BUDGET PREPARATION INSTRUCTIONS

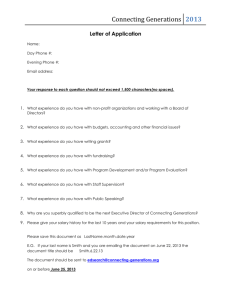

advertisement