Turnover Time and Its Relation to the Rate of Profit

advertisement

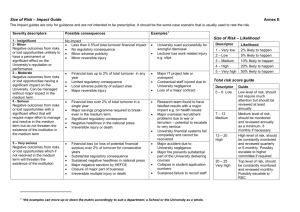

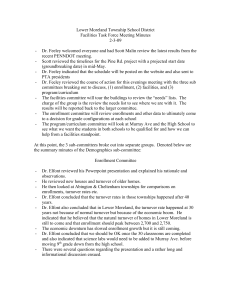

Turnover Time and Its Relation to the Rate of Profit Hyun Woong Park UMASS, Zhun Xu UMASS 2010 Oct 17 Economy of time, to this all economy ultimately reduces itself. Marx, Grundrisse, p.173 I. Introduction The rate of profit is the major Marxian variable that indicates overall workings of the capitalist economy.1 And its falling tendency in relation to crisis has been a subject of intense debate in Marxian literature. Yet there has been no agreement on the determinants of the tendency. Profit squeeze theory (Weisskopf 1979, Wolff 1986, etc.) and rising organic composition of capital (Marx 1981, Shaikh 1978, Weeks 1981, etc.) have been the two most widely accepted approaches. The increase of the ratio of unproductive labour to productive labour as a major determinant of the falling rate of profit was also discussed as an alternative explanation (Moseley 1990, 1997). In addition, the increase in the rate of surplus value was pointed out as a main factor that generates a counter-tendency.2 However, one important element which plays no less important role in Marx’s discussion of the rate of profit and crisis has been more or less downgraded in the literature: i.e. turnover time. In various places in Capital Volume II Marx indicates turnover as one of the most important categories in direct relation to profitability. As is well-known, the major theme of Volume II is the circuit, the life cycle, of capital comprising the production process and the 1 A distinctive feature of capitalist mode of production lies in the fact that its primary aim is producing more (surplus) value not use-value; thus its production process amounts to valorization process. For this reason, “the rate of which the total capital is valorized, i.e. the rate of profit is the spur to capitalist production (in the same way as the valorization of capital is its sole purpose.)” (Marx 1981, p.350-1) The importance of the rate of profit in the analysis of capitalism is well demonstrated in Dumenil & Levy (1999, p.7) 2 The law of falling rate of profit itself was refuted by the so-called Okishio Theorem (Okishio 1961, Roemer 1977, Parijs 1980, etc.). 1 circulation process in their unity. The gist is to conceive capital as a process which spans a certain time period. And turnover is introduced as a fundamental concept that reflects the time structure of capital. An implication is that, simply put, it takes time or has to risk time to produce and realize surplus value since the variable capital generating surplus value has to go through a certain time period of circuit along with its constant counterpart. Therefore a conclusion is derived that turnover time is one of the factors that significantly affect the profit rate of capital. An implication that follows is that manipulating the turnover time is what capitalists can rely on at times when the profitability conditions get deteriorated. In this regard Marx’s demonstration of turnover provides an insight in understanding characteristic phenomena of the modern industrial capitalism where various cutting-edge technology are intensively utilized in time-management so as to affirmatively respond to the aggravating environment for the business, and to acquire more profit in a given period of time; as Dell founder Michael Dell says, “The closer you get to perfect information about demand, the closer you get to zero inventory. It's a simple formula. More inventories mean you have less information, and more information means you have fewer inventories.” Indeed, turnover is one of the categories that distinguish Marx’s theory of capitalist production from that of neoclassical economics which does not consider time structure.3 Given such an important theoretical status and implications of turnover within Marx’s theory, it is quite striking to find that the concept has not drawn due attention in the literature. Among a few articles that came to our view, Webby & Rigby (1986) and Fichtenbaum (1988) were the ones that directly deal with turnover time in their empirical study of the trend of profit rate. In large, we adopt their method in constructing the turnover rate and extend their results, which cover pre-Neoliberal era, into quite recent years. In this way we could compare the trend of turnover rate in the so-called Golden Age capitalism when the business environment was rather ‘peaceful’ and in the Neoliberal era when all-round competition among capitalists drastically increased. The paper is presented in the following order: In section two we examine Marx’s discussion on the turnover and its relation to the rate of profit throughout Capital. And in Pointing at this, Haass (1992, p.118) writes “The problem of evaluating time lags as distinct from quantities, however, directly challenges the most basic assumption of neoclassical price theory: the concept of marginal productivity.” Dymski (1990, p.42) relates the absence of a consideration of time in Walrasian general equilibrium theory to its indifference to money and credit. 3 2 section three Webby & Rigby (1986) and Fichtenbaum (1988) are discussed. Explanations on the method and data set adopted in this paper will be given in the fourth section. And the empirical results will be presented in section four. In the last section we provide a case study of food industry as our conclusion of this paper. II. Turnover and its relation to the rate of profit In this section we examine Marx’s analysis of the concept of turnover and its relation to the profit rate. Marx on turnover (i) Theory The most systematic demonstration of the concept can be found in Part Two of Capital, Volume Two. In particular Chapter 7, 8, and 9 need a careful examination. There the most difficult aspect of the concept arises when considered in relation to the fixed capital. In Chapter 7 Marx introduces the concept of turnover with an assumption of the absence of fixed capital, and in the following chapter discusses the distinction between fixed capital and circulating capital. And in chapter 9 the concept is analyzed with the fixed capital taken into account. Throughout these discussions two conceptually different approaches to ‘turnover’ seem to emerge: - 1st notion of turnover: ‘the sum of the time of circulation and that of production’; or, ‘the interval between one cyclical period of the capital value and the next.’ - 2nd notion of turnover: time taken for the advanced capital value to return to its initial form recovering its initial amount.4 Both definitions emerge from the analysis of the circulatory nature of the capital circuit of the forms M ...M ' (the circuit of money capital) and P...P ' (the circuit of productive 4 The same definition is derived in Chapter 16 as well, where it is emphasized that turnover is directly related to the concept of ‘advanced.’ According to it, “the capitalist value is always advanced and not genuinely spent, in that once this value has gone through the various phrases of its circuit, it returns again to its starting-point, and, moreover, it does so enriched with surplus-value. This is what characterized it as advanced. The time that elapses between its point of departure and its point of return is the time for which it is advanced. The entire circuit which the capital value undergoes, measured by the time from its advance to its reflux, forms its turnover, and the duration of this turnover is a turnover time.” (Marx 1978, p.382) 3 capital). Namely, the capital value advanced returns to its initial form (either the money form or the form of productive elements) in order to repeat the same process; what is more, it repeats the same process in order to be perpetuated and valorized.5 Capital value that has ‘perpetuated valorization’ as its nature is subject to a circular movement, constantly returning to its initial form after a series of processes. Marx writes “[This] circuit of capital, when [it] is taken not as an isolated act but as a periodic process, is called its turnover.” 6 One period of cycle which the advanced capital value goes through and recovers its initial form at the end is consisted of production and circulation process. From this it necessarily follows that the two definitions of turnover coincide with each other. In other words, the capital value advanced is recovered with surplus value only after it has gone through the combined cycle of production and circulation process. However, this holds only with an unrealistic assumption: the absence of fixed capital. The distinction between circulating and fixed capital as resulting from the circulatory aspect of the capital lies in that the circulating capital goods enter both the labour process and the valorization process in their entire physical shape, while this is the case for the fixed capital goods only in the labour process.7 So to speak, contrary to the circulating capital goods, the fixed capital goods transfer their value to the final output only gradually. Obviously, the time for the fixed capital goods to completely recover their initially advanced form cannot be identical with, but should be longer than, the time lasting for one cycle of production and circulation. Marx recognizes this so well, and it is in Chapter 9 where he analyzes “how two new forms which capital obtains as a result of the circulation process [i.e. fixed capital & circulation capital] … affect the form of its turnover.”8 Now if the first definition of turnover is adopted the turnover time wouldn’t be affected by the existence of the fixed capital. However when we take the second definition, the problem arises how to conceptualize the notion of turnover and its duration in case of the capital constitutive of both circulating capital goods and fixed capital goods with various turnover times. Marx’s solution is ‘the average turnover of its different component parts.’ 9 But he merely cites an ‘American economist’ Scrope’s 5 6 7 8 9 Marx 1978, p.235 Marx 1978, p.235 Marx 1978, p. Marx 1978, p.236 Marx 1978, p.262 4 numerical example of the calculation of the average turnover rather than providing his own case. We briefly reproduce it here with numbers changed.10 A total capital value advanced is $100,000. One half of it is invested in the first fixed capital goods which turn once in twenty five years; four tenths of it is invested in the second fixed capital goods which turn once in five years; the remaining one tenth is invested in circulation capital goods which turn four times in one year. Then the capitalist’s annual expenditure would be $50, 000 25 $2, 000 $40, 000 5 $8, 000 $10, 000 4 $40, 000 ____________________________ $50, 000 . From this Scrope calculates that the average turnover of the various components of the capital is 2 years by reasoning that the capitalist’s ‘annual expenditure’ is $50,000, and that the total capital advanced is $100,000. The fallacy of this approach is immediately obvious. The pinpoint here is the difference between capital ‘expended’ and capital ‘advanced.’11 In Scrope’s case, capital is said to turn over when its initial total value is expended in the process of capital circuit regardless of whether it completely recovers its initial form. Accordingly, turnover time is conceived as time taken for the entire expenditure of the amount identical to the total capital value. However, this is not what the second definition of turnover refers to. It is the time taken for the capital value to recover its initial form in its initial magnitude. The correct calculation would be as follows: The entire value of circulating capital goods of $10,000 is always recovered at the end of each cycle and advanced again in the next cycle, and thus the same is true at the end of each year as well. For the fixed capital goods, $10,000 (depreciation of the first fixed capital goods $2,000 + that of the second fixed capital goods $8,000) would be recovered at the end of each year. Therefore, at the end of year 9 the capitalist would have in her pocket $10,000 of circulating capital returned and $90,000 of fixed capital returned. The entire capital value initially advanced $100,000 is fully recovered in 9 years. Thus the correct 10 Notice that Marx assumes there is no surplus values creation, and this assumption does not affect the result of the examination of the essential relation between fixed capital and turnover of capital. 11 See footnote 6 as for the difference. 5 turnover time should be 9 year. Whether Marx approves Scrope’s method is somewhat vague since he merely cites it and does not make any comment on the calculation itself. Yet despite the incomplete and rough nature of Volume II and the difficulty, as Marx himself admits, of the issue itself, we think the core idea of the second definition of turnover and of the average turnover time is clear enough. And according to it, Marx would have rejected Scrope’s approach. One problem with Marx’s (incomplete) theory of turnover is that he seems to think that the consideration of fixed capital modifies one concept of turnover to the other. This is also true with Engels. Observing that “In commercial practice, the turnover is generally worked out only roughly,” he comments “It is assumed that the capital has turnovered over once as soon as the sum of commodity price realized reaches the sum of the total capital applied. But the capital can have completed a whole cycle only if the sum of the cost prices of the commodities realized equals the sum of the total capital.” (Capital III, p.334-5) However, better way to theorize turnover is to conceptualize its two distinctive definitions as referring two different types of turnover. To put it differently, whether or not fixed capital is existent, we can conceive without any hinderance those two different types of turnover. Of course they would coincide with each other only in a special case when there are no fixed capital goods. And we can also measure at least conceptually the first definition of turnover even when there are fixed capital goods. Actually, this approach is what Marx and Engels seem to take, as can be verified in their discussion of turnover in relation to the rate of profit in Volume 3. That is, with the term ‘turnover’, they solely refer to the first type of turnover (as a sum of production time and circulation time). Measurement issue as well is confined to this type of turnover, to which we now turn. (ii) Measurement First of all, the main problem with measuring the turnover cycle as a sum of production time and circulation time is that it is not immediately known; indirect ways to calculate it using accounting data need to be devised. As mentioned above, Engels makes a comment in an editorial note that “In commercial practice, the turnover is generally worked out only roughly.” In Chapter 4, Volume 3 written by Engels, it is suggested to calculate the number of turnover during the year by dividing the annual expenditure of variable capital by variable 6 capital advanced. That is, n V v (1) where n: the annual number of turnover, V: annual expenditure, and v: variable capital advanced at the start of the year. Actually, this approach is adopted by Marx already in Chapter 16 of Volume 2 where the turnover of variable capital is discussed. The problem of this approach however is that, as Engels rightly complaints, “The capitalist himself does not know in most cases how much variable capital he employs in his business …. Even if he were to keep a separate record for wages paid, this would simply indicate the total sum paid at the end of the year, i.e. vn [=V], and not the advanced variable capital v itself.” (Capital III, p.167) In a word, it is almost impossible to get data for the variable capital advanced; this is true even to this day! Since “the only distinction within his capital that impresses itself on the capitalist as fundamental is the distinction between fixed and circulating capital,” Engels comes up with an unique way to calculate v so as to eventually measure n as follows: Since circulating capital ( Cc ), which is consisted of constant part of circulating capital ( cc ) and variable capital ( v ), is known,12 the ratio by which circulating capital ( Cc ) is consisted of cc and v would be identical to the ratio of the annual expenditure on constant part of circulation capital ( CC ) to that on variable capital ( V ), both of which are also known data. Thus, v Cc V CC V (2). Combining equations (1) and (2) we finally get the annual number of turnover as: n CC V Cc (3). In words, if the sum of the annual expenditures on the constant part and variable part of the circulating capital is divided by the circulating part of the total capital advanced, we would get the annual number of turnover. Marx on the relation of turnover and the profit rate Marx’s systematic discussion of the relation between the turnover and the rate of profit is 12 The circulating capital would be the total capital advanced less the fixed capital. 7 found in two places throughout Capital13; Chapter 16 of Volume 2 and Chapter 4 of Volume 3. To begin with, the rate of profit is measured as an annual rate with the annual production of surplus value divided by the capital value advanced at the start of the year not by the capital expended or turned over during the year.14 That is, the profit rate measures the ratio of the annual flow of surplus value on the stock of capital value. Here the turnover time affects the rate of profit by directly influencing the magnitude of surplus value produced during the year. Let us examine Marx’s analysis more closely. First of all, the relation between turnover and production of surplus value is discussed in Chapter 16 of Volume 2 titled ‘The Turnover of Variable Capital’. As the appropriation of surplus value is directly associated with the employment of the variable capital in the production cycle, the more frequently the variable capital goes through the production cycle along with the constant capital the more surplus value would be appropriated. Thus we have: S sn (4) where S: annual appropriation of surplus value, s: appropriation of surplus value in only one production cycle. Now dividing both S and s by variable capital advanced v gives us: S s n , S ' s 'n v v (5) where S’: annual rate of surplus value and s’: real rate of surplus value, using Marx’s terminology. Then the discussion is expanded to the rate of profit in Chapter 4 of Volume 3 titled ‘The Effect of the Turnover on the Rate of Profit.’15 As noted earlier, Marx constructs the annual rate of profit as an annual flow of surplus value over the stock of capital value advanced as Turnover as an essential aspect of capital is elaborated in Grundrisse p.537-544. For example, “It follows from the relation of circulation time to the production process that the sum of values produced, or the total realization of capital in a given epoch, is determined not simply by the new value which it creates in the production process, or by the surplus time realized in the production process, but rather by this surplus time (surplus value) multiplied by the number which expresses how often the production process of capital can be repeated within a given period of time.” (Grundrisse, p.544) 14 Marx 1981, p.165. See the footnote 6 above for the difference of capital ‘advanced’ and capital ‘expended.’ Dumenil & Levy point out the same idea: “A model with fixed capital accounts for the fact that capital is not consumed in one period, but lasts several periods and is, consequently, a stock. It is necessary to distinguish the cost (the productive consumption) from the advance which must be used in the denominator of the profit rate.” (Dumenil & Levy 1993, p.54) 13 15 This chapter is written by Engels. 8 follows: S S p' v c v c 1 v (6) Where c: constant capital advanced, v: variable capital advanced.16 Now in order to grasp the influence the turnover has on the rate of profit, combine (4) and (6) and we have s n sn p' v , c v c 1 v (7) The positive relation of the turnover to the rate of profit is evident in the equation. However, Marx himself ignores it in Part 3 of Volume III where he analyzes the tendencies and countertendencies of the rate of profit to fall. c In Chapter 13 of Volume III a rise in the organic composition of capital ( ) associated v with a technological development is discussed as major determinant of the tendential fall of s the rate of profit; whereas in Chapter 14, Volume III the rate of surplus value ( ) comes at v the center of the analysis of the counter-tendencies. But no word is given to turnover. Marx does not distinguish surplus value appropriated during the whole year (S) and that during one production cycle (s). As an editor Engels makes a supplementary remark in a parenthesis that Marx is assuming that S is identical to s which is the same thing to assume capital turns over only once during the year. (Capital III, p.334-5)17 The implication is not small. If we are confined to such assumption, our behavioral analysis of the capitalist in counter-acting to the tendential fall of the profit rate would be confined to the management strategies within the production site. The elements Marx discusses in Chapter 14 as counteracting factors all belong to this category.18 The problem 16 To avoid a confusion in notation, notice that total capital value advanced can be think of two ways; consisting of fixed capital ( C f ) and circulating capital ( Cc ), or of constant capital ( c ) and variable capital ( v ). Thus it holds C f + Cc = c + v . 17 Also considering the fact that the chapter on the relation between the turnover and the rate of profit, i.e. Chapter 4 of Volume 3 is written by Engels, Engels seems to be more sensitive than Marx to this issue at least in Volume 3. 18 They are i) more intense exploitation of labour, ii) reduction of wages below their value, iii) 9 with this is that other possible capitalist strategies related to the circulatory nature of the capital circuit as a periodic process constituting various phases of production and circulation escape from our attention. It is our argument that increase of the velocity of capital should have been included as one of the major counteracting factors to the tendential fall of the profit rate. One last comment on Engels’s treatment of turnover in Chapter 4 of Volume 3 relates to another important issue of fixed capital. Notice that when fixed capital is taken into consideration the rate of profit is constructed as follows: p' S sn C f Cc C f Cc (8) where C f is the value of fixed capital advanced. The profit rate considered here is an annual rate; and fixed capital goods may possibly have a life cycle of longer than a year depreciating across its life span of several years, i.e. C f getting smaller as time goes by until it is entirely used up and thereby new investment on fixed capital goods is made. As a consequence, the rate of profit should grow larger as fixed capital depreciates decreasing the denominator of the profit rate equation. This strange phenomenon is not adequately observed and addressed in that Chapter. Indeed this issue involves theoretical and practical difficulties in dealing with turnover and depreciation of fixed capital, which are all left unattended in Engel’s treatment of them. III. Previous Studies In this section we examine Webby & Rigby (1986) and Fichtenbaum (1988). One of the main methodological advance Webby & Rigby made is to use the accounting scheme that “distinguishes wages paid (annual cost) from the variable capital advanced [at the beginning of each cycle].” This method is much more realistic than not so doing as was the usual case with previous literature. It is because since “wages are paid at fixed intervals, the total wage bill does not have to be advanced at the beginning of each production period.” (Webby & Rigby 1986: 43) This exactly confirms to our main interest in the circuitous nature of capital production. Webby & Rigby explain that distinguishing between, to use our notations, V cheapening of the elements of constant capital, iv) the relative surplus population, v) foreign trade, and vi) the increase in share of capital. 10 and v is based on their critique of previous empirical works that makes an unrealistic assumption that the number of turnover is one each year. Admitting the difficulty faced by the previous studies of getting data on the turnover, they suggest to calculate it using other available date. Their method of measurement is exactly the same with that suggested by Marx & Engels; equation (1) for the number of turnover i.e. n V 19 . And the way they measure variable v capital advanced, which is not readily known as we have mentioned, is also the same with that of Marx & Engels, i.e. equation (2) v Cc V . Note that as a proxy for the CC V circulating capital Cc , they use ‘the owned inventory’ which is consisted of “raw material held, goods in process and finished goods of own manufacture at plant and warehouse.” Actually such ‘owned inventory’ is not a precise proxy for the circulation capital since it is embodied not only with variable capital advanced ( v ) and circulating part of constant capital advanced ( cc ) but also the depreciated part of fixed capital. However, we follow Webby & Rigby’s method due to the lack of better proxy. And an assumption is made that the ratio by which the owned inventory is consisted by cc and v is the same with the ratio by which the total annual expenditure on circulating capital is consisted of annual expenditure on variable capital ( V ) and that on circulating part of constant capital ( CC ). Remind that this assumption is the same with Engel’s idea for calculating the variable capital advanced as in equation (2). Lastly, Webby & Rigby calculate CC as the sum of depreciation, raw material and fuel. Using this method for the Canadian manufacturing industry and projecting the relation between the rate of profit and turnover rate during 1950~1980, Webby and Rigby report that the rate of profit steadily decreased and the number of turnover slightly increased fluctuating around the average of 4. That is, they identified an inverse relation between the rate of profit and turnover signifying that the increase of the turnover rate was not sufficiently large to offset the other forces that cause the fall in the profit rate. Similarly to Webby & Rigby, Fichtenbaum (1988) points out the confusion between the 19 To be more precise they include another parameter that takes into account the extent to which the wage payment is delayed as is usually the case in reality. This parameter would have a positive relation with the number of turnover. However we disregard it to simplify our discussion, which does not belittle our main discussion. 11 annual rate of surplus value ( S ' ) and the real rate of surplus value or exploitation rate ( s ' ) – see equation (4) and (5) above – as a major flaw of previous studies caused by not incorporating the turnover rate in measuring profit rate. Keeping in line with Webby & Rigby’s 1986 work, Fichtenbaum goes beyond them by examining the effect of turnover on the business cycle. More concretely, he does a regression analysis of the effect of turnover along with other parameters such as the real rate of surplus value and organic composition of capital on the cyclical change of industrial production and capital utilization. And he reports the affirmative result that the turnover rate and real rate of surplus value have a positive effect on the two business cycle variables, i.e. the cyclical change of industrial production and capital utilization, and that the organic composition of capital has a negative effect. As for the method of measurement, everything is almost the same except one: Fichtenbaum does not adopt the assumption used in equation (2). Recall that given the equation for the turnover rate as n V , for Webby & Rigby and Engels V is known and v the unknown v could be calculated from the other available data and thus finally n can be measured. On the other hand Fichtenbaum, who does not accept that v can be calculated with other known variables, attempts first to calculate n using other data, and then measures v from V and n . Fichtenbaum’s idea is the following: “Turnover, in general, is measured by taking the ratio of a flow to a stock which tells us the number of times of the stock is contained in the flow. Turnover, in the manufacturing sector is therefore calculated by taking sales (value added less the change in the inventory of finished products) which is a flow, and dividing it by the total inventory of the manufacturing sector which is a stock.” (Fichtenbaum 1988: 224) IV. Method and Data In order to construct consistent series of turnover cycles and profit rates, we use data solely from bureau of economic analysis (thereafter BEA). The details of variable construction are briefly explained below. 1) Turnover construction We have observed above two approaches to empirical measure of turnover rate. The first 12 version is n CC V , namely the ratio between annual expenditure on the constant and Cc variable parts of circulating capital and circulating capital advanced. The second version can be written as . The latter is a more loosely defined turnover, which captures the core information of Marxian turnover, that is the number of production cycles needed to recover the investment spent by capitalists. The technical issue here is how to turn these constructions into operational variables. For the first version, due to lack of information about annual circulating capital from BEA data, we turn to the closest proxy: annual total expenditure on compensation and other “wear and tear” costs calculated by subtracting profits from gross income. The circulating capital advanced is calculated as the sum of depreciation and inventory which is normal practice. For the second version, since no information of total revenue is available, gross income is used instead. Therefore, the two versions of turnover can be rewritten as below20: Webby & Rigby type: Fichtenbaum type: The final complete dataset includes annual turnover in both versions for manufacture sector as a whole and also separate series on durable and non-durable goods with the said sector during 1948-2008. 2) Profit rate construction In this research, only the current cost measure of fixed asset is used to calculate profit rates. The simple construction of profit rate is: 3) Smooth the dataset 20 The data for these variables are taken from BEA NIPA Table 6.1 B,C,D (gross income), Table 6.16 B, C, D (profits), Table 5.7.5 A, B (inventory), Table 3.4 ES (depreciation), Table 3.3 ES (fixed assets). 13 The remaining technical issue here is how to reconcile the industry classification change from Standard Industrial Classification (SIC) 1972 to 1987 and to North American Industry Classification System (NAICS). In this dataset, the fixed assets and depreciation data are both consistently measured based on NAICS; however, gross income, profits and inventory experienced classification system changes. In particular, the data between 1972 SIC and 1987 SIC are dramatically different from the break point in 1987, on the other hand, we did not observe a similar structural break between 1987 SIC and NAICS at the break point 1998. Although in general the data between systems are not comparable, it makes sense to adjust the turnover series to make a smooth data as long as the trend does not change, because after all we are only interested in the trend and its relationship with profit rates. Therefore, the pre1987 data are divided by 4 to make the series smooth; at the same time, separate analysis will be conducted to examine the issues we are interested at. V. Results Figure 1. The rate of profit of US manufacturing for 1948-2008 We have largely the similar result with those reported in the previous literature on the empirical study on the historical trend of the rate of profit using the current-cost approach. It shows a downward trend of the rate of profit during the whole the postwar period until around 1980 where it starts to peak up but not fully, around one third of the highest peak in 1953. 14 Figure 2. The two versions of turnover rate in US manufacturing for 1948-2008 Figure 2 projects the trend of two different versions of turnover rate. As can be seen from the way they are constructed the only difference is that as for the numerator profit is subtracted from gross income for the first turnover rate and no such subtraction for the second one. Therefore, the two trends show a similar pattern with a gap reflecting the profit. The trend of turnover rate was more or less flat during the post-war period. This flat trend staying at a high level (approximately 5 in one case and 7 in the other) in this period reflects a certain character of business environment which does not enforce the capitalists to ardently rely on turnover strategy to adjust the time structure of their business. That is, we might conjecture that even though the rate of profit during this period was on the decreasing trend the business environment was agreeable so that the capitalists were able to maintain the high level of turnover rate and satisfied with that currently high level. But the trend went through a steep fall in 1973-1974 when the oil crisis occurred and stayed low until early 1980s when it started to peak up. And it shows a well-worked out increasing trend during the so-called neoliberal era almost recovering its post-war period level at around the middle of 1990s at least for the first version of turnover rate. Probably the worst profitability and the crisis in the early 1980s, the latter of which can be seen as a continuation of the one started from around the middle of 1970s, spurted the capitalists to heavily rely on increasing the turnover rate as one of the main management strategies to improving the profitability conditions. As the upward trend of the rate of profit during the same period evidences, the capitalists’ turnover strategy seems to be successful. Yet another 15 steep plunge of the turnover rate at around the middle of 2000s where the economy was experience a boom remains to be explained with more concrete data analysis and case studies. Figure 3. The relation between profit rate and the turnover rate 1. Figure 4. The relation between profit rate and the turnover rate 2. The relations between the profit rate and two different versions of turnover rate respectively are plotted in figure 3 and 4. Even though the first one shows a rather less consistent relation compared to the second, both of them largely reflects Marx’s basic idea on turnover as observed in this paper, namely that the turnover rate is in positive relation to the profit rate. In the next section we intensify our theoretical arguments and the empirical results through the 16 case study on the US food industry. VI. Case study: The role of turnover in restructuring food industry It is the nature of capitalism to try to decrease turnover time (or increase turnover) as far as it could. However, as we have seen in the previous sections, the actual turnover did not always see an increase. With some abstraction, we can differentiate the determinants of turnover into three segments: internal labor control, technical progress, market conditions; the former two determines production time and are often time indistinguishable, while the third factor is beyond control of individual capitalists but rather determined by general laws of capitalism such as secular trend of declining profit rate and chronically under-consumption crisis, etc. Based on the previous empirical results, it can be observed that during the early neo-liberal era, both the turnover and the profit rate revived a little bit from its bottom from late 1970s, early 1980s. Thus it will be interesting to for us to look at an individual industry to see what historical changes happened in the said industry to increase turnover as well as profit rate at the same time. By any measure, Food industry is great case to focus on. It is relatively less capital intensive, and seems to be constrained by lots of natural limits on turnover which are not easily overcome by capitalists. For example, Marx himself vividly described how farmers changed the way of feeding animals in order to bring them to the market as soon as possible due to the natural limits on growth of animals. Nevertheless, increasing turnover in food manufacturing is not easy; then our question is, how did capitalists manage to do a great job? As we will see, the changes in food manufacturing sector in USA during recent decades have been great footnotes for Marx’s insights into the passion of shortening turnover time. By no means could we provide a complete picture of the evolving food industry. However, there are several interesting features in this industry that we would like to link to our previous results, i.e., there has been a pattern change in American manufacturing sector since late 1970s in which production time (one determinant of turnover) was greatly reduced compared to the “Golden Age” capitalism. The first feature is the increasing consolidation of food industry and increasing productivity. This includes both the consolidation among food producers and concentration of food processing industry. Both are important for us to understand the dynamic in the food industry. For example, “the top 20 firms’ share rose from 36 percent of industry sales in 17 1987 to 43.7 percent in 1992 and to 51 percent in 1997.” (Harris, et. al., 2002, pp. 6). “In red meatpacking, market share of the four largest firms rose from 47 percent in 1987 to 61-63 percent since 1993. In steer and heifer slaughter, this same measure rose from 70 percent in 1989 to 81 percent in 1999, with most concentration occurring prior to 1989. Four-firm concentration in hog slaughter also increased from 30 percent in 1989 to 57 percent in 1999.” (ibid, pp. 6). The increasing consolidation is partly the result of the huge wave of merger and acquisition since 1980s, and this implies increasing competition among food processors. In order to survive, the capitalists have to become more productive by using more and more machinery and automation techniques, which are mentioned by lots of authors (McBride et. al. 2003, Ward et. al. 1997). Moreover, the economy of scale itself provides the possibility to reduce production time by producing in more units at the same time. The increased productivity has enabled producers to consider some alternative to mass production (accompanied by lots of inventories). More importantly, retailers are also restructuring their supply chain by reducing inventory and shorten cycle time (Van Donk 2001). This also forced food processors to more rely on flexible production and “make to order” instead of “make to stock”, which in turn relies on increased productivity and increasing consolidation of the whole industry. The second feature is the increasing importance of so-called “vertical integration”. This in essence is the integration of capitalist sectors in different stages of production/circulation, and it could greatly reduce the circulation time which is needed if firms were to sell products on market; as we discussed earlier, this would also greatly reduce the negative impact of turnover time---uncertainty, which has been mentioned as the most important factor in the vertical integration. In the food industry case, it has taken various forms due to different market structure in different industries, such as production contract, sale contract, and direct ownership. The trend of vertical integration has been very clear to the scholars since 1980s. “Another feature of the restructuring of the 1970s and 1980s, in particular, has been the development of vertical links in the food chain as large corporations seek to gain control over a greater proportion of the production process in order to sustain accumulation. A good example of vertical integration in the UK is the case of Hillsdown Holdings. Hillsdown is a diversified food company that grew rapidly during the 1980s to achieve a turnover of well over 3,000 18 million through over 150 subsidiary companies. As a major producer of red meat and bacon, poultry and eggs, Hillsdown supplies the majority of its own animal feed requirements from its ten mills and its own chicks from its commercial hatcheries.” (Ward et. al. 1997) Another example comes from meatpacking industry: “the most recent stage of restructuring in the industry, which began in the late 1970s, has been particularly turbulent. The major features of this restructuring include changes in the production process, a new wave of plant relocations, intensified competition, and a significant reduction of wage scales” (Stanley 1994), “Production in the meatpacking industry also has become more automated”(ibid). Even in those departments where manual labor remained dominant, productivity (manifested by time) has been increased because of “a finer division of tasks (facilitating rapid repetition) and increased chain speeds.” (ibid) For the wave of plant relocation, the new plants have been built near the feedlots on High Plains so that live animals could be delivered easily, which saved lots of time (and money). (ibid) Lots of authors have noticed the dramatic changes happening in hog production, especially the structural changes of the industry. This took place in both production and circulation phases, and resulted in reductions in turn over time as well as increase in efficiency. On production side, there are some evidence of close coordination between packing and production units (vertical integration), for example, “Tyson, almost a decade after becoming a mega-producer (500,000 head or more marketed), purchased a packing plant in Missouri adjoining its production sites centered in Arkansas” (Rhodes 1998). This may not be as important as it looks (as the author suggested), but at the same time the author concluded that “…a few packers are increasing their controlled hog production and two large producers, Cargill and PSF, have recently become pork packers.” (ibid, pp. 237). Moreover, the contract production has been more and more important since 1970s, for example, “the marketing of contractors are estimated to have grown from 9.5 million head of market hogs in 1988 to 13.2 million in 1991, and 22.8 million in 1994.” According to one of the authors, approximately 21% of the US swine inventory was being raised by contractees on December 1, 1996 (ibid, pp. 213). The primary reason for contracting is because it could reduce the capital invested by the contractor and reduce the production time (more units are producing at the same time). On circulation side, it is well noted that spot (free) market for slaughter hogs has been less and less important. Spot market is where price is given by the market and transactions happen “naturally”. It may take a long time for producers to sell their hogs, especially when they are 19 large producers. Actually, according to the authors, “very large producers sold only 10% of their hogs on the spot market, 78% by formula pricing, 1 percent on fixed price contracts, 2 percent on risk-sharing deals with packers”(ibid, pp. 230), this means that the circulation time is greatly reduced by the prior price agreements between producers and packers or other large customers. Even where packers and producers are not merged, they become quite closely related. “Uncertain supplies day to day and season to season also impose costs on packers when facilities are not used to capacity and when labor is underutilized.” (ibid, pp. 213) So instead of procuring hogs by employing lots of buyers, packers increased coordination with producers by agreements or contracts. This greatly reduced the uncertainty and waiting in the overall turnover period, thus contributed to capital accumulation. The author provided an example that with agreements with several large producers to expand production, Smithfield Foods successfully built the country’s largest plant in North Carolina when hogs were already at deficit in this region.(ibid, pp. 213) To sum up, the recent restructuring in American food processing industry and other industries along the supply chain clearly shows that capitalists use two main strategies to reduce turnover time; first is reducing production time by strengthening control on workers by flexible production and improved techniques; second is to reduce circulation time by consolidation both horizontally (merger and acquisition) and vertically (vertical integration) to reduce market transaction time. These restructuring took place as neo-liberalism reached its height and proved to be useful for quite some time as the revive of turnover in neoliberalism shows. However, no matter how much production time and circulation time capitalists are able to reduce, they are not able to solve the fundamental realization problem which is partly directly caused by their pursuit of turnover increase. Therefore, the any strategy to increase turnover in capitalism cannot work forever, sooner or later, the strategy will be defeated by the contradiction generated by it. That is what we see in today’s world. References Dobb, Maurice. 1937. Political Economy and Capitalism. Dumenil, G & D. Levy. 1999. Profit Rates: Gravitation and Trends. Clark, Simon. 1994. Marx’s Theory of Crisis. 20 Harris, J.M., P.R. Kaufman, S.W. Martinez, and C. Price. 2002, The U.S. Food Marketing McBride W.D. , Nigel Key, 2003, Economic and Structural Relationships in U.S. Hog Production. Resource Economics Division, Economic Research Service, USDA. AER 818. Moseley, Fred. 1990. “The Decline of the Rate of Profit in the Postwar U.S. Economy: An Alternative Marxian Explanation”, RRPE 22(17). Moseley, Fred. 1997. “The Rate of Profit and the Future of Capitalism”, RRPE. Okishio, 1961. Parijs 1980. “The Falling Rate of Profit Theory of Crisis: A Rational Reconstruction by Way of Obituary”, Rhodes, V. J., 1998, The industrialization of hog production, in J. Royer & R. Rogers (Eds.), The industrialization of agriculture: vertical coordination in the US food system, Ashgate Publishing Company. Shaikh, Anwar. 1978. “An Introduction to the History of Crisis Theories”. System, 2002: Competition, Consolidation, and The Technological Innovations in the 21st Century, USDA, ERS, AER 811. Stanley, K., 1994, Industrial and labor market transformation in the US meatpacking industry, in Philip McMichael (Ed.), The global restructuring of agro-food systems, Cornell University Press Van Donk, D.P., 2001, Make to stock or make to order: The decoupling point in the food processing industries, International Journal of Production Economics Ward, N., Reidar Almås, 1997, Explaining Change in the International Agro-Food System, Review of International Political Economy, Vol. 4, No. 4 Weisskopt, Thomas. 1979. Marxian Crisis Theory and the Rate of Profit in the Postwar US, CJE 69(June): 341-378. Wolff, Edward. 1986. The Productivity Slowdown and the Fall in the U.S. Rate of Profit 1947-1976. RRPE 18(Spring-Summer): 87-109. 21