Introduction

advertisement

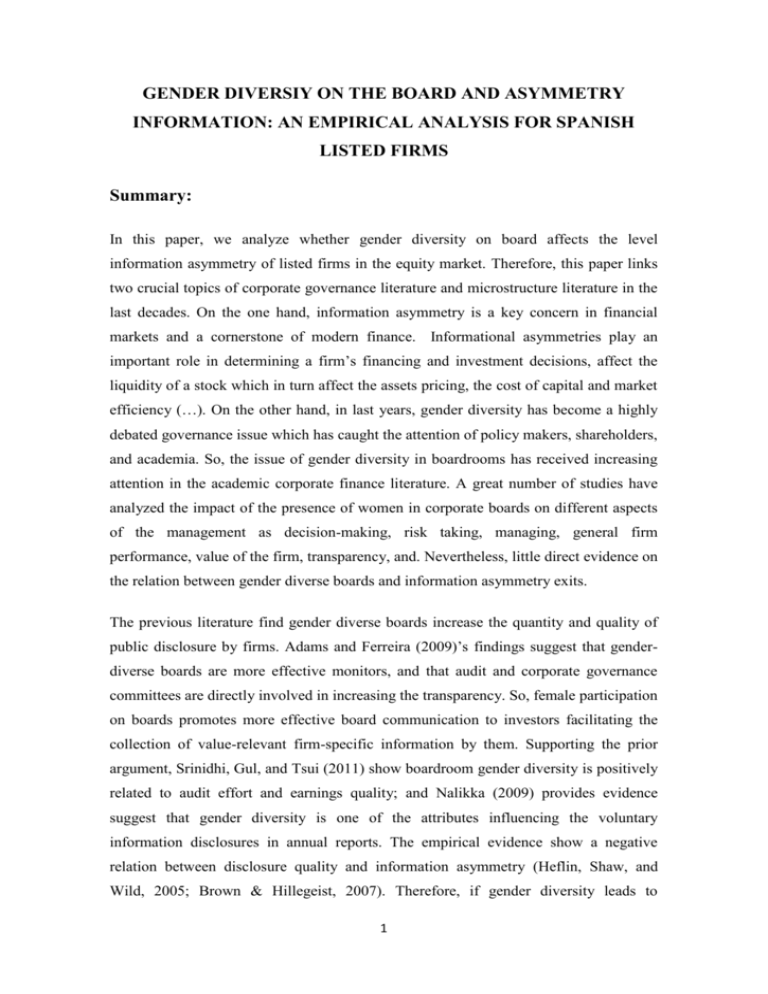

GENDER DIVERSIY ON THE BOARD AND ASYMMETRY INFORMATION: AN EMPIRICAL ANALYSIS FOR SPANISH LISTED FIRMS Summary: In this paper, we analyze whether gender diversity on board affects the level information asymmetry of listed firms in the equity market. Therefore, this paper links two crucial topics of corporate governance literature and microstructure literature in the last decades. On the one hand, information asymmetry is a key concern in financial markets and a cornerstone of modern finance. Informational asymmetries play an important role in determining a firm’s financing and investment decisions, affect the liquidity of a stock which in turn affect the assets pricing, the cost of capital and market efficiency (…). On the other hand, in last years, gender diversity has become a highly debated governance issue which has caught the attention of policy makers, shareholders, and academia. So, the issue of gender diversity in boardrooms has received increasing attention in the academic corporate finance literature. A great number of studies have analyzed the impact of the presence of women in corporate boards on different aspects of the management as decision-making, risk taking, managing, general firm performance, value of the firm, transparency, and. Nevertheless, little direct evidence on the relation between gender diverse boards and information asymmetry exits. The previous literature find gender diverse boards increase the quantity and quality of public disclosure by firms. Adams and Ferreira (2009)’s findings suggest that genderdiverse boards are more effective monitors, and that audit and corporate governance committees are directly involved in increasing the transparency. So, female participation on boards promotes more effective board communication to investors facilitating the collection of value-relevant firm-specific information by them. Supporting the prior argument, Srinidhi, Gul, and Tsui (2011) show boardroom gender diversity is positively related to audit effort and earnings quality; and Nalikka (2009) provides evidence suggest that gender diversity is one of the attributes influencing the voluntary information disclosures in annual reports. The empirical evidence show a negative relation between disclosure quality and information asymmetry (Heflin, Shaw, and Wild, 2005; Brown & Hillegeist, 2007). Therefore, if gender diversity leads to 1 improvements in firm information disclosures and that better disclosures leads to reduce information asymmetry, we expect a negative association between the board gender diversity and the average level of information asymmetry. Since the degree of information asymmetry is not directly observable, empiricists must rely on proxy variables. Both the corporate finance and microstructure literature have developed and used different types of proxies for information asymmetry. Among others, proxies as such analyst forecast, market to book ratio, firm size, accuracy of analyst’ forecasts, or idiosyncratic volatility have employed in the corporate finance studies. Meanwhile, in the market microstructure literature different models and measures have developed to capture financial markets’ perception on the adverse selection that exists between informed and uninformed traders in the market. In this paper, we employ different types of information asymmetry measures on intraday basis from high frequency data: broad measure of transaction costs, such as the relative spread; intraday price impact measures; and imbalance measure, such as PIN. We examine the impact of gender diversity on boards upon information asymmetry using a data panel of 531 firm-year observations in the period 2003-2009 from a sample of 119 companies listed on the Spanish Stock Exchange. We use the generalized method of moment (GMM) dynamic panel technique to control the unobservable heterogeneity and endogeneity effect. We find a negative relationship between the gender diversity and the degree of information asymmetry in the market. This paper contributes to the prior literature integrates corporate governance and information asymmetry in several ways. First, it adds to the very scarce empirical evidence on the association between women on corporation boards and the information environment of firms. Second, the studies using microstructure proxies for information asymmetry to analyze how different characteristics of board composition affect firm information environment are also scarce. Besides these earlier studies do not include the board gender diversity in their analyses (Kanagaretnam, Lobo, and Whalen, 2007). Third, we use more sophisticated proxies for gender diversity, like Blau and Shannon diversity indexes, than the prior studies. We consider that these measures are rough proxies for gender diversity because, for example, a value of 100% of women would mean a total absence of diversity. However, diversity indexes have been suggested as an optimal measure of diversity to capture variations within a group of people. 2 Finally, this paper provides evidence from Spain, one of pioneer countries in developing laws to encourage the presence of women on director boards. Following the example of a Norwegian law enacted in 2003, in 2007 Spain passed guidelines (Ley de Igualdad, Gender Equality Act) to encourage companies to increase the share of female directors to 40% by 2015. Companies reaching this quota will be given priority status in the allocation of government contracts but there are no formal sanctions. Later other European countries (among others, France, Italy, Belgium, Austria, Germany) are considering significant actions and enacting laws to improve the gender balance of corporate boards. Consequently, the boardroom gender diversity has become a key policy focus in many countries as well as has generated an intense debate on its effects on the corporate governance and firm performance in the academic and professional literature. Our paper provides evidence of that the board gender diversity are negatively related to information asymmetry in the stock market, which can be of interest to investor, managers, regulators and standard setters. References Adams, R.B. and D. Ferreira, 2009. Women in the boardroom and their impact on governance and performance, Journal of Financial Economics 94, 291-309. Brown, S. and S.A. Hillegeist, 2007. How disclosure quality affects the level of information asymmetry. The Review of Accounting Studies 12, 443-477. Heflin, F., K.W. Shaw, and J.J. Wild, 2005. Disclosure quality and market liquidity. Contemporary Accounting Research 22 (4), 829-865. Kanagaretnam, K., G.J. Lobo, and D.J. Whalen, 2007. Does good corporate governance reduce information asymmetry around quarterly earnings announcements? Journal of Accounting and Public Policy 26, 497-522. Nalikka, A., 2009. Impact of gender diversity on the extent of voluntary disclosure in annual reports. Journal of Accounting and. Taxation 1:1, 101–113. Srinidhi, B, F.A. Gul, and J. Tsui, 2011. Female directors and earnings quality, Contemporary Accounting Research 28, 1610-1644. 3