Financial Accounting

advertisement

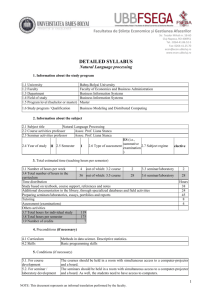

Facultatea de Științe Economice și Gestiunea Afacerilor Str. Teodor Mihali nr. 58-60 Cluj-Napoca, RO-400951 Tel.: 0264-41.86.52-5 Fax: 0264-41.25.70 econ@econ.ubbcluj.ro www.econ.ubbcluj.ro DETAILED SYLLABUS Financial Accounting 1. Information about the study program 1.1 University 1.2 Faculty 1.3 Department 1.4 Field of study 1.5 Program level (bachelor or master) Babeș-Bolyai University Faculty of Economics and Business Administration Accounting and Audit Accounting Bachelor 1.6 Study program / Qualification Accounting and Management Information Systems 2. Information about the subject 2.1 Subject title Internship - Financial Accounting 2.2 Course activities professor 2.3 Seminar activities professor Professor PhD Adriana Tiron-Tudor (adriana.tiron@econ.ubbcluj.ro) 2.4 Year of study II 2.5 Semester IV 2.6 Type of assessment SE 2.7 Subject regime Ob 3. Total estimated time (teaching hours per semester) 3.1 Number of hours per week out of which: 3.2 course 3.3 seminar/laboratory 3.4 Total number of hours in the 90 out of which: 3.5 course 3.6 seminar/laboratory curriculum Time distribution Study based on textbook, course support, references and notes Additional documentation in the library, through specialized databases and field activities Preparing seminars/laboratories, essays, portfolios and reports Tutoring Assessment (examinations) Others activities ................................... 3.7 Total hours for individual study 3.8 Total hours per semester 90 3.9 Number of credits 3 90 Hours 5 75 5 2 3 4. Preconditions (if necessary) 4.1 Curriculum 4.2 Skills • Knowing and applying (at a basic level) the techniques and recording procedures specific for financial accounting. 5. Conditions (if necessary) 5.1. For course development 5.2. For seminar / laboratory development • • 1 NOTE: This document represents an informal translation performed by the faculty. 6. Acquired specific competences Professional competences • • • • • • Transversal competences • • • Carrying out the financial-accounting activity at economic entities level, public institutions and other non-profit organizations Applying recording techniques and operational procedures specific to financial and management accounting Performing specific tasks related to financial control Participating in the development and implementation of software for financial accounting Preparing the financial statements, synthesis documents, reporting statements and analyses to different bodies as well as analyzes, summaries, forecasts and economic evaluation Assisting management in decision making Knowledge, explanation and interpretation of ideas, processes, phenomena, states and trends specific to economic activities and development of augmented judgments at micro and macroeconomic level Use of technology and modern tools for processing information and managing databases specific to economic and social activities Ability to teach students from high school level topics related to economics in case of graduates possessing a certificate of pedagogical module 7. Subject objectives (arising from the acquired specific competences) 7.1 Subject’s general objective To develop and deepen skills needed to record transactions in the financial accounting of a manufacturing, trade or service entity. 7.2 Specific objectives • • • To deepen the general knowledge received after studying Basic Accounting; To shape the abilities needed for the recognition, assessment and accounting information disclosure for the purpose of presenting the financial standing and entity performance; To develop the students’ ability to understand the activity of an economic entity 8. Contents 8.1 Course Teaching methods Observations References: 8.2 Seminar/laboratory 1. Entity description 1.1 Entity background, description of the major activities; 1.2 Structure of the accounting department; 1.3 Description of the accounting software. 2. Treasury 2.1 Receipts and payments in cash and by bank transfer; 2.2 Payment and settlement of travel advances; 2.3 Deposits and cash withdrawals. 3. Inventory 3.1 Inventory procurement and dept settlement; 3.2 Inventory consumption; 3.3 The entity’s accounting treatment for inventories. 4. Non-current asset 4.1 Procurement and disposal of tangible and intangible assets; 4.2 Asset’s depreciation; 4.3 The entity’s accounting treatment for non-current assets. Teaching methods Observation, interviews with management Observations Observation, documentation, simulation and computation Observation, documentation, simulation and computation Observation, documentation, simulation and computation 2 NOTE: This document represents an informal translation performed by the faculty. 5. Wage 5.1 Expenses with wages and social reimbursements; 5.2 The accounting of retained contributions. 6. Operational and financial expenses and revenues 6.1 Operational expenses; 6.2 Financial expenses; 6.3 Operational revenues; 6.4 Financial revenues. 7. Equity and long term loans 7.1 Increase/Decrease of shared capital, Premiums, Reserves; 7.2 Recording and settlement of profit/revenue tax; 7.3 Leasing contracts / long term loans 8. Preparation of Trial Balance and General Ledger for the following accounts: Suppliers, Cash/Treasury, Current Result Observation, documentation, and computation Observation, documentation, and computation Observation, documentation, simulation and computation Observation, documentation, computation References: 1. Matiş D., Pop At. (coordonatori), Contabilitate financiară, ediția a 3-a, Editua Alma Mater, Cluj-Napoca, 2010. 2. Pântea P.I., Pop At. (coordonatori), Contabilitatea financiară a întreprinderii, Ed. Dacia, Cluj-Napoca, 2006. 3. Stolowy H., Lebas M.J., Financial Accounting and Reporting – a Global Perspective, Second Edition, Cengage Learning EMEA, London,2006 4. Mateş D., Matiş D., Cotleţ D., Contabilitatea financiară a entităţilor economice, Ed. Mirton, Timişoara, 2006. 5. ***; Legea Contabilităţii nr.82/1991, republicată, M.Of. nr.48/14.01.2005 6. ***, OMFP 3512 Privind documentele financiar-contabile comune pe economie 7. ***; Reglementări contabile conforme cu Directiva a IV-a a Comunităţii economice Europene, aprobate prin OMFP nr.3055/2009 9. Corroboration / validation of the subject’s content in relation to the expectations coming from representatives of the epistemic community, of the professional associations and of the representative employers in the program’s field. This subject is needed for a certification offered by the Association of Chartered Certified Accountants (ACCA); For this subject, the formative contents were established considering the education standards for the accounting profession issued by IASB and the requirements of the national professional organizations: CECCAR and CAFR and the conclusions of the debates held with business representatives and potential employers. 10. Assessment (examination) Type of activity 10.1 Assessment criteria 10.4 Course 10.5 • Seminar/laboratory • • 10.2 Assessment methods Learning and understanding of the specific issues listed above; Applying the techniques and recording procedures based on the entity’s specificities and documents Synthesis and analytical thinking Evaluation of the portfolio prepared by the students. The assessment will reveal the students’ ability to understand the mechanisms specific for economic activities form an accounting perspective. 10.3 Weight in the final grade 100% 10.6 Minimum performance standard • Applying the techniques and procedures for recording in accounting of the major transactions encountered in the economic activity; • It is necessary to obtain a minimum grade of 5 (five) in order to pass this subject; • The grades being granted are between 1 (one) and 10 (ten); • Students must approach each element (question, problem) within the exam sheet; • The exam is written and takes approximately 120 minutes; Date of filling ........................... Signature of the course professor ............................................. Date of approval by the department ............................................ Signature of the seminar professor ............................................. Head of department’s signature ...................... 3 NOTE: This document represents an informal translation performed by the faculty.