West Lothian Community Learning and Development Plan 2015/18

advertisement

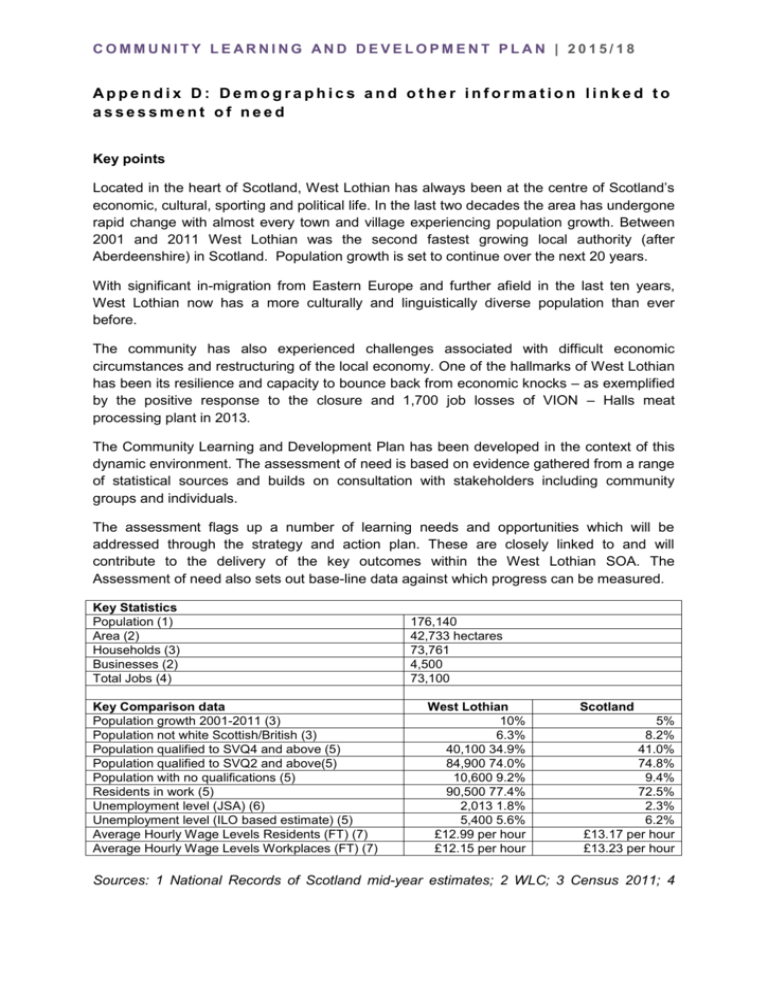

COMMUNITY LEARNING AND DEVELOPMENT PL AN | 2015/18 Appendix D: Demographics and other information linked to assessment of need Key points Located in the heart of Scotland, West Lothian has always been at the centre of Scotland’s economic, cultural, sporting and political life. In the last two decades the area has undergone rapid change with almost every town and village experiencing population growth. Between 2001 and 2011 West Lothian was the second fastest growing local authority (after Aberdeenshire) in Scotland. Population growth is set to continue over the next 20 years. With significant in-migration from Eastern Europe and further afield in the last ten years, West Lothian now has a more culturally and linguistically diverse population than ever before. The community has also experienced challenges associated with difficult economic circumstances and restructuring of the local economy. One of the hallmarks of West Lothian has been its resilience and capacity to bounce back from economic knocks – as exemplified by the positive response to the closure and 1,700 job losses of VION – Halls meat processing plant in 2013. The Community Learning and Development Plan has been developed in the context of this dynamic environment. The assessment of need is based on evidence gathered from a range of statistical sources and builds on consultation with stakeholders including community groups and individuals. The assessment flags up a number of learning needs and opportunities which will be addressed through the strategy and action plan. These are closely linked to and will contribute to the delivery of the key outcomes within the West Lothian SOA. The Assessment of need also sets out base-line data against which progress can be measured. Key Statistics Population (1) Area (2) Households (3) Businesses (2) Total Jobs (4) Key Comparison data Population growth 2001-2011 (3) Population not white Scottish/British (3) Population qualified to SVQ4 and above (5) Population qualified to SVQ2 and above(5) Population with no qualifications (5) Residents in work (5) Unemployment level (JSA) (6) Unemployment level (ILO based estimate) (5) Average Hourly Wage Levels Residents (FT) (7) Average Hourly Wage Levels Workplaces (FT) (7) 176,140 42,733 hectares 73,761 4,500 73,100 West Lothian 10% 6.3% 40,100 34.9% 84,900 74.0% 10,600 9.2% 90,500 77.4% 2,013 1.8% 5,400 5.6% £12.99 per hour £12.15 per hour Scotland 5% 8.2% 41.0% 74.8% 9.4% 72.5% 2.3% 6.2% £13.17 per hour £13.23 per hour Sources: 1 National Records of Scotland mid-year estimates; 2 WLC; 3 Census 2011; 4 COMMUNITY LEARNING AND DEVELOPMENT PL AN | 2015/18 BRES ONS; 5 Annual Population Survey ONS; 6 DWP benefit claimants data; 7 Annual Survey of Hours and Earnings ONS Demographics West Lothian is the 9th largest local authority by population in Scotland. In the last two decades the area has undergone rapid change with almost every town and village experiencing population growth. Between 2001 and 2011 West Lothian was the second fastest growing local authority in Scotland (after Aberdeenshire) and has been the fastest growing area in Scotland since 1991. Population change – Fastest growing area in Scotland over last 20 year 1991 2001 2011 1991-2011 West Lothian 4,999,000 5,062,000 5,295,000 22% Scotland 144,000 159,000 175,000 6% Source: Census 2011 Population growth in West Lothian has been driven by both “natural increase” (more births than deaths) and in-comers choosing to move to the area. In-migration is not a new phenomenon. However, with significant in-migration from Eastern Europe and further afield in the last ten years, West Lothian now has a more culturally and linguistically diverse population than ever. Population composition – % of population by home language English/Scots Polish Other West Lothian 94.3% 1.8% 2.9% Scotland 93.7% 1.1% 4.5% Source: Census 2011 COMMUNITY LEARNING AND DEVELOPMENT PL AN | 2015/18 The recent growth in population from in-migration is concentrated in the young adult age range – 20-35 year olds. Whilst 1.9% of the total West Lothian population is of Polish ethnicity, the proportion increases to 7% for 25 to 29 year olds and 5% for 30 to 34 year olds. Population 2013 WEST LOTHIAN West Lothian percentage Scotland Percentage Total 0-4 5 -15 176,140 11,074 23,937 100% 6.3% 13.6% 100% 5.5% 11.6% 16 - 19 20 - 64 65 + 8,864 106,038 26,227 5.0% 60.2% 14.9% 4.8% 60.3% 17.8% Multi Member Ward 0-4 5 -15 16 - 19 20 - 64 1 - Linlithgow 15,770 876 2,151 749 9,252 2 - Broxburn Uphall & 18,932 1,179 2,377 952 11,149 Winchburgh 3 - Livingston North 21,922 1,519 3,261 1,156 13,462 4 - Livingston South 24,677 1,474 3,846 1,448 14,923 5 - East Livingston & East 20,194 1,132 2,606 1,053 12,454 Calder 6 - Fauldhouse & Breich Valley 16,150 866 2,085 769 9,769 7 - Whitburn & Blackburn 19,501 1,159 2,432 1,011 11,308 8 - Bathgate 23,671 1,780 3,172 1,092 14,609 9 - Armadale & Blackridge 15,323 1,089 2,007 634 9,112 Source: National Records of Scotland – mid-year population estimates 2013 65 + 2,742 3,275 2,524 2,986 2,949 2,661 3,591 3,018 2,481 West Lothian has a slightly younger population profile than Scotland (i.e. a higher proportion of the overall population is under 16 and lower proportion over 65). Recent housing development has resulted in changing demographics at a local level - an influx of families into Wester Inch in the Bathgate area for example is reflected in a higher proportion of the population (62%) in the 20-64 age-group in the Bathgate Multi Member Ward. The Population growth is set to continue over the next 20 years with 10,000 additional houses and projected population increase of 20,000. In the next five years this growth will be focused in core development areas (CDAs) across West Lothian – the Heartlands (Whitburn), Armadale Station, Calderwood (East Calder) and Winchburgh. As illustrated below the net effect of demographic change and growth over the next 25 years is that the population over 65 will increase (by 90%) whilst other life stage groupings will remain largely stable. COMMUNITY LEARNING AND DEVELOPMENT PL AN | 2015/18 West Lothian Projected Population Growth 250,000 200,000 65 + 150,000 20 - 64 16 - 19 100,000 5 -15 0-4 50,000 0 2012 2017 2022 2027 2032 2037 Source: National Records of Scotland The pattern of housing tenure in West Lothian is very similar to that for Scotland. Housing Tenure Owner occupied Social rented Private rented Other TOTAL Source: Census 2011 West Lothian 65% 22% 12% 1% 100% Scotland 63% 23% 13% 2% 100% Economy and Employment Labour supply Population of working age in West Lothian of 115,500 has increased and is projected to be at a similar level up to 2025 (Scotland will decrease by 1.4%). This does not take account of changes to the retirement age. Latest estimates indicate that 94,300 are economic active 80.4% of working age population (compared to 77.6% for Scotland). Within the economically active population there are 79,900 employees and 7,600 self-employed. West Lothian is not a self-contained economy or labour market. Whilst 61% of in-work residents are employed in West Lothian, 39% commute out to mainly neighbouring areas – the largest proportion to the Edinburgh area. It is likely that commuting into and from West Lothian will increase over the next few years as CDA developments attract additional residents. COMMUNITY LEARNING AND DEVELOPMENT PL AN | 2015/18 Pattern of commuting for West Lothian residents (2011 census) Work at home or nearby 8,000 Work in other parts of West Lothian 42,000 Work in Edinburgh, Mid/East Lothian 20,000 Work in other neighbouring local authority areas 5,400 Work in Glasgow area 1,800 Work elsewhere in Scotland/UK 2,000 Source: Census 2011 8% 53% 25% 9% 2% 2% Unemployment The headline Job Seekers Allowance based unemployment is currently 2,013 or 1.8% (Dec 2014). The unemployment level is at it’s the lowest since 2007. The International Labour Organisation based unemployment estimate is 6,000 (6.4%) (average for the year Oct 13 to Sept 14). The number of working age residents claiming Key Out of Work benefits is 13,500 (11.8%) (May 2014) The Youth unemployment level based on 18 to 24 year-olds claiming JSA is 520 (3.6%). This is the lowest level since records began in 1994. However, the JSA based measure does not provide a comprehensive picture – it excludes 16-17 year olds and individuals claiming other out-of-work benefits or no benefits at all. Two wider estimates suggest that youth unemployment might be approximately 1,700 or 13% of the overall population – slightly higher than the equivalent rate for Scotland. With the reduction in the JSA claimant count, an increasing proportion of the remaining jobless population will be more likely to experience multiple barriers and be more difficult to reach. At the same time entry-level jobs now require higher developed core skills than might have been the case previously – including for example enhanced customer and communication skills and computing capacity. The process of job search and submitting applications to prospective employers is now mainly IT based. There appears to be a close relationship between housing tenure and economic status. Housing Tenure and Economic status (2011 Census) Population In work Owner occupied 94,277 69.8% All Social rented 30,825 41.4% Private rented 12,793 64.5% Source: Census 2011 Unemployed 3.0% 10.9% 8.3% Inactive 27.2% 47.7% 27.2% Employment Employment by occupation according to the Standard Occupational groupings shows: 33% in group 1-3 (Managerial, professional and technical) 25% in group 4-5 (Admin, skilled trades) 16% group 6-7 (Personal and customer services, sales) 26% group 8-9 (Elementary and process operators). COMMUNITY LEARNING AND DEVELOPMENT PL AN | 2015/18 West Lothian has a higher percentage of employees in occupational groups 4-9 with below national average in groups 1-3. Retail, health and manufacturing are the three largest employment sectors in West Lothian. As well as Enterprise Area Status for the food and drink sector, West Lothian can also note key strengths and a strong presence in information and communication, life sciences, tourism, enabling technologies such as electronics and precision engineering, wholesale, construction and transport and storage. Recently there has been significant growth in some of the locally based and larger SME’s particularly in the manufacturing and production sectors, and encouraging inward investment in Research and Design facilities in the energy sector. Lightsource Renewable Energy, a London based solar power company, has established its Scottish head office at Alba Campus, Livingston and the on-going development of The Heartlands Business Park at Whitburn has secured a deal with Oil States Industries (UK) Ltd to develop a new state-ofthe-art facility at the site. Employers Recruitment and Skills Requirements Future recruitment and skills demands are difficult to predict. However, the recently published Regional Skills Assessment for Edinburgh and the Lothians indicates that employers in the area are more likely to have recruited and have experienced hard to fill vacancies and skills shortages than the Scottish norm: Almost three-quarters of employers in Edinburgh, Fife & the Lothians have recruited in the past 2-3 years, including leavers from Scottish education institutions Most employers recruiting leavers from Scottish schools, colleges and universities report that the recruits were well or very well prepared for work Of those employers that report leavers from Scottish education institutions to be poorly prepared, the main reasons cited were a lack of world / life experience, poor attitude or lack of motivation or lack of required skills or competencies Employers in the region were more likely to report a vacancy than the Scottish average, and had more experience of hard to fill and skill shortage vacancies Of those employers that considered recruits from Scottish education to be poorly or very poorly prepared for work, the main reasons cited were: • lack of working world / life experience or maturity • poor attitude / personality or lack of motivation • lack of required skills or competencies. Key messages in terms of future demand by employers include: • • • Employment in Edinburgh, Fife & the Lothians is expected to rise modestly until 2016 with the pace of employment growth quickening from then until 2022. The trend is roughly in line with Scotland as a whole the greatest employment increases in Edinburgh, Fife & the Lothians over the coming decade are expected to come from health and social work, professional services and information technology Tthe long term decline in employment within traditional industries, such as manufacturing, mining and agriculture, is set to continue. There are also expected job losses in public administration, defence and education COMMUNITY LEARNING AND DEVELOPMENT PL AN | 2015/18 • • Replacement demand will result in over 253,000 job openings in the region over the coming decade. These openings will occur across all types of jobs, including those that are expected to decline in net terms The majority of job openings in Edinburgh, Fife & the Lothians over the coming decade will require individuals with higher level skills and qualifications. There will be limited opportunities available to those with low or no qualifications at all. Future Recruitment Projections Expansion Demand Managers, directors & senior officials Professionals Associate professional & tech. Administrative & secretarial Skilled trades Caring, leisure & other service Sales & customer service Operatives Elementary Total 11,800 30,500 14,000 -7,600 -5,500 12,000 -800 -4,300 -2,600 47,500 Replacement Total Demand Demand 24,800 36,600 55,000 85,500 30,600 44,600 38,000 30,400 22,400 16,900 21,300 33,300 20,400 19,600 12,300 8,000 28,500 26,000 253,400 300,900 % of Total demand 12% 28% 15% 10% 6% 11% 7% 3% 9% 100% Source: Working Futures 2012-2022 Education, Skills and Lifelong Learning Qualifications Jan-Dec 2013 % with SVQ4+ - aged 16-64 % with SVQ3+ - aged 16-64 % with SVQ2+ - aged 16-64 % with SVQ1+ - aged 16-64 % with other qualifications (SVQ) - aged 16-64 % with no qualifications (SVQ) - aged 16-64 Source: Annual Population Survey ONS West Lothian number % 40,100 35.5% 60,900 53.9% 83,000 73.5% 95,700 84.7% 7,500 6.7% 9,800 8.7% Scotland % 39.4% 59.3% 73.7% 83.4% 6.2% 10.3% The overall picture in terms of skills and qualifications suggests that: West Lothian has a similar pattern to Scotland for basic and intermediate level qualifications – e.g. 73.5% of adults are qualified to SVQ level 2 (compared with 73.2% for Scotland) However, West Lothian lags behind Scotland for higher level qualifications. The gap has been narrowing in recent years as a result of demographic change and the outcome of interventions to promote attainment and progression into higher education. The gap has been narrowing in recent years as a result of demographic change and the outcome of interventions to promote attainment and progression into higher education. COMMUNITY LEARNING AND DEVELOPMENT PL AN | 2015/18 Educational Attainment Historically, attainment levels as measured by SQA examination results lagged behind the levels for Scotland. However, in recent years significant progress has been made in addressing this attainment gap. Over the 5 year period 2010 to 2014, the percentage of students attaining 3+ at level 6 (Higher) and 1+ at level 6 (Higher) has continued to increase. The 2014 results were the highest ever achieved by students across West Lothian Council schools. 3+ Level 6 (Higher) A-C % 2010 2011 West Lothian 24 24 Scotland 25 26 Benchmark 22 24 2012 26 27 25 2014 2013 29 29 26 30 na na The percentage of students attaining 1+ at level 7 (Advanced Higher) has equalled the previous best of 2013. The percentage of students attaining 5+ level 6 (Higher) equalled the pre-appeal level of 2013 with 2013 being the highest achieved at this level. School Leaver Destination Results 100.0% 90.0% 80.0% 70.0% 60.0% % Positive 50.0% % Other (negative and unknown) 40.0% 30.0% 20.0% 10.0% 0.0% 07/08 08/09 09/10 10/11 11/12 12/13 13/14 Over the last seven years, West Lothian has achieved a sustained improvement in the levels of school leavers achieving a positive destination. The latest figures for 2013/14 leavers show 93.0% of young people have entered a positive destination (higher education, further education, training, volunteering or employment) - an increase of 1% on 2012/13. Since 2007/08, positive destinations have increased by 12 percentage points. COMMUNITY LEARNING AND DEVELOPMENT PL AN | 2015/18 This positive trend has been achieved against the backdrop of changing economic circumstances. In 2013/14 19.4% of all leavers progressed into employment compared with 27% in 2005/06 reflecting the competition for a reduced number of vacancies. The increase in positive destinations has been achieved through increases in the number and percentage of leavers progressing into higher education, further education and training opportunities. The council, West Lothian College and Skills Development Scotland have provided additional opportunities - after successfully lobbying for additional college and training programme places. The growth in progression into higher education is particularly positive and reflects the sustained improvement in Higher results noted above. Community Learning Infrastructure West Lothian has well-developed learning infrastructure with 2 modern college campuses (West Lothian College and SRUC) numerous school facilities and local learning centres. West Lothian is within an hours travel time of 10 of Scotland’s universities and a further 10 regional colleges. Whilst community learning and development is regarded as distinct from secondary, further and higher education, there is a significant overlap in practice between educational sectors. The Superfast Scotland scheme, supported by a £2.5m invest from West Lothian Council will ensure that Superfast Broadband availability will increase from 60% of West Lothian premises (homes and businesses) to 99% by 2017. It is expected that take up of Superfast Broadband in West Lothian will increase from 16.5% at present to somewhere between 30% and 40% by 2018. These speeds in excess of 20Mbps will enable channel shift in the delivery of online learning allowing live streaming of audio and video content and enable an increase in the amount of Self Directed Learning using online resources. Income and pay Gross wage levels for West Lothian (both residence and workplace) are slightly below the Scottish and GB levels. The gap has increased in the last year. Approximately 19% of West Lothian working residents earn below the living wage level of £7.65 per hour (data based on 2013-14 living wage and 2013 ASHE data). Approximately 23% of jobs located within West Lothian pay hourly rates below the living wage level. Approximately 9.4 thousand West Lothian working households receive Working Tax Credit or Child Tax Credit. The represents 19% of all working households (slightly higher than the Scottish level of 18%) The latest available figures show that 24% of children in West Lothian live in low income working households, compared to 25% for Scotland and GB. Part time jobs in West Lothian (based on 2013 data) represent 29% of total jobs (compared with 26% in 1998 and 27% in 2008). The West Lothian level of part time jobs is however significantly lower than the 33% recorded for Scotland and GB. COMMUNITY LEARNING AND DEVELOPMENT PL AN | 2015/18 Earnings by resident West Lothian Gross weekly pay full time workers 503.4 Gross weekly pay p/t workers 172.9 Hourly pay excluding overtime (f/t) 12.99 Hourly pay excluding overtime (p/t) 8.51 Source: Annual survey of Hours and Earnings Scotland % difference 518.2 -2.9% 169.4 +2.1% 13.17 -1.4% 8.72 -2.4% Earnings by workplace West Lothian Gross weekly pay full time workers 490.6 Gross weekly pay p/t workers 196.5 Hourly pay excluding overtime (f/t) 12.15 Hourly pay excluding overtime (p/t) 8.25 Source: Annual survey of Hours and Earnings Scotland % difference 519.4 -5.9% 172.7 +13.8 13.23 -5.5% 8.78 -6.0% Employment and wage levels – low paying sectors in West Lothian number I : Accommodation and food service activities G : Wholesale and retail trade; repair of motor vehicles and motorcycles A : Agriculture, forestry and fishing R : Arts, entertainment and recreation N : Administrative and support service activities S : Other service activities 3,800 Median Lowest wage 10% 5.3 6.62 5.46 % 15,800 22.1 100 1,800 4,900 900 0.2 2.5 6.8 1.3 8.47 8.57 8.75 8.77 10.19 6.24 6.26 6.20 6.19 6.20 Source: Annual survey of Hours and Earnings & BRES Area based deprivation 2012 SIMD in Relation to West Lothian A more appropriate approach to area regeneration is to focus interventions on the most disadvantaged 20% of datazones in West Lothian and surrounding areas so that coherent communities and localities are targeted. These areas will be prioritised through community learning and development interventions. COMMUNITY LEARNING AND DEVELOPMENT PL AN | 2015/18 The above map of regeneration areas shows data zones in the worst 20% in West Lothian in red, and adjacent data-zones which also experience significant disadvantage in yellow. April 2015 Contact: David Greaves Economic Development West Lothian Council david.greaves@westlothian.gov.uk