Hi, this is Dmitry Glotov from the Department of

advertisement

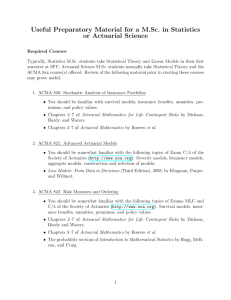

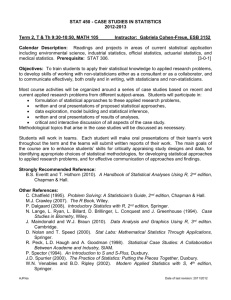

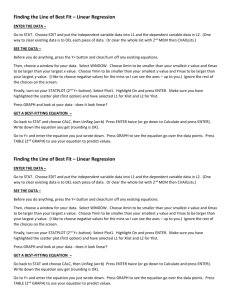

Hi, this is Dmitry Glotov from the Department of Mathematics and Statistics. I am involved with the Actuarial Science program and today I would like to talk about some elective courses the students in our program can take and benefit from. I will discuss six courses that can complement the actuarial courses that you are taking as part of the degree requirements. Most of them are in our department and one course is offered in the school of business. The first course is STAT 3610. This is a continuation of STAT 3600, the standard probability course that everyone in the program has to take in your junior year. This sequence, STAT 3600/10 is called Probability and Statistics I and II, respectively. STAT 3600 that you are required to take focuses mostly on the probability part while STAT 3610 explores thoroughly the statistical side. This is a course in which you learn topics such as confidence intervals and hypothesis testing. The main reason why this course is useful is that it serves as a prerequisite for the next two important courses. Before I discuss them, let me first say why I think these courses are important. As part of the process that the Society of Actuaries has in place for obtaining the designation of Associate, there is a requirement called Validation by Education Experience or VEE. It has three components and one of them is Applied Statistical Methods. This requirement can be satisfied by taking approved college courses. Conveniently, two of our courses are approved by the SOA to satisfy the Applied Statistical Methods component of the VEE. These courses are STAT 4610 and STAT 4630. The first one of them, STAT 4610 is titled Applied Regression Analysis. I am including the descriptions from the Bulletin in the slides. As you can see, the course covers least squares estimation, hypothesis testing and confidence interval estimation in regression; simple and multiple linear regression; and correlation analysis among other things. The second course, STAT 4630 is called Applied Time Series. It talks about AutoRegressive Moving Average processes, forecasting and forecasting errors and application in econometrics. In addition to learning about these very practical things these courses offer hand-on experience in analyzing actual data and working with real statistical software packages such as SAS and Minitab. The next three courses would go under the rubric Actuarial Models. We do have a course in our curriculum that has ‘modeling’ in its title and it is called MATH 5000 Mathematical Modeling. Sometimes it takes on topics from Exam C. However, traditionally this course is more related to the theory of differential equations than to the actuarial exams. Another course, called MATH 5970 Special Topics: Actuarial Models was first offered in the Fall of 2008. I taught it and we went over some topics from Exam MLC that included the Poisson process, Markov chains, and Brownian motion. These are all stochastic processes. The students who took the course were able to get approval to substitute this course for MATH 5000 in their plans of study. MATH/STAT 5670/80 is another sequence that talks about stochastic processes. The first course goes over probability in more detail than STAT 3600, for example and includes multivariate, conditional and marginal distributions, the Law of Large Numbers and the Central Limit Theorem. In the second semester you get to learn about the Poisson process, Markov chains, and Brownian motion. These are solid mathematical courses and one of their nice features is that they have an emphasis on solving problems. The last course that I would like to talk about is offered by the Finance department. It is called FINC 5680 Financial Engineering. If you decide to take it, you will have to get approval from that department. Fortunately, one of the courses in our curriculum, namely FINC 3630 is a prerequisite so getting the approval should not be a problem. The reason I think this is a nice course is that it covers part of the syllabus for the new SOA exam, Exam MFE. Our program today does not yet offer a comparable course. This is a course in which you learn about financial derivatives such as forwards, futures, options, and you explore different ways of computing the price for these securities, including the famous Black-Scholes formula. You also get very practical about computing these quantities. I have heard very favorable comments about this course from the some graduating seniors. I should point out that this advice is current as of April, 2009. If you have taken some other courses that you think might be good electives for the Actuarial degree and you would like to share your comments don’t hesitate to e-mail me at actu@auburn.edu and please visit the program website at http://www.auburn.edu/~dvg0001/ACTU/ . This is Dmitry Glotov for the Actuarial program at Auburn University.