Philippines National Customs Legislation and Regime

Philippines National Customs Legislation and Regime

Additional Information

On February 6, 1902, the Philippine Commission passed Act No. 355, "The Philippine Customs

Administrative Act.” Patterned after the principles of the customs administration laws of the United

States, this act created the customs service of the Philippines whose function was to collect all the revenue warranted by law.

On March 3, 1902, the Commission passed Act No. 367 mandating the organization of the personnel of the Philippine Customs Service and thereby gave uniformity to classification, grades, and qualifications of customs officials and employees.

Years later, graft and corruption slowly deprived the government of millions of pesos in revenue, giving the country a bad name abroad. In October 4, 1947, an Executive Order signed by then

President Manuel Roxas effected the reorganization of seven government offices, including the

Bureau of Customs (BOC). The BOC head was given a new tide, Commissioner of Customs instead of the former tide Insular Collector of Customs. It abolished the position of Deputy Insular Collector of

Customs and in its place was created the position of Collector of Customs for the Port of Manila.

The BOC has a daunting challenge to face with the expeditious' advances of technology and competition borne by globalization, not to mention, the dictates in the general conduct of businesses, individual travels, and consumer demands by the World Trade Organization (WTO), the General

Agreement on Tariffs and Trade (GATT), and the Asean Free Trade Agreement (AFTA).

These and the other complex problems posed by the growing sophistication of criminal syndicates, which also have gone global, smuggling, drug trafficking, money laundering, and movements of prohibited cargoes which require a more responsive enforcement system, are the heavy burdens

BOC has to bear.

The on-line system---to process clearance of imports, payment of duty, and delivery of release orders for shipments to leave the docks---has lessened the cost of trade for businesses, reduced opportunities for fraud, and helped the Bureau to maximize revenue collection.

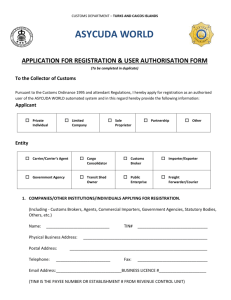

Accompanied Baggage Intended as Donation

Relief, charitable and/or humanitarian organizations intending to donate for free distribution or extend free medical, dental or any other services to the less privileged must coordinate with the Philippine

Department of Social Welfare and Development through the Philippine embassy and/or consulate abroad, for purposes of clearance, prior to actual departure. Donations must be covered by a Deed of

Donation and Deed of Acceptance, approved by the Department of Finance

“One-Stop Shop” according to the Customs Memorandum Order No 27-2009 dated 14 October 2009

One-Stop shop shall be available twenty-four hours, seven days a week for the processing and immediate release of the foreign donated articles from BOC with the following requirements

- Letter of Intent to Donate the Goods

- Bill of Lading / AirWaybill

- Packing List and / or Commercial Invoice

- Other documents as may be required by the One-Stop Shop