WORD - Ghana Revenue Authority

advertisement

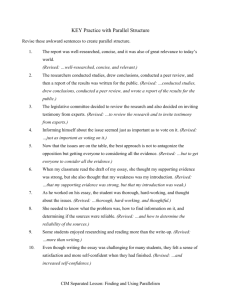

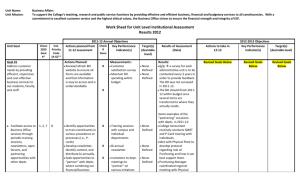

GHANA REVENUE AUTHORITY DOMESTIC TAX REVENUE DIVISION COMPANY SELF ASSESSMENT FORM REVISED ANNUAL ESTIMATE CURRENT TAX OFFICE LTO MTO STO (Tick One) Name of GRA Tax Office YEAR OF ASSESSMENT (yyyy) PERIOD: FROM TO (dd/mm) Select currency in which data is presented. GH¢ (dd/mm) US$ £ € COMPANY NAME NEW TIN OLD TIN IRS TAX FILE NO COMPUTATION OF TAX (Please refer to the completion notes overleaf for guidance in completing this form) AMOUNT 1. Revised Annual Chargeable Income 2. Revised Annual Total Income Tax payable 3. Amount Already Paid/ Earlier Installment 4. Revised Total Amount of Tax Due 5. Number of Quarters Outstanding 6. Amount to be paid / Each Remaining Quarter DECLARATION I, hereby declare that the Information in this form is true and accurate. (Full Name) Signed Designation / Position Date DT 0102a ver 1.0 COMPLETION NOTES ON COMPANY SELF ESTIMATED FORM This form gives a summary of the Estimated Computation of Tax for a Self-Assessed Company NB: A new form is to be completed at any time the Estimate is revised The fields to be completed are: CURRENT TAX OFFICE : The GRA office where taxpayer transacts business YEAR OF ASSESSMENT: This is the financial year to which the return relates PERIOD: This refers to the beginning and end of the basis period (The Accounting year ) of the Company NAME OF COMPANY: This is the legally registered name of the company NEW TIN: This the new TIN (eleven characters) - Taxpayer Identification Number OLD TIN: This is the old TIN (ten characters) - Taxpayer Identification Number IRS TAX FILE NUMBER: This is the number assigned to the company by the former Internal Revenue Service POSTAL ADDRESS: This refers to the postal contact address of the company REVISED ANNUAL CHARGEABLE INCOME: This is the revised estimated annual income that is to be subjected to Tax, i.e. the figure which is charged to tax at the various corporate tax rates per the schedule of corporate tax rates attached. REVISED ANNUAL TOTAL INCOME TAX PAYABLE: This is the revised estimated annual income tax to be paid to the Ghana Revenue Authority. AMOUNT ALREADY PAID/ EARLIER INSTALLMENT: This is the Amount paid earlier from an earlier estimated annual total income tax payable OR Revised annual total income tax payable REVISED TOTAL AMOUNT OF TAX DUE: This refers to the amount due GRA by deducting Amount already paid/ earlier installment form Revised annual total income tax payable NUMBER OF QUARTER(S) OUTSTANDING: The number of quarter(s) remaining to end the financial year of the Tax payer AMOUNT TO BE PAID/ EACH REMAINING QUARTER: The remaining estimated annual income tax to be paid to the Ghana Revenue Authority at the end of each remaining quarter. DECLARATION. This must be done by an authorized officer of the company and the required details that include the following Should be completed: i. Name in full ii. Designation/position iii. Signature iv. Date DT 0102a ver 1.0