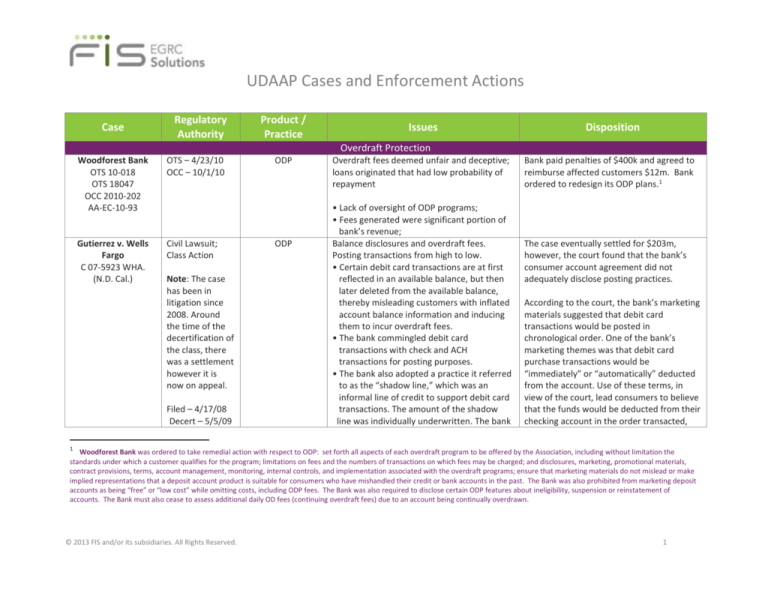

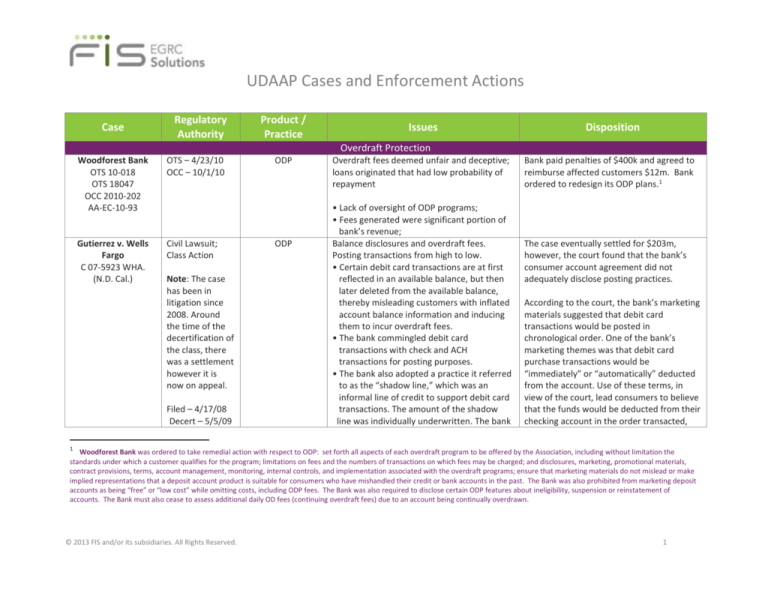

UDAAP Cases and Enforcement Actions

Case

Regulatory

Authority

Product /

Practice

Issues

Disposition

Overdraft Protection

Woodforest Bank

OTS 10-018

OTS 18047

OCC 2010-202

AA-EC-10-93

OTS – 4/23/10

OCC – 10/1/10

Gutierrez v. Wells

Fargo

C 07-5923 WHA.

(N.D. Cal.)

Civil Lawsuit;

Class Action

Note: The case

has been in

litigation since

2008. Around

the time of the

decertification of

the class, there

was a settlement

however it is

now on appeal.

Filed – 4/17/08

Decert – 5/5/09

ODP

ODP

Overdraft fees deemed unfair and deceptive;

loans originated that had low probability of

repayment

• Lack of oversight of ODP programs;

• Fees generated were significant portion of

bank’s revenue;

Balance disclosures and overdraft fees.

Posting transactions from high to low.

• Certain debit card transactions are at first

reflected in an available balance, but then

later deleted from the available balance,

thereby misleading customers with inflated

account balance information and inducing

them to incur overdraft fees.

• The bank commingled debit card

transactions with check and ACH

transactions for posting purposes.

• The bank also adopted a practice it referred

to as the “shadow line,” which was an

informal line of credit to support debit card

transactions. The amount of the shadow

line was individually underwritten. The bank

Bank paid penalties of $400k and agreed to

reimburse affected customers $12m. Bank

ordered to redesign its ODP plans.1

The case eventually settled for $203m,

however, the court found that the bank’s

consumer account agreement did not

adequately disclose posting practices.

According to the court, the bank’s marketing

materials suggested that debit card

transactions would be posted in

chronological order. One of the bank’s

marketing themes was that debit card

purchase transactions would be

“immediately” or “automatically” deducted

from the account. Use of these terms, in

view of the court, lead consumers to believe

that the funds would be deducted from their

checking account in the order transacted,

1

Woodforest Bank was ordered to take remedial action with respect to ODP: set forth all aspects of each overdraft program to be offered by the Association, including without limitation the

standards under which a customer qualifies for the program; limitations on fees and the numbers of transactions on which fees may be charged; and disclosures, marketing, promotional materials,

contract provisions, terms, account management, monitoring, internal controls, and implementation associated with the overdraft programs; ensure that marketing materials do not mislead or make

implied representations that a deposit account product is suitable for consumers who have mishandled their credit or bank accounts in the past. The Bank was also prohibited from marketing deposit

accounts as being “free” or “low cost” while omitting costs, including ODP fees. The Bank was also required to disclose certain ODP features about ineligibility, suspension or reinstatement of

accounts. The Bank must also cease to assess additional daily OD fees (continuing overdraft fees) due to an account being continually overdrawn.

© 2013 FIS and/or its subsidiaries. All Rights Reserved.

1

Case

Regulatory

Authority

Product /

Practice

Appeal –

11/29/10

Cross-Appeal

4/20/11

In the Matter of

Greenbank,

Greenville,

Tennessee

FDIC-10-802K

Mathena v. Webster

Bank

did not provide notice of this practice to its

customers.

Buffington v.

SunTrust Banks

1:09 CV 23632

and that the purchase would not be

approved if they lacked sufficient available

funds to cover the transaction.

The court noted that overdraft fees were the

second highest source of revenue for the

bank.

Consent Order –

Bank ordered to pay the US Treasury $132k.

ODP

• Violations of UDAP and Section 5 of FTC Act

• Marketing and implementation of overdraft

protection program.

Civil Lawsuit

(class action)

ODP

UDAP practices alleged in connection with

overdraft program. Bank manipulated debits

in a way that maximized overdraft fees.

Debit transactions posted from highest

dollar amounts to lowest.

$3m settlement.

FDIC – 10/25/11

ODP

Overdraft program

• Practices were unfair and deceptive,

Violations of Section 5 of FTC Act.

Consent Order –

Bank ordered to reimburse affected

customers.

Civil Lawsuit

(class action)

ODP

Underlying action based on overdraft fees

which plaintiffs claim are not allowed per the

deposit agreement. Allegations include:

Deceptive processing of transactions.

Buffingtons charged more than $4k in

overdraft fees.

US Supreme Court denied to hear the case

and it will go into mandatory arbitration.

Note that a key point of the case is the

mandatory arbitration clause being

“unconscionable” due to its take it or leave

it nature. The Appeals Court sided with

SunTrust.

3/1/12

Hough v. Regions

Financial

Corporation, Regions

Disposition

FDIC – 8/4/11

Settled - 3/28/11

East Boston Savings

Bank

FDIC-11-558k

Issues

Civil Lawsuit

(class action)

© 2013 FIS and/or its subsidiaries. All Rights Reserved.

ODP

Similar to the Buffington case, this involves

overdraft litigation and has the “mandatory

arbitration” component. Underlying action

Final outcome based on arbitration to be

determined.

US Supreme Court denied to hear the case

and it will go into mandatory arbitration.

Final outcome based on arbitration to be

2

Case

Regulatory

Authority

Bank

1:10 CV 20476

3/5/12

BankAtlantic

OCC – April 2012

Product /

Practice

ODP

Issues

Disposition

based on overdraft fees which plaintiffs claim

were contrary to the deposit agreement.

Allegation include:

Breach of duty of good faith and fair

dealing.

Unfair levying of overdraft charges.

Deceptively processing transactions in

order to maximize overdraft fees.

ODP fees were “usurious.”

determined.

BankAtlantic was cited by the OCC for

material violations of section 5 of the FTC Act

(unfair and deceptive practices) and OTS

advertising regulations in connection with its

ODP program. Deceptive actions included:

Automatic enrollment of customers in the

AOP program without disclosing material

facts;

Marketing checking and savings accounts as

“free” and having low cost features while

omitting material information; and

Suspending customers’ enrollment in the

AOP program and reinstating enrollment in

the program after the accounts returned to

a positive balance, without disclosing the

suspension or the reinstatement status of

accounts to customers.

Resulted in downgraded CRA and

compliance ratings. Bank ordered to

establish limits on aggregate overdraft fees

as it related to consumers who frequently

overdraw their accounts.

Deposit Product Disclosures

© 2013 FIS and/or its subsidiaries. All Rights Reserved.

3

Case

Regulatory

Authority

Product /

Practice

Bank of Wolcott

FDIC – 6/25/12

Disclosures; Reg. E

DBC Financial

FTC – 2/4/00

Reg. E; marketing;

ODP fees; other

fees

MarkleBank

FDIC – 9/9/11

Reg. E; disclosures

Issues

Disposition

Violations of section 5 of FTC Act (unfair and

deceptive practices) in connective with

deceptive practices that contradicted the

bank’s disclosed practices. Although the

disclosed practices were compliant with Reg.

E, the actual practices were found to be more

burdensome.

Deceptive bank card promotion to Social

Security recipients. Public benefits recipients

mislead regarding electronic transfers to bank

accounts.

ATM card marketed as having “no up-front

fees” (however, there were account “set

up” fees and monthly service fees).

Free overdraft protection of $1000 per year

marketed, however, there was an ODP fee

of $19.95 per month for any month

overdrafts incurred;

CMPs of $15k.

Error resolution violations constituted UDAAP

issues. Although Reg. E policy previously

reviewed by FDIC without problems, in a

subsequent exam UDAAP issues were found

to exist.

$82.5k fine.

$250k settlement

Bank procedures for the resolution of errors

involving the automated teller machines

and/or debit cards, and payment transactions

serviced through its automated clearing

house that were contrary to the Bank’s

disclosures concerning error resolution for

these products, in violation of Regulation E.

United Citizens Bank

FDIC – 2/19/13

© 2013 FIS and/or its subsidiaries. All Rights Reserved.

Reg. E; disclosures

EFT disclosures were deemed deceptive as

CMP $15k

4

Case

Regulatory

Authority

Product /

Practice

of Southern

Kentucky

Citizens Bank of

Philadelphia

FDIC-12-542b

FDIC-12-543k

RBS Citizens of

Rhode Island

4/24/13

4/29/13

OCC AA-EC-2013-12

Overdraft

Protection

Overdraft

Protection

Issues

bank actually administered more

burdensome practices. The administered

practices were contrary to Reg. E.

Section 5 of the FTC Act; UDAP related to

deceptive marketing and implementation of

ODP, checking rewards, and stop-payment

process for preauthorized recurring EFTs.

Section 5 of the FTC Act; UDAP related to

deceptive marketing and implementation of

ODP, checking rewards, and stop-payment

process for preauthorized recurring EFTs.

On an ad hoc basis, to Bank allowed

customers to opt out of Standard ODP, but

did not disclose technical limitations of the

opt-out that prevented it from being effective

for all transactions. Customers who opted

out of Standard ODP were charged overdraft

fees as a result of this practice.

The written customer agreement for Savings

Account Overdraft Protection did not disclose

that the Bank would not transfer funds from a

savings account to cover overdrafts in a

linked checking account if the savings account

did not have funds to cover the entire

overdrawn balance on a given day, even if the

available funds would have covered one or

more overdrawn items. Certain consumers

were charged overdraft fees as a result of

available savings funds not being transferred.

© 2013 FIS and/or its subsidiaries. All Rights Reserved.

Disposition

Restitution Plan to address harm to

customers;

CMP $5m

Independent auditor to oversee restitution

plan

Cease and Desist Order:

The Bank must establish a Compliance

Committee to oversee remediation of the

consent order.

The Bank must develop a Comprehensive

Action Plan to address issues in the Order.

Bank must update policies and procedures.

Bank must update compliance risk

management systems to ensure compliance

with UDAP, all applicable consumer

protection laws, rules and regulations,

including Section 5 of the FTC Act.

The Bank shall make full restitution and

remediation to consumers adversely

affected.

5

Case

Regulatory

Authority

Product /

Practice

Issues

Disposition

The Bank’s Personal Deposit Account

Agreement stated that the Bank would stop

preauthorized recurring EFTs at the

consumer's request, if notice was given at

least three business days before the

scheduled payment. Due to technical

limitations not disclosed to consumers, the

Bank was unable to process stop payments

between at least January 1, 2008 and August

1, 2010. As a result, some customers were

charged overdraft fees despite requesting

that certain EFTs cease.

The checking reward program disclosures

stated that its customers who have at least

ten eligible account transactions in a month

would receive rebates, without disclosing

posting date requirements for those

transactions. As a result, some consumers did

not receive anticipated rewards.

Credit Cards and Debit Cards

Capital One

CFPB – 7/16/12

OCC – 7/18/12

Credit Card addons; payment

protection; unfair

billing

Call center vendors engaged in deceptive

tactics to sell credit card add-on products

including payment protection and credit

monitoring. The products were geared

toward those with low credit scores and they

were solicited when they called in to activate

a new card.

• Products had a deceptive nature;

• Misled about eligibility;

• Misinformed about cost of products; and

• Enrolled customers without consent.

• Unfair billing practices (OCC only)

© 2013 FIS and/or its subsidiaries. All Rights Reserved.

CFPB - Bank reached settlement of $140m to

be repaid to customers. May also have to

pay a $25m penalty.

OCC – Restitution of $150m (which includes

$140m CFPB). Separate restitution orders

will ensue for customers harmed by unfair

billing practices. $35m civil penalty.

Additionally, Capital One must implement an

enterprise risk management program to

detect and prevent unfair and deceptive

practices.

6

Case

Regulatory

Authority

Product /

Practice

Powers v. Santander

Consumer USA, Inc.

Civil Action –

4:12 CV 11932

10/17/12

Late fees; credit

card and debit

cards; auto loan

payments

Salazar v. Capital

One

7:2010cv00021

Civil Lawsuit

(class action)

1/5/10

Credit card addons; payment

protection

Monterey County

Bank

FDIC – 9/29/10

Debit card, credit

card program

features;

marketing

© 2013 FIS and/or its subsidiaries. All Rights Reserved.

Issues

Card holders will receive a refund of

associated finance charges, over limit fees

resulting from the products and those whose

payment protection plans were denied will be

paid for claims.

Santander is accused of assessing late fees to

consumers who had not actually fallen behind

on payments.

Details developing.

Unfair and deceptive practices regarding

payment protection plan and subprime credit

card marketing.

• Payment protection program would cover

payments in event of short-term disability

or unemployment.

• Product terms not adequately disclosed;

• Thousands paid for plan and received no

benefit;

• Bank signed up thousands who were

ineligible for the program due to being

retired.

• Bank increased its fee income through this

plan.

Violations of UDAP, Section 5 of the FTC Act

and the FDCPA

• Balance transfer and debit card program

deemed unfair, deceptive

• The Balance Transfer Card was marketed to

consumers with bad credit as an

opportunity to pay down old debts and

obtain credit cards.

• Lack of disclosure for consumers to make an

informed decision.

Bank failed to adequately disclose all fees

Disposition

To be determined.

Consent order – Bank will pay $2m in

restitution to affected customers. Bank will

also donate $300k to consumer financial

education and counseling.

7

Case

Regulatory

Authority

Product /

Practice

In the Matter of

World’s Foremost

Bank

FDIC – 3/8/11

Credit card overlimit-fees; late

fees; debt

collection

CompuCredit (an

affiliate of Columbus

Bank and Trust

Company)

FDIC – 6/10/08

FTC – 12/19/08

Credit card

lending; deceptive

marketing

Issues

and charges assessed in connection with

product, which was marketed by a third

party.

Deceptive practices and violations of Section

5 of the FTC Act

A second over-limit fee (OL) was charged on

first day of billing cycle when cardholder

exceeded credit limits during prior billing

cycle.

Cardholders contacted at places of

employment for debt collection.

Practice of establishing minimum monthly

payment so low it causes OL fees.

Practice of assessing late fees when

payments due on Sunday/holiday and

payment posted next business day.

CompuCredit offered subprime credit cards

through FDIC-supervised banks. Violations of

Section 5 of the FTC Act.

Credit card solicitations did not properly

disclose credit limits and fees.

Important information disclosed on

different pages, resulting in confusion.

Cards marketed to those with low FICO

scores.

Amount of available credit misrepresented

($300 advertised limit; however after fees

assessed, actual limit was $185).

Disposition

Consent order and order to pay – Overhaul

of bank’s compliance management system,

management and board review of all new

products, training, etc. Restitution and

CMPs of $250k.

$114m settlement and CMPs of $2.4m

Banks involved included First Bank of

Delaware, First Bank & Trust of Brookings, SD

and Columbus Bank & Trust Company

© 2013 FIS and/or its subsidiaries. All Rights Reserved.

8

Case

Higher One, Inc.

Bancorp Bank

Regulatory

Authority

Product /

Practice

FDIC – 8/8/12

Debit card;

overdrafts and NSF

fees

Issues

Higher One is an affiliated entity of Bancorp

Bank. Both parties agreed to consent orders

and restitution to 60,000 students.

Student debit card program (OneAccount)

violated section 5 of FTC Act.

• Student account holders charged multiple

NSF fees from a single transaction.

• Accounts remained in overdrawn status for

long periods, allowing NSF fees to continue

accruing.

• Fees were collected from subsequent

deposits.

In the Matter of

Discover Bank

FDIC – 9/24/12

CFPB – 9/24/12

Deceptive credit

card add-ons

Joint enforcement by FDIC and CFPB where

Discover alleged to have engaged in

deceptive telemarketing and sales tactics

regarding credit card add-on products:

Payment protection

Credit score tracking

ID theft protection

Wallet protection

Disposition

Settlement:

$11m restitution to be paid to students.

CMPs - $110k Higher One; $172k Bancorp

Bank

Higher One must:

• Not charge NSF fees to accounts that have

been in a continuous negative balance for

more than 60 days.

• Not charge more than 3 NSF fees per day

on an account.

• Only one NSF fee may be charged per

transaction that is returned unpaid in any

21 day period.

• Marketing materials must be updated to

eliminate misleading representations.

Bancorp Bank must:

• Increase board oversight.

• Improve compliance management.

• Improve audit program.

• Increase oversight on third parties.

Discover must pay $200m consumer refund

plus addition $14m penalty.

Telemarketing scripts contained misleading

language likely to deceive consumers. Key

terms downplayed and reps spoke quickly

during the part of the call in which prices and

© 2013 FIS and/or its subsidiaries. All Rights Reserved.

9

Case

Amex, American

Express Centurion

Bank

Regulatory

Authority

Product /

Practice

FDIC – 10/1/12

OCC

FRB

CFPB

Deceptive credit

card marketing and

debt collection

Issues

terms of the add-on products were disclosed.

It was determined that the Bank violated

federal law prohibiting unfair and deceptive

practices by, among other things:

Disposition

Settlement reached with regulators.

Consent orders, restitution, order to pay,

CMPs

Misrepresenting to consumers that if they

entered into an agreement to settle old

debt (that was no longer being reported to

credit bureaus), such settlement would be

reported to credit bureaus, thereby

improving consumers’ credit scores.

Using settlement solicitations that implied

that consumers who entered into

settlement agreements to partially pay such

debts would have the remaining balance of

their debts forgiven, when in fact the

balance remained a debt owed to Amex.

Using solicitations that misrepresented

points and awards.

Advanta Bank

Corporation

FDIC - 2009

Cash Bank Rewards

for Credit Cards

American Express

Bank

OTS and FDIC 2009

Credit Card

Convenience

Checks

© 2013 FIS and/or its subsidiaries. All Rights Reserved.

Advanta's credit card "Cash Back Reward"

program advertised a percentage of cash

back on certain purchases by business credit

card accountholders.

Tiered structure of the cash back payments

meant that not all purchases would qualify

for advertized cash back rate.

It was nearly impossible to earn the stated

percentage of cash back reward payments.

FDIC issued a C&D. Bank must pay

restitution of $14m to affected customers,

and to pay a civil money penalty of $150k.

The OTS and FDIC brought enforcement

actions against American Express Bank for

failure to honor credit card convenience

checks without notice. Customers paid

returned check fees and experienced a

CMP of $250k

10

Case

Regulatory

Authority

Product /

Practice

Issues

Disposition

negative impact upon to their credit report.

Mortgage Products

Massachusetts v.

Fremont

897 N.E.2d 548, 551

(Mass. 2008)

Levin v. Citibank

2009 WL 3008378

(N.D. Cal. 2009)

Ellis v. J.P. Morgan

Chase & Co.

Massachusetts

Attorney

General;

Commonwealth

of

Massachusetts

6/9/09

Mortgage Lending;

Servicing,

Foreclosures

Civil Lawsuit –

8/30/10

HELOC Reduction

in Credit

Availability

Civil Lawsuit –

06/07/13

Mortgage Lending

Ohio Attorney

General – 2/9/12

Loan Servicing

US District Court for

the Northern District

of California

Case No. 12-cv03897-YGR

Subprime lending and foreclosure practices

• UDAP

• Lender should have reasonably foreseen

borrower inability to make scheduled

payments.

• Unfair for lender to make high-priced loan,

reap rewards of high fees and points, then

enjoy benefits of foreclosure.

Home equity line of credit reduction deemed

unfair and deceptive.

Although Reg Z provides that creditors may

reduce/suspend HELOCs when the value of

the borrower’s home is significantly less than

the appraisal value, the commentary to Reg. Z

states that what constitutes a “significant

decline” depends upon individual

circumstances.

Borrowers of mortgage loans had standing to

bring a claim of a violation of the California

Business and Professions Code for unfair

business practices where the borrowers paid

some or all of the alleged unlawful fees and

where the lender had omitted an itemization

of fees that would have identified the true

nature of each charged fee and instead

included a "miscellaneous fee" category of

fees never incurred by the borrowers.

Agreement with AG –

Bank must provide AG with 90 days advance

notice of any foreclosure action.

Foreclosure process substantively changed

in Massachusetts as a result of this action.

Court ruled partially in favor of Levin

and partially in favor of bank. However,

plaintiffs given permission to file new class

action suit.

Although Reg. Z permits a lender to reduce

HELOC if valuation of home declines, court

partially sided with Levin in that it

acknowledged he had paid down amount

owed (partial increase in equity) and that

appraisal used to value home was faulty.

No adjudication yet. Borrowers allowed to

bring a claim forward.

Loan Servicing

Ohio v. Mortgage

Servicers

© 2013 FIS and/or its subsidiaries. All Rights Reserved.

Inefficient handling of complaints, inquiries

and disputes

• UDAP

Lead to National Settlement with

Mortgage Servicers

11

Case

Regulatory

Authority

Product /

Practice

Fairbanks Capital

(now known as

Select Portfolio

Servicing)

FTC – 9/4/07

HUD – 9/4/07

Mortgage

Servicing; RESPA,

FDCPA, FCRA, force

placed insurance

Joint Federal-State

Mortgage Servicing

Settlement

DOJ, HUD, State

Attorneys

General –

February 2012

Unfair and

deceptive

mortgage servicing

practices

Issues

• RESPA

• Lenders criticized for not taking action to

prevent foreclosures.

• Inadequate handling of consumer

complaints and requests for information.

• Inadequate customer service

• Unreasonable or unwarranted fees

• Misrepresenting terms of loan

modifications

• Misrepresenting that a borrower qualifies

for a loan modification.

Subprime loan servicer charged with illegal

loan servicing practices.

• 5 year prohibition on marketing optional

products (e.g. home warranties).

• Refunds of optional product fees to

borrowers.

• Full disclosure of attorney or payoff fees

required in connection with foreclosures.

Reimbursement of fees charged that were

not actually performed.

• Monthly mortgage statements did not

include important information about loans.

• Payments applied to fees first, then P&I.

Action brought against five leading mortgage

servicers, large joint federal-state settlement

in history. Resulted in widespread reform in

the loan servicing industry.

Robo-signing

Dual-track processing (modification and

foreclosure at same time)

Poor customer service

Overall servicing misconduct

Disposition

2003 settlement with several subsequent

amended orders. Includes $40m settlement,

restitution to borrowers.

$25b settlement; $17b in assistance to be

provided to homeowners; $5.2b allocated

for homeowner assistance. Historic joint

federal-state settlement with the country’s

five largest mortgage servicers:

Ally/GMAC

Bank of America

Citi

JP Morgan Chase

Wells Fargo

Reforms:

© 2013 FIS and/or its subsidiaries. All Rights Reserved.

12

Case

Regulatory

Authority

Product /

Practice

Issues

Disposition

Foreclosure affidavits must be based on

personal knowledge.

Standing to foreclose must be documented

and disclosed to borrowers.

Pre-foreclosure notice must be sent to

borrowers.

Borrowers must be evaluated for loss

mitigation options before foreclosure

referral.

Procedures required re default fees,

accuracy of account information, including

audits of accounts and monthly billing.

Procedures required to ensure oversight of

foreclosure vendors.

SCRA – enhanced protections.

Murphy v.

Ameriquest

Civil Lawsuit 2004

ARMs – Loan

Servicing

FTC –2005

Mortgages

O4 CV 12651 RWZ

FTC v. Capital City

Mortgage Corporate

© 2013 FIS and/or its subsidiaries. All Rights Reserved.

Ameriquest sued for engaging in deceptive

loan servicing practices and unfair financial

gain under Mass. UDAP statute, 93A. Bait

and switch tactics and improper disclosure of

ARM features.

Confusing interest rate structure;

High points and fees;

Large number of “discount points” that

resulted in thousands of dollars added to

principal;

Duplicative costs charged during refinances;

and

Unjustified repayment penalties

FTC brought an enforcement action for

Capital City refusing to release lien after final

payment made on mortgage. This practices

was deemed to be a violation of the FTC Act,

section 5:

• Caused substantial economic injury when

A stipulation was reached in 2006. Note

that the stipulation was reached through

other Ameriquest borrowers joining forces

in a class action.

13

Case

Regulatory

Authority

Product /

Practice

Issues

Disposition

the liens were not released upon full

repayment;

• Practice not outweighed by benefits to

Capital City;

• Consumers could not reasonable avoid the

practice.

Llewellyn v. Allstate,

Nomura Credit and

Capital, NCC

Servicing, Ocwen,

et. al.

2013 – US Court

of Appeals for

the 10th Circuit

Loan Servicing

No. 11-1340

Russell v. BAC Home

Civil Lawsuit

© 2013 FIS and/or its subsidiaries. All Rights Reserved.

Mortgage Loan

The FTC stated that “consumer cannot chose

their loan servicer” which echoes recent

comments by the CFPB.

Servicing had been transferred to Ocwen

without proper notice to the borrower. Then

Ocwen transferred the servicing to NCC.

However, the borrower had been making

payments to Allstate, the original servicer but

they were not posted correctly and timely.

As a result, the loan became delinquent.

Behind the scenes, Allstate transferred the

funds to Ocwen, then Ocwen transferred the

funds back to Allstate because the loan had

subsequently been transferred to NCC.

Ocwen continued to negatively report the

loan which adversely impacted the

borrower’s credit. The borrower made

several complaints to Ocwen which were not

properly or adequately resolved. The

borrower faced hurdles that became

insurmountable in trying to resolve the

delinquency and credit reporting issue.

However, he ultimately filed a lawsuit for

alleged “outrageous conduct” by Ocwen for

loan servicing deceptions, unfair treatment

and erroneous credit reporting.

First Massachusetts case setting standards for

The district court found in favor of Ocwen.

The Appeals court “remanded” the case

(which is to the borrower’s favor). The case

will now be heard again in the district court.

Although the case was dismissed, it set

14

Regulatory

Authority

Product /

Practice

Loans Servicing

10-10670-MBB

2001 WL 99016

Mass.

2011

Republic Bank and

Trust

12/8/11

Case

Issues

Disposition

Servicing

banks’ violations of Consumer Protection Act.

Borrowers alleged that BAC violated Mass.

Gen. L. c. 93A, the Consumer Protection Act,

by failing to comply with federal regulations

relating to the Home Affordable Modification

Program (“HAMP”).

important standards and highlights banks’

requirements to abide by UDAAP statutes,

including the state UDAAP statute, MGL 93A.

Refund

Anticipation Loans

Unfair and deceptive practices were found

relative to Refund Anticipation Loans offered

by the Bank. Moreover, the Bank was found

to have engaged in unsound banking

practices and to have deficient oversight of

third party vendors providing electric refund

services on the Bank’s behalf.

Chase cited for UDAAP and FTC Act violations

related to “debt cancellation” and “debt

suspension agreements” related to auto

lending (collectively "credit protection

products"), which consisted of an agreement

by the Bank to suspend or cancel all or part of

the customer's obligation to repay an

outstanding account balance upon the

occurrence of a qualifying event, in exchange

for a monthly fee. The Bank's credit

protection products imposed various

eligibility requirements, provided various

exclusions, and set forth a process for

claiming benefits.

Credit Products

FDIC-10-079b

FDIC-10-216k

JPMorgan Chase

Bank, NA

6/14/11

AA-EC-11-57

Auto Loans - Chase

Payment

Assurance (“CPA”)

Cease and Desist – The Bank may no longer

make Refund Anticipation Loans

CMP of $900k (and the Bank may not seek

indemnification from any third party)

Consent Order:

CMPs - $2m

Restitution to customers

Customer service representatives (“CSRs”)

utilized high-pressure sales tactics and made

materially false, deceptive or misleading oral

© 2013 FIS and/or its subsidiaries. All Rights Reserved.

15

Case

Regulatory

Authority

Product /

Practice

Issues

Disposition

statements relating to the cost and coverage

terms of the CPA product marketed and sold

to Chase Auto customers. Written scripts and

training materials with instructions to use

statements as "rebuttals" in response to

Chase Auto customers who declined or were

not initially inclined to purchase CPA. Certain

rebuttal statements were deceptive or

otherwise materially misleading because they

could lead a reasonable consumer to

misapprehend what was being offered and

affects a reasonable consumer's decision to

purchase CPA.

This practice was also subsequently found to

have existed in credit card lending, home loan

lending and other Chase products.

Other

American Debt

Settlement Solutions

CFPB –

May 2013

Fees related to

debt relief

The CFPB fined service provider $500k+ for

selling debt relief products and services that

mislead consumers. The fees charged are

deemed “illegal” by the CFPB.

$500k+ fines

The service provider charged consumers

illegal upfront fees for debt-relief services

that rarely, if ever, materialized

Achieve Financial

Services

FDIC – June 2013

FDIC-13-048b

FDIC-13-049k

© 2013 FIS and/or its subsidiaries. All Rights Reserved.

Practices related to unfairness and deception

regarding a prepaid mastercards. Specific

UDAAP allegations alleged regard advertising

and marketing, resolving claims of dispute,

and issues pertaining to delivery via ACH of

federal benefits payments. The use of the

word “free” particularly caught the FDIC’s

$110k

Lengthy consent order

16

Case

Regulatory

Authority

Product /

Practice

Issues

Disposition

attention and in addition to CMPs, the

consent order items mandated by the FDIC is

quite lengthy.

© 2013 FIS and/or its subsidiaries. All Rights Reserved.

17