference to RDB, distinguish between operational objectives (line 152) and strategic objectives. [4 marks] An operational objective (or tactical objective) is a short-term goal that is in line with the organization’s overall long-term targets. Typically, operational objectives have a time frame of less than a year. In the case of RDB, a key operational objective is to make the marketing department less ‘sleepy’. By contrast, a strategic objective is a medium-term goal used to achieve the overall strategic goal of an organization. Typical strategic objectives include growth (expansion), market leadership, green targets and profit maximization. Anna Holstein’s strategic objective is to grow RDB by restructuring and using local staff around the world (offshoring), mainly in China, Brazil and India (lines 96-99). Award [1 – 2 marks] if the terms are outlined although they lack some detail/clarity. Examples may also be missing. There is no attempt to distinguish between the two terms. Author: Paul Hoang © Tutor2u 2013 www.tutor2u.net Award [3 – 4 marks] if both terms are clearly understood and a distinction is made. There is good use of examples and proficient use of business and management terminology. (c) Using at least one content theory of motivation, examine the factors that affect the level of motivation at RDB. [7 marks] Content theories of motivation explain the actual factors that motivate people, i.e. what motivates. F.W. Taylor, for example, looked at scientific management whilst McClelland studied the need for achievement, affiliation and power. Theories that students could apply comprise of the following: F.W. Taylor – Scientific management, e.g. staff being well paid (line 49) A. Maslow – Hierarchy of needs, e.g. job security (line 53) would go some way to addressing workers’ safety needs; staff enjoy working in a culturally homogeneous environment (lines 49-50) or feeling part of the ‘family’ (line 52) could address workers’ belonging needs; but the lack of opportunities for promotion (line 47) could hinder some people’s esteem needs D. McGregor – Theory X and Theory Y managers, e.g. Anna Holstein has less empathy for the factory floor workers (line 70) compared to Valdemar Holstein who has a paternalistic leadership style (line 45) and wanted to protect jobs in Denmark (line 130) Herzberg – Two-factory theory (hygiene factors and motivators), e.g. the working environment as a hygiene factor (lines 53-54) Accept any other relevant factor(s) that examine the factors affecting the level of motivation at RDB. Award [1 to 2 marks] if the answer shows some understanding of the factors that affect the level of motivation at RDB. The answer lacks detail and makes minimal use of appropriate business and management terminology. No reference is made to the RDB case study. Award [3 to 5 marks] for a descriptive or partial examination. There is a good understanding of the factors that affect the level of motivation at RDB. There is appropriate use of business and management terminology with some reference made to the RDB case study. At the lower end of the markband, the response is mainly theoretical and lacks clear application. Award [6 to 7 marks] for a balanced examination with accurate and detailed understanding of the factors that affect the level of motivation at RDB, using relevant content theory(ies) of motivation. There is appropriate use of business and management terminology and theory throughout the response, with explicit references to the RDB case study. Author: Paul Hoang © Tutor2u 2013 www.tutor2u.net 2. (a) Define the following terms: (i) economies of scale (line 16). [2 marks] These are cost-saving benefits from operating on a large scale. For example, by mass producing ball bearings, RDB can save on its unit costs by buying raw materials and components in bulk, by using sophisticated technology to raise productivity and by gaining easier access to low-cost finance. Award [1 mark] for a basic definition that conveys partial knowledge and understanding of economies of scale. Award [2 marks] for a full, clear definition that conveys knowledge and understanding similar to the answer above. For only a relevant example or application to the RDB case study award [1 mark]. (ii) strategic alliances (line 155). [2 marks] A strategic alliance is a form of external (inorganic) growth, involving two or more companies working together on a particular project. Valdemar Holstein suggested forming strategic alliances with ball bearings companies to expand in Brazil, India and China. Award [1 mark] for a basic definition that conveys partial knowledge and understanding of strategic alliances. Award [2 marks] for a full, clear definition that conveys knowledge and understanding similar to the answer above. For only a relevant example or application to the RDB case study award [1 mark]. (b) Prepare a SWOT analysis showing only the strengths and weaknesses of RDB. [4 marks] A SWOT analysis provides a framework for decision makers at RDB to consider factors in both the internal and the external business environment that affect the company’s operations. The internal factors can be classified as either strengths or weaknesses within the organization. These include: Strengths of RDB Author: Paul Hoang Successful multinational company in the ball bearings industry (line 1) Highly skilled workforce (line 15) Megafactories allow RDB to benefit from several types of economies of scale (line 16) Held in high esteem both locally and regionally in Europe by being the main employer in these areas (lines 17-18) Ball bearings from RDB are perceived to be of higher quality than those of rival firms (line 19) Well-established reputation for high quality (line 24) © Tutor2u 2013 www.tutor2u.net Profitable (line 38) Brand loyalty (line 38) Employees are appreciative of job security (lines 53-54) Flexibility in production methods; job, batch and flow used (lines 63-65) Strong ties with the Danish government (lines 129-130) Public-private partnership projects with the Swedish and German governments (lines 131-132) Weaknesses of RDB Gross profit margin and net profit margin both lower than before (lines 38-39) Lack of attention to maintenance and technological upgrades (lines 40-41) Avoidance technique used in response to pressure groups (lines 41-43) Few opportunities for staff to be promoted (line 47) Modernist structures in the RDB megafactories are outdated for the 21st Century (lines 80-81) Staff have a lack of cultural understanding of their customers (lines 85-86) A ‘sleepy’ marketing department (line 108) Small marketing budget and unchallenging marketing objectives (line 108) Advertising and promotion limited to trade journals and trade shows only (line 109) Accept any other relevant strengths or weaknesses. Award [1 to 2 marks] if the SWOT analysis is limited, with some evidence of understanding of strengths and weaknesses at RDB. The answer may be theoretical, with little reference to the case study. Award a maximum of [2 marks] if only strengths or only weaknesses are used. Award [3 to 4 marks] if the SWOT analysis shows a clear understanding of both the strengths and weaknesses of RDB, with specific reference to the information in the case study. At the top end of the markband, there is a clear and detailed analysis although it does not need to be as detailed as above (illustrative purposes only). (c) Examine the reasons for Anna Holstein’s desire to downsize the workforce at the Danish megafactory (lines 96-97). [7 marks] Downsizing occurs when an organization reduces the size of its workforce. Downsizing would be inevitable if Anna Holstein reduces the scale of operations in the Denmark megafactory. Possible reasons (driving forces) for downsizing: Author: Paul Hoang Long term labour cost savings as European workers would be too expensive (lines 168-169) Slowing demand for ball bearings in Europe (lines 76-77) Research suggested that manufacturing in the 21st Century would be accomplished in smaller and more flexible factories (lines 79-80) To improve logistics (distribution and delivery times) to the growing number of clients in Asia and South America (lines 87) © Tutor2u 2013 www.tutor2u.net Anna’s strategic priorities were to develop a global identity and to have a workforce beyond Europe Relocation (offshoring) production facilities to Brazil, China and India Green factories needed achieve Anna’s vision (lines 95-96) The driving forces of globalization (line 170) necessitates changes at RDB The possibility of diseconomies of scale at the megafactory on Denmark Accept any other relevant reason that is substantiated and examined in the context of the case study. Award [1 to 2 marks] for an answer that shows some understanding of the reasons for downsizing. The response may be superficial and lacks depth of analysis. There is no reference made to the RDB case study. Award [3 to 5 marks] for an answer that is descriptive and shows evidence of partial analysis. There is an understanding of the reasons for downsizing, with some use of appropriate business and management terminology. Some reference is made to the RDB case study. Award a maximum of [3 marks] if only one valid reason is examined. Award [6 to 7 marks] for a detailed analysis of the reasons for downsizing at RDB. There is accurate and appropriate use of business and management terminology with explicit references made to the RDB case study. Author: Paul Hoang © Tutor2u 2013 www.tutor2u.net 3. (a) Identify two characteristics of an autocratic leader (line 46). [2 marks] Characteristics of an autocratic leader could include someone who: Makes autonomous decisions without consultation or regard for his/her subordinates Dictates all work methods and processes Has absolute and authoritarian control over a group of workers Is largely unreceptive to changes in the business environment Accept any other valid characteristic of an autocratic leader. Award [1 mark] for each characteristic of an autocratic leader that is correctly identified, up to a maximum of [2 marks]. (b) (i) Define the term just-in-time (line 26). [2 marks] Just-in-time is a method of stock control used in the production process whereby materials and components are scheduled to arrive precisely when they are needed for production. JIT is a prerequisite to lean production (efficiency) because holding large volumes of stock (inventory) can be very costly and wasteful. Award [1 mark] for a basic definition that shows partial knowledge and understanding of just-in-time. Award [2 marks] for a full, clear definition that shows knowledge and understanding similar to the answer above. For only a relevant example or application to the case study award [1 mark]. (b) Explain how a move to just-in-time production could help manufacturers to remain competitive (line 26). [4 marks] Possible reasons could include an explanation of: JIT cuts the costs of holding stock (inventory), such as insurance and the cost of theft or damage of inventories Moving to a just-in-time system eliminate the need for stockpiling, thereby shortening the working capital cycle JIT is part of lean production (the process of streamlining operations and procedures to reduce all forms of waste); thus, JIT helps to reduced costs for ball bearings manufacturers such as RDB JIT also encourage a ‘right first time’ approach; striving for zero defects makes better use of scarce and expensive resources JIT allows RDB to be more flexible and responsive to the needs of their customers (lines 27 and 80) Accept any other valid reason that is clearly explained in the context of the RDB case study. Award [1 mark] for each valid reason identified up to a maximum of [2 marks], and [1 mark] for a correct explanation of the reason, up to a maximum of [2 marks]. Author: Paul Hoang © Tutor2u 2013 www.tutor2u.net (c) Examine the advantages of operating smaller factories as opposed to RDB’s current operational model of megafactories. [7 marks] Advantages of operating smaller factories include: Greater flexibility (line 80) Relatively easier to implement just-in-time production using smaller factories Local knowledge by using a locally hired manager (line 101) Reduced need to tall hierarchical structures (line 35), thus benefiting from flatter structures at RDB Improved distribution channels by being located nearer to the growing number of customers in Asia and South America However, operating megafactories can also bring advantages to RDB, such as: Greater opportunities for achieving economies of scale Having a presence in the industry/country, creating thousands of jobs (line 17) and being held in high esteem A large ‘family’ community/culture from being located in three European megafactories, rather than twelve smaller factories spread around the world Accept any other relevant point that is substantiated. Award [1 to 2 marks] for an answer that shows some knowledge and understanding of the advantages of operating smaller factories or operating on a smaller scale. There is minimal use of appropriate business and management terminology. There may be no reference made to the RDB case study. Award [3 to 5 marks] for a partial examination with some evidence of relevant knowledge and/or understanding of the advantages of operating smaller factories. There is appropriate reference made to the RDB case study, with some correct use of business and management terminology. Award up to [3 marks] if only one advantage is examined in detail. Award [6 to 7 marks] for a detailed examination of at least two advantages of operating smaller factories with accurate and detailed understanding and application to the RDB case study. The response shows appropriate use of business and management terminology throughout. Author: Paul Hoang © Tutor2u 2013 www.tutor2u.net SECTION B 4. (a) Define the following terms: (i) working capital cycle (line 83). [2 marks] This refers to the time interval between cash payments for RDB’s costs of production and the cash receipts from its customers. The delay means that RDB must manage its working capital (the money available for its day to day operations) very carefully to continue functioning. Relocating RDB’s factories to be nearer to its customers would improve logistics and distribution, thereby shortening the company’s working capital cycle. Award [1 mark] for a basic definition that shows partial knowledge and understanding of the working capital cycle. Award [2 marks] for a full, clear definition that shows knowledge and understanding similar to the answer above. (ii) gross profit margin (lines 38-39). [2marks] The gross profit margin is a profitability ratio that measures the proportion of a firm’s gross profit generated from the sales revenue of the business. For example, if RDB’s GPM is 65%, this means for every $100 of sales revenue, $65 is generated as gross profit (with the other 35% representing the costs of goods sold). Award [1 mark] for a basic definition that shows partial knowledge and understanding of gross profit margin. Award [2 marks] for a full, clear definition that conveys knowledge and understanding similar to the answer above. (b) Explain why a shortened working capital cycle would be an important benefit to RDB (line 83). [4 marks] Working capital refers to the money available for the daily running of a business, calculated as the difference between its current assets and current liabilities. Working capital is used to pay for RDB’s operational costs, such as purchasing raw materials, paying wages and paying suppliers. Benefits of a shorter working capital cycle for RDB include: RDB has more cash available to fund its routine operations Less risk of running into a liquidity crisis (when a firm has negative working capital and is unable to fund its running costs) Having sufficient working capital in case of contingencies (emergencies) Working capital is an important source of finance for growing businesses such as RDB trying to expand its operations An increase in RDB’s scale of operations implies a need for greater levels of cash, so shortening the working capital cycle will be beneficial. Accept any other relevant explanation. Award [1 to 2 marks] for a limited answer with some understanding of the benefits Author: Paul Hoang © Tutor2u 2013 www.tutor2u.net of a shortened working capital cycle. The answer may be superficial, without specific or relevant reference to the RDB case study. Award [3 to 4 marks] if the answer is clear and developed, with appropriate use of terminology and application to the case study. For [4 marks] the answer is coherent and detailed, with competent use of terminology and explicit references the case study. (c) Explain the importance of quality assurance at multinational companies such as RDB. [4 marks] Quality assurance (QA) is the management process of guaranteeing (assuring) the consumer of a product’s quality by ensuring that everything is done ‘right first time’. Reasons that could be explained include: QA can be an important source of competitive advantage (line 28). It is more concerned about preventing poor quality output (of ball bearings) than rectifying the problems. The reputation of firms, even large multinationals, can be irrevocable damaged if there is a lack of QA. Employee participation at RDB can also help to generate new ideas for improving the quality of RDB’s products, operations and processes. There is less wastage and reworking of products as output and processes are checked at every stage of output. This helps to reduce production costs – or the costs of reworking – at RDB. Today’s consumers have easier access to information, such as through consumer protection organizations, the internet and social media networks. Any mistake made by large multinationals is likely to be reported in various media sources very quickly all over the world. Rivalry from foreign manufacturers of ball bearings also means that RDB has to maintain its quality assurance to retain its brand loyalty and to gain a larger customer base. Quality, as a form of product differentiation, can give RDB a competitive advantage, i.e. a distinctive selling point. Accept any other relevant explanation. Award [1 to 2 marks] for an answer that shows some understanding of the benefits of quality assurance. The answer may be superficial, without relevant reference to the RDB case study. Award [3 to 4 marks] for an accurate answer and applied to the RDB case study. For full marks, the answer is detailed, with explanations of why QA is important to RDB. Author: Paul Hoang © Tutor2u 2013 www.tutor2u.net (d) Evaluate the opportunities and threats to RDB posed by entry into international markets such as Brazil, India and China. [8 marks] Opportunities for RDB might include: Increased customer base - The size of RDB’s market can be enlarged by marketing products to overseas businesses, such as carmakers in China and India. Economies of scale - By operating on an even larger scale, RDB is likely to benefit from cost savings, thereby gaining higher profit margins Increased brand recognition - Anna Holstein wants RDB to have a global identity (lines 165-166). Spread risks - By operating in various countries, RDB is less exposed to the risks in one particular country (such as the current economic downturn in Europe). Opportunities to form strategic alliances with foreign firms can allow RDB to gain access to overseas markets such as India, Brazil and China. Gain more profit - Ultimately, all the reasons above for entering China, India and Brazil help to generate more profits for RDB. Overseas markets provide an extra source of customers and can be very lucrative. Potential threats of entering international markets include: Cultural Issues - Successful operations and expansion in one country or continent does not guarantee similar success in other overseas markets. Anna, for example, has never worked in Asia or South America. Legal Issues - Entry into international markets can also be a problem due to different legal systems. Some countries will have very strict laws on what can and cannot be advertised, for example. Social and demographic issues - Different socio-economic and demographic conditions in overseas markets can mean that RDB has to reconsider its marketing mix; this can be costly to the firm. The need for increased working capital or other sources of finance to fund the expansion/entry in international markets Accept any other relevant opportunity or threat that is substantiated in the evaluation. Award [1 to 2 marks] if the answer shows some understanding of the opportunities and threats. The answer is likely to be superficial, without relevant application to RDB. Award [3 to 4 marks] for an understanding of the opportunities and threats of entering international markets. There is some use of appropriate business and management terminology, with some reference made to the RDB case study. The answer may be descriptive or merely theoretical and lack clear application. Award [5 to 6 marks] for a response with relevant knowledge and understanding of the opportunities and threats of RDB entering international markets. There is relevant and appropriate use of B&M terminology. There are explicit references to information in the case study but there is no judgment and/or a lack of critical thinking. Award [7 to 8 marks] for a response with accurate and detailed understanding of the opportunities and threats of RDB entering international markets such as China, Author: Paul Hoang © Tutor2u 2013 www.tutor2u.net India and Brazil. Business and management terminology have been used competently throughout the answer, with effectiveness application of the RDB case study. The answer includes an evaluation and/or justified conclusion underpinned by a balanced and in-depth analysis. Author: Paul Hoang © Tutor2u 2013 www.tutor2u.net