Business Analysis McDonalds & Burger King

advertisement

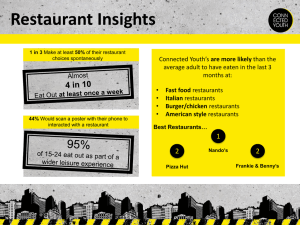

Business Analysis McDonalds & Burger King Mounia Belkoura, Hau Ping Cheng, Lan Ki Cheng Table of Contents PART I: DESCRIBE TWO PUBLICLY TRADED BUSINESS RIVALS .................................................................... 2 PART II: OPPORTUNITY ................................................................................................................................ 3 1. DESCRIBE THE INDUSTRY ................................................................................................................. 3 2. GEOGRAPHIC AREA .......................................................................................................................... 5 PART III: INDUSTRY ANALYSIS ...................................................................................................................... 6 1. FIVE FORCES ANALYSIS..................................................................................................................... 6 2. LOW POWER COUNT........................................................................................................................ 7 3. KEY SUCCESS FACTORS..................................................................................................................... 8 4. ECONOMIES OF SCALE & HIGH POWER THREAT ........................................................................... 10 PART IV: STRENGTH ASSESSMENT ............................................................................................................. 11 1. RAW DATA ON KEY SUCCESS FACTORS.......................................................................................... 11 2. CONVERTED SCORE OF KEY SUCCESS FACTORS............................................................................. 14 3. AVERAGE CONVERTED SCORE ON KEY SUCCESS FACTORS ........................................................... 14 4. SUSTAIN COMPETITIVE ADVANTAGES ........................................................................................... 15 REFERENCES ................................................................................................................................................ 16 1 PART I: DESCRIBE TWO PUBLICLY TRADED BUSINESS RIVALS 1. This research paper is a business analysis on the two publicly traded corporations, McDonalds and Burger King. Both of them are competing in fast food industry. Fast food industry is one of the largest food services sectors around the world. This industry focuses on the lower prices strategy in order to attract customers worldwide. Therefore, S&P Industry surveys suggests that “Our view is that restaurants will be largely unable or unwilling to raise prices much, if at all, for fear of losing customers to the competition” (Restaurant Industry Survey, Standard and Poor’s). On the other hand, the fast food industry is facing great criticisms from different health organizations and most people blame the fast food for causing health problems such as obesity and diabetes to the teenagers and adults nowadays. Recently, the San Francisco Board of Supervisors “passed a ban on restaurant toy giveaways unless the aforementioned meals meet certain healthy nutritional standards for calories, sodium and fat” (Mckinley, The New York Times). The authority urged the fast food industry to balance the nutrition needs for kids. With the economic downturn, fast food industry is still making money because “During a recession, the spike in unemployment generally leads to declines in consumption levels. When personal consumption expenditure is high, consumers will be more likely to spend money on eating out at fast food restaurants. This driver is expected to increase over the next year, providing a potential opportunity for the industry” (Fast Food restaurant in the US, Industry Performance, IBISWorld). McDonalds, the largest fast food restaurant in the US is located in 2111 McDonald's Dr., Oak Brook, IL 6052. It could generate 22,7451 million total revenues during the recession period according to the annual 10-K report. Burger King, the second largest fast food restaurant located in 5505 Blue Lagoon Drive, Miami, Florida 33126 still earned 2,537.4 2million total revenues during the past fiscal year according to its 10-K report. In general 1 2 Source: http://www.sec.gov/Archives/edgar/data/63908/000119312510042025/d10k.htm Source: http://www.sec.gov/Archives/edgar/data/1352801/000095012309038762/g20346e10vk.htm#113 2 McDonalds and Burger King compete with all types of food retailers on the basis of prices, convenience, food qualities and customer services. PART II: OPPORTUNITY 1. DESCRIBE THE INDUSTRY McDonalds and Burger King are competing in the dynamic food retail industry. Customers have various choices of food. They have the powers to determine the whole industry’s directions and developments. McDonalds and Burger King are working to maximize the market shares and increase the revenue across countries. Moreover, fast food industry is still the leading food retail sector in the United States and this attracts lots of local and regional companies to join the industry. The capital and technical requirements of setting up a fast food restaurant is not that huge in compared with other industries. Therefore, McDonalds and Burger King are not only competing with the large food retail companies, they also need to compete against the small business within the United States. On the other hand, increasing among of people show their concerns on the health issues related to the fast food restaurant and some people even criticize the excessive calories provide by this kind of restaurants. According to the performance research, “Consumers are becoming increasingly aware of issues related to weight and obesity, fatty food intake and food safety issues. This factor particularly affects industry growth for meat and hamburger products and any fried foods. This driver is expected to increase over the next year, potential threatening the industry” (Fast Food restaurant in the US, Industry Performance, IBIS World). Hence, most fast food restaurants start to provide healthier food like yogurt, salads and fruits in order to minimize the impacts of these criticisms. Fast food industry is still generating significant amount of profits in the US market even though people have realized the importance of health. Right now, the fast food industry is trying to sell more healthy food which will enhance the corporation image and provide more choices to the public. McDonalds and Burger King are not only competing against each other, they also need to face the challenges from other types of 3 restaurants. For instance, most dine-in restaurant such as TGI Friday and Chilies offered low price menus last year which greatly affected the attractiveness of McDonald and Burger King’s food to the customers. Furthermore, other fast food restaurants such as Kentucky Fried Chicken, Wendy’s and Pizza Hut has launched various marketing campaigns and provided more choices of food to suit the customers’ needs. There is rapid competition in the fast food industry when the economy is bad because people are spending less on food and often pick up the cheapest one with the most values. Consumers will spend more in affordable restaurants as the Economist reports, “Fast food was once thought to be recession-proof. When consumers need to cut spending, the logic goes, cheap meals like Big Macs and Whoppers become even more attractive” (Good and Hungry, The Economist). Since the market in the United States is well developed, Burger King and McDonalds are going to further expanding their market shares overseas in order to increase their revenues. According to McDonalds’ 10-K report, the European region had contributed $9274 3million total revenue in year 2009. On the same time, the United States had $79444 million total revenue, the Asia-Pacific region had $4,337 5million total revenue and other countries and corporate had $1190 6million total revenue. Other than increasing the number of restaurant in foreign counties, menu innovation will be a good method to attract customers overseas. Therefore, McDonalds offered special beverages like the Mc Café brand coffee and milk shakes to attract more customers. Consumers demand more from the fast food restaurants, they want to get the most out of the lowest prices nowadays. With the increasing supply of services and food from various fast food restaurants, the competition will be keen and only the best one will survive after the global economic downturn. The Standard & Poor’s Industry also predicts this by saying “ In 2010, given our forecast of only modest sales growth for the industry and with cost pressures likely to 3 Source: http://www.sec.gov/Archives/edgar/data/63908/000119312510042025/d10k.htm Source: http://www.sec.gov/Archives/edgar/data/63908/000119312510042025/d10k.htm 5 Source: http://www.sec.gov/Archives/edgar/data/63908/000119312510042025/d10k.htm 4 6 Source: http://www.sec.gov/Archives/edgar/data/63908/000119312510042025/d10k.htm 4 intensify, we would expect more operators to fail. Indeed, industry research firm NPD Group Inc. announced in July 2010 that their US restaurant unit count declined by 1%, or a loss of 5,204 restaurants, this spring compared with spring 2009” (Restaurant Industry Survey, Standard and Poor’s). 2. GEOGRAPHIC AREA The industry’s largest demand is from the North America Region. The fast good industry is first developed in the United States. After years of developments, fast food has definitely changes the habits of people’s consumption patterns in the Unites States. Most consumers are used to eat in the fast food restaurant since they are young. They are used to french fires, cheese burgers with free re-fill soft drinks. The development in the North America region is mature enough for the fast food industry to capture most of the customers. It maintains growth rate in the North America region even though the economic is bad in the recent periods. McDonald and Burger King still have over thousands chain stores across the United States and Canada. McDonalds generated $7944 million total revenue within the United States. According to Burger King‘s 10-K report, 69%7 of the revenue was coming from the United States and Canada. Burger King also had 1.2% sales growth in this Region in year 2009. Furthermore, it is more difficult to further expanding the fast food industry in the European countries. People around the world think of fast food as American culture and tradition. As far as we know, most Europeans love their traditional food and hesitate to try the American fast food. For instance, most Europeans rather spend money in the local stores than eating hamburgers in McDonald. They always criticize about the monopoly behaviors of McDonalds and the unfair labor contracts provided by McDonalds to the employees. Moreover, some Europeans just value the time of cooking and eating and they do not prefer eating a 5 minutes wrap up meal with excessive amount of calories in fast food stores. 7 Source: http://www.sec.gov/Archives/edgar/data/1352801/000095012309038762/g20346e10vk.htm#113 5 Unlike the European region, the American fast food store is still under developing process in most Asia-Pacific region. The huge market demands from China and Korea has attracted most fast food brands to set up their chain stores. They had successfully developed in menu innovation, service enhancement and restaurant re-imaging in the Asia–Pacific region. Although the potential growth in this region is high, the overall demand is still small in compared with the North America Region. Asian people have totally different eating patterns than Americans and Canadians. They will eat in any fast food restaurant but not that often as Americans do. It is more like a fashion to eat in American restaurant in China than a need to enjoy the hamburgers and french fries. Overall, McDonalds and Burger King still have the largest amount of demand in the North America region currently. They have successfully changed the eating patterns of people within this region. The demand growing is slowing in this geographic area but the total consumption volume in huge. PART III: INDUSTRY ANALYSIS 1. FIVE FORCES ANALYSIS The fast food industry is a highly competitive industry. The first competitive force of the five forces analysis for the fast food industry is suppliers. For suppliers, it is low because there are many suppliers for the fast food industry, such as the soft drink industry. According to the IBISWorld, there are many suppliers in the soft drink industry, such as the Coca-Cola Company, PepsiCo, Inc., Dr. Pepper Snapple Group, Inc., National Beverage Corporation, and the Cott Corporation. (Soft Drink Production In The US-Major Companies, IBISWorld) Hence, demand for supplies is less than suppliers’ capacity to satisfy all demand. The second competitive force is customers (buyers). For customers (buyers), it is high because “there is little differentiation among products and buyers can choose from among more than two sellers.” ([10/11] Industry Analysis, Slide #14) For example, “Burger King excels at its new Steakhouse XT burgers and McDonald’s is also trying to deliver an upscale burger with its Angus “Third Pounder”. (Fast 6 food is no longer all bad food, The Boston Globe) The third competitive force is the threat of substitute products. For the threat of substitute products, it is high because switching cost is low and since “…there are a million burger concepts…” (Additions to Midtown’s Menu, The Wall Street Journal) not only in the fast food industry but also in other industries as well, such as gourmet restaurants and fast-casual restaurants “which distinguish themselves from fast-food eateries by marketing themselves as higher quality…” (Additions to Midtown’s Menu, The Wall Street Journal) and serving healthier products. The fourth competitive force is rivalry. For rivalry, it is high because “an increasing trend toward the co-location of several different quick service establishments in the same geographic area or in food courts at department stores and airports etc.” (Fast Food Restaurant In The US-Competitive Landscape, IBISWorld) Due to that increasing trend, “there is significant price-based competition within this industry, but quick service establishments also compete on the basis of location, food quality and consistency, style and presentation, food range with new products, including for the more health conscious and older population, needing to be introduced regularly, variety and service (including availability of drive thru, staff training and attitudes etc)” (Fast Food Restaurant In The US-Competitive Landscape, IBISWorld) The last competitive force is threat of entry. For the threat of entry, it is high because even though the fast food industry is highly saturated, they are facing the issue of obesity and “health and nutrition value and information for customers is now of increasing importance.” (Fast Food Restaurant In The US-Competitive Landscape, IBISWorld) so if new entrants were able to target the issue of obesity by coming out with healthier products than competitors’ and provide all the information that customers wanted, then it would definitely become a threat to other competitors. 2. LOW POWER COUNT “As a rule, the higher the collective power of the five competitive forces, the lower the expected profitability of the average rival with no particular strengths or weaknesses.” ([10/11] Industry Analysis, Slide #9) Based on the five forces analysis, there is only one low force so the 7 expected profitability of the average rival with no particular strengths or weaknesses with is less than cost of capital and because “competitive pressure and declining demand are forcing companies to consolidate their operations and streamline employment. Industry profit margins have been falling or remaining flat at best. This factor has occurred because of lower sales volume and customers opting for lower priced items (thereby reducing revenue), high levels of competition in the domestic market and the industry reaching saturation levels.” (Fast Food Restaurants In The US-Industry Performance, IBISWorld) 8 3. KEY SUCCESS FACTORS “Key Success Factor is either a financial ratio measure or a strategy, and neither can be a Key Success Factor because Key Success Factor must be a resource or capability that a business must be strong on in order to execute a strategy and achieve financial performance that exceeds the cost of capital.” ([11/17] Review for Team Research Paper, Part C) The first Key Success Factor is inventory turnover. Inventory turnover is “measures the rate at which inventory is sold. It is calculated as the store’s cost of goods sold (recorded on the income statement for a given period) divided by its average inventory (recorded on the balance sheet for the same period).” ([11/17] Review for Team Research Paper, The Balance Sheet) Also, “a high turnover implies that the company is managing its inventory efficiently” ([11/17] Review for Team Research Paper, The Balance Sheet), so the higher it is the better the company is doing. For example, products of fast food restaurant are perishable so they have to get rid of it quickly. The second Key Success 8 Source: http://www.ibisworld.com/industryus/currentperformance.aspx?indid=1676 8 Factor is G*, the Index of Sustainable growth. For G*, it is calculated as one minus dividend payout ratio then multiply the return on equity. So, “if G* is more than company growth rate, then cash is available to flow to the corporation, and if it is less than the company growth rate, then it needs additional financial resources to keep up with the growth so its cash does not flow to the corporation.” ([09/13-15] Measuring Performance Using Financial Ratios & Setting Objectives, Slide #4) For example, “the professional needs to develop an appreciation of Research and Development and innovation in critical technology areas such as novel process development in preservation and storage techniques, packaging, process control, rheology, colloids among others as it is very important in the food industry for sustainable growth.” (Supply Chain Management and Challenges Facing the Food Industry Sector in Tanzania, CCSE) The third Key Success Factor is Manufacturing Efficiency. Manufacturing efficiency “determines how well a factory operates in production. To avoid wasting money, all processes in manufacturing must be as efficient as possible.” (How to Calculate Manufacturing Efficiency, eHow) It is calculated as the cost of goods sold divided by sales revenue and the “lower is better if it is not a differentiation strategy.” ([09/13-15] Measuring Performance Using Financial Ratios & Setting Objectives, Slide #3) The fourth Key Success Factor is economies of scale. For economies of scale, it is calculated as the costs divided by the total assets and “lower is better if it is a growth strategy.” ([09/13-15] Measuring Performance Using Financial Ratios & Setting Objectives, Slide #3) Also, it means that “the cost per unit produced decreases as the size of production increases. This is a way to cut costs without hurting the product features and services.” ([10/11] Industry Analysis, Slide #17) The fifth Key Success Factor is scale. For scale, it is the total assets. As for the result, “higher is better if it is a growth strategy.” ([09/13-15] Measuring Performance Using Financial Ratios & Setting Objectives, Slide #3) The last Key Success Factor is charity program. For charity program, it is the net assets. For example, by having a charity program like McDonald’s Ronald McDonald House Charities and Burger King’s Have It Your Way Foundation, it helps to 9 establish a good image in the community. As for the result, higher is better if it is a growth strategy. 4. ECONOMIES OF SCALES & HIGH POWER THREAT OF RIVALRY For high-power threat of Rivalry, it means “there is a significant price-based competition within this industry, but quick service establishments also compete on the basis of location, food quality and consistency, style and presentation, food range with new products, including for the more health conscious and older population, needing to be introduced regularly, variety and service (including availability of drive thru, staff training and attitudes etc)” (Fast Food Restaurant In The US-Competitive Landscape, IBISWorld) This means that fast food restaurant are “likely to reduce prices frequently, and take on added costs for new products, food quality, advertising, promotion, and services. Since Profit = [(Quantity x Average Sales Price)] – Costs, all else equal, profit is vulnerable to high-power threat of Rivalry because it reduces price and adds to costs of product features and services. One way to protect profit in this situation, all else equal, is to cut costs wherever possible without hurting the product features and services that support Average Price and Quantity. “Economies of Scale” means that the cost per unit produced decreases as the size of production increases. This is a way to cut costs without hurting the product features and services. Therefore, “Economies of Scale” protects profit against the highpower threat of Rivalry by reducing cost without decreasing the essential product features and services that support higher Average Price and Quantity. At the same time, if Rivalry forces Average Price to come down, the lower costs of production from Economies of Scale can be passed to customer as lower prices, while preserving profit.” ([10/11] Industry Analysis, Slide #17) 10 Part IV: Strength Assessment 1. McDonalds and Burger King raw data on Key Success Factors a. McDonalds raw data on relevant Key Success Factors McDonalds 2009 Calculation 128.18 Revenue/Average Inventory 22,745M/177.446M9 Inventory Turnover 0.13 G*: the Index of Sustainable Growth Manufacturing Efficiency 0.69 0.53 Economies of Scale Scale Charity Program [1-dividend payout ratio]*ROE Dividends payouts ratio=Dividends per shares/earning per shares: 0.59 ROE =34% 1-0.59*0.34=0.1310 COGS/Sales Revenues 15904/22745=0.6911 Costs/Total Assets 15,904/30,224.9=0.5312 30224.9M13 Total Assets 1462715414 Total Assets of Ronald McDonald House of Charities of Metro St. Louis 9 http://www.aboutmcdonalds.com/etc/medialib/aboutMcDonalds/investor_relations0.Par.17264.F http://www.aboutmcdonalds.com/etc/medialib/aboutMcDonalds/investor_relations0.Par.17264.F 11 http://www.aboutmcdonalds.com/etc/medialib/aboutMcDonalds/investor_relations0.Par.17264.F 12 http://www.aboutmcdonalds.com/etc/medialib/aboutMcDonalds/investor_relations0.Par.17264.F 13 http://www.aboutmcdonalds.com/etc/medialib/aboutMcDonalds/investor_relations0.Par.17264.F 14 http://www.bbb.org/charity-reviews/stlouis/children-and-youth/ronald-mcdonald-house-charities-of-metro-stlouis-in-st-louis-mo-4753 10 11 b. Burger King raw data on relevant Key Success Factors 2009 Burger King Calculation Revenue/Average Inventory Inventory Turnover 97.21 2537.4/26.10=97.2115 G*: the Index of Sustainable Growth [1-dividend payout ratio]*ROE16 Dividends payout ratio =0.0017 ROE=200.1/974.8=0.2 1-0.0017*0.20=0.2 COGS/Sales Revenues17 2198/2537.4=0.86 0.2 0.86 Manufacturing Efficiency Costs/Total Assets18 0.81 Economies of Scale 19 Scale 2707.1M Charity Program 201275120 2198/2707.1=0.81 Total Assets Net assets of Have It Your Way Foundation The inventory turnover shows how often the company sells and replaces its inventory during one year. It represent a ratio calculated by dividing revenues over average inventory the company is holding between two successive two period, in our case it is average inventory for 2009 and 2008. It is a measure of how quick a company sells her product. As we mentioned in part III, it is a very relevant measure to assess the company well management skills. The higher the ratio of turnover the better is the company doing in managing the inventory. On that Key 15 http://www.sec.gov/Archives/edgar/data/1352801/000095012309038762/g20346e10vk.htm#113 http://www.sec.gov/Archives/edgar/data/1352801/000095012309038762/g20346e10vk.htm#113 17 http://www.sec.gov/Archives/edgar/data/1352801/000095012309038762/g20346e10vk.htm#113 18 http://www.sec.gov/Archives/edgar/data/1352801/000095012309038762/g20346e10vk.htm#113 16 19 20 http://www.sec.gov/Archives/edgar/data/1352801/000095012309038762/g20346e10vk.htm#113 http://www.haveityourwayfoundation.org/pdf/Audited_Financial_Statements_2009.pdf 12 Success Factor McDonald’s ratio is 128.18 and burger king is 97.21. So McDonald’s does a better job in managing its inventory than Burger king does. For the G*, it is measure of company growth. The higher the ratio the better. G* shows how much a company is growing and expanding. From the raw data we collected for both companies, McDonalds and Burger kings, we conclude that burger king with G* of 20% is growing faster than McDonalds with G* of 13%. This result may be due to the fact that McDonald’s use a big part on net income to pay dividends, and its dividends payout ratio is 0.59 opposite to burger king has a lower payout ratio 0.0017. We can conclude that Burger king use its net income to buy more assets and to grow its market share instead of paying dividends to its stockholders. Manufacturing efficiency ratio, shows how efficient the company in manufacturing its product by using less resource to get the maximum output. Both McDonald’s and Burger king manufacture their product from paper cup to beef patties, and they are required to manage well their resources to lower their costs and to increase their profitability. Manufacturing efficiency is calculated by dividing the COGS over the Sales Revenues, and the lower is the ratio the better is the company doing in efficiency. McDonalds’s ratio in that KSF is 0.69 and it is lower than burger king 0.86. So McDonalds is better in that metric. “Economy of scales means that the cost per unit produced decreases as the size of production increases.” ([10/11] Industry Analysis, Slide #17). It is calculated by dividing COGS by Total Assets. The lower the ratio the better. McDonalds and burger king are both fast food industry and the prices in that industry is basically fix so to realize gains they need to reduce the cost of their product by increasing the production. McDonald’s economy of scale ratio is lower than burger king with 0.59 and 0.81 respectively. So McDonald’s is higher in that KSF. The Scale financial ratio is a key success factors that shows how big is the company, because it looks at the total assets the company owes. Scale is very important in fast food industry, because when the company is big, it has higher production and that lower its units cost 13 and increase the margin profit. McDonalds has higher Scale with total assets $30,224M against $2,707M total assets for burger king The charity program is how much money a company spends in their social work to help the community they are serving, the higher the better. It is KSF to help a company to develop its brand name among community while marketing its own image. McDonalds total assets on charity program to help children and youth in their education is $14,627,154 and it is seven times higher than the charity program of burger king with only $2,012,751. So McDonalds has a competitive advantage over burger king in that KSF. 2. McDonalds and Burger King Converted scores on Key Success Factors McDonalds Burger King 5 1 1 5 Manufacturing Efficiency 5 1 Economies of Scale 5 1 Scale 5 1 Charity Program 5 1 Inventory Turnover G*: the Index of Sustainable Growth 3. McDonalds and Burger King Average Converted scores on Key Success Factors McDonalds Burger King 4.33 1.66 Average Converted Score on Key Success Factors 14 4. Identify the rival that is most likely to create and sustain competitive advantage against the other. Using the average on Key Success Factors in part IV -3 McDonalds scores 4.33 on 2009, however Burger king scores1.66.We believe that excelling in the Key Success Factors mentioned above are very important in the fast food industry because they are the base of gains realization, and they assure a prolonged competitive advantage among competitors in that industry. Therefore, McDonalds has a competitive advantage over Burger king in the overall Key Success Factors, hence McDonalds will sustain a higher profitability than Burger King in the fast food industry. 15 References Better Business Bureau, . (2009). Charity Review of Ronald McDonald House Charities of Metro St. Louis. Retrieved Dec. 1, 2010, from Better Business Bureau of Eastern Missouri & Southern Illinois, St. Louis, MO. Web site: http://www.bbb.org/charity-reviews/stlouis/children-andyouth/ronald-mcdonald-house-charities-of-metro-st-louis-in-st-louis-mo-4753. Basham, M. (2010). Restaurants INDUSTRY SURVEYS. Retrieved Dec. 1, 2010, from Standard & Poor\'s, New York. Web site: http://www.netadvantage.standardandpoors.com/NASApp/NetAdvantage/showIndustryS urvey.do?code=rst. Chidsey, J. W. (2009). Burger King Holdings, Inc.-Form 10-K. Retrieved Dec. 1, 2010, from United States Securities and Exchange Commission, Washington, DC. Web site: http://www.sec.gov/Archives/edgar/data/1352801/000095012309038762/g20346e10vk.htm#113. DeLorenzo, I. (2010). Fast Food Is No Longer All Bad Food. Retrieved Dec. 1, 2010, from The Boston Globe, Boston, MA. Web site: http://www.boston.com/ae/food/restaurants/articles/2010/03/03/fast_food_is_no_longer_all_bad_ food/?page=3. Hessong, A. (2010). How to Calculate Manufacturing Efficiency. Retrieved Dec. 1, 2010, from eHow.com. Web site: http://www.ehow.com/how_5523216_calculate-manufacturingefficiency.html. Mckinley, J. (2010). You Want a Toy with That? Retrieved Dec. 1, 2010, from The New York Times, New York. Web site: http://www.nytimes.com/2010/11/04/us/04happy.html?ref=mcdonalds_corporation. Kaczanowska, A. (2010). Soft Drink Production in the US-Major Companies. Retrieved Dec. 1, 2010, from IBISWorld, Los Angeles, California. Web site: http://www.ibisworld.com/industryus/Majorcompanies.aspx?indid=284. 16 McDonald's Corporation, . (2009). Annual Report 2009. Retrieved Dec. 1, 2010, from McDonald\'s Corporation, Oak Brook, IL. Web site: http://www.aboutmcdonalds.com/etc/medialib/aboutMcDonalds/investor_relations0.Par.6540.Fil e.tmp/McD_2009_AR_Final_032910.pdf. Samadi, N. (2010). Fast Food Restaurants in the US. Retrieved Dec. 1, 2010, from Ibis world, Washington, DC. Web site: http://www.ibisworld.com/industryus/currentperformance.aspx?indid=1676. Reddy, S. (2010). Additions to Midtown's Menu. Retrieved Dec. 1, 2010, from The Wall Street Journal, New York, NY. Web site: http://online.wsj.com/article/SB10001424052748703567304575628750178015496.html?KEYW ORDS=gourmet+burger. Ruteri, J. M., & Xu, Q. (2009). Supply Chain Management and Challenges Facing the Food Industry Sector in Tanzania. International Journal of Business and Management, 4(12), 76. Web site: http://www.ccsenet.org/journal/index.php/ijbm/article/viewFile/3706/3764 Samadi, N. (2010). Fast Food Restaurants in the US-Competitive Landscape. Retrieved Dec. 1, 2010, from IBISWorld, Los Angeles, California. Web site: http://www.ibisworld.com/industryus/competitivelandscape.aspx?indid=1676. Samadi, N. (2010). Fast Food Restaurants in the US-Industry Performance. Retrieved Dec. 1, 2010, from IBISWorld, Los Angeles, California. Web site: http://www.ibisworld.com/industryus/currentperformance.aspx?indid=1676. The Economist, . (2010). Good and Hungry. Retrieved Dec. 1, 2010, from The Economist Newspaper Limited, London. Web site: http://www.economist.com/node/16380043?story_id=16380043. 17 Verdeja, O., & De Armas, P. M. (2009). Have It Your Way Foundation, Inc.-Financial Statements. Retrieved Dec. 1, 2010, from Verdeja & De Armas, LLP, Coral Gables, FL. Web site: http://www.haveityourwayfoundation.org/pdf/Audited_Financial_Statements_2009.pdf. Young, G. (2010). [09/13-15]Measuring Performance & Setting Objectives-Slide #3. Retrieved Dec. 1, 2010, from NCSU, Raleigh, NC. Web site: http://mie480.files.wordpress.com/2010/09/mie480_lec07_sept151.ppt. Young, G. (2010). [09/13-15]Measuring Performance & Setting Objectives-Slide #4. Retrieved Dec. 1, 2010, from NCSU, Raleigh, NC. Web site: http://mie480.files.wordpress.com/2010/09/mie480_lec07_sept151.ppt. Young, G. (2010). [10/11] Industry Analysis-Slides #9. Retrieved Dec. 1, 2010, from NCSU, Raleigh, NC. Web site: http://mie480.files.wordpress.com/2010/10/industry-analysis2.ppt Young, G. (2010). [10/11] Industry Analysis-Slides #14. Retrieved Dec. 1, 2010, from NCSU, Raleigh, NC. Web site: http://mie480.files.wordpress.com/2010/10/industry-analysis2.ppt Young, G. (2010). [10/11] Industry Analysis-Slides #17. Retrieved Dec. 1, 2010, from NCSU, Raleigh, NC. Web site: http://mie480.files.wordpress.com/2010/10/industry-analysis2.ppt Young, G. (2010). [11/17] Review for Team Research Paper-The Balance Sheet. Retrieved Dec. 1, 2010, from NCSU, Raleigh, NC. Web site: http://mie480.files.wordpress.com/2010/11/mie480_ppr_rvw_nov17.ppt Young, G. (2010). [11/17] Review for Team Research Paper-Part C. Retrieved Dec. 1, 2010, from NCSU, Raleigh, NC. Web site: http://mie480.files.wordpress.com/2010/11/mie480_ppr_rvw_nov17.ppt 18