A message to our customers

advertisement

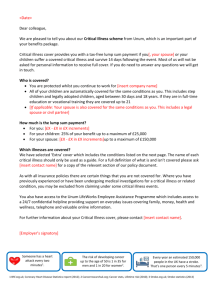

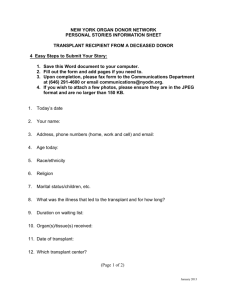

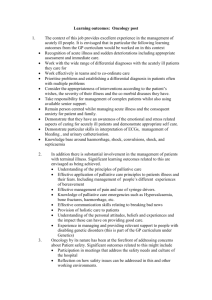

<Date> Dear colleague, We are pleased to tell you about our Critical Illness scheme from Unum, which is an important part of your benefits package. Critical Illness cover provides you with a tax-free lump sum payment if you[, your spouse] or your children suffer a covered critical illness and survive 14 days following the event. Most of us will not be asked for personal information to receive full cover. If you do need to answer any questions we will get in touch. Who is covered? You are protected whilst you continue to work for [insert company name] All of your children are automatically covered for the same conditions as you. This includes step children and legally adopted children, aged between 30 days and 18 years. If they are in full-time education or vocational training they are covered up to 21 [If applicable: Your spouse is also covered for the same conditions as you. This includes a legal spouse or civil partner] How much is the lump sum payment? For you: [£X - £X in £X increments] For your children: 25% of your benefit up to a maximum of £25,000 For your spouse: [£X - £X in £X increments]up to a maximum of £150,000 Which illnesses are covered? We have selected ‘Base’ cover which includes the conditions listed below. The name of each critical illness should only be used as a guide. For a full definition of what is and isn’t covered please ask [insert contact name] for a copy of the relevant section of our policy document. Cancer - Cancer - excluding less advanced cases Heart and circulatory diseases - Coronary artery bypass grafts - Heart attack - Heart transplant - from another donor - Stroke Organ failure - Kidney failure - requiring permanent dialysis - Major organ transplant - from another donor Diseases of the brain and central nervous system *resulting in permanent symptoms - Creutzfeldt-Jakob disease* - Dementia including Alzheimer’s disease* - Motor neurone disease* - Multiple sclerosis - with persisting symptoms - Parkinson’s disease and Parkinson plus syndromes* Respiratory diseases - Lung transplant - from another donor As with all insurance policies there are certain things that you are not covered for. Where you have previously experienced or have been undergoing medical investigations for a critical illness or related condition, you may be excluded from claiming under some critical illness events. You also have access to the Unum LifeWorks Employee Assistance Programme which includes access to a 24/7 confidential helpline providing support on everyday issues covering family, money, health and wellness, telephone and valuable online information. For further information about your Critical Illness cover, please contact [insert contact name]. [Employer’s signatory] Someone has a heart attack every two minutes1. The risk of developing cancer up to the age of 50 is 1 in 35 for men and 1 in 20 for women2. Every year an estimated 150,000 people in the UK have a stroke. That’s one person every 5 minutes3. 1 Bhf.org.uk; Coronary Heart Disease Statistics report (2012); 2 Cancerresearchuk.org; Cancer stats, Lifetime risk (2010); 3 Stroke.org.uk; Stroke statistics (2013) A message to our customers A good benefits package, communicated well, can help to manage - and reduce - bottom line costs, and help to build a loyal and more productive workforce. Unum has created a number of examples, like the one featured above, to help you communicate your benefits to your employees. However, please be aware that these examples just provide a framework, rather than starting with a blank sheet. You will have your own view on the level of detail suitable for your employees and will want the communication to reflect your corporate style. Please also note that there are a number of sections in the leaflet which need to be "tailored" to fit and describe your scheme basis. Red square brackets ([ ]), highlight that you need to input information. Please Note: Although every effort has been made to ensure the accuracy of this leaflet the Scheme's legal documents prevail in the case of any dispute.