Cereals, Horticulture and Organics

advertisement

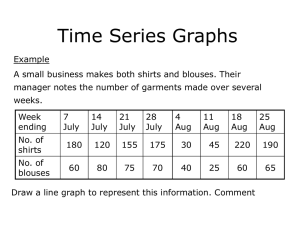

BACKGROUND PAPER CEREALS, HORTICULTURE AND ORGANICS Note: The views expressed in this background paper do not purport to reflect the views of the Minister or the Department of Agriculture, Food and the Marine 1 Cereal/Tillage Sector 1. Overview of the Sector The cropped area in Ireland extends to 378,000 ha or 9% of the area farmed. Cereals account for the main acreage under tillage at around 300,000 ha. The national tillage sector is compact, comprising of approximately 11,000 growers, of whom 4,000 have tillage as the primary farm enterprise. It is estimated that a further 15,000 people are employed in the crop based food processing sector. Annual combinable crop output amounts to between 2.0 and 2.5 million tonnes accounting for approximately 1% of EU production. Irish cereal yields are among the highest in the world and, despite reaching a plateau in recent years, have the potential to increase by up to 1% per annum. Tillage crop production in Ireland has traditionally been based on the provision of feedstuffs to the livestock sector and feedstock to industries such as malting, milling, sugar, breakfast cereal, distilling and food. Approximately 1.5 million tonnes or 75% of the annual national cereals harvest are used to produce animal feedstuffs with the remainder of the harvest going to on-farm feeding, production of seed, export, or use in the food and industrial sector. The farm sector has also developed cheaper processing options for direct on-farm use of cereals, such as crimping and wholecrop, and the production of feed crops like triticale, forage maize, fodder beet and kale for livestock feed. The volume of grain exports is volatile in nature but is usually between 200,000 and 300,000 tonnes of grain (mostly wheat and barley) per annum, mainly to Northern Ireland and Great Britain for feed. Some malting barley is periodically exported, mainly to Belgium, and there are some exports of grain to other EU countries, notably to the Netherlands and Germany. 3,000 to 4,000 tonnes of grain is exported annually to the USA. There is scope for increased production from tillage to replace a proportion of imported cereals used for animal feed. Native cereals provide home-grown traceable feed that helps to underpin expansion in the dairy and livestock sectors. They also provide a good source of quality traceable raw material for malting, milling, distilling and breakfast feeds and oils. Over 50% of tillage production in Ireland is carried out on leased or rented land and this is one of the most significant features of the sector, with implications for expansion, profitability and capacity to compete with other farming enterprises. 2. Market Prospects The 2013 Teagasc National Farm Survey (1Hennessy et al., 2013) indicated that the average family farm income for mainly tillage farms was €28,800 compared to an average family farm income for all farms of €25,000. On average, income on specialist tillage farms declined by 22% in 2013 over 2012. Despite yields improving relative to 2012, lower prices and declines in average area harvested per farm meant that crop output value declined by 13%. Despite lower direct and overhead costs, this decreased value of output led to reduced incomes in 2013. Teagasc estimates that the cereal harvest for 2014 will reach or exceed 2.5 million tonnes. However, due to a buoyant EU and world harvest, prices for green wheat and barley are likely to remain very weak in the short term. 1 Hanrahan K., Hennessy T., Kinsella A., Moran B. (Teagasc National Farm Survey 2013) 2 Table 1: Area, Yield and Production of Cereals 2014* Area (000 ha) Yield (T/ha) Wheat Winter Spring 70 64 6 10.0 8.5 Barley Winter Spring 214 60 154 Oats Winter Spring 18 10 8 Totals 302 Production (000 tonnes) 696 642 54 9.1 7.5 1,699 541 1,158 8.5 7.5 146 84 62 2,541 Source: Teagasc estimate (Rounded) *refers to all production, which is subsequently sold or used alternatively typically for feed Extreme world cereal price volatility has been witnessed over the past 5 – 10 years due to low world stocks, the rise in global cereal consumption and biofuel production. This volatility is expected to continue into the medium term, hence uncertainty about the production response and price stability is expected to remain for some time. For example, after some years of tight supplies mainly due to poor harvest conditions in the main cereal producing regions of the world, the 2014 world harvest for cereals and other combinable crops was extremely good. This in turn resulted in one of the lowest Irish green cereal prices for a number of years. According to the latest International Grain Council Market (IGC) report for August 2014 global grain production for 2014 is up 17m/tonne to 1,976m/tonne which is only marginally below 2013 largely because of better than expected results in China and Russia while production levels have decreased in the USA and Canada. World production of wheat has been driven by animal feed use. The latest EU cereal balance sheet estimate for 2013/14 shows total cereals production of 302m/tonnes with consumption at 271m/tonnes and current stocks of 31 m/tonnes. The EU Cereals area for 2014 is estimated (September 2014) at 58m/ha which is similar to the previous year. 3. Potential for future development of the cereals sector The Tillage Sector Development Report of 2012 2 assesses projections up to 2020 for nine major crop categories. As crop yields and areas sown can be quite volatile from year to year, the base-line figures for area and output were based on the four year average from 2008 to 2011. The individual crop projections for 2020 are based on the potential for that crop under favourable conditions. However, it is important to bear in mind that these projections represent only the potential for each crop and are not targets as such. In reality any increase in the area of a given crop would depend on profitability, competition from other crops, land availability and also competition from other farm 2 A report compiled by the Teagasc Tillage Crop Stakeholder Consultative Group 3 enterprises, most notably from dairying post 2015. The end date for these projections could also be taken as relevant for 2025. Table 2: Crop Yield and Area Potential 2008/11-2020 2008/11 2020 2008/11 2020 2020 Tonnes Tonnes Ha Ha Increase Ha Barley 1,288,900 1,755,500 184,000 223,660 39,660 Wheat 820,400 1,109,400 91,800 105,800 14,000 Oats 158,420 246,320 21,100 34,860 13,760 Pulses 18,700 64,700 3,560 10,300 6,740 OSR 32,300 287,300 8,100 59,900 51,800 Maize 313,000 463,000 20,875 30,875 10,000 Crop Potential Increases in Value and Job Creation If the potential increases in area and production outlined in the report were realised, this would also result in significant increases in the value of output and also in terms of new job creation as estimated in the Table 3. Table 3: Potential Increases in Value Based on Increased Output Potential Crop Additional Value (million €) Barley 87.13 Wheat 53.90 Oats 16.32 Pulses 9.74 Oilseed Rape 101.90 Maize 28.5 In a paper produced for the Food Harvest 2020 Report High Level Implementation Group, Miller et al., (2012)3 estimated that there are 17 jobs associated with every million euro of domestic output in the cereal sector at farm level. 3 Miller C. Matthews A. Donnellan T and O’Donoghue C. (2012) The Economic Impact of Food Harvest 2020 Targets. Paper prepared for the FH 2020 High Level Implementation Group 4 This figure is on a par with the employment associated with milk and beef production at farm level. Such figures are described as employment intensities and represent the average number of jobs associated with €1 million of output in the sector. It would not be appropriate to assume that at the margin (i.e. additional output) an increase in output value of €1 million would be associated with a similar amount of jobs. In reality the marginal employment intensity would be lower. Consequently, at farm level the job creation associated with increased tillage production is likely to be considerably less than would be suggested by the average employment intensities. Pressure to increase productivity at farm level will continue and given that production in the tillage sector tends to be capital rather than labour intensive, additional jobs within the farm gate would be limited. Beyond the farm gate, there is also job creation potential associated with a higher level of tillage production.. The farm sector has strong linkages with a range of food, beverage and animal feed producers. Miller et al. in the same report indicated that there are about 2 jobs associated with each €1 million increase in output value in the animal feed sector and the figure in the beverage sector is similar. 3.1 Barley Barley is the largest cereal crop in Ireland accounting for some two thirds of cereal production or 214,000 ha in 2014. The total area of this crop fell for many decades but this has levelled off and increased somewhat in recent years, partly at the expense of winter wheat. The winter crop is increasing in popularity in recent years as a result of improved varieties and very high yield potential from six-row hybrid types. This is increasing the overall yield and total barley production. Barley is primarily used for feed production but with a significant proportion of the area (23,500 ha) used for malting and roasting. Demand for feed is likely to increase given the increased production targets for the livestock sector in FH2020. Demand for malting barley is also likely to increase with planned expansion by the malsters and increasing demand for barley and malt for distilling at home and abroad. In March 2014 the Irish whiskey sector formed the Irish Whiskey Association. The aims of the association are to double exports of Irish whiskey from 6 to 12 million cases per annum by 2020. This target is to be underpinned by an expansion in the number of distilleries from current 4, to 20 in the coming years. These additional distilleries are already at various stages of planning or advancement. In order to achieve the growth targets set out by the Irish Whiskey Association, consumption of barley for distilling would double from the present 65,000 - 70,000 tonnes per annum. The principal constraint of expansion in the area of barley grown is the availability and cost of land and the competition for land between crop and animal enterprises. The greening measures in the CAP Reform will require a greater need for crop rotation thereby affecting the continuous growth of barley. 3.2 Wheat Wheat production which accounted for 70,000 ha in 2014 has been somewhat erratic in recent years due to a combination of area planted and yield. The main area constraint relates to winter wheat planting which is often hampered by wet weather. As indicated earlier, this has resulted in an increase in plantings of barley at the expense of wheat. Wheat has two main market outlets – feed and milling. The feed wheat market provides wheat for use in feed and for export. Overall demand can be expected to increase in the face of increasing livestock production and there is potential to displace a significant portion of wheat and corn imports for feed rations. 5 There is a domestic market for up to 50,000 tonnes of milling wheat annually. A very high average annual yield means that adequate protein levels are difficult to achieve on a constant basis. In addition, poor or variable harvests often result in the rejection of a significant proportion of the crop for milling due to excessive sprout damage and poor seed specific weights. Any further development of a market for milling wheat would depend largely on the availability of milling varieties more suited to our climate. Wheat is a high-cost crop and one of the principal constraints to maintaining or increasing wheat acreage is its vulnerability to increasing input costs such as fertiliser, fuel, crop protection products, machinery and land. Fungicide resistance and the threatened loss of at least some fungicides also pose a considerable threat. 3.3 Oats There is a domestic market for oats of approximately 160,000 tonnes which slightly exceeds current national production. Oats are a very traditional Irish crop and are now grown largely for food (porridge oatlets) and premium feed for sport horses, with lower grade feed going into ruminant rations. The demand for oats both for premium feed and food is likely to expand further. Production of oats in both Canada and the US is contracting; both could be important outlets for Irish oats, with both Flahavans of Waterford and Glanbia targeting these potential markets, particularly the high-end premium oatmeal market in the US. Notwithstanding these favourable developments, constraints remain on expansion of the present area of oats grown in Ireland. There has been an over-reliance on the variety Barra for food production, while difficulties with the crop remain in terms of disease resistance, crop standing power and stagnant yields. Some promising new varieties have emerged in recent years but none yet to rival the quality of Barra. 4. Other Arable Crops 4.1 Protein crops The main protein crops of relevance in Ireland are the pulse crops, namely peas and beans. While Lupins are also a protein crop, their production here is marginal. Production of pulses is traditionally low at around 4,000 ha grown annually, producing approximately 18,000 tonnes of protein feed. This accounts for a minor fraction of overall demand for proteins by the livestock sector so there is no barrier to increasing production of peas and beans. Traditionally these crops have not been widely grown here due to variable yields and disease problems, created largely by adverse weather conditions and non-availability of varieties suited to our climate. The marginal nature of these crops has also meant that there has been a low investment into research on breeding and agronomics, production costs are relatively high and gross margins have been volatile. Also, the development of processing and production infrastructure has been slow for the same reasons. The introduction from 2015 of a coupled protein payment of €250 per ha up to an annual national ceiling of €3 million will provide a significant boost to this sector, providing the possibility to expand production of supported proteins to 12,000 ha. Importantly for arable farmers, land under protein crops will be eligible to qualify as an Ecological Focus Area. 6 4.2 Oilseed Rape The area sown to oilseed rape has remained low for many years due to the lack of price related profitability of the crop. This has changed in recent years with the acreage increasing from 2,300 ha in 2003 to a peak of approximately 17,000 ha more recently. However, due to weaker market prices, the area sown to Oilseed rape has reduced back to more traditional plantings of 8,000 – 12,000 ha in the last two years. The winter crop accounts for two-thirds of total production. To fully exploit the crop’s potential, a sufficient market would be necessary to facilitate crushing and utilization nationally, leaving the protein feed for use in the livestock sector. There is increasing interest in the use of oilseed rape oil as a food ingredient for cooking and salads. Expansion in this area looks likely to continue with potential for exports of the processed oil. As with pulses, the current small scale of oilseed rape production has resulted in a shortfall in terms of the necessary infrastructure and a lack of investment in research and development. As the area increases, there is likely to be increased disease pressure which could impact on average yields. 4.3 Maize Annual production of maize is around 20,000 ha. Maize is grown almost entirely for whole crop silage production, and can produce a high value high energy feed. Increasingly, maize has been grown under plastic mulches to extend the growing season and hence productivity. Maize can offer a less costly option for fodder production on outlying land than grass because there is only one harvest a year at a different time to other harvests, and as it has a greater transport density than grass,. The principal constraint to a significant increase in the area under maize is the level of seasonal variability which can only be addressed through improved varieties. Maize is also vulnerable to increasing input costs such as fertilizer, fuel and chemicals. 4.4 Beet Sugar beet production ceased in Ireland in 2006 when production stood at around 1.2 million tonnes of sugar beet produced from 35,000ha. The agreement reached under the CAP Reform package in 2013 to abolish the sugar quota system for sugar beet from the 30 September 2017 sparked renewed interest in re-establishing a national sugar/bioethanol industry in Ireland. Proposals to revive the industry were initially submitted in 2011 to the Minister for Agriculture, Food and the Marine for consideration and at the time and many times since the Minister has stated that any new sugar production facility will have to be a viable commercial proposition and supported by a business case which is sufficiently robust to attract the funding from investors for the very substantial capital investment required. The future sugar prices will determine the feasibility of sugar production in this country as will the willingness of growers and others to invest in a brand new processing facility. Fodder beet acreage of 8,000 ha has remained relatively stable since 2006. Most of this production is used as animal feed with the majority used on-farm and approximately 25% available for sale. The potential for fodder beet growth is limited due to transport costs and machinery limitations at farm level. 7 5. Animal Feed Sector 5.1 Feed Consumption Animal feed for ruminants in Ireland comes principally from dry matter intake based on grass, hay or silage complemented, where appropriate, by compound feeds. In the case of pigs and poultry, all their nutrition is derived from compound feeds. There are 90 mills approved to manufacture compound feed in Ireland. On average, Ireland imports about 3 million tonnes of animal feed per annum. In addition, approximately 1.5 million tonnes of home-grown cereals is used in the production of feed, bringing the total feed use to 4.5 million tonnes. In 2013 use of compound feed in Ireland reached 4.9 million tonnes, due to the additional demand during the fodder crisis. Approximately 66% of feed is used for ruminant feed; 16% for pigs; 12% for poultry and 6% to others. Of the three million tonnes imported, approximately 55% comes from third countries outside the EU. Virtually all protein supplement must be imported, mainly as soya bean and maize or maize byproducts, much of which originates in the USA, Brazil, Argentina and Canada. Over 90% of the feed materials from these countries come from GM crops authorised for marketing in the EU. Ireland relies on importing a much higher proportion of its animal feed requirement compared to other EU countries: Ireland imports 65% of its requirements compared to 37% for the UK, 27% for France and 26% for Germany. The EU is 35% deficient in its requirement for protein for animal feed, so third-country imports are unavoidable. Origin of commodities imported for use in animal feed in Ireland: USA: Distillers Dried Grains; Maize Gluten Feed; Soya bean; Citrus Pulp; Sugar Cane Molasses; Beet Pulp Argentina: Soyabean; Citrus Pulp Brazil: Citrus Pulp; Soyabean; Maize Canada: Canola (Ex); Maize Gluten Feed; Distillers Dried Grains. Asia: Palm kernel Extract The remaining feed materials used consist mainly of home grown and EU grown cereals (barley, wheat) and non-GM maize produced in the EU, viz: France: Maize; Rape Seed Extract; Sunflower Seed Extract; Distillers Dried Grains UK: Wheat; Barley; Distillers Dried Grains; Beet Pulp NL: Wheat; Rapeseed Extract Germany: Rape Seed Extract; Wheat 8 5.2 Options to Substitute Some Feed Imports The current level of demand for feed imports which represents 65% of the total national requirement for feedstuffs can only increase significantly if the targets for increased output from the livestock sector are to be realised. Some scope exists to replace feed imports, for example, 295,000 tonnes of cereals were imported in 2013 for use as feed. This equates to domestic production of approximately 35,000 ha. Given that the national acreage of cereals in both of the last two years exceeded 300,000 ha there is clearly some scope for import substitution of cereal imports. However, the extent to which this can be brought about is very much dependent on external market movements, availability of rental land (50% of arable crops are grown on rented or leased land) and competition from other enterprises, most notably from dairying. The introduction from 2015 of a coupled protein payment of €250/ha up to a ceiling of 12,000 ha nationally has the capacity to significantly increase production of proteins from the present average of 4,000 ha or so. Peas and beans are a valuable break crop and have a very positive effect on soil quality and organic matter content, while contributing positively to the diversification obligation Feed producers have indicated a clear interest in sourcing reliable and consistent supplies of home produced proteins. This would require provision of further processing infrastructure and a commitment from both producers and processors to work together on this. As outlined earlier in the document maize can play a greater role in providing an alternative source of feed in certain circumstances. For example the capacity to produce high quality maize crops is more readily suited to many intensive grassland farms than the production of whole-crop small grain cereals. 9 6. Analysis of the Tillage Sector The analysis of some key arable crops is largely taken from The Tillage Sector Development Plan published in 2012 and compiled by the Teagasc Tillage Crop Consultative Group Barley Current Position Barley is the largest cereal crop in Ireland. The total area of this crop fell for many decades but this has levelled off and increased somewhat in recent years. We currently grow 184,000 ha of winter and spring barley to produce nearly 1.3 million tonnes of grain. The winter crop is increasing in popularity in recent years as a result of improved varieties and very high yield potential from six-row types. This is increasing total barley production. Barley is primarily used for feed production (87% area). Demand for feed is likely to increase given the plans for increased production in the livestock sector in FH2020. A significant proportion of the area (23,500 ha or 13%) produces barley for premium malting and roasting markets. Demand for malting barley is also likely to increase with planned expansion by malsters and increasing demand for barley and malt for distilling at home and abroad. Table 4: Summary of Growth Opportunities for Barley in Ireland Opportunity Additional Market Additional Value ( '000 tonnes) (million €) Additional Area (ha) Malting 115 23.7 14,000 Feed 348 62.7 25,160 Roasting 3.8 0.73 500 (Prices: Malting €205, Feed €180, Roasting €190) Actions needed to achieve the Potential Intensive research to ensure growers can achieve necessary quality standards for malting barley in the areas of protein level and prevention of ear blight is essential. Access to a broad spectrum of fungicide tools must be maintained to help prevent resistance developing to limited fungicide families. Increased production of barley will require additional land and storage. Improved cost effectiveness and stable land access systems must be developed to facilitate this area expansion. Increasing yields and reducing production costs will be necessary to remain competitive. Breeding varieties with improved disease resistance, yield potential and grain quality for our climate. 10 6.2 Wheat Current Position Wheat is the second largest cereal crop in Ireland. Annual production varies with autumn weather which impacts on planting levels. We currently grow 91,800 ha of winter and spring wheat to produce nearly 0.82 million tonnes. Winter sown wheat has a higher yield potential and accounts for 75% - 80% of total wheat production. Wheat is primarily used for feed production (94% of output). Demand for feed is likely to increase given the plans for increased production in the livestock sector in FH2020. A small proportion of wheat (6%) is sold to the milling market but this varies form season to season due to difficulties meeting milling standards in our climate. While average wheat yields are high, production costs are also high and productivity is reduced in unfavourable positions in rotations (2nd wheats or continuous wheat). Table 5: Summary of Growth Opportunities for Wheat in Ireland Opportunity Additional Market ( '000 tonnes) Additional Value (million €) Additional Area (ha) Distilling 44 8.58 4,000 Feed (inc exports) 245 45.32 10,000 (Prices: Distilling €195, Feed €185, Export €200) Actions needed to achieve the Potential The anticipated need for and increased use of organic manures will require comprehensive research support. Increased research is needed to explore uses for Irish milling wheat even when milling quality is compromised in poor weather. Opportunities such as traditional soda bread should be considered and may have scope for designated protected product status. Scope for research in the use of wheat for distilling to supply Irish brands with native raw materials. Incentivised production may be needed to kick-start this niche market. Promote rotations to enhance yield potential. Research, advice and industry support required to address all the threat areas listed above including disease vulnerability, yield stagnation, costs including land and machinery, scale and price volatility. Particular emphasis on cost reduction is required. Specific quality standards and crop processing protocols (e.g. max drying temperature) need to be developed for specific markets. 6.3 Oats Current Position The current market for Oats is about 160,000 tonnes (grown on 21,000 ha) which is used for animal feed (mainly horses), milling for food use, and for seed and export. The feed market is split between premium grade for horse feeds, which has similar quality requirements to human food consumption, and discounted grade which is used in ruminant rations 11 Market dependent on our ability to grow high quality product and is dependent largely on the variety Barra. Food grade oats demand is increasing for domestic milling and also for export. Horse feed exports are successfully being developed. Table 6: Summary of Growth Opportunities for Oats in Ireland Additional Market ( '000 tonnes) Additional Value (million €) Additional Area (ha) Milling 12.3 2.34 6,000 Feed / Export 75.6 13.98 7,760 Opportunity (Prices: Milling €190, Feed €180, Export €190) Actions Needed to Achieve the Potential We need to find new varieties that combine high yield potential with good standing power, good disease resistance (including mosaic virus) and with grain quality at least as good as Barra. As most markets depend on quality grain we need to have processing/cleaning facilities to ensure that we can make the quality to supply our premium export markets. Identify husbandry that will help protect winter sown crops against frost kill and frost heave. Need proven husbandry advice on how best to achieve good grain quality. Increased yields and in particular reduced production costs will be necessary to remain competitive. Need to capitalise on our oat crop advantage by promoting export markets and continuing to develop new food products that capitalise on the health benefits of this cereal. 6.4 Pulses Current Position Pulse crops (peas and beans) are currently minority crops with an estimated 18,700 tonnes produced from 4,000 ha annually. While peas for human consumption were significant, less than 4,000 tonnes are now produced with field beans for animal feed now being the main pulse crop grown. Lupins are occasionally grown. Ireland is significantly deficient in animal feed protein but the industry has not developed to fill this deficit. Table 7: Summary of Growth Opportunities for Pulses in Ireland Additional Market ( '000 tonnes) Additional Value (million €) Additional Area (ha) Peas 4 0.95 600 Beans 42 8.79 6145 Opportunity (Prices: Peas €240, Beans €210) 12 Actions Needed to Achieve the Potential Increasing the current pulse area will require much improved technical advice and tools. This means increased research to guide both rotation and husbandry and to quantify the residual benefits of these crops later in the rotation. - A better understanding of the nutritional constraints associated with these protein crops is needed. The consequences of cooking/toasting techniques on palatability needs to be assessed - Drying these large seeds remains a problem so alternative techniques need to be explored. - Alternative milling / processing techniques must also be examined to help overcome a perceived problem with dry beans for example. There needs to be a complete and co-ordinated industry commitment to the development of protein crops We need to maximise the potential benefit of every tonne of protein feed that can be grown in Ireland to help complement the concept of Brand Ireland. A production strategy is necessary for development of all animal sectors to help ensure that we are not over-exposed to feed market volatility. A transparent pricing system with forward-selling options is necessary. 6.5 Oilseed rape Current Position Oilseed rape is now the most important break crop grown with an average of 8000 ha grown annually over the last 4 years; but having increased from 2,300 ha in 2003 to 17,000 ha in 2012. Improved price has been the main driver; added-to by good yields in 2010 and 2011. While bio fuel initiatives spurred growth in 2006/7, these have ceased and production is now mainly for export for crushing (to produce oil and high protein cake) with consequent loss of value-added opportunity and carbon credits. There is increasing interest in the use of oilseed to produce specialist oils for cooking and food preparation. Table 8: Summary of Growth Opportunities for Oilseed Rape in Ireland Additional Market ( '000 tonnes) Additional Value (million €) Additional Area (ha) Food 39 15.5 7,800ha Crushing 216 86.4 44,000ha Opportunity (Prices: OSR €400 Actions Needed to Achieve the Potential Research is needed to meet the requirement for high yields as area increases. 13 A market for oil must be established in this country to help justify the requirement for crushing facilities, to retain the added-value benefit of both the oil and protein cake on the island. Increased crushing capacity is needed. Increased access to chemical control tools is necessary, especially for weed control. Export market opportunities need to be actively promoted. 6.6 Maize Current Position Maize has averaged 20,875 ha over the period 2008-2011, but the area declined to 19,000 ha in 2011 and dropped significantly again in 2012 (early estimates 11,000 ha) following a poor crop in 2011. Maize is grown almost entirely for whole crop silage production, and can produce a high value high energy feed. Increasingly maize has been grown under plastic mulches to extend the growing season and hence productivity. Table 9: Summary of Growth Opportunities for Maize in Ireland Opportunity Fodder Additional Market ( '000 tonnes) Additional Value 150 (DM) Additional Area (million €) (ha) 28.5 10,000 Value estimated at €190/tonne DM Actions Needed to Achieve the Potential Breeding/more intensive selection of varieties with improved suitability for our climate. Determination of the optimum production strategy (variety, sowing date, plastic mulch, management) for different regions of the country. A clear indication of production risk, (impacting on yield, quality and cost) needs to be developed for all potential growers in different climatic regions. A formal method for trading maize between tillage farmers and livestock producers is needed to establish market confidence. This requires: - Clear definition of crop ‘quality’. - Means of estimating quality preferably prior to harvest. 6.7 By-Products The previous sections have outlined potential areas for growth for a range of crops, and the potential increased revenue and job creation possible if the expansion is realised. On the whole, the revenues and jobs created are based on the exploitation of the primary marketable product. However, with a large number of tillage crops there are additional benefits, either to the tillage farmer or the agricultural industry as a whole, to be gained from the exploitation of by-products either from the growing of the crop or from its processing. 14 The benefits from exploiting these by-products are more difficult to quantify and in some instances separate from the production of the primary product. This section does not attempt to quantify the value of, or even identify, all of the potential by-products. Rather, the objective is to flag to the industry as a whole that, when seeking to exploit any of the opportunities identified, there could be significant additional benefits and revenue streams from exploiting these by-products. Some of the more obvious examples of by-products with additional income potential include; - Cereal straw for combustion or digestion for bio fuel production. - Barley and wheat straw for feeding. - Beet tops as an additional feed for livestock. - Beet Pulp for incorporation into rations. - Oilseed rape meal, if pressed at home, as a protein replacement in rations. - Distillers grains for livestock rations. - Pea haulm for lamb feeding. 6.8 Environmental Sustainability Considerations of Increased Crop Production This report aims to set-out a vision and pathway for the development of the tillage sector in Ireland. As part of that process it is important to consider environmental issues from a number of perspectives. Firstly, it is important to identify any risks to the environment from the developments outlined in the plan. Secondly, it is important to identify any threats or opportunities arising from present or proposed future regulation that could impact on the sector. Finally, given our current international reputation as a producer of ‘green’ environmentally friendly produce; it is vital that this plan ensures that there is no threat to that reputation and that it includes an objective of improved sustainability and image. 15 Horticulture Sector Overview Ireland’s horticulture industry consists of a range of different sub-sectors including mushrooms, field vegetables, potatoes, fruit, amenity plants, bulbs, flowers, cut foliage and honey production. While there are some similarities, each of these diverse sectors face different challenges and opportunities. Annex 1 set out a detailed analysis for the main sectors within the Irish horticultural industry. The horticulture sector contributed approximately €478 million to farm-gate output in 2013. The sector makes an important economic contribution and generates significant ancillary employment in areas such as preparing, packing produce, distribution, retail, garden design and landscaping. Table 10: Farm-gate value of horticultural output, 2011-2013 2013 Product 2011 2012 €m €m €m % change 2013 v 2012 Mushrooms 100.2 111.9 121.5 8.6 Potatoes * 85.7 103.3 164.5 59.2 Field Vegetables 61.1 55.8 59.7 7.0 Protected Crops 83.8 79.9 82.0 2.6 Outdoor Fruit Crops 7.5 6.3 7.7 22.2 Hardy Nursery Stock 44.5 39.1 38.2 -2.3 Bulbs, outdoor flowers and foliage sector 4.2 3.6 4.5 25.0 Total 387 400 478 19.5 Source: Note: DAFM estimates. * CSO estimates The value of output for certain crops in 2012 was influenced by the exceptionally wet weather during the year. The domestic retail and food service markets are the most important markets for Irish fresh horticulture produce. However, mushrooms produced for the UK market represent a major export destinantion with a value in excess of €100 million. Ireland is a net importer of horticultural products and there is still significant potential to replace imported product with Irish product. Amenity products are focused to a large extent on the domestic market. The main exports are Christmas trees, nursery stock and cut foliage. 16 There is a very open market for horticultural products and the Irish industry has to compete with others who in some cases have a significant competitive advantage both in terms of scale and a lower cost base. The competitive pressures faced by the horticultural sector in particular are high input costs, notably energy, competitively priced imports, lack of scale and limited development in innovation. Notwithstanding this, the sector has significant potential for further development. The food service market offers opportunities to replace imported product with home grown seasonal produce, to supply into the organic market and to diversify to meet ethnic and other emerging food demands. On the amenity side, there is a need to innovate and to develop new products, services and markets. The best way to achieve this is through a coordinated approach where businesses, both large and small, would combine resources to exploit new opportunities. Sectoral Goals Overall sectoral goals to 2025 for Ireland’s horticulture sector are to: maintain production area and diversify production in response to new market opportunities increase saleable yield maintain, and where possible, increase value per unit sold reduce production costs. Future Market Prospects In general, future market prospects are good as there should be increasing demand for Irish horticultural produce through an increased focus on consuming more fruit and vegetables as part of a healthy diet, combined with increased consumer awareness of food origin. Notwithstanding these issues, the horticultural sector is under significant downward price pressure from the retail multiples and there are also challenges in terms of the State’s horticultural research and advisory capacity. Actions planned To continue to support the development of the Irish horticultural sector, the main actions planned from DAFM’s point of view are to continue to operate the Scheme of Investment Aid for the Development of the Commercial Horticulture Sector, as well as the EU Producer Organisation Scheme, to continue implementing EU legislation including food safety controls and to provide ongoing support to Teagasc and via the various promotional activities conducted by An Bord Bia. a) Scheme of Investment Aid for the Development of the Commercial Horticulture Sector This Exchequer-funded scheme assists the development of the horticulture sector by grant aiding capital investments in specialised horticultural equipment and buildings that will: facilitate environmentally friendly practices, improve the quality of products, promote diversification of on-farm activities, improve working conditions at producer level. 17 It is a competitive grant scheme where each round is run on an annual basis. Grant aid is provided at a rate of up to 40% (50% for applicants under 35) for approved investments. Each year, typically 170 growers (approx) apply to participate in the Scheme. The Scheme, which is heavily oversubscribed each year, represents the main (and in most cases only) support for capital investments by horticultural growers. The Department recently secured approval under EU State Aid Rules to facilitate continuation of the Scheme to 2019. As the economy recovers, it would be beneficial to increase the level of funding available for the scheme (2014 budget €4.25m; pre-recession budget was €7m per annum). In line with the recommendation of the HLIC under FH2020, DAFM is also exploring the possibility of extending the timeframe for applicants to draw down funding to two years to facilitate specific large scale projects that cannot be completed within the year of approval. b) Producer Organisation Scheme This EU-funded scheme is part of the COM in fruit and vegetables. Its objective is to encourage growers to come together to strengthen their position in the market in the face of increased concentration of demand by the multiples. Each Producer Organisation (PO) implements an approved Operational Programme over 3, 4 or 5 years, implemented from year to year. The programmes have the objectives of improving marketing, quality, production and demand planning and using environmentally sustainable methods. 50% of the cost of implementing actions to achieve these objectives is refunded on submission of a claim in respect of each year. There are currently two POs in Ireland participating in the PO Scheme - Commercial Mushrooms Producers Co-op Society Ltd (CMP) and Quality Green PO. The payment to the 2 POs for the 2012 claim year (paid in 2013/14) was over €2.5 (about 95% of this went to CMP). There is scope to increase the number of Irish POs; however, there is a significant administrative burden associated with operating a PO. To justify its creation, any new PO will require a number of large scale growers agreeing to collectively market their produce; this could be difficult to achieve. The scheme is subject to audit by the EU. All Member States have reported that the EU auditors have taken a very narrow view of what may be approved in operational programmes. Auditors have applied severe disallowances for certain activities and arrangements approved by Member States. The Commission has produced a report on the implementation of the provisions on POs, operational funds and operational programmes in the fruit and vegetable sector since the reform in 2007. The EU Farm Council has considered this report and concluded that the procedure to set up and run a recognised PO which has access to EU funds for its operational programme is complex and prone to legal uncertainty. Moreover, the Council considers that the administrative burden is too high and that more can be done to cut red tape and simplify the rules and procedures, providing producers with a clear, predictable and transparent framework within which they can best respond to the market. The Commission is to review the regulatory framework by the end of December 2018 at the latest. c) EU Marketing Standards for fresh Fruit, Vegetables and Potatoes DAFM is responsible for enforcing EU legislation relating to the quality and labelling of fresh fruit and vegetables and national legislation in respect of potatoes. While the standards cover a number of technical quality parameters, the most important aspect for most consumers (and Irish producers) is to ensure correct country of origin labelling. 18 DAFM conducts inspections throughout the fruit, vegetable and potato distribution chain, at import, wholesale and retail level to verify compliance with this legislation. These inspections should continue to prevent abuses within the trade and to ensure that consumers are aware of where their food originated. d) Food Hygiene Since 2006, food hygiene legislation has applied to farmers, growers and other food producers, as part of the 'farm to fork' approach to food safety. This legislation lays down the food hygiene rules for all food businesses, applying effective and proportionate controls throughout the food chain, from primary production to sale or supply to the food consumer. DAFM is responsible for implementing controls to verify primary producers of fruit, vegetables, potatoes, mushrooms and honey comply with the legislative requirements. Since the E.Coli crisis in Germany in 2011, there is an increased focus on the risks posed by horticultural products and in particular “ready to eat” products. If any food safety outbreak were linked to Irish fruit or vegetables, it could have a significant impact on the reputation and demand for Irish fruit and/or vegetables. DAFM controls must ensure producers put measures in place to avoid a food safety crisis associated with Irish horticultural produce. In addition, difficulties have been encountered in relation to the level of cadmium in potatoes. DAFM is undertaking a research programme to address the issue; there is a need to continue to explore measures over the long term that could reduce the level of cadmium in Irish potatoes. e) Teagasc Due to retirements and the non-filling of posts, the number of Teagasc horticultural advisory posts has been significantly reduced over the past decade. There are currently 6 advisers with a number of vacant posts. This is having a severe impact on horticultural growers’ ability to access professional advice; there are no dedicated personnel within Teagasc to provide advice to growers in certain sectors of the horticultural industry, including nursery stock and potatoes. In addition, the number of horticultural researchers has also declined and while Teagasc has entered an agreement to share research outputs with the UK’s HDC there is a need for more research under Irish conditions to guide growers investment decisions and to determine the likely impacts of climate change on Ireland’s horticultural sector. Teagasc needs to explore all available options, including the possibility of co-funding from industry, to fill advisory vacancies and develop its horticultural research capacity. f) Bord Bia and Promotions There are several campaigns run by Bord Bia including: Food Dudes Programme which develops taste for fruit and vegetables among primary schoolchildren. Scientific evaluations and surveys have consistently shown that children including those with special needs develop a taste for fruit and vegetables, eat more and continue to do so over time. Food Dudes Boost Programme commenced in autumn this year. It will introduce a new cycle of children in the 4-8 year old cohort to Food Dudes and provide a four day Boost to those in the 8+ to 12 year old cohort. This programme fits with a recommendation in the eHealthy/Healthy Ireland Strategy. An EU-funded promotion scheme is in place for mushrooms on the UK and Irish markets. This has delivered strong market growth. To address declining potato consumption, a 3-year promotion campaign is being developed with a view to commencing in 2015; which will hopefully also achieve EU 19 funding. This will, it is hoped, at least stabilise potato consumption over the coming years. Sustainability considerations Over recent years, growers have invested heavily in reducing energy costs and maximising saleable yield. If support for such investments continues under the Scheme of Investment Aid for the Development of the Commercial Horticulture Sector and the Producer Organisation Scheme, the industry should continue to develop in a sustainable manner. Given the improved environmental focus of production coupled with Ireland’s status as a net importer of horticultural products, the Irish horticulture sector should benefit from an increased focus on sustainability. The focus on sustainable methods of food production should increase demand for Irish product and provide opportunities for by-products. The drive to reduce the level of peat in amenity compost will provide opportunities to utilise spent mushroom compost. Disposal of this by-product currently represents a significant cost for the industry. Similarly other material currently regarded as waste may become an asset. Challenges up to 2025 The main challenges will be: to develop an adequate advisory and research service to allow the sector achieve its potential to maintain production area and diversify production in response to new market opportunities to maintain value per unit sold to reduce production costs (in particular energy and labour costs) and thereby to increase competitiveness of the Irish industry. to enhance the bargaining powers of growers relative to the supermarkets to encourage greater co-operation between growers in each of the sectors to attract new entrants, particularly young people, as the financial resources needed to start a business continue to increase for growers to meet the increasing food safety requirements. Climate change will likely affect the Irish horticultural industry in a number of different ways. There is a need to increase research in this area to allow the industry prepare for these changes. 20 Organic Cereal/Tillage Sector 1. Overview of the Sector Organic cereal production in Ireland includes wheat, barley, oats, arable silage, peas, beans, oilseed rape, triticale and linseed. In 2012, the area under organic crop production totalled 2,312 hectares, with oats being the most predominant crop grown as shown in Figure 1 below: Figure 1: Organic Cereals 2012 Ireland Cereals Summary 100 1400 1200 156 growers Ha 2,312 ha 1000 75 No. growers 800 50 600 400 25 200 0 0 Source: DAFM While this area is relatively small compared to the conventional tillage sector, it is important to remember that the total utilisable agricultural area under organic production in Ireland is approximately 1.2%. Based on Department figures, the number of organic farmers engaged in cereal production increased from 94 growers in 2008 to 156 growers in 2012. There is considerable disparity however in the size of the holdings, with 94 growers with less than 10 hectares and only 11 growers with over 40 hectares. 21 Figure 2: Size range of organic cereal growers 2012 >40ha, 30 - 11 40ha, 20 - 12 30ha, 13 10-20ha, 26 0 - 10ha, 95 94 Source: DAFM Similar to the conventional sector, there is scope for increased production to replace a proportion of imported organic cereals used for animal feed. 2. Market Prospects The price per tonne for organic cereals compares favourably with the price for conventionally grown cereals. In 2014, the price for breakfast cereal organic oats ranges from €330 to €350 per tonne. The price per tonne for organic barley, wheat and oats for animal feed ranges from €260 to €280 per tonne while the weekly average price (w/ending 12 September, 2014) for conventional barley is €156 per tonne and for conventional wheat is €156 per tonne. It is important to note that yields on organic cereal/tillage farms are lower however margins are higher because costs are lower due to lower inputs. The key message from stakeholder consultations carried out prior to the publication of the Organic Farming Action Plan in 2013 in respect of organic cereals is one of opportunity, potential for growth and import substitution. While a large proportion of the total tillage crop is dedicated to oats, there is insufficient supply of organic cereals and proteins to meet demand. The issue of developing demand for other organic tillage crops was highlighted by stakeholder consultation. The potential opportunity for import substitution by developing an animal feed industry based in Ireland is clear. 3. Actions Needed to Achieve Potential In order to achieve progress in respect of import substitution, the quantity and type of organic feed being imported into the country must be established to determine if and how these can be replaced by home grown produce. Encourage large scale organic tillage farmers to set up small scale feed manufacture e.g. one coarse feed initially rather than complete range of pellets etc. Continue advising farmers to grow organic cereals and proteins to supply the existing market. Research and cropping trials. Trial of equipment and varietal trials that aid cereal production. 22 Annex 1 Detailed current sectoral analysis for the main sectors within the Irish horticultural industry Mushrooms: Largest sector of the Horticulture industry. 75 growers principally located in Monaghan, Tipperary and Cavan producing an estimated 68,000 tonnes of mushrooms annually using over 200,000 tonnes of compost. At least 70% of production is exported to the UK where Irish mushrooms account for about 50% of all retail sales. While the sector has positive future prospects, reliance on the UK market is a concern. Very dependent on UK market and value of sterling UK market performed well in 2013 assisted by an Industry/EU co-funded mushroom promotion campaign administered by DAFM’s Food Industry Development Division. “Buy British” campaign is a risk to Irish producers Potatoes: Majority of crop produced by 100 large scale growers “Rooster” is the dominant potato variety grown representing 60% of the overall production area grown in 2013. 14% increase in production in 2013, following exceptionally high prices in 2012 The oversupply in 2013 and the absence of any strong export market had the effect of significantly reducing producer prices. 2014 planting lower than 2013 but good yields expected; demand remains depressed. Growers and potato packers in Ireland and the UK are collaborating with a view to submitting a joint proposal for a 3-year Industry/ EU co-funded potato promotion campaign which will hopefully commence in 2015. Table A1: Area, Yield and Production of Potatoes, 2011-2013 Year Area (000 Ha.) Estimated Average Yield (tonnes per Ha.) 2011 9.61 40.0 2012 8.86 29.7 2013 10.09 36.0 Source: DAFM Estimates Production (000 tonnes) 384.4 263.1 362.9 Field Vegetables: 200 growers produce a wide range of field vegetables in Ireland. Winter field vegetable crops (carrots, cauliflowers, cabbage, sprouts and swedes) bore the brunt of the 2013 supermarket price war. In most cases, those supplying retail multiples were not immediately affected in terms of price. However, it did impact on the wholesale market and grower confidence. To date, 2014 has been a reasonably good year for most field vegetable producers. Frequent competitive tendering by those supplying the retail multiples is creating a degree of instability within the trade as contracts move from one supplier to another. 23 Protected Crops (excluding soft fruit). 120 protected crop growers mainly located in North Dublin, Louth and Wexford, mainly tomatoes, peppers, cucumbers and some flower crops. Output has decreased over the years due to high capital and running costs (especially in terms of energy and labour costs) coupled with competition from imports and the dominance of the supermarkets. In 2013, salad crop growers suffered due to the cold weather early in the year but enjoyed very good demand for their product during the summer and autumn period. Fruit Soft Fruit: Over 70 growers producing mainly strawberries and raspberries, mostly grown under protection. Sector has fared well over recent years with strong consumer demand In 2013 the Irish market for berry fruit grew by circa 10% compared to 2012. Apples: 40 apple growers producing culinary, dessert and cider apples. Less than 10% of the dessert apples consumed in Ireland are produced in the country. The outlook for the apple sector is reasonably positive with some renewed interest in planting apple trees. Hardy Nursery Stock: 100 nursery stock producers located mainly in Kildare, Tipperary, Kilkenny and the east of the Country. Sector has been severely hit by the economic recession with a decline in landscaping, severe frost damage in late 2010 and the detection of Chalara in late 2012. Many growers have scaled back production and staff numbers; however, trading conditions for the sector have improved in 2014. 24