Bill

advertisement

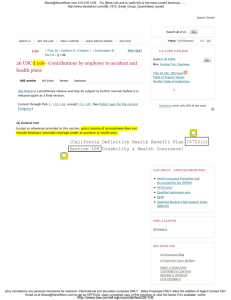

MISSISSIPPI LEGISLATURE 2015 Regular Session To: By: Bill # AN ACT TO PROVIDE AN INCOME OR PREMIUM TAX CREDIT TO EMPLOYERS WHO PAY COSTS IN CONNECTION WITH A QUALIFIED WELLNESS PROGRAM IN THE AMOUNT OF 50% OF THE COSTS PAID IN CONNECTION WITH THE QUALIFIED WELLNESS PROGRAM; TO PROVIDE THE COMPONENTS THAT A WELLNESS PROGRAM MUST HAVE TO QUALIFY FOR THE CREDIT; TO PROVIDE THAT IF THE AMOUNT OF THE ALLOWABLE CREDIT EXCEEDS THE INCOME OR PREMIUM TAX LIABILITY OF THE EMPLOYER, THE AMOUNT OF THE EXCESS SHALL NOT BE REFUNDABLE OR CARRIED FORWARD TO ANY OTHER TAXABLE YEAR; TO LIMIT THE AMOUNT OF THE CREDIT; AND FOR RELATED PURPOSES. BE IT ENACTED BY THE LEGISLATURE OF THE STATE OF MISSISSIPPI: SECTION 1. (1) A credit is allowed against the income and premium taxes imposed by this chapter to an employer who pays costs in connection with a qualified wellness program. The amount of the credit, subject to the limitations set forth under subsection (2) of this section, is an amount equal to fifty percent (50%) of the costs paid in connection with the qualified wellness program. (2) The amount of credit allowed under this section for any taxable year may not exceed the sum of: (a) The product of Two Hundred Dollars ($200.00) and the number of eligible employees of the employer not in excess of one hundred (100) eligible employees; (b) An annual cap of $20,000 per employer; (c) This credit shall be allowed to employers each year on a “first-come, first-serve” basis, and shall be available only up to a cumulative cap of $1,000,000 per year. (3) "Qualified wellness program" means a program that consists of at least three (3) of the following components: (a) A health awareness component, which provides for the dissemination of health information and resources that address the specific needs and health risks of employees; (b) An employee engagement component, which provides for: (i) The establishment of leadership to actively engage employees in workplace wellness programs through program planning, delivery, evaluation and improvement efforts; and (ii) The tracking of employee participation; (c) A behavioral change component, which encourages healthy employee lifestyles and medical condition prevention and management through coaching, seminars, online programs, or self-help materials that provide technical assistance and problem-solving skills. This component may include programs relating to management of lifestyle issues such as tobacco use, physical fitness, nutrition, and substance abuse, as well as prevention and management of conditions such as obesity, diabetes, heart disease, cancer, pre-term delivery, mental health, and other chronic conditions; (d) A supportive environment component, which includes access to healthy options at the workplace as well as policies and services that promote healthy lifestyle behaviors, including policies relating to: (i) (ii) Tobacco use at the workplace; The nutrition of food available at the workplace through cafeterias and vending options; (iii) Minimizing stress and promoting positive mental health in the workplace; (iv) Access to on-site care and/or telehealth services; (v) Where applicable, accessible and attractive stairs and walking routes; (vi) The encouragement of physical activity before, during, and after work hours; and (vii) Lactation supportive resources for nursing mothers; (4) "Eligible employee" means an employee who works an average of not less than twenty-four (24) hours per week during the taxable year. (5) If the taxpayer is a partnership or Subchapter S corporation, the credit is allowed to the partners or shareholders in accordance with the determination of income and distributive share of income under Sections 702 and 704 and Subchapter S of the Internal Revenue Code. (6) If the amount of the allowable credit exceeds the tax imposed by this chapter, the amount of the excess shall not be refundable or carried forward to any other taxable year. (7) The Department of Revenue, in cooperation with the Department of Health and the Mississippi Development Authority, shall adopt any rules necessary for the administration of this section. In addition, the Mississippi Department of Health/Office of Preventive Health, shall be charged with the duty of certifying employers as qualified, and shall re-certify employers on an annual basis upon satisfactory evidence that the employer’s qualified wellness program is succeeding in measurable compliance to at least three (3) of the foregoing components. An annual appropriation of $30,000 from state funds shall be made to the Mississippi Department of Health/Office of Preventive Health to assist with the discharging of these duties. In said certification process, special consideration shall be given to programs that target the following areas, where intervention is shown to prevent or reduce illness or death: Congestive Heart Failure, Cancer, Hypertension, Types I and II Diabetes, Pre-Natal Care/Pre-Mature Birth Prevention, Asthma, and Addictions. SECTION 2. Section 1 of this act shall be codified in Chapter 7, Title 27, Mississippi Code of 1972. SECTION 3. This act shall take effect and be in force from and after January 1, 2016, and shall be repealed from and after January 1, 2019.