Bachelor of Science with Honours/Bachelor of Science

advertisement

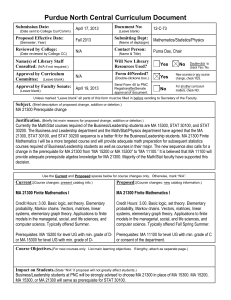

03 UC/14 BSc(Hons),BSc/1 UNIVERSITY OF CANTERBURY Te Whare Wānanga o Waitaha CUAP Proposal-New Qualification/Subject/Endorsement 2014 Section A Proposal Description Purpose of the proposal The purpose of the proposal is to introduce Financial Engineering as a major in the Bachelor of Science and Bachelor of Science with Honours degrees. Justification The 2007-2009 turmoil in the capital markets was a powerful illustration that there is a lack of high-quality professionals with the required expertise to design and develop new financial products, instruments and investment strategies. The financial regulators and grading agencies also lacked sufficient financial engineering expertise to properly evaluate the rapidly developing and expanding market in these products. The proposed programmes are designed to prepare graduates for this professional career, as well as a wide range of allied careers with similarly highly technical knowledge and skill requirements, e.g. actuarial science, thus helping UC in achieving its aspiration goal of providing all graduates with the opportunity to graduate competent in this core academic discipline. Students may choose to specialize in financial theory, financial mathematics/statistics, financial economics or computational finance. The proposed degrees will strengthen the relationship between the proposing School of Mathematics and Statistics and the Departments of Economics & Finance and Computer Science & Software Engineering, part of the “interconnections between Colleges and Faculties” in UC’s 2014/2015 plan to improve engagement with staff. In particular, it will build upon the strong collaborations in teaching and research between these units. The BSc and BSc (Hons) programmes will produce graduates with an excellent set of technical skills and they will be well prepared for further study in Financial Engineering and related fields thus providing a solid foundation for building research capacity at UC. This helps to enhance UC’s research performance and directly contributes to research collaborations in the KPI in the 2014/2015 plan. Importantly, the proposed majors can be successfully accomplished within existing resources, thus enabling the greater efficiency that comes about from the concentration of student enrolments. Hence, the proposal clearly contributes to the 2014/2015 plan to “manage our resources prudently”. The inherent cross-disciplinary nature of this career path requires that we combine existing resources (including staff with the expertise and interest in this area) of the Department of Economics & Finance, School of Mathematics & Statistics and the Department of Computer Science & Software Engineering in order to take advantage of this emerging educational opportunity. The proposed programmes are designed to help “Recover student numbers” as in the UC 2014/2015 plan. They are designed to attract a new breed of high calibre students, interested in the highly technical knowledge required of Financial Engineers and related careers. In particular, the focus is to attract new students that the University does not currently engage, because our present offerings do not permit sufficient cross-disciplinary flexibility, particularly across the core technical areas, which is required in such a multidisciplinary field. There is no other programme in New Zealand directly targeted towards this career, thus providing UC with a point of difference. The programme is comparable in content, objective and level, to similar programmes offered in some of the world’s best institutions, e.g. Carnegie Mellon and University of California at Santa Barbara. The proposed major in the BSc focuses on most of the important features of the financial engineering discipline. These include the theory of financial modelling, mathematical and statistical quantitative techniques and computational skills 1 03 UC/14 BSc(Hons),BSc/1 and experience. To achieve most of the pathways through this degree, students would currently need to undertake a double degree, which is not a very attractive proposition. A carefully tailored pathway has been defined which provides flexibility depending on students’ interests, but ensures coherent qualifications which provides the breadth of the core skills and knowledge needed by Financial Engineers. The breadth and depth of the attained technical knowledge will also prepare them for study at the postgraduate level, which will be appreciated by the research community both in the fields of finance and financial mathematics/statistics at UC and in the wider NZ education system. This proposal is consistent with the strategic direction stated in the UC Strategic Plan 2011-2013. In the design of the programme we seek to ensure that students are prepared for lifelong learning and graduate from the University with qualifications of international standing, fully prepared for future careers in New Zealand and beyond. The design of the programme also conforms to the contributing Departmental/Schools and our strategic direction of being a top institution for teaching and research in quantitative finance and statistical analysis. The new programme is inherently cross-disciplinary. It requires students to take courses across three broad disciplines: economic & finance, mathematics & statistics and computer science & software engineering. It is deliberately designed to attract a new breed of technically minded students with a strong interest in finance. As mentioned above, the proposed Financial Engineering programmes provide a natural complement to the existing offerings in Finance at UC, which have a lower technical requirement across mathematics, statistics and computing. The combined offerings should therefore cater to a fuller spectrum of student interest. The new Financial Engineering programme requires academic staff from various departments to collaborate more closely in teaching and the running of the programme. In particular, it is envisaged that the programme coordinator role will alternate between staff in the relevant departments over the long term. The close working relationship will also enable an exchange of information that allows people to learn more about their counterparts’ research expertise. Eventually, this should lead to future research collaboration. In addition, the new Financial Engineering programmes should draw international attention to UC and should lead to visits by experts in the field. This enables the UC’s staff to network and seek collaboration with further experts outside of the university. The new financial engineering programmes are built upon strengths in teaching and research of the available staff in the Department of Economics and Finance, the School of Mathematics and Statistics and the Department of Computer Science and Software Engineering. The programmes consist of courses from our existing programmes (except new courses as part of the change proposal in the Department of Economics and Finance discussed below), so requires no additional courses. Furthermore, the core courses for the programme are normally offered by the relevant departments every year. The recommendations from a review of the Department of Economics and Finance are currently being implemented. The changes to the course offerings are being proposed in a separate Round 2 CUAP proposal. A summary of the fairly minimal impact of these changes to this proposal are as follows. The existing courses ECON202 and ECON203 which are two parts of intermediate microeconomics with calculus are being discontinued. In their place students can take ECON207 and ECON 208, which have the essentially same microeconomics content taught without the use of calculus. However, supplementary reading material on the use of calculus will be provided for interested students. Financial Engineering students would be expected to take one of either ECON 207 or FINC 203, the latter unaffected by these changes. At 300 level, the elective ECON345 on the Economics of Risk and Insurance will remain but the calculus topics removed (from 2016 onwards). Qualification BSc in Financial Engineering- the proposal meets the requirements for a major in the BSc BSc (Hons) in Financial Engineering- the proposal meets the requirements for a subject in the BSc(Hons) degree. Acceptability of the programme and consultation 2 03 UC/14 BSc(Hons),BSc/1 The programme has been put together between staff from the units involved in teaching the key courses in the programmes, namely the Department of Economics and Finance, the School of Mathematics and Statistics and the Department of Computer Science and Software Engineering. The Deans and PVC’s from the affected Colleges and Faculties have been consulted. They have all provided their support for the proposal. The Dean of Science organised a meeting to formalise discussion about this multi-College and Faculty proposal. They have agreed that the proposal is consistent with the strategic direction of the university and relevant sub-units. In particular, they agree that the proposed undergraduate major and BSc(Hons) programme are an appropriate stepping stone to the 180 point Masters in Financial Engineering which is intended to be proposed in the 2015 CUAP Round 1. They agreed that there is unlikely to be any negative effects on existing programmes due to EFTs substitution/redistribution and there is potential for reinvigorate certain courses. There is potential for generating new student enrolments once the programme is fully operational. The UCSA representative supported this “exciting” programme. Feedback was sought from Head of the UC International Relationships Office and its senior international recruitment coordinator. Each has provided feedback based on their experience with attracting international students to UC and discussions with Hobson’s. They indicated that it would be the actuarial science aspect of the degrees that would be a popular option for international students. Given the extent of cross-over with topics in actuarial science degrees (further supported by the external feedback discussed below) this programme should be of interest to such students. HOD Economics and Finance contacted academics in financial engineering and related programmes around the world to get direct feedback on the proposal. All of the four respondents were positive about the programme structure. Some commented on the growth of jobs in this specific field and related careers which require this broad range of technical skills and knowledge. One of the respondents mentioned the possibility of an exchange programme with UC, which could be very valuable. Three of the four cautioned that to attract international students, we must build and document examples of good industry linkages and employment opportunities for past students. Thus, a critical task of the degree coordinator will be to collect and maintain records of employment opportunities attained by graduates of the programme, which can be used for marketing purposes. A process for maintaining linkage with past graduates and potential employers will also be invaluable for this purpose. It is planned that the research project component of the intended 180 point Masters in Financial Engineering should include the potential for industry linked projects (thus contributing to the pillar of Work Integrated Learning). One the respondents also mentioned that accreditation of the degree would be valuable. It is intended to attain accreditation for this programme, initially from PRMIA. The potential for accreditation is discussed in the “Programme Overview” below. External consultation also sought feedback from potential NZ employers, wider feedback from internationally recognised academics and past students. The full feedback from each person is available on request, but a summary of the key feedback is given below. The academic referees all provided support for the programme, providing confirmation of the consistency of the proposed programme with international best practice. There were some comments on specific aspects of the programme that could be improved. However, these comments are mostly resolved by a lack of clarity and detail in the relevant course descriptions. The employment prospects for graduates from the proposed programme are demonstrated by the feedback from potential employers including Dr John McDermott, Assistant Governor and Head of Economics of the Reserve Bank of New Zealand who commented that the “the quantitative skills that such a programme would provide would be of interest to the Reserve Bank as a potential employer”; Andy Hagan, Head of Risk Policy and Balance Sheet, The Treasury who said the programme will be “be a valuable addition to the University curriculum” and believes the technical and business knowledge they will receive will be useful to The Treasury and Nicholas Ellwood, Head of Market & Treasury Risk at the ANZ “continues to see considerable demand for highly quantitative graduates within the financial services industry” and that “The proposed Bachelors of Financial Engineering (BSc) degree would position graduates well in what is an increasingly technical industry” and Richard Beauchamp, Appointed Actuary at Vero Insurance and Vice President of the NZ Society of Actuaries said “the syllabus looks very interesting and would equip a graduate for a number of roles 3 03 UC/14 BSc(Hons),BSc/1 that increasingly are needed in industry and commerce”. As this is not an Actuarial Science degree, it does not optimize courses towards this profession and the current accreditation process, but he can foresee that “technical part of the actuarial qualification may need to head more in the direction you're proposing so perhaps it's just a matter of time”. Richard has invited us to submit a formal letter requesting feedback and support from the NZ Society of Actuaries given the relevance of our programme to his field. Treaty of Waitangi Liz Brown provided very useful feedback on the proposal as Kaiārahi Māori from the Office of the AVC Māori. She pointed out that it would be useful to cover topics on Risk and Compliance, which will look to be included in the FINC628 (Risk Analysis) and FINC629 (Credit Risk Management). She highlighted the need to cover various topics around ethics, some of which are specific to Māori and others of wider relevance from an international perspective. Two courses required for the BSc in Financial Engineering are ECON104 and FINC201. Within the BCom, these courses are already among those used to meet a learning goal set out as part of AACSB accreditation (http://www.aacsb.edu/accreditation/accounting/): “discuss the ethical implications of a situation from the perspective of relevant stakeholders, which may include the role of governments, corporates, and individuals.” Some ethical issues are also included in STAT courses (in particular STAT201 and STAT312 which are potential electives), as these are designed for students who may be collecting data from people or on animals so they need to be aware of the ethical issues in this realm. She also mentioned topics which could be described as knowledge of cultural beliefs, particularly of Māori beliefs. There are ongoing discussions about the development of a University wide cultural competence course, which would cover these concepts. In developing the core set of courses for this degree we have left sufficient room for students to undertake such a course at any level. It is anticipated this programme will attract both Māori and non-Māori students. The programme is also designed to attract new international students to New Zealand, thus contributing to the cultural diversity of our country. Goals of the programme The basic goal of the programmes in Financial Engineering is to provide the following technical knowledge, competencies and skills: mastery of finance theory, microeconomics, econometrics, statistical inference, mathematics and key concepts like risk and valuation from the insurance industry; acquaint students with the special features of financial and stochastic models and their application in practice; develop student skills in critical thinking and to make complex decisions based on empirical data from the viewpoint of suitable risk management and achieving suitable profitability; train students to seek new sources and create new knowledge as well as use modern interdisciplinary research methods to address the challenges and issues they encounter during their work at a financial institution; and be able to design or redevelop a new financial product or instrument. As part of core courses and elective courses, students learn the fundamental theory and practice in finance & economics, mathematics & statistics and modern computing. There is a fairly prescriptive core set of 17 courses which provide the required skill, knowledge and experience required of all Financial Engineers. The level of prescription is inherent in such a highly technical cross-disciplinary subject. There are also clear identified pathways within the BSc major. The “Financial” pathway provides expertise on financial markets and instruments, risk modelling and analysis, and portfolio selection. The “Economics” pathway is similar but permits students to specialise in microeconomics. The “Maths” pathway trains students to specialize in stochastic modelling, mathematical optimization, and computational mathematics and applications in finance. The “Stats” pathway is designed to enhance those who wish to acquire the specific expertise in random processes, computational statistics and their applications in finance, including financial statistics/econometrics and data mining. The “Computational” pathway provides expertise on programming and software engineering for financial products and computation finance. Students will be given academic course advice on how to complete the different pathways. Outcome statement Graduates from the programmes in Financial Engineering will have in-depth cross-disciplinary technical knowledge and skills across finance and economics, statistics, mathematics, and computing. This training will make them sought after in 4 03 UC/14 BSc(Hons),BSc/1 the job market and well equipped for a research career in finance and allied fields. These graduates will also be excellent candidates for postgraduate study given the breadth and depth of technical training they will receive. Graduate profile for BSc in Financial Engineering Personal Attributes demonstrate knowledge of Financial Engineering and an ability to apply scientific principles and concepts to solve problems in this field; independently solve problems through the application of scientific knowledge and methods; demonstrate in-depth knowledge of and skills across finance and economics, mathematics and statistics and computing; demonstrate analytical abilities across these fields; understand, evaluate, access and critically review new information; demonstrate the development of skills for lifelong learning; demonstrate the ability to think independently; demonstrate understanding from a multidisciplinary perspective; show an awareness of ethical issues; Interactive Attributes communicate effectively formally and informally, both in written and spoken English; work collaboratively on tasks. Graduate profile for BSc (Hons) in Financial Engineering demonstrate advanced knowledge of and an ability to apply financial, mathematical and statistical principles and concepts to solve problems in this field; independently solve problems in finance through the application of statistical, mathematical, statistical and computational knowledge and methods; demonstrate strong quantitative and analytical skills and abilities; engage in intellectual analysis, criticism and problem solving; understand, evaluate, access and critically review new information, including findings and discussions in the research literature; demonstrate in-depth knowledge of the knowledge and skills required of financial engineers, including the theory and practice of designing and developing a new financial product, instrument or investment strategy; Personal Attributes demonstrate the ability to think independently; understand, evaluate, access and critically review new information; apply knowledge and skills to new situations; research, analyse, evaluate, and argue from evidence; plan and carry out a specific programme of relevant scientific research in finance; demonstrate an understanding of sophisticated theoretical subject matter; demonstrate skills for lifelong learning; able to work independently. Programme overview The BSc in Financial Engineering consists of a core of 17 courses which is reasonably prescriptive due to the inherent cross-disciplinary nature of this subject. An accompanying Schedule defines a complete set of relevant courses which prescribes the new “subject” of Financial Engineering. The students must choose sufficient electives from the Schedule to satisfy the major requirements of each degree. Further electives can be chosen off this schedule if needed. The major follows the typical BSc structure (135 at 100 level, 135 and 200 level and 90 in 300 level). The BSc (Hons) programme includes a required STAT course- Advanced Time Series Methods, three FINC courses and the remaining courses from a list of ECON, FINC, COSC, MATH and STAT courses. It also has a research component, e.g., 5 03 UC/14 BSc(Hons),BSc/1 a research project where students can utilize and apply the knowledge and skills learned from coursework. This is taken from CAMS, FINC or STAT. A key requirement for students from the Northern Hemisphere is to be able to enter the programme mid-year rather than at the usual start of the academic year. Students in both the BSc and BSc (Hons) programmes can enter in both intakes. The mid-year intake is more restrictive, but is achievable with a reasonable number of pathways for such students. The honours projects in statistics (STAT449), mathematics (CAMS449) and finance (FINC680) are offered across academic years. Fundamental concepts in ethics are covered in the core courses ECON104 and FINC201, as these are key components of the recently attained AACSB accreditation as discussed above. Further, basic ethics concepts are covered in STAT201 and STAT312 which are electives, as these are targeted at students who may be collecting data on humans or animals so need to be aware of such important considerations. Accreditation Many of the Department of Economics and Finance degree programmes are accredited to offer students the possibility of getting two of four exams to attain the designation of Professional Risk Manager (PRM) from the Professional Risk Managers' International Association (PRMIA). The details of the current accreditation are available from http://www.econ.canterbury.ac.nz/prmia.shtml. The courses required to attain the exemptions from Exams I and II are achievable on the proposed programme. We intend to seek accreditation of the BSc combined with BSc (Hons) in Financial Engineering from PRMIA, for which the staff in the Department of Economics and Finance have much experience as this was recently obtained for the new Masters in Applied Finance and Economics (MAFE). We will also consider accreditation of the proposed programmes with the International Association of Quantitative Finance and the Accredited Financial Analyst Council. Proposed teaching/delivery methods Delivery methods for taught courses will be as per individual courses, including lectures, tutorial and laboratory sessions. Delivery of projects on the supervised projects for the BSc (Hons) will be as per usual, with industry partners for these projects promoted as providing extra value to the students wherever possible. Prescriptions for courses No change to existing courses. Assessment and moderation procedures Assessments will be according to the individual courses and in accordance with the University of Canterbury’s assessment policy. Resources There are two significant costs associated with the programme, for marketing and degree coordination, which are over and above the required contribution margin. There will be some marketing expense as this programme is designed to attract a new breed of more technically minded students, compared to those who traditionally enrol in related degrees at UC. The growth in the number of programmes in Financial Engineering and related degrees in the USA, UK and Europe and forecasted growth (above average 16-28% in US) in job market discussed above, demonstrates the potential international demand. The inherent cross-disciplinary nature of the proposed degree will create challenges in ensuring the existing course offerings continue to satisfy the needs of the enrolled students, to ensure the continued cohesion of the programme and that appropriate advice is given to students about their course choices. Student advice will be provided by the student advisors’ team in Science, which is covered as part of the aforementioned contribution margin. However, a key responsibility of the degree coordinator will be as the point of contact for the student advisors for programme information and for students with challenging queries. The marketing of the programme to international students will also benefit from examples of graduating students going to relevant careers in industry, which will need to be tracked and communicated to the relevant marketing teams. Therefore, the budget includes the cost associated with a programme coordinator to oversee the programme and perform these tasks. 6 03 UC/14 BSc(Hons),BSc/1 This degree coordinator role will form part of the usual administrative role of an academic from either the School of Mathematics and Statistics and Department of Economics and Finance, which over the long term will be split based on EFT’s contributions. The role will typically reside in either unit for at least three years for continuity purposes. The School of Mathematics and Statistics has agreed to provide the degree coordinator in the developmental stage. Plans for monitoring programme quality The programme will be subject to a CUAP graduating year review and the University of Canterbury’s quality assurance processes. Review of the programme The programme itself will be reviewed by a variety of means: For the first three years, student enrolments and success rates will be closely monitored. Programme evaluations will also be undertaken annually with graduating students. After the first three years, course and programme evaluations will be used to re-evaluate the programme and used towards deciding if the course schedule or any individual courses need to be revised. This review will also consider whether any revisions to the core courses or introduction of new courses as needed to better meet the graduate profile. Graduates of the first three years will also be contacted two years after graduation (where possible) for their feedback on how applicable and relevant the teaching programme has been to their chosen profession, and to seek feedback on how this could be improved if necessary. For New Qualifications – TEC/NZQA/UNZ Requirements EFTS value of qualification: BSc in Financial Engineering = 3 EFTS, BSc (Hons) in Financial Engineering = 1.25 EFTS NZSCED code: 08 11 01 NZQA exit level of qualification to go on the New Zealand Qualifications Framework: BSc in Financial Engineering = Level 7, BSc (Hons) in Financial Engineering = Level 8 Statement regarding funding: The BSc(Hons) programme can be funded at the postgraduate level. Memorandum of understanding: Not applicable. Duration of the Qualification-NZQF requirement Minimum number of points to complete the qualification: BSc in Financial Engineering = 360 point, BSc (Hons) in Financial Engineering = 150 points Vacation/recess weeks: As per UC academic calendar Work experience/placement hours per week; None Tuition/teaching (full-time equivalent) weeks (including exam and study weeks): As per UC academic calendar Teaching hours per week: As per existing courses. Self-directed learning hours per week: As per existing courses. Calendar Form New Qualification Regulations Changes to Calendar for BSc: 2014 Calendar, page 366, regulation 3(a). Insert ‘Financial Engineering’ before Geography. 7 03 UC/14 BSc(Hons),BSc/1 2014 Calendar, page 370. Insert the following before Geography’s entry. Financial Engineering 100-level Required: COSC121, COSC122, ECON104, MATH102, MATH103 and STAT101 Recommended: ACCT102 and INFO125 200-level Required: ECON213, FINC201, (FINC203 or ECON207), MATH201, SENG201, (STAT211 or STAT221) and STAT213. Recommended: INFO213 300-level Required: (FINC311 or FINC312), FINC331 and STAT317. Any other 300 level course from those listed in Schedule B for Financial Engineering. 2014 Calendar, page 382, schedule. Insert the following before Geography’s entry. Financial Engineering Course Code COSC 121 Course Title Introduction to Computer Programming Pts 15 COSC 122 15 FINC 101 ECON 104 Introduction to Computer Science Personal Finance Introduction to Microeconomics ECON 105 Introduction to Macroeconomics 15 MATH 102 Mathematics 1A 15 MATH 103 Mathematics 1B 15 MATH 120 MATH 170 Discrete Mathematics Mathematical Modelling and Computation 15 15 STAT 101 Statistics 1 15 COSC 262 Algorithms 15 SU2 S1 S2 S1 ECON 207 Intermediate Microeconomics I 15 S2 ECON 208 Intermediate Microeconomics II 15 S1 ECON 213 Introduction to Econometrics 15 S1 FINC 201 Business Finance 15 S1 S2 15 15 2014 SU1 S1 S2 S2 S2 S1 S2 S1 S2 S1 S2 S1 S2 S2 S2 8 P/C/R/RP/EQ RP: COSC 121 R: ECON 199 R: MATH 108, MATH 199, EMTH 118 P: MATH 102 or MATH 108 or EMTH 118 R: MATH 109, MATH 199, EMTH 119 R: MATH115 R: MATH 171, EMTH 171 RP: MATH 109 or MATH 103 (prior or concurrent enrolment recommended) R: STAT 111, STAT 112 EQ: STAT 111, STAT 112 P: (1) COSC 121; (2) COSC 122; (3) 15 points from Mathematics, Statistics, Engineering Mathematics or MSCI 110. MATH 101 is not acceptable. MATH 120/STAT 101 are strongly recommended. R: COSC 202, COSC 229, COSC 329 P: ECON 104 R: ECON 202 and ECON 203 P: ECON 104 R: ECON 202 and ECON 203 P: (1) ECON 104 or ECON 105; and (2) 15 points from STAT or MSCI 110. RP: MATH 101 or Year 13 Math with Calculus. P: (1) ACCT 102 or MATH103; and (2) STAT 101 or MSCI 110; and (3) A further 45 points from the BCom or BSc schedules. 03 UC/14 BSc(Hons),BSc/1 FINC 203 Financial Markets, Institutions and Instruments 15 S1 FINC 205 Personal Finance with Mathematics 15 S2 MATH 201 Mathematics 2 15 S1 MATH 202 Differential Equations 15 S2 MATH 203 Linear Algebra 15 S2 MATH 270 Mathematical Modelling and Computation 2 15 S2 SENG 201 Software Engineering I 15 S1 STAT 201 Applied Statistics 15 S1 STAT 202 Regression Modelling 15 S2 STAT 211 Random Processes 15 S1 STAT 213 Statistical Inference 15 S2 STAT 221 Modern Statistical Computation and Simulation 15 S1 COSC 367 Computational Intelligence 15 S2 ECON 321 Microeconomic Analysis with Calculus 15 S1 ECON 323 Time Series Methods 15 S2 ECON 324 Econometrics 15 S1 9 R: FINC 202, AFIS 204 RP: Students without a mathematics background equivalent to NCEA Level 2 should pass MATH 101 before enrolling in this course. EQ: AFIS 204 P: (1) STAT 101 or MSCI 110; and (2) A further 60 points from the BCom or BSc schedules. R: AFIS 214 RP: Students without a mathematics background equivalent to NCEA Level 2 should pass MATH 101 before enrolling in this course. EQ: AFIS 214 P: (1) MATH 102 or MATH 108 or MATH 199; and (2) STAT 101 or MSCI 110. C: MATH 103 RP: MATH 103 P: MATH 103 or MATH 109 or MATH 199 or EMTH 119 R: MATH 261, MATH 264, EMTH 202, EMTH 204, EMTH 210 P: MATH 201 or EMTH 210 R: MATH 262, MATH 264, EMTH 202, EMTH 204 P: MATH 103 or EMTH 119 or MATH 199 R: MATH 252, MATH 254, EMTH 203, EMTH 204, EMTH 211 P: (MATH 170 or MATH 171 or EMTH 171 or MATH 280 or MATH 282) and (EMTH 119 or MATH 103 or MATH 109 or MATH 199) R: EMTH 271, MATH 271 P: (1) COSC 121; (2) COSC 122; (3) 15 points from Mathematics, Statistics, Engineering Mathematics or MSCI 110. MATH 101 is not acceptable. MATH 120/STAT 101 are strongly recommended. R: COSC 263, COSC 324 P: STAT 101, STAT 111, STAT 112 or STAT 131 R: FORE 210, STAT 220, FORE 222, STAT 222 P: STAT 101, STAT 111, STAT 112 or STAT 131 R: FORE 210, STAT 220, FORE 224, STAT 224 P: (STAT 101 or STAT 111 or STAT 112) and (MATH 102 or EMTH 118 or MATH 108 or MATH 109); or any one of MATH 103, MATH 199, EMTH 119. R: STAT 216 P: (STAT 101 or STAT 111 or STAT 112) and (MATH 102 or EMTH 118 or MATH 108 or MATH 109); or any one of MATH 103, MATH 199, EMTH 119. R: STAT 214 P: (STAT 101 or STAT 111 or STAT 112) and (MATH 102 or EMTH 118 or MATH 108 or MATH 109); or any one of MATH 103, MATH 199, EMTH 119. R: STAT 218 P: COSC 262 R: COSC 329 P: (1) ECON 202 and ECON 203, or ECON 207 and ECON 208, or ECON 230 or ECON 231; and (2) MATH 102 or MATH 199 or MATH 108; P: (1) ECON 213; and (2) ECON 202 or FINC 205 R: FINC 323, STAT 317 EQ: FINC 323, STAT 317 P: (1) ECON 213 or STAT 213; and (2) MATH 102 03 UC/14 BSc(Hons),BSc/1 ECON 331 Financial Economics 15 S1 FINC 305 Financial Modelling 15 S2 FINC 311 Investments 15 S1 FINC 312 Derivative Securities 15 S2 FINC 331 Financial Economics 15 S1 FINC 345 The Economics of Risk and Insurance 15 S1 MATH 302 Partial Differential Equations 15 S1 MATH 303 Applied Matrix Algebra 15 S1 MATH 353 Computational Mathematics and Applications 15 S2 SENG 301 Software Engineering II 15 S1 STAT 314 Bayesian Inference 15 S2 STAT 315 Multivariate Statistical Methods 15 S1 STAT 317 Time Series Methods 15 S2 STAT 318 Data Mining 15 S2 or MATH 199 P: 30 points from ECON 202, ECON 203, FINC 201, FINC 205 R: FINC 331 RP: MATH 103 EQ: FINC 331 P: (1) FINC201, FINC203 and one of (MATH101 or MATH102 or MATH108 or MATH199); or (2) FINC201 and MATH103 P: (1) FINC201, FINC203 and one of (MATH101 or MATH102 or MATH108 or MATH199); or (2) FINC201 and MATH103 P: (1) FINC201, FINC203 and one of (MATH102 or MATH108 or MATH199); or (2) FINC201 and MATH103 P: 30 points from ECON 202, ECON 203, FINC 201, FINC 205 R: ECON 331 RP: MATH 103 EQ: ECON 331 P: (1) ECON 203; or (2) ECON 202 and FINC 205; or (3) ECON 208 and (MATH 102 or MATH 199) EQ: ECON 345 P: MATH 264, EMTH 204, (MATH 261 and MATH 262), EMTH 202, MATH 202 or EMTH 210 R: MATH 361, EMTH 391, EMTH 413 P: (MATH 251 and MATH 252), MATH 254, EMTH 204, MATH 203, EMTH 203 or EMTH 211. R: MATH 352, EMTH 412 P: 1) Either MATH 201 or EMTH 210; AND 2) One of MATH 202, MATH 203, MATH 240, MATH 270, EMTH 211 or EMTH 271. With the permission of the Head of Department a high grade in either MATH 201 or EMTH 210 will suffice. R: EMTH 414 P: SENG 201. R: COSC 324, COSC 314 RP: COSC 110, ENCE 260. P: One of the following: 1) (MATH 103 or MATH 199 or EMTH 119) and (15 points at 200-level MATH or STAT (or other quantitative 200 level courses by approval of the Head of Department)); 2) STAT 211 or STAT 213 or STAT 221. P: 15 points from (STAT 202 or STAT 213) and a further 15 points from STAT 200-299, or, subject to Head of Department approval. P: 15 points from STAT 201, STAT 202, STAT 213 and a further 15 points from STAT 200-299, ECON 213, MATH 103, MATH 199 or EMTH 119. P: i) 15 points from STAT 200 to STAT 299 and ii) a further 15 points from STAT 200 to STAT 299 or COSC 200-299 or any other relevant subject with Head of Department approval. Changes to Calendar for BSc (Hons): 2014 Calendar, page 406, regulation 2. Insert ‘Financial Engineering’ before Geography. 2014 Calendar, page 410. Insert the following before Geography’s entry. Financial Engineering 10 03 UC/14 BSc(Hons),BSc/1 STAT470 (.1250 EFTS) and three courses from FINC621 to FINC629 (each course is .1250 EFTS), and an Honours research project chosen from CAMS449, FINC680 or STAT449 (each course is .2500 EFTS). With the approval of the programme co-ordinator, the remaining courses (.5000 EFTS) should be chosen from COSC401, ECON615, ECON641, ECON642, ECON643/FINC643, FINC610, FINC613, FINC616, FINC621, FINC622, FINC623, FINC624, FINC628, FINC629, MATH407, MATH408, MATH412, STAT445 and STAT460. One of the remaining courses should be STAT456/ECON614 if the student has not been credited with STAT317/ECON323 previously. P: (1) All required courses specified in Schedule A for the BSc in Financial Engineering; and (2) At least 90 points at 300 level from Schedule B for the BSc in Financial Engineering. Otherwise, subject to approval of the programme coordinator. 11