256.34Kb - G

advertisement

On the development and usage of the market economy parametrical

regulation theory on the basis of one-class mathematical models

Abdykappar A. Ashimov*, Nurlan A. Iskakov*, Yuriy V. Borovskiy**, Bahyt T. Sultanov*, Askar

A. Ashimov*

* Laboratory of Systems Analysis and Control, Institute of Problems of Informatics and Control

221 Bogenbay batyr str., Almaty, 050026, Republic of Kazakhstan

** Kazakh-British Technical University, 59 Tole be str., Almaty, 050000, Republic of

Kazakhstan

E-mail: * ashimov@ipic.kz, ** yuborovskiy@topmail.kz

Abstract

The paper offers further development and

applications of the theory of a parametrical regulation

of market economy evolution. This theory consists of

the following sections: formation of a library of

economic systems’ mathematical models; of rigidness

(structural stability) of mathematical models;

development of parametrical regulation laws etc. The

work contains new results of the considered one class

models’ rigidness research with and without

parametrical regulation.

1. Introduction

Many dynamic systems [8] including economic

systems of nations [9, 10], after certain transformations

can be presented by the systems of non-linear ordinary

differential equations of the following type:

dx

f ( x, u , ), x(t0 ) x0 ,

dt

(1)

Here x ( x1 , x 2 ,..., x n ) X R n is a vector of a

state of a system; u (u1 , u 2 ,...,u l ) W Rl - a

vector of (regulating) parametrical influences; W, Х are

compact sets with non-empty interiors - Int (W ) and

Int ( X )

respectively;

a

vector

of

uncontrolled

parameters ( , ,, ) R , is an

opened connected set; maps f ( x, u, ) : X W R n

1

and

f

,

x

f

,

u

f

2

m

m

are continuous in X W ,

[t 0 , t 0 T ] - a fixed interval (time).

As is known [4], solution (evolution) of the

considered system of the ordinary differential

equations depends both on the initial values’ vector

x0 Int ( X ) , and on the values of vectors of controlled

(u) and uncontrolled ( ) parameters. This is why the

result of evolution (development) of a nonlinear

dynamic system under the given vector of initial values

x0 is defined by the values of both controlled and

uncontrolled parameters.

Main components of market economy parametrical

regulation theory have been developed and offered in

[4, 5, 6] based on the fact of a possible description of a

country’s economic system with the help of a

mathematic model of type (1). Thus, in [3, 2] an

approach is offered to finding the vector u values in the

form of extremals of variation calculation task on the

choice of parametrical regulation laws from the given

set of parameters’ dependences on these or those

significant endogenic indicators of economic system’s

evolution. These laws are deduced from the conditions

of economic processes optimal evolution, when certain

parameters (e. g., price level) are preserved within the

given scales. In [7] a dependence of the deduced

optimal regulation laws on a non-regulated vector

change has been investigated. An assumption has been

proved on the existence of solutions to the above

mentioned variation calculation tasks. A definition is

provided and an assumption is proved on the sufficient

terms of existence of extremals bifurcation points of

the above-mentioned variation calculation tasks under

the parametrical perturbations [4].

Development and usage of this theory in solving of

certain tasks of parametrical regulation of market

economy development depend on the choice of

mathematic models meeting the requirements of

economic system evolution. This requires additional

study of roughness (structural stability) of the models

chosen [1, 12]. The results of this research allow

considering an adequate nature of mathematic models

as well as a structural stability of the economic system

described by this model. Development and application

of a theory for the chosen models require that definite

parametrical regulation laws should be chosen, and the

dependence of the chosen laws on the values of the

non-controlled parameter should be studied as well.

The paper presents latest results of development and

application of the parametrical regulation theory to a

mathematical model of an economic system with the

account of foreign commerce [3].

i s i i

xi

1

1 i p i

1 i

i

Rid

(11)

1

1 i

1 i

f i 1 1

x

i i

;

(13)

G

i i pi M i f i ;

(14)

iL

iI

(1 n L i ) si Rid

;

(15)

1

1 n pi

2.1. Model description

n0 i (d iB d iP ) n p i O

i

dM i

i M i ;

dt

pi bi

(2)

dQi

M i fi i ;

dt

pi

(3)

dLGi

dt

rG i LGi

(4)

G

i

n p i i n L i s i RiL

nO i (d iP

dpi

Q

i i pi ;

dt

Mi

R d R S

dsi

s

i max 0, i S i ,

dt i

Ri

RiL

LPi

d iB );

(5)

LGi ;

k qi M i f i

i

(1 n pi ) G

i

(16)

n L i (1 n L i )n p i s i RiL

n pi ( ji i ij ) i L pi rG i LPi };

RiS P0Ai exp( p it )

i

(1 CiL i

iL

pj

pi

1

1 ii

,

j 3i

;

;

) P0 i ( pit )

(27)

p2

O p2

С1

p1

p1

L

12

1

1O ;(18)

L p2

O p2

1 C1

1 C1

p1

p1

p

p

С 2L 1

С 2O 1

p2

p

2

21

2L

O2 ;(19)

L 1 p1

O 1 p1

1 С2

1 C2

p2

p2

С1L

1 1I 1L 1O 1G 21 12 ; (20)

(6)

1

2 2I 2L O2 G2 12 21 . (21)

min{ Rid , RiS };

1 i

(12)

O

i 0 i pi M i f i ;

{

iI

(10)

M i xi ;

2. Research of rigidness (structural

stability) of a mathematic model without

parametrical regulation

The considered task is solved on the basis of the

parametrical regulation theory and on the sample of the

following mathematical model [10], which presents the

phase restrictions and restrictions in the permitted form

of the researched variational calculus task at the choice

of parametric regulations laws by the following

relationships:

;

i

1 i

d iP

i r2 i LGi ;

i

(7)

d iB i r2 i LG

i ;

(9)

(8)

Here: i = 1, 2 is for a number of the state; t is for

time; M i – total production capacity, Qi – the general

stock of the goods in the market relatively some

balance; LGi – total amount of a public debt; pi –

price levels; si – average real wages; LPi -volume of

manufacture debts; d iP and d iB - enterprise and bank

dividends respectively; Rid and RiS – a supply and

demand of a labor respectively; i , i - parameters of

function

f i( xi )

fi ;

si

pi

xi

– a solution to the equation

; iL and O

i -consumer spending of

workers and proprietors; iI - investment flows; G

i consumption government spending; ij – consumer

spending of the i-th country on an imported product

from the j-th country; θ - exchange rate of the first

country in relation to the exchange rate of the second

country ( 1 , 2 1/ ); CiL (CiO ) - volume of

imported product units consumed by the workers

(proprietors) of the i-th country on the domestic

product unit; i – norm of reservation; i - ratio of

the average profit rate from commercial activities to

the rate of return of the investor; r2i - deposits rate ;

r1i - credit rate; rGi – government bonds rate; Oi factor of proprietors’ propensity to consume; i -share

of consumption government spending from the gross

domestic product; nPi , nOi , nLi - rates of the tax to flow

payments, dividends tax and surtax accordingly; bi norm of a capital intensity of a production capacity

unit; i -factor of power unit leaving which is caused

by degradation; i - norm of amortization; ai - time

constant; i - time constant setting the characteristic

time-scale of wages process relaxation;

P0i , P0Ai

- initial

values of amount of workers and total amount ablebodied population respectively; i - per capita

consumption in group of employees; Pi 0 appointed tempo of demographic growth; k qi - share

of the gross domestic products reserved in gold.

This system reduces to a system of the eight

ordinary differential equations for the variables, si are

constant.

The model parameters and initial conditions for the

differential equations (2)-(6) were accepted on the

basis of economic data of the Republic of Kazakhstan

and the Russian Federation at 1996-2000

or

(bi , r1i , r2i , rGi , nPi , nLi , i , si , Oi , i , i* , i )

are assessed through the solution of the parametric

identification task ( i , i , i , i , bi , i , Qi (0)) .

2.2. Research of rigidness (structural stability)

of a mathematic model

Let us conduct statement of rigidness (structural

stability) of a model under consideration in a closed

field , basing on the definition of rigidness and the

theorem on sufficient conditions of rigidness [12]. The

conditions are as follows.

Let N be some set and N be such a compact subset

N that the closure of interior of N would be N. Let

some vector field be given in the area of set N in N ,

then this field would determine the C 1 flow f in this

area. The chain recurrent set of the flow f on the N is

marked as R( f , N ) .

Let the R( f , N ) be contained inside the N and have

a hyperbolical structure; besides this, the f on the

R( f , N ) would satisfy the transversality conditions on

stable and unstable manifolds. Then the flow f on the N

is weakly structurally stable. Particularly, if the

R( f , N ) is an empty subset, then the flow f weakly

structurally stable on the N.

We will assume further that Rid > RiS . In this case

differential equations (6) are replaced with the

conditions of stability of variables si .

Statement 1. Let N be a compact set in area

(M 1 0, Q1 0, p1 0) or (M 1 0, Q1 0, p1 0) ,

of the phase area of differential equations system

obtained from the (2-21), i.е. eight-dimension area of

variables ( M i , Qi , pi , LG i ) , i 1, 2 ; closure of

interior of N coincides with the N. Then the flow f

determined by the (2-21) is weakly structurally stable

on the N.

F.i., a parallelepiped could be chosen as the N, with

boundaries

M i M i min , M i M i max , Qi Qi min , Qi Qi max ,

pi pi min , pi pi max , LG i LG i min , LG i LG i max

Here

0 M i min M i max ,

0 Qi min Qi max ,

Qi min Qi max 0

.

or

0 pi min pi max ,

LG i min LG i max .

The proof. To start with, let us make sure that the

half-trajectory of the flow f beginning in any point of

the set N under a certain value of t (t>0) comes out

from the N. Let us consider any half-trajectory starting

in the N. There are two cases possible for it if t 0 : all

the half-trajectory points are left in the N, or for a

certain t a point of the trajectory does not belong to the

N. It follows in the first case from equation (5) of the

system dp1 Q1 p1, that the variable p1(t) for all the

dt

M1

t 0 has got a derivative that is either more than some

positive

constant

under

the

N (M 1 0, Q1 0, p1 0) or less some negative

constant under the N (M 1 0, Q1 0, p1 0) , that

is, the p(t) unlimitedly rises or tends to zero under the

unlimited increase of the t. This is why, the first case is

impossible, the orbit of any point from the N comes out

from the N.

As far as any chain recurrent set R( f , N ) is an

invariant set of this flow, in case of its non-emptiness it

should consist of whole orbits. Consequently, in our

case the R( f , N ) is empty. The assumption has been

proved.

3. Research of rigidness (structural

stability) of the mathematic model with

parametrical regulation

Handling the law U i , under the fixed ki , in the

system (2-21) means the substitution function U i ,

from (22) in equations of the system (2-21) instead of a

parameter i , i or .

The task of selection of an optimal parametrical

regulation law for the economic system of the icountry at the level of one of the economic parameters

( i , i , ) was set in the following form: to find on the

basis of mathematical model (2–21) an optimal

parametrical regulation law in an environment of the

set of algorithms (22), i.е. to find an optimal law (and

its factor ki , ) out of the set { U i , }, which would

have provided a maximum for the criteria

Ki

3.1 The task of choice of effective parametrical

regulation law

The possibility of the choice of an optimal set of

laws of type (3) of parametrical regulations was

researched: at the level of one of the 3 parameters

i ( 1) , i ( 2) , ( 3) ; at the time interval

[t 0 , t 0 T ] and in an environment of the following

algorithms.

1) U1i, k1i,

2)

U 2i ,

M i (t )

consti ;

M i (t0 )

k2i ,

3) U 3i , k3i ,

M i (t )

consti ;

M i (t0 )

pi (t )

consti ;

pi (t0 )

4) U 4i , k4i ,

1 t0 T

Yi (t )dt ,

T t0

(23)

where Yi M i f i is a gross domestic product of the istate. The calculation experiments studied the impact

of parametrical regulation of the first country (i=1).

The closed set in the space of continuous vectorfunctions of discharge variables of the system (2-21)

and regulating parametrical influences is defined with

the following relationships:

1

p

(t ) p1* (t ) 0.09 p1* (t ),

( M i (t ), Qi (t ), LGi (t ), p i (t ), s i (t )) X ,

(22)

pi (t )

consti

pi (t0 )

Here: U i , - is a α-law of regulation of βof the i-state, 1 4, 1 3 ,

Mi (t ) M , ,i (t ) Mi (t0 ), pi (t ) p , ,i (t ) pi (t0 ), t 0 – is

parameter

the time of the start of regulation, t t0 , t0 T ,

M , ,i (t ) , p , ,i (t ) are values of the production

capacity and price levels of the i–state respectively

under the U i , -regulation law. ki , is a tuned factor

of the relevant law ( ki , 0 i ); consti is a constant

that is equal to the assessment of the values of βparameter by the results of parametric identification.

(24)

0 u a , 1, 4, 1, 3, t [t 0 , t 0 T ]

Here a is the biggest possible value of a i

(t ) are values of price levels under the

parameter, p

i

U

(t )

law

of

regulation;

pi* (t )

are

model

(accounting) values of price levels in i-state without

the parametrical regulation, X is a compact set of

possible values of the given parameters.

The formulated task for the first country is solved in

two stages:

- at the first stage optimal values of factors k1 , for

each law U 1 , are defined by way of their values

sorting in relevant intervals (quantized with small

step), which provide maximum K 1 under the

restrictions (24);

- at the second stage an optimal parametrical

regulation law of a parameter based on the first stage

results for the maximum value of criterion K 1 will be

chosen.

is optimal for the other, both laws are optimal for the

projection line itself.

3.2. Research of dependence of the optimum

law of parametrical regulation on the values of

uncontrolled parameters

3.3. Results of research of rigidness (structural

stability) of a mathematical model with

parametrical regulation.

The given task of variational calculation considered

its dependence on a two-dimensional factor

(r2,1, ) of the mathematical model, whose

Application of the found above optimal laws of

parametrical regulation U 21, 2 and U 41, 2 means

possible values belong to some area (rectangle) on

the plane.

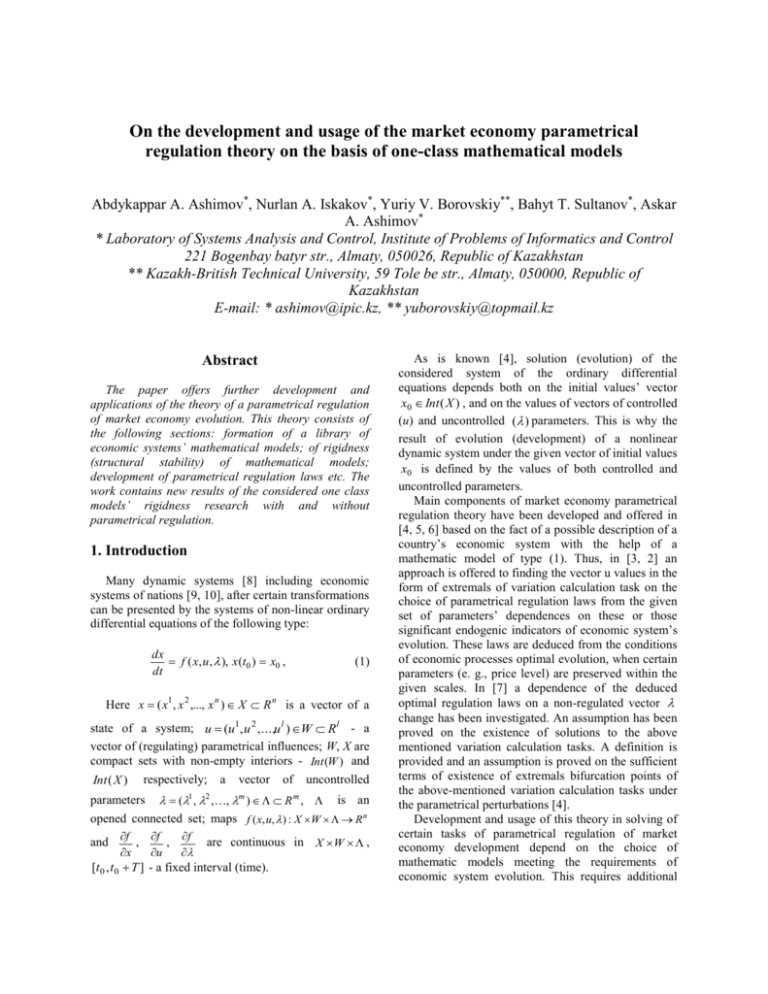

As a result of calculation experiment dependence

graphs of the optimal value of criterion K 1 on the

values of parameters (r2,1 , ) were obtained for each

of the 12 possible laws U 1 , , 1,4, 1,3 . Figure 1

demonstrates the given graphs for two laws, U 21, 2 and

U 41, 2 , which give the biggest value of the criterion in

area , an intersection line of corresponding surfaces

and a projection of this intersection line upon the plane

of values , which contains the bifurcation points of

this two-dimensional parameter. This projection

divides the rectangle into two parts; the regulating

law

Figure. 1. Graphs of dependences of the criterion’s

K 1 optimal values on the parameters of interest rates

on deposits r2,1 and currency exchange rate θ

M 1 (t )

const12

M 1 (t 0 )

is optimal in one of these parts, and the law

p (t )

U 41, 2 k 41,2 1 const12

p1 (t 0 )

U 21, 2 k 21, 2

(25)

(26)

replacement of parameter 1 by the relevant functions

in the equation (14), the rest equations of the model

remain unchanged. The proof of the weak structural

stability of the mathematical model given in i. 2.2. and

basing on equation (5), allows to find the following.

Statement 2. Let N be a compact set in area

(M 1 0, Q1 0, p1 0) or (M 1 0, Q1 0, p1 0) ,

of the phase area of the differential equations system

obtained from the (2-21), i.e. eight-dimension area of

variables ( M i , Qi , pi , LG i ) , i 1, 2 ; closure of

interior of N coincides with the N. Then the flow f

determined by the (2-21) and (25, 26) is weakly

structurally stable on the N.

4. Conclusions

This paper gives the following latest results of the

development and usage of the parametrical regulation

theory for a mathematical model of an economic

system with the account of foreign commerce [10]:

- the model’s weak structural stability for compact

areas of its phase space has been proved;

- the task of choice of optimal parametrical

regulation laws has been solved for maximizing an

average VAT of a country under some limitations upon

price level increase;

- a dependence of the found optimal laws on the

values of non-controlled parameters has been defined

and a set of optimal laws bifurcation points has been

found;

- a weak structural stability of a model preserved

under the usage of the chosen parametrical regulation

laws influenced by the non-controlled parameters of

the model has been proved.

5. References

[1] D.V. Anosov, “Rough systems”, Proceedings of the

USSR Academy of Sciences’ Institute of Mathematics, 1985,

Vol. 169, pp. 59-96 (in Russian).

[2] A. Ashimov, Yu. Borovskiy, and As. Ashimov,

“Parametrical Regulation Methods of the Market Economy

Mechanisms”, Systems Science, 2005 Vol. 35, No. 1, pp. 89103.

[3] А. Ashimov, Yu. Borovskiy, As. Ashimov, and O.

Volobueva, “On the choice of the effective laws of

parametrical regulation of market economy mechanisms”,

Automatics and Telemechanics, 2005, No 3, pp. 105-112 (in

Russian).

[4] А. Ashimov, К. Sagadiyev, Yu. Borovskiy, N. Iskakov,

and As. Ashimov, ’’Parametrical regulation of nonlinear

dynamic systems development”, Proceedings of the 26th

IASTED

International

Conference

on

Modelling,

Identification and Control, Innsbruck, Austria, 2007, pp.

212-217.

[5] А. Ashimov, К. Sagadiyev, Yu. Borovskiy, N. Iskakov,

and As. Ashimov, (2007): “Elements of the market economy

development parametrical regulation theory”, Proceedings of

the Ninth IASTED International Conference on Control and

Applications, Montreal, Quebec, Canada, 2007, pp. 296-301.

[6] А. Ashimov, К. Sagadiyev, Yu. Borovskiy, N. Iskakov,

and As. Ashimov, “On the market economy development

parametrical regulation theory”, Proceedings of the 16th

International Conference on Systems Science, Wroclaw,

Poland, 2007, pp. 493-502.

[7] А. Ashimov, К. Sagadiyev, Yu. Borovskiy, and As.

Ashimov, “On Bifurcation of Extremals of one Class of

Variational Calculus Tasks at the Choice of the Optimum

Law of Parametrical Regulation of Dynamic Systems”,

Proceedings of Eighteenth International Conf. On Systems

Engineering, Coventry University, 2006, pp. 15-19.

[8] Gukenheimer, J., P. Cholmes, Nonlinear fluctuations,

dynamic systems and bifurcations of vector fields, Institute of

Computer Researches, Moscow – Izhevsk, 2002 (in Russian).

[9] V.М. Matrosov, М.М. Chrustalyov, О.V. Arnautov, and

Krotov V.F., “On the highly aggregate model of development

of Russia”, The Proceedings of the 2nd International

conference “Analysis of instability development based on

mathematical modeling”, Moscow, 1992, pp. 182-243 (in

Russian).

[10] Petrov, A., I. Pospelov, and A. Shananin, Experience of

mathematical modeling of economy, Energoatomizdat,

Moscow, 1996 (in Russian).

[11] Pontryagin, A., The ordinary differential equations,

Nauka, Moscow, 1970 (in Russian).

[12] C. Robinson, “Structural Stability on Manifolds with

Boundary”, Journal of differential equations, No. 37, 1980,

pp. 1-11.