Housing Management Bulletin 2013

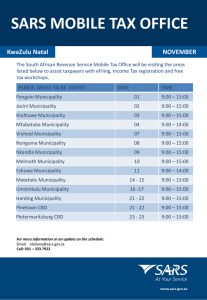

advertisement

HOUSING MANAGEMENT BULLETIN 2013-1 PROCEDURES FOR INCOME VERIFICATION UNDER REAL PROPERTY LAW § 421-m I. Description Real Property Tax Law (“RPTL”) § 421-m is a tax exemption program for new or substantially rehabilitated housing for individuals or families of moderate income (households which earn 90% or less of the Area Median Income (“AMI”)). It is applicable at the option of a city, town or village (“municipality”) or a special benefit area within such municipality. RPTL § 421-m requires the Division of Housing and Community Renewal (“DHCR”) to establish income verification procedures for residents to be used by owners of such housing, as well as for compliance monitoring standards to be used by the municipality in establishing procedures to assure program compliance by owners. The following procedures are therefore established by DHCR, in accordance with RPTL § 421-m – Exemption of certain new or substantially rehabilitated multiple dwellings from local taxation. Questions regarding this procedure should be directed to DHCR’s Office of Asset Management at OHMquestions@nyshcr.org. II. Eligibility Pursuant to RPTL § 421-m(3)(c) at least twenty percent of the units in such housing must be affordable to individuals or families of low and moderate income whose incomes at the time of initial occupancy do not exceed ninety percent of the AMI adjusted for family size and the individual or family shall pay in rent or monthly carrying charges no more than thirty percent of their adjusted gross income (“AMI”) as reported on their federal income tax return, or would be reported if such return were required, less such personal exemptions and deductions and medical expenses as are actually taken by the taxpayer or could be taken where there is no tax return. Area Median Income is available on HUD and Census websites. For the income reviews, DHCR has created an Annual Income Review Sheet which is to be completed by the participating households and submitted to the owner. There are three kinds of households which may be participating: (a) households which are already participating in another affordable housing program which is income tested; (b) households where adult members have filed tax returns and (c) households where adult members have not filed tax returns. There are different methods of establishing eligibility and income for each group. A. Determining eligibility and income when RPTL § 421-m is used with other income tested affordable housing programs: RPTL § 421-m(3)(d) provides that for such construction or substantial rehabilitation to be eligible for an exemption it must be carried out with the assistance of grants, loans, or subsidies from a federal, state or local agency. Many of these grant, loan or subsidy programs have income testing components designed to serve populations at or below 80% of AMI (without necessarily taking into account additional deductions to income provided for by RPTL § 421-m). The income verification procedures under those programs will be considered an adequate substitute for an independent review of compliance with RPTL § 421m(2)(c). Among the programs identified by DHCR as acceptable are the following: Federal Low Income Housing Tax Credit Program, State Low Income Housing Tax Credit Program, Project Based Section 8 Program, Housing Choice Voucher Program, HOME Program, CDBG Program, HUD 236 Program and the Rural Development Program. If the owner or municipality believes that any other affordable housing program in which it participates is also an acceptable program it must request approval from the DHCR to use such program as an adequate substitute. For tenants in this category A, only Parts I, V and VI of the Annual Income Review Sheet need to be completed. B. Determining Eligibility and Income when A is not applicable and the adult family members have filed a federal tax return. The owner shall require a certified copy of the federal tax return and use the adjusted gross income on line 37 of Internal Revenue Service (IRS) form 1040, line 37 to establish income. The IRS 1040 form is annexed to the Annual Review Sheet herein. For tenants in this category B, only Parts I, II, V and VI of the Annual Income Review Sheet need to be completed. C. Determining Eligibility and Income when A and B is not applicable (i.e. the adult family members have not filed a federal tax return). For tenants in category C, all parties of the Annual Income Review Sheet need to be completed. III. Initial and Annual Recertification by the Municipality A municipality providing an exemption pursuant to RPTL § 421-m must develop an income monitoring and compliance plan to meet the criteria of RPTL § 421m(3)(c) which may include a random sampling of tenant files as part of such compliance monitoring. A municipal plan for compliance monitoring shall be reviewed, evaluated and approved by DHCR as a condition of providing such exemption. If such requirements are not met, then the multiple dwelling shall not qualify for the exemption in that year. At a minimum as part of any such plan an Income Qualified Unit Report by each owner shall be submitted to the municipality as well as DHCR at least 60 days prior to the beginning of the tax exemption period. The DHCR Annual Income Qualified Unit Report attached to this bulletin. A municipality’s plan must be designed to serve as a readily accessible guide for the people and organizations involved and must address the following criteria in a clear, concise manner: IV. Owner Certification Process A. Review and Selection Process The municipality must require owner intake and review of applications including an owner certification process to ensure compliance with the income targeting and eligibility requirements on RPTL § 421-m. B. All information contained in the forms attached to this bulletin is confidential to the extent it contains personal or private information concerning residents. Appropriate storage and access measures must be taken to safeguard privacy. Municipal employees and property management personnel should be advised that this information may be disclosed only where necessary as part of this program such as to the municipality or DHCR, or otherwise in conformance with the New York State Personal Privacy Protection Laws. V. Municipal Certification Process A. On-going Monitoring The municipality must describe any other applicable procedures regarding monitoring, rent adjustments, and tenant income eligibility which must also assure the individuals or families are not paying more than 30% of their income (as defined by RPTL § 421-m ) for rent. B. Follow-up Activities The municipal plan should require owner to communicate with the municipality and DHCR with respect to any issues that arise in the application of this program which need municipal or DHCR input. C. Certification The municipal plan must include the receipt of an annual certification from the owner that the multiple dwelling receiving an exemption meets the requirements of New York RPTL § 421-m. Such certification shall be provided to the municipality and the DHCR. Such certification must include the following language: OWNER CERTIFICATION FOR REAL PROPERTY TAX EXEMPTION FOR CERTAIN NEW OR SUBSTANTIALLY REHABILITATED MULTIPLE DWELLINGS (New York Real Property Tax Law, Section 421-m) The undersigned, under penalty of perjury, hereby certifies to the city, town or village assessor that all of the information set forth in the income monitoring and compliance plan of (enter name of the municipality) has been verified for the taxable year ____ as provided for in accordance with RPTL § 421-m. I am authorized to execute _____________________________ this document on behalf of The project has been, and is, owned and operated in compliance with the income and rent restrictions as defined in RPTL § 421-m. 421M-Housing Mgmt Bulletin 2013-1-4.19.13/Melnitsky:h/db:g/4.19.13/4:35 pm