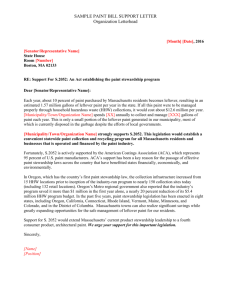

DOC | 391KB Case for Voluntary Paint Product Stewardship

advertisement