SecReg - Module IV (33Act Liablity)

advertisement

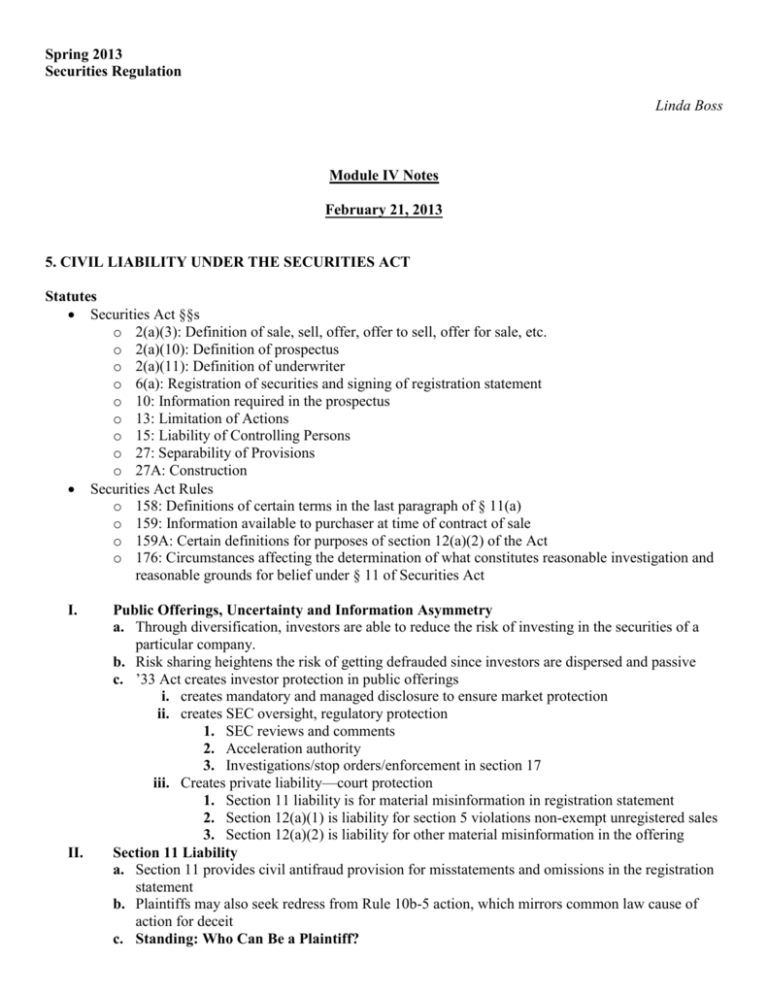

Spring 2013 Securities Regulation Linda Boss Module IV Notes February 21, 2013 5. CIVIL LIABILITY UNDER THE SECURITIES ACT Statutes Securities Act §§s o 2(a)(3): Definition of sale, sell, offer, offer to sell, offer for sale, etc. o 2(a)(10): Definition of prospectus o 2(a)(11): Definition of underwriter o 6(a): Registration of securities and signing of registration statement o 10: Information required in the prospectus o 13: Limitation of Actions o 15: Liability of Controlling Persons o 27: Separability of Provisions o 27A: Construction Securities Act Rules o 158: Definitions of certain terms in the last paragraph of § 11(a) o 159: Information available to purchaser at time of contract of sale o 159A: Certain definitions for purposes of section 12(a)(2) of the Act o 176: Circumstances affecting the determination of what constitutes reasonable investigation and reasonable grounds for belief under § 11 of Securities Act I. II. Public Offerings, Uncertainty and Information Asymmetry a. Through diversification, investors are able to reduce the risk of investing in the securities of a particular company. b. Risk sharing heightens the risk of getting defrauded since investors are dispersed and passive c. ’33 Act creates investor protection in public offerings i. creates mandatory and managed disclosure to ensure market protection ii. creates SEC oversight, regulatory protection 1. SEC reviews and comments 2. Acceleration authority 3. Investigations/stop orders/enforcement in section 17 iii. Creates private liability—court protection 1. Section 11 liability is for material misinformation in registration statement 2. Section 12(a)(1) is liability for section 5 violations non-exempt unregistered sales 3. Section 12(a)(2) is liability for other material misinformation in the offering Section 11 Liability a. Section 11 provides civil antifraud provision for misstatements and omissions in the registration statement b. Plaintiffs may also seek redress from Rule 10b-5 action, which mirrors common law cause of action for deceit c. Standing: Who Can Be a Plaintiff? Spring 2013 Securities Regulation i. Because section 11 provides cause of action only for persons ‘acquiring such security’ sold through the registration statement, courts interpret this as a stringent ‘tracing’ requirement ii. claim must show that the specific shares purchased were sold as part of the public offering under the registration statement that contained the alleged misstatement iii. IPO companies typically have other shares outstanding of the same class as those sold in the IPO iv. Insiders and venture capitalists that don’t sell in the IPO will sign lock-up agreements under which they agree not to sell their non-registered shares during a specific period of time v. During this lock-up period, investors purchasing stock in the secondary market can argue only shares trading in the secondary markets are those registered for the IPO vi. ‘seasoned public offerings’ make section 11 tracing requirement very difficult to satisfy vii. Krim v. pcOrder.com, Inc. 1. Facts a. Three investors brought Rule 11 claims against pcorder for misrepresentations on registration statement b. One bought its shares during lock-out period while others bought on secondary market after non-registered shares were intermixed with IPO shares 2. Procedure a. District court said no standing for two who bought intermixed shares 3. Issue a. Can you have standing for Section 11 if there is a very high percentage one of your shares was an IPO share 4. Reasoning a. Appellants acknowledged there is no way to track individual shares within a pool once contaminated w/ outside shares b. Accepting ‘statistical tracing’ would impermissibly expand the statute’s standing requirement c. Not within court’s power to rewrite statute to take account of changed conditions—that’s legislature’s job 5. CLASS NOTES a. At the same time as the IPO and the shareholders are buying, some insiders were also selling that weren’t part of the registered public offering i. Beebe bought before the insiders, so he’s good ii. The other two bought after, so they’re not. b. We have a market of 2.75 million shares, some registered and some not. All the shares are indistinguishable c. Why not just sue for 75% of damages since 25% of shares are nonregistered—no. SEC won’t allow. Have to be able to trace 100% of your shares to the IPO. If you bought after comingling, you’re SOL. viii. Section 11 does not require plaintiffs to demonstrate any reliance on the registration statement d. Statutory Defendants i. Section 11 explicitly defines range of potential defendants 1. Those who signed the registration statement including the issuer, CFO, CEO, among others 2. Directors Spring 2013 Securities Regulation 3. Various experts who prepared or certified a part of the registration statement 4. Underwriters; and 5. Controlling persons of any of the above e. Elements of the Cause of Action i. Section 11 Compared w/ 10b-5 and common law fraud 1. Silence is never actionable w/ any of these 2. All require material misstatement a. Materiality depends upon what a reasonable investor would view as significant given the ‘total mix’ of information available to the investor 3. Section 11 requires no additional burdens besides misstatement and materiality a. 10b-5 and fraud requires scienter and reliance b. you can bring a 10b-5 action ONLY in federal court. Private action. No SEC action required. c. 10b-5 has 5 year statute of repose; 3 year statute of limitations. [see below for section 11 sol] ii. if the issuer makes public an earnings statement covering a period of at least 12 months beginning after the effective date of the registration statement, section 11 provides plaintiffs bear burden of demonstrating reliance iii. misstatements are determined as of the effective date 1. use of the phrases ‘any part’ and ‘such part’ in the statute imply that different sections of the registration statement may have different effective dates iv. issuers must amend the registration statement in certain instances 1. Rule 415 shelf registration must furnish an undertaking to file a post-effective amendment if, a fundamental change has occurred 2. Form S-3 users may avid post-effective amendment under Item 512(a)(1)(i) through incorporation of the information by reference to an Exchange Act reporting filing or a prospectus supplement v. To avoid amendment, Issuers can also file a prospectus supplement pursuant to Rule 424(b), which is deemed part of the registration statement 1. Rule 430B provides a prospectus supplement— a. Is considered part of the registration statement b. Resets the effective date ‘for that part of such registration statement relating to the securities to which such form of prospectus relates’ for the issuer and underwriters i. Aka—prospectus supplement sets new effective date for securities in the particular shelf takedown 2. The resetting of the effective date for the registration statement exposes issuer to section 11 liability and gives issuer incentive to ensure registration statement as a whole is accurate at the time of shelf takedown a. Effective date does not reset for officers and directors of the issuer, or for the experts f. Defenses i. Possible defenses 1. A defendant who resigns from position and notifies SEC of actions 2. Defendants may attempt to show actual knowledge on part of plaintiffs a. After issuer makes public announcement detailing and correcting the fraud, the entire market ‘knows’ of the fraud, eliminating section 11 liability Spring 2013 Securities Regulation b. Once the correcting information is in the ‘total mix’ of information on the market, prior fraud is no longer material c. One year statute of limitations after plaintiff knew or should have known about fraud d. Three year statute of repose ii. Due Diligence Defense 1. Found in section 11(b)(3) 2. Standards are divided among experts/non-experts, and whether the statement was found in the expertised or non-expertised section of the registration statement 3. Expert in non-expertised section a. No liability under § 11(a)(4) 4. Non-expert in non-expertised section a. No liability if there was reasonable investigation, reasonable ground to believe and the non-expert did believe in the truthfulness of the statement, under § 11(b)(3)(A) b. Ignorance is no defense 5. Expert in expertised section a. No liability as long as there was reasonable investigation, reasonable ground to believe, and expert did believe the truthfulness of the statement under § 11(b)(3)(B) b. Ignorance is no defense 6. Non-expert in expertised section a. No liability as long as reasonable ground to believe and non-expert did believe in the truthfulness of the statement under § 11(b)(3)(C) b. Ignorance is a defense 7. Escott v. BarChris Construction Corp. a. Facts i. Investors sued directors, underwriters, lawyers, accountants, etc. for misrepresentation under Section 11 b. Procedure i. court found the misrepresentations material ii. defendants asserted due diligence defenses c. issue i. to what extent do parties have to investigate in order to achieve the due diligence defense d. reasoning i. who are the experts 1. lawyers are not experts as to the entire registration statement 2. the accountants are experts as to certain expertise areas in the documents ii. CEO, CFO, founders of the business, directors 1. Just because you’re not smart doesn’t mean you don’t have to investigate 2. If you’re on the executive committee discussing all affairs of the business, you know enough to know a misrepresentation in the prospectus 3. If you don’t read the prospectus that’s your fault Spring 2013 Securities Regulation 4. Have to make an investigation by reading the prospectus and knowing what is said is backed up 5. Can’t rely on others, unless they’re experts in that section 6. Doesn’t matter if you’re a new director, outside director, etc. iii. Underwriters 1. Underwriters are under same exact standard as directors 2. Can’t rely on others that what is said is true 3. Just as responsible as the company 4. If you delegate tasks to others, you’re bound by their failures iv. Accountants 1. Failing to meet industry standards is not due diligence 2. Failed to use GAAP in the financial part of prospectus. 8. Rule 176 provides guidance on what constitutes due diligence. a. Varies level of due diligence based upon— i. Type of security ii. Type of issuer iii. Presence of another relationship to the issuer when the person is a director iv. Type of underwriting arrangement for underwriters b. No guidance how to weigh these factors iii. Due Diligence and Underwriters 1. Reporting companies may incorporate previously filed SEC documents by reference 2. Incorporated items are still subject to section 11 liability 3. In re WorldCom a. Procedure i. Investors suing underwriters ii. Underwriters saying due diligence as defense b. Issue i. Do underwriters have the same duty to investigate previously incorporated SEC filings vs. the registration statement c. Holding i. Yup. d. Reasoning i. The underwriters today relied upon the due diligence of SSB and JP Morgan. ii. Even though an accountant qualifies as an expert, not every statement made by an accountant is his area of expertise that an underwriter can rely on 1. Comfort letters can’t be relied on 2. Quarterly financial statements can’t be relied on iii. Underwriters have to be on the look out for ‘red flags’ that denote further inquiry; failure to inquire further = liability iv. Just b/c it’s shelf registration and the time period for due diligence is short is no excuse for not doing the due diligence fully and thoroughly Spring 2013 Securities Regulation 1. No one is making the underwriter approve; underwriter can say I need more time v. Whether an underwriter inquired far enough is often a question for the jury vi. An underwriter must conduct a reasonable investigation to prevail on the due diligence defense, even if it appears that such an investigation would have proven futile in uncovering the fraud e. CLASS NOTES i. Financial statement/balance sheet fraud ii. Underwriters can have defense easily for audited financials, but unaudited financials they have a harder time iii. You don’t get a separate due diligence standard for a shelf registration—must do your due diligence. 4. The court supports the SEC’s position that issuers and underwriters may accommodate the need to do due diligence even for previously filed documents incorporated by reference in a registration statement by simply taking more time prior to the commencement of the offering. g. CLASS NOTES ON DUE DILIGENCE i. BarChris case 1. The misrepresentation in the case was that BarChris was saying all the financials are great, when in actuality they are selling all of their debts to a factor and the finances are collapsing 2. The factors have guarantys against BarChris for all these notes 3. So they do an IPO to get money w/ a managing underwriter, underwriting syndicate, underwriters have counsel, there’s a retail group that’s selling to the market, the plaintiffs. 4. Who is liable? [See statutory defendant section above] a. Anyone who signed i. CEO, CFO, treasurer/comptroller, president b. Every single underwriter part of the syndicate c. Accountants i. Liable, but only for financials. d. The Board of Directors—every director is liable even if director did not sign i. D&O insurance doesn’t help you for section 11 liability e. NOT Securities firms in the retail group—their liability comes from 10b-5 or 12(a)(2) [people involved in offering but not on section 11 list] f. NOT Underwriter’s counsel i. Lawyers aren’t subject to section 11 liability, but whoever they represent are bound by lawyer’s actions g. NOT company counsel who drafted prospectus for underwriter/issuer i. Liable for malpractice, not section 11 ii. Lawyers are not experts for everything they draft h. Everyone has a due diligence defense except the ISSUER i. Issuer is strictly liable ii. Is the ‘duty to investigate’ the same for everyone that’s a defendant? 1. No—it changes given the role of the company a. An outside director is different from an inside director. Spring 2013 Securities Regulation 2. 3. 4. 5. b. An outside director w/ insider role is different from outside director w/ outside role c. Insider w/ insider role you’re practically a guarantor—you need to know everything d. Inside director w/ outsider role—you need to know everything See Rule 176 for those different circumstances and items to consider when deciding these issues Inside Insiders a. Virtual guarantors of everything in the registration statement and prospectus b. Read through the entire thing, ask questions if anything comes up, re-draft everything until it’s perfect c. Joint and severally liable if misrepresented Outside Insiders a. Need to read through everything b. Can rely on financials that you’re not an expert w/ regards to c. As a director, must ask questions of uncertified financials that would be reasonable for his position d. Don’t necessarily have to know about negotiations if he’s not part of those negotiations and doesn’t even deal w/ the other parties in those contracts e. If people still send out prospectus/RS when he knows stuff is misrepresented, he has to resign AND tell the SEC he is resigning. He doesn’t have to give reasons for resignation. Outsiders a. He can rely on certified financials b. Has a higher standard for due diligence than the outside counsel drafting the registration statement c. Every word drafted by counsel he is responsible for d. By becoming outside counsel and a director, he’s not necessarily a virtual guarantor e. He didn’t follow up w/ people, examine records available, etc. f. He’s supposed to be looking at contracts and summarizing what they say, and he doesn’t even ask for the contracts. Because he didn’t do this, he didn’t do due diligence. g. At a certain point, after asking these questions, he’ll have a reasonable belief that everything is true. h. he can come to a reasonable belief that everything’s ok relying on others, as long as he does enough diligence and asks enough questions i. if he catches client in a lie, he should resign, tell SEC, and stop being counsel. Fire client. j. The underwriter for bank/director needs to ask lots of questions about what the bank knows or should know k. Establishes idea that underwriters aren’t just in contractual relationship, they’re in a gatekeeper relationship, supposed to be watching out for investors. They have to do more than exercise business judgment. l. Always have to know what you’re signing and read the registration statement. Any red flags—ask questions. i. If no red flags, you’re probably let off the hook. Spring 2013 Securities Regulation III. m. If you have relationship w/ bank, you need to call bank and make sure all financial standing is good. 6. Underwriters a. Worldcom—we get some indication that when you have an ongoing relationship and everything looks ok based on that relationship you’re good. But they’re still required to do high level of due diligence. b. Look over accounting information for red flags, dig deeper if red flags i. Don’t have to dig into certified financials unless red flags. Can rely on accountants. ii. Uncertified information—you can’t rely. You have to ask questions. 1. More than red flags. You’re responsible for them. 7. Accountant/Auditor a. Only responsible for certified information b. Need to ask questions when making these certified financials. c. Needs to look at line item entries w/ regards to the financials of the issuer. d. Do a sample test [1,000 checks arrived, lets see how 30 of them ended up] e. Look at factors contracts that affect your financials. f. Cannot rely on information that issuers or directors give you—you have to make sure all that information is correct. g. The information besides certified financials—not responsible. Off the hook. 0 liability. Shelf Registration a. The offering of a convertible security, the right of convertibility which cannot be exercised until some future date, shall not be deemed to be an offer or sale of such other security, but the issue or transfer of such other security upon the exercise of such right of conversion or subscription shall be deemed a sale of such other security b. Shelf Registrations: Rule 415 i. Issuers can sell registered securities for an extended period of time after the initial effective date without running afoul of the time limitation imposed by § 6(a) ii. Five basic requirements— 1. Only certain types of offerings qualify a. Those sold solely by or on behalf of a person or persons other than the registrant b. Those that are issued upon conversion of other outstanding securities c. Securities the offering of which will commence promptly, be made on a continuous basis, and may continue for a period of more than 30 days d. Securities registered on Form S-3 or F-3 which are to be offered and sold on an immediate, continuous or delayed basis by or on behalf of the registrant 2. Two-year time limit for shelf registration offerings a. Not for S-3 issuers 3. Updating the prospectus and registration statement a. Requires issuer to reflect in prospectus any ‘fundamental’ changes in registration statement 4. ‘at the market’ equity offering by or on behalf of issuer, issuer may only use 415 to qualify for shelf registration Spring 2013 Securities Regulation c. d. e. f. g. a. ‘at the market’ equity offering is an offering of equity securities into an existing trading market for outstanding shares of the same class at other than a fixed price. 5. Three-year limit to shelf offerings registered iii. You graduate directly to an S-3 and you can incorporate all your SEC filings into your prospectus/registration statement Automatic Shelf Registration i. Only for well known seasoned issuers ii. Automatic shelf registration statement and any amendments is immediately effective without SEC review iii. Time limit of 3 years from initial effective date iv. Pays filing fees as securities are sold The Base Prospectus i. Omits information related to the public offering price and underwriters ii. Can omit information unknown or not reasonably available to the issuer iii. Can omit whether offering is primary offering or offering on behalf of persons other than the issuer or a combination, the plan of distribution for the securities, description of the securities registered other than identification of name/class, and identification of other issuers iv. may omit identities of selling security holders and amounts of securities to be registered on their behalf. Applies only for those meeting specific requirements. Underwriters Issue and Liability i. Speed undercuts the ability of underwriters to perform due diligence on the offering necessary if they want to avoid section 11 liability ii. What are they supposed to do when a company goes into these additional public offerings? iii. 10b-5 1. Underwriters are on the hook 2. Underwriters are defendants 3. Plaintiff has burdens to show underwriter materially misrepresented and was aware of falsity, scienter, reliance, causation and damages 4. Must be in federal court 5. Statute of limitations is 1 year 6. Statute of repose is 5 years iv. 11—much easier for plaintiffs 1. underwriter just has to be involved in the misleading registration statement 2. plaintiff must be purchaser – tracing requirement 3. underwriters are defendants under statute 4. plaintiff only has burden of proof for material misrepresentation or omission 5. defendant has burden of proof for defenses a. due diligence, plaintiff ‘knew’, causation not there, and rescission (up to the offering price) 6. can be in federal or state court 7. statute of limitations is 1 year 8. statute of repose is 3 years Overhang i. Shelf registration stock prices typically drop ii. The price drop is known as the shelf registration overhang Asset-backed securities Spring 2013 Securities Regulation IV. i. These issuers are among principal users of shelf registration Damages a. Measuring § 11 Damages i. Rule 10b-5 does not specify how to measure damages like § 11 ii. If the plaintiff sold her shares prior to the filing of suit, damages = the difference between what the plaintiff paid for the shares and the price at which the plaintiff disposed of its shares iii. If the plaintiff still owns its shares at the end of the lawsuit, the damages = the difference between what the plaintiff paid for the shares (up to the exceeding offering price) and the value of the shares at the time of the filing of the § 11 lawsuit iv. If the plaintiff sold its shares after the filing of the suit (but before judgment), damages = the difference between what the plaintiff paid for its shares (up to the offering price) and the price at which the plaintiff disposed of its shares (selling price), if greater than value at the time of the filing of the lawsuit (can’t exceed the value in section I above). v. Beecher v. Able 1. Facts a. Plaintiffs bought debentures based on misrepresentations in prospectus b. Plaintiffs likely have the burden for ‘value’ 2. Issue a. How should the court determine the ‘value’ of the debentures when plaintiffs purchased them? 3. Reasoning a. Plaintiffs argue market price of debenture on date of suit should be lowered to arrive at fair value since the financial crisis of the company was misrepresented i. Had plaintiffs known about the financial crisis, they would’ve paid less for the debentures b. Defendants argue that market price of debenture on date of suit was not reliable indicator of fair value c. Everyone agrees realistic value might be something other than market price, depending on circumstances d. In this case, the market was a sophisticated market and interested in the long range investment and speculative features of the debenture e. Defendant’s immediate financial troubles would likely be viewed as temporary rather than terminal by this market f. Evidence strongly supports the conclusion that the market price on the date of the suit was characterized by panic selling g. Court concludes market price is some evidence of fair value i. Whatever amount might be subtracted to account for temporary financial crisis should be off-set by adding like amount to account for reasonable likelihood of defendant’s recovery h. Market price was also influenced by panic selling i. To correct this, court adds 9.5 points to market price of 75.5 to get 85 as value vi. Loss Causation Defense 1. § 11(e) tells us damage measure depends on difference between offering price and value at the time of filing the suit Spring 2013 Securities Regulation 2. § 11(e) also provides affirmative loss causation defense that allows defendants to reduce their liability if they can prove that the depreciation of the stock’s value resulted from factors other than the misstatement in the registration statement 3. this is a situation where extraneous events are affecting the price 4. Rule 10b-5; plaintiff bears burden of showing loss causation 5. Akerman a. Facts i. IPO price of $4.75 ii. Corrective disclosure to SEC while price is $4.00 iii. Corrective disclosure to public price at $3.25 iv. After corrective disclosure, price goes up to $3.50 b. Defendant said their stock price was just rising and falling with the IPO market—the falls had nothing to do with the corrective disclosures c. Plaintiffs said ok, but the market for these kinds of over the counter companies actually went up significantly more than this company d. Defendants say ok, but this decline happened after talking confidentially to the SEC and the market never knew about those conversations e. Court’s reasoning i. Burden to prove negative causation is on the defendants, but we’ll accept their argument ii. No damages b. Indemnification, Contribution, and Joint & Several Liability i. § 11 starts w/ presumption that all defendants are jointly and severally liable, with 2 exceptions. 1. Limits liability of underwriters to the ‘total price at which the securities underwritten by him and distributed to the public were offered to the public’ § 11(e) 2. Limits liability of outside directors to their proportionate liability § 11(f)(2) 3. If liable, you can seek contribution ‘as in cases of contract’ § 11(f)(1) ii. Eichenholtz v. Brennan 1. Issue a. Should the court enforce indemnification agreements between underwriters and issuers b. Should the court require contribution from settling defendants 2. Holding a. No b. Yes—but only for the proportion they are liable for 3. Reasoning a. There is an express right to seek contribution under § 11, but no express right to indemnification b. Indemnification i. Federal courts disallow claims for indemnification b/c they run counter to the policies of federal securities acts ii. Doesn’t matter whether underwriters played major or ‘de minimis’ role iii. Federal securities laws seek to encourage underwriters to conduct thorough independent investigations Spring 2013 Securities Regulation V. iv. If court enforces indemnification provisions, it would effectively eliminate underwriters’ incentives to fulfill its investigative obligation c. Contribution i. Proportionate judgment reduction method should be used ii. Jury, in non-settling defendants’ trial, will assess the relative culpability of both settling and non-settling defendants, and the non-settling defendants will pay a commensurate percentage of the judgment iii. This satisfies the statutory contribution goals of equity, deterrence and the policy goal of encouraging settlement iv. Non-settling defendants are only responsible for their portion of the liability 4. CLASS NOTES a. Where do we get a statutory argument? b. If the statutory structure is that everyone has to do due diligence, why would a statute allow you to contract out of that due diligence Section 12(a)(1) a. Not an antifraud provision b. Private cause of action for violations of § 5’s gun-jumping rule requirements c. Strict liability for statutory sellers who sell nonexempt unregistered public offerings d. Plaintiff chooses which state to file in (can’t be removed to federal court) if you win you get all the money you paid back, with interest as soon as you give the security back, or you can sue for damages. e. Chart from slide i. All you need is a violation of section 5 ii. You have to be a purchaser and sue a ‘statutory seller’ [see below] iii. None of the misrepresentation requirements are needed 1. You can buy a security knowing there’s a section 5 violation and you can get all your money back if things go bad. iv. You can be in federal or state court v. one year statute of limitations and repose f. Standing and Defendants i. “Any person who…offers or sells a security in violation of section 5…shall be liable…to the person purchasing such security from him…” 1. language seems to imply that the person purchasing can only sue the person who is actually selling (not soliciting) ii. Pinter v. Dahl 1. Facts a. Dahl solicited people to buy securities for an issuer, but he didn’t receive commission b. Investors sued Dahl under § 12(a)(1) 2. Issue a. Was Dahl properly sued under this section, since he didn’t actually hold title to any of the securities 3. Holding a. Need more facts b. Must go back to determine whether he acted gratuitously or received some benefit from soliciting the securities Spring 2013 Securities Regulation 4. Reasoning a. Under the federal securities laws definitions of ‘offer’ and ‘sale’, the range of people potentially liable under § 12 isn’t limited to those who pass title b. The definition of ‘purchased from’ in the statute could restrict § 12 liability to the owner of the security—some courts have held; this court doesn’t c. An interpretation of statutory seller that includes brokers and others who solicit offers to purchase securities furthers the purposes of the Securities Act d. The person who gratuitously urges anther to make a particular investment decision is not, in any meaningful sense, requesting value in exchange for his suggestion or seeking the value the titleholder will obtain in exchange for the ultimate sale e. Fifth Circuit test i. One ‘whose participation in the buy-sell transaction is a substantial factor in causing the transaction to take place’ ii. Don’t adopt this standard b/c it doesn’t rely on words of statute 5. CLASS NOTES a. Black Gold Oil is the entity that sold the limited partnership interests, so that’s actually who passed title b. So why is pinter liable? i. He was the manager that managed all the securities ii. He’s also liable under federal laws because section 15 makes owners liable iii. Under 15, if you control anything that is liable as the seller, you’re liable as the owner due to the control c. So under section 12, the company is liable and pinter is liable by virtue of section 15 d. The counterclaim here is ‘if I’m liable, you are as well Dahl’ e. Pinter himself is liable to the investors—he’s just making a counterclaim that Dahl also has to share that liability f. Pinter argues dahl is a seller under section 12 g. The issue—is soliciting the investment close enough to being like the seller that the person should be liable h. Supreme Court adds a gloss, saying that an offer is one where you’re trying to dispose of a security for value. i. For value means that the sale is motivated at least in part by a desire to esrve his own financial interests or those of the securities owner iii. § 12 liability focuses on the relationship of the participating party and the investor purchasing the securities g. Class hypotheticals i. If you’re a lawyer and you’ve raised money in the private placement, but something went wrong and the private placement is actually a public offering suddenly. Your firm prepared private placement memo, sent cover letter, etc. sent memos to investors, etc. firm was paid for the work. Does your firm face section 12(a)(1) put liability when investors say sorry, we want our money back and we’re going after every statutory seller? 1. Consider this--Court declines to use substantial factor test, because that would expose people to liability that they don’t want to expose, like lawyers and Spring 2013 Securities Regulation accountants. The buyer doesn’t ‘purchase a security from’ those people in any meaningful sense. 2. Answer—when the lawyer takes a nonprofessional role, not just doing his lawerly duties, he becomes a seller. You can’t send solicitations. In this situation and in securities realm, lawyers do NOT disseminate documents. Get the issuer to do that. ii. Limited corporation sells unregistered common stock. One investor is alice, who two months later sells her shares to bob at a loss. Value of the shares declines even further while in hands of bob. 1. Can Bob sue Alice? a. This is a secondary market. Is this transaction a violation of § 5? It’s a sale, unregistered, but is it exempt? Requires that you understand § 4(1) exemption that says any transaction other than by an issuer, underwriter, or dealer, is exempt. If it’s exempt, no cause of action. If A held securities with investment intent (no plan to distribute), the securities have come to rest with A and thus A is not a statutory underwriter under the definition. A is thus an exempt transaction because A is not an issuer, underwriter, or dealer. If she bought with intent to distribute, she’s technically an underwriter and it’s not exempt, and there would be a cause of action. Depends on how you characterize A. the SEC rules say it’s a bright line holding period, other courts say we look at intent regardless of the holding period. SEC’s safe harbor looks only at length of the holding. Now it’s 6 months. 2. Can Alice sue Oil & Gas? a. Is there a violation of § 5? Yes. It’s an unregistered nonexempt sale. A becomes potential plaintiff. A bought from O&G, so O&G is a seller passing title and statutory seller. A has a 12(a)(1) claim and gets her money back plus interest. She no longer holds securities, so she gets rescisionary? damages 3. Can Bob sue Oil & Gas? a. There’s no privity of contract; not an actual passing of title. The question now is 1) violation of § 5? 2) is O&G statutory seller? O&G did violate § 5 by selling to A if there were no protections that said A can’t transfer to others until securities have come to rest with you. If no protections, O&G has set up A to be an underwriter. Those protections go into every private placement. If A sells to somebody else, A is a statutory underwriter; issuer is O&G. no 4(1) exemption for this issuer selling to B through A. O&G was statutory seller to the extent that B received any kind of solicitation, promotional material, etc. through A. does not have to be direct solicitation; can be an indirect solicitation. Particularly strong if O&G had any knowledge that A intended to sell to others. Look to see if O&G engaged in any ‘selling effort’. h. Elements of the Cause of Action i. All plaintiff has to show is a § 5 violation ii. Entitled to get money back in exchange for security iii. Plaintiffs who already sold security can seek damages i. Damages and Defenses i. Defendants have no defenses, unlike § 11 liability ii. § 13 does impose a statute of limitations and statute of repose Spring 2013 Securities Regulation VI. 1. limitations is 1 year from discovery 2. repose is three years from sale Section 12(a)(2) Liability a. Provides private cause of action for misstatements in the prospectus b. Requires material misstatement or omission and use of instrumentality of interstate commerce i. Like 10b-5 and 11 c. Only those purchasing securities have standing to sue i. Like 12(a)(1) ii. Courts apply Pinter to this rule as well d. Rule 159A i. Defines ‘seller’ only to include issuer of securities ‘sold to a person as part of the initial distribution of such securities’ e. Item 512(1)(6) of Regulation S-K i. Purchasers in initial distribution of securities have standing to sue issuer as a ‘seller’ of the securities regardless of the underwriting method ii. Expands the scope of defendants for 12(a)(1) and 12(a)(2) for shelf registration issuers f. CLASS NOTES—statutory scheme of 12(a)(2) i. It says any person who offers to sell a security by means of a prospectus (SEC means for this to mean a written communication that conditions the market); and ii. purchaser doesn’t know about the falsity or omission; and iii. defendant has to claim its own due diligence defense; and iv. therefore there’s liability for rescission v. chart 1. transactional nexus is ‘by means of prospectus’ 2. plaintiff is purchaser 3. defendant is ‘statutory seller’ 4. plaintiff BOP a. material misrepresentation b. plaintiff can’t know 5. defendant bop a. scienter b. causation 6. damages are rescission 7. court is federal or state 8. limitations is one year 9. repose is three years g. Sanders v. John Nuveen & Co. (7th Cir. 1980) i. How lawyers and courts understood 12(a)(2) at this time ii. Issuer issues through underwriter who sends commercial paper to investors 1. Remember commercial paper is exempt from 33 Act registration under 3(a)(3) iii. Remember 12(a)(2) applies anyway, despite no requirement for registration iv. As the underwriter, what are your responsibilities 1. You are selling by means of prospectus according to the 7th circuit 2. You’re using a written document that describes basic terms of this commercial paper and it outlines a quick summary of the finances of this issuer and the market says that’s enough v. As the underwriter, did it exercise reasonable care 1. In this case, underwriter said they knew banks were lending to these investors, no indication of financial difficulty, did their own assessment. Spring 2013 Securities Regulation vi. In this case, 7th circuit said despite due diligence arguments, they didn’t perform the due diligence that should’ve been performed under SECTION 11. So they use the same due diligence standard. vii. Powell writes dissent and says 12(a)(2) should have a more lenient reasonable care standard than section 11 due diligence requirement. viii. Supreme Court denies cert and everyone accepts this 7th circuit reasoning. Then supreme court decision comes along in Gustafson. h. Scope of § 12(a)(2) i. ‘prospectus’ is ambiguous ii. could mean 2 things— 1. any prospectus meeting SEC’s broad interpretation of the definition contained in § 2(a)(10) 2. only prospectuses forming part I of the registration statement which satisfy § 10 of the securities act iii. Gustafson v. Alloyd Co., Inc. 1. Facts a. This is a family business, family owns 100% of alloyd. They decide to sell to Gustafson who sells to Wind point. i. Windpoint is venture capitalist firm b. By buying securities, creating possibility of securities fraud case. If it bought assets, case would’ve never come up c. They have a sophisticated contract, where they used the previous year’s numbers for their financials d. Put a provision in saying if financials were wrong, an adjustment would be made. The contractual remedy is just a readjustment of the purchase price. e. The sale from Gustafson to Wind point is not a violation of § 5 because Gustafson is not an issuer or underwriter, securities came to rest w/ Gustafson. This is a private placement, secondary transaction and therefore exempt. f. Gustafson files a lawsuit against Alloyd alleging securities fraud and negligence under 12(a)(2) and they want to rescind the whole contract; all of the money back. g. They claim the purchase contract was a prospectus and this sale was by means of a prospectus i. Written offer that conditions the market. Document has representations as an attempt to dispose of securities. 2. Procedure a. Alloyd argues prospectus should be defined in broad manner, broad enough to encompass the contract b. Gustafson argues that prospectus means a communication soliciting the public to purchase securities from the issuer 3. Issue a. How does 12(a)(2) define ‘prospectus’ 4. Holding a. A prospectus under § 10 is confined to documents related to public offerings by an issuer or its controlling shareholders 5. Reasoning a. ‘prospectus’ must have the same meaning under §§ 10 and 12 Spring 2013 Securities Regulation b. the liability imposed by 12(a)(2) cannot attach unless there is an obligation to distribute the prospectus in the first place c. reluctant to conclude that 12(a)(2) creates vast additional liabilities that are independent of the substantive obligations in the securities act d. communication under the definition only includes communications held out to the public at large but that might have been thought to be outside the other words in the definitional section 6. Dissent a. To limit the scope of this civil liability provision, the court maintains that a communication qualifies as a prospectus only if made during a public offering b. The § 2(a)(10) definition does not confine 12(a)(2) term ‘prospectus’ to public offerings iv. CLASS NOTES ON GUSTAFSON 1. Gustafson is the Supreme Court making a decision not understanding the Securities Act, but making a decision based on policy grounds really 2. The supreme court doesn’t even begin at 2(a)(10); they begin with the requirements of a § 10 prospectus. 3. Why would they start here? a. They had to figure out some way to say prospectus means something only used in a public offering, so they just decided to start here because it worked for them b. They don’t want those cases in federal court—no private securities litigation in federal court. c. Only public securities offerings in federal court d. Policy reasons 4. How do you deal w/ the provision in the statute itself? a. The court tortures the words of the definition to say ‘communication’ only refers to radio or television, communications to the public at large, not a few people. b. They use a canon of construction to say that we define terms based upon the company they keep. 5. Supreme court reinterprets 60 years of securities law regarding definition of ‘prospectus’ 6. SEC understands the policy and just moves on… 7. Still could’ve filed a 10b-5 action if they wanted i. Class Hypotheticals i. Hypothetical 1 1. It’s a private placement; exempt 2. They can’t rescind; Supreme Court says you can’t use 12(a)(2) even though you used an exact prospectus 3. What if she used Regulation A as her exemption? Says you can sell securities subject to a mini-registration and you get an exemption. 4. It’s a public offering, but exempt. 5. Does the Gustafson analysis apply to only registered offerings, or only to public offerings, whether exempt or not? 6. Answers a. Might depend on sophistication of the buyers b. This is probably not a public offering; it’s an exempt private placement Spring 2013 Securities Regulation c. If you have a nonregistered, nonpublic offering, gustafson’s holding is you don’t get to treat your documents as prospectuses even if they look identical d. What if it’s an exempt public offering? i. Section 10 refers to prospectus used in registered public offering; if we use that in a definition it doesn’t apply ii. Under regulation A exempt public offerings do require a distribution of a prospectus iii. Elsewhere supreme court talks about public offerings differently iv. This is unclear ii. Hypothetical 2 1. It’s a reporting public company and files registration statements 2. Its underwriter sends customers a false newspaper clipping (Freewriting prospectus) about the issuer 3. Is there 12(a)(2) liability? Is this a ‘prospectus’ under 12(a)(2)? a. Answers i. To distribute a free writing prospectus, you have to accompany it with a formal prospectus. Is the free writing prospectus a ‘prospectus’ because it’s accompanied by a prospectus? ii. Here the supreme court has the idea that the only thing that’s a prospectus is the formal prospectus—that’s not this newspaper clipping iii. This is not a prospectus. 4. What if underwriter calls customers and quotes newspaper story? Is false oral statement a ‘prospectus’ under 12(a)(2)? a. The oral communication is subject to 12(a)(2) liability b. There is liability for false oral statements, but not false written statements c. Weird conundrum j. Implications of Gustafson i. Confines 12(a)(2) liability to public offerings ii. Feiner v. SS&C Technologies, Inc. 1. Facts a. Underwriters sold securities to investors, some of whom bought in the secondary market b. Investors sued under 12(a)(2) 2. Issue a. Do investors who purchase on the secondary market lack standing to bring a 12(a)(2) action? 3. Holding a. No 4. Reasoning a. 12(a)(2) only requires that plaintiffs purchase their shares directly from a seller who makes use of a false or misleading prospectus b. Gustafson only drew a distinction between public and private offerings— not initial and secondary markets c. 12(a)(2) ‘seller’ encompasses not only anyone who stands in privity with a purchaser, but also anyone ‘who successfully solicits the purchase of a security, motivated at least in part by a desire to serve his own financial interests or those of the securities owner. Spring 2013 Securities Regulation iii. Aftermarket trading 1. Section 11 claims have been largely unaffected by Gustafson k. Elements of the Cause of Action i. Material misstatement or omission contained in prospectus, and use of interstate commerce ii. No need to show reliance or scienter iii. ‘by means of’ requires some limited causal connection between prospectus and purchaser’s decision to buy the issuer’s security l. Defenses i. One year statute of limitations applies ii. 3 year statute of repose applies iii. defendants can demonstrate plaintiffs knew about the untruth or omission in the prospectus iv. defendants can demonstrate they ‘did not know, and in the existence of reasonable care could not have known, of such truth or omission’ v. section 12(a)(2) has a defense of reasonable care that is less demanding than the duty of due diligence imposed under section 11 vi. section 12(a)(2) makes no distinction based upon ‘expertised’ statements and only requires the defendant to show that it used reasonable care m. Damages and Loss Causation i. Same remedies as those available under 12(a)(1) 1. Rescission if they hold security 2. Damages if they sold the security a. Difference between plaintiff’s purchase price and her sales price ii. Defendants can attempt to show absence of loss causation under 12(b), by providing evidence that the drop in the issuer’s stock price is due to factors unrelated to fraud iii. Miller v. Thane Int’l, Inc. 1. Facts a. Thane Int’l sold securities and the prospectus said they would be listed on the Nasdaq NMS, but in actuality they were going to be listed on the NASDAQ OCBB b. During the nineteen days on the OCBB, the shares traded above market price, then was below $5.00 2. Procedure a. District Court said that the stock price reflected the trading on NASDAQ OCBB and therefore since the price didn’t immediately go down, there was a loss causation defense 3. Reasoning a. Stock price slump in august was compounded by the company’s failure to fin and market the hit product it had hoped for b. The august 2002 earnings report could’ve also caused the loss c. The OTCBB instead of NMS does not necessarily cause the loss Spring 2013 Securities Regulation