ACT 6654 - the Sorrell College of Business at Troy University

advertisement

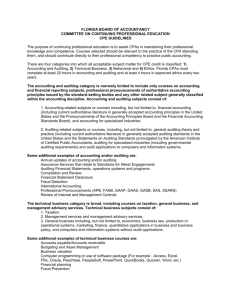

TROY UNIVERSITY MASTER SYLLABUS SORRELL COLLEGE OF BUSINESS ACT 6654 Advanced Auditing & Assurance Services Prerequisites Admission into the Master of Accountancy degree program and completion of all Master of Accountancy foundation and accounting prerequisites. Description A study of advanced auditing theory, standards, practices and problems encountered in the practice of public accounting. Objectives Students successfully completing the requirement of this course should be able to: Demonstrate an advanced understanding of auditing theory as it relates to the practice of public accounting Demonstrate an advanced understanding of auditing practice and problems as they relate to the practice of public accounting Demonstrate an ability to recognize and address complexities associated with relevant auditing situations to include ethical and legal obligations Demonstrate a level of understanding of auditing theory and practice similar to the expectations for the CPA exam Purpose To provide students with an understanding of auditing theory and practice as they relate to both the profession’s certification process and the practice of public accounting. Texts Certified Public Accountants Examination AA section review course, Wiley CPA Review Current edition. Master Syllabi are developed by the senior faculty in each business discipline. This Master Syllabus must be used as the basis for developing the instructor syllabus for this course, which must also comply with the content specifications outlined in the Troy University Faculty Handbook. The objectives included on this Master Syllabus must be included among the objectives on the instructor’s syllabus, which may expand upon the same as the instructor sees fit. The statement of purpose seeks to position the course properly within the curriculum and should be consulted by faculty as a source of advisement guidance. Specific choice of text and other details are further subject to Program Coordinator guidance. 1 Aug 2005 Master Syllabus: ACT 6654 2 Course Topics (Minimum) Professional Responsibilities Engagement Planning, Obtaining an Understanding of the Client and Assessing Risks Understanding Internal Control and Assessing Control Risk Responding to Risk Assessment: Evidence Accumulation and Evaluation Reporting Accounting and Review Services Audit Sampling Auditing with Technology Assessments in this course: SLO 3.1 Students will identify ethical/unethical behavior in dilemmas related to accounting issues. Measure: Multiple Choice questions related to an ethical dilemmas SLO 3.2 Students will objectively apply knowledge of ethical behavior in dilemmas related to accounting issues. Measure: Case Study Troy University Faculty Handbook (2013): Section 3.9.2.8 [extract] — essential elements of the syllabus (somewhat modified for space): 1. Course title 8. Classroom 2. Course number + location section 9. Office location + 3. Term e-mail address 4. Instructor 10. Office telephone 5. Prerequisites 11. Course 6. Office hours description, 7. Class days, times objectives 12. Text(s) 13. Other materials 14. Grading methods, 16. General supports criterion weights, (computer works, make-up policy, writing center) mid-term grade 17. Daily assignments, reports holidays, add/drop 15. Procedure, course & open dates, requirements dead day, final exam 18. ADA statement 23. Cheating policy 19. Electronic device 24. Specialization statement requirements 20. Additional (certification, services, licensure, teacher statements competencies) 21. Absence policy 22. Incomplete-work policy