Financial Regulations

advertisement

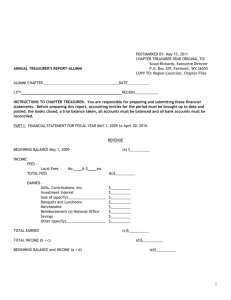

Leicestershire Retirement Association Financial Regulations These regulations set out practical guidance of the Leicester Retirement Association's (LRA) policies to financial control. These were approved by the Committee on 12th September 2012 and apply to all officers of the LRA. The aim of the regulations is to provide control over the resources of the LRA and to provide assurances to the members that their resources are being used in a prudent manner, in particular with regard to: a) Financial Viability b) Value for Money c) Effective financial control over funds belonging to members d) Complying with relevant statutory legislation These financial regulations must be complied with by all officers of the LRA and by anyone running an event on behalf of the LRA. The regulations should be reviewed at least every four years to ensure that they remain relevant to the organisation at that time. A General Financial Planning 1. The Treasurer is responsible for maintaining the accounting records of all income and expenditure together with all records and receipts relating thereto. 2. These shall be maintained on a regular basis and the financial position reported to each Committee meeting of the LRA. 3. The Treasurer shall prepare accounts each year to the 31st August and a Balance Sheet as at that date and submit these to the approved auditor in time for the Annual general Meeting to received audited accounts. 4. The Treasurer shall bring to the attention of the Committee at any time any issue relating to the finances of the LRA with advice of the best method of dealing with that issue. 5. The Treasurer shall retain the cheque books and paying in books of the LRA and be the main liaison contact with the LRA banks. The Treasurer shall review the investment rates obtained by the LRA and make recommendations as necessary. All cheques require two signatures out of the approved number of four available. 6. The Treasurer shall reconcile the accounting records with the bank statements periodically during the year and the cash held with the records. 7. The Treasurer shall retain the accounting records of the LRA in accordance with the statute of limitations. 8. The Treasurer shall pay the insurance premium of the LRA each year and inform the company of the number of members or other information requested. B General Policy on Organised Events and Social meetings 1. The LRA provides events for its members in different formats. Some incur a charge which is made directly for that event. Other events may have no direct charge but do have overall costs to the LRA, for example walks. 2. The aim of the LRA is that events which involve direct costs will achieve at least a ‘break-even' financial position over a financial year., unless the Committee agrees that a subsidy is authorised for a particular event, or type of event. 3. Events need to be researched and estimated costs ascertained, before incurring liability, so that a charge can be calculated which at least aims to achieve a break-even financial position, including an administration charge to cover incidental expenditure. A format for such is attached as an appendix as Activity Sheet. 4. The organiser of an event needs to make a judgement on the support for the event to minimise the deficit should the break-even not become possible. An event may need to be cancelled if insufficient 5. 6. 7. 8. 9. 10. 11. support is not forthcoming. The cancellation of events does need to be exercised with caution as excessive cancellations will deter future attendance at events. In particular, events where most costs are incurred in advance of ticket sales, caution needs to be taken to avoid deficits on the finances of the LRA. Organisers of events need to keep records showing that planned costing has been carried out and the event to be formally reconciled at the end of the event to the income and expenditure. This document to be retained by the treasurer as part of the accounting records. Income received for events should be paid to the Treasurer within three months and without deduction. The Treasurer will bank these sums as quickly as possible. Detailed records of the income for each participant needs to be maintained by the organiser and banking made up in a table to facilitate the banking of these sums. Expenditure incurred on the event should be invoiced to the LRA and the invoice passed to the Treasurer for payment after it has been verified as correct for payment. Expenditure incurred directly by the organiser of an event should be reclaimed from the Treasurer on a claim form submitted with the receipts and details of the event. If required, an advance sum should be claimed by the organiser to facilitate the payments that need to be made directly by the organiser to avoid using the organiser's own funds. Expenditure incurred indirectly on events should be dealt with as expenses below. The person organising an event as a right to take a free place offered by the event supplier but this should be recorded on the appropriate Activity Sheet. If more than one place was offered a report should be made to committee for decision. C Reimbursement of Expenses Incurred 1. Expenditure incurred indirectly for an organised event should be reclaimed from the Treasurer on a claim form together with the appropriate receipts, where applicable. Expenditure under this heading would include ; 1. Travel in association with the pre-organisation of an event where a familiarisation trip is deemed necessary 2. Printing and stationery costs to provide literature and envelopes 3. Postage for sending documents to participants 4. Telephone usage in association with events and official business of the LRA. 5. Joining fees of Travel Association 2. Expenditure incurred by officers in carrying out approved duties of the committee shall claim for expenses on an expenses claim form together with receipts where applicable. Normal expenditure under approved duties would include: 1. Travel to committees meetings, at the currently approved rate. 2. Parking charges incurred for committee meetings. 3. Stationery, printing and postage costs in undertaking the role of committee member or officer. 4. Telephone costs incurred in official business of the LRA. 5. Providing refreshments for committee and social meetings for members. 3. Economy should be exercised when incurring expenditure on behalf of the LRA and the best price obtained consistent with practicality and efficiency. 4. Other non-routine costs should be submitted to the committee for approval before liability has been entered into for the LRA. 5. Claims should be submitted within six months of the date of expenditure to be valid. Leicestershire Retirement Association Financial Regulation September 2012