MBA 8411: Policy Formulation and Implementation

advertisement

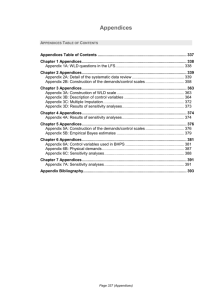

MBA 8411: Policy Formulation and Implementation Hand-in Analyses: The Airline Industry This semester, I am asking you to complete a three-part hand-in analysis on the US airline industry and one firm in that industry (you may choose among Delta, American, Southwest, and US Airways). You will need to do your own research on the industry and the company you choose using publicly-available resources. Part 1 of the assignment is due on February 24th, part 2 on April 7th, and part 3 on May 5th. Each part of this assignment is worth 20% of your course grade, to a total of 60% of the course grade. All of your analyses should be prepared from the point of view of a consultant hired to advise the CEO of the company you choose to examine. Each part of the analysis should be roughly 10 pages, double-spaced, 12-point font, plus your bibliography and appendices containing the information that underlies the written portion of your report. That is, the main body of your report should summarize and integrate the material contained in the appendices. I should be able to read the main body as a stand-alone document without referencing the appendices (but rest assured, I will read them!). The appendices also should each stand on their own. That is, when I read each appendix, I should be able to understand why it’s there and what it’s telling me without having to refer to the body of your report. By the end of the project, you should have a clear understanding of where the airline industry is at and where it’s going, along with an equally strong understanding of the strategy, strengths and weaknesses, and challenges facing the airline you’ve examined. I now will proceed to outline the content for each part of the assignment: Part 1: Industry analysis Part 1 of the assignment looks at the industry structure of the airline industry, and assesses the profit potential of the industry, both now and in the future. The specific questions you need to address in this part of the assignment include: What does the industry structure look like? What are the strategic groups in the industry? Given this, what is the overall attractiveness of the overall industry and each of the strategic groups you identified? What are the key success factors in the industry? Do they vary by strategic group, or are they consistent across the industry as a whole? What are the driving forces acting to change the industry? (I.e., macroenvironmental analysis)* How are those changes likely to affect the industry as a whole and the different strategic groups in the industry?* If the driving forces play out as you anticipate, how will that affect the attractiveness of the industry and its constituent strategic groups? 1 Part 2: Firm (internal) analysis Part 2 of the assignment looks inside at the airline you’ve chosen to analyze. It considers both the strategy of the firm, as well as the resource base the firm draws upon. The specific questions you must consider in this part of the assignment are as follows: What is the strategy your airline is following? Be sure to include the following components of the strategy: o Overall strategy (Hambrick & Fredrickson typology) o Business-level strategy o Corporate-level strategy o Cooperative strategy o International strategy How well does the strategy seem to be working? Do the financials indicate a successful strategy? What is your evidence? Do you believe the strategy will be successful in light of the industry conditions you identified in part 1? Why or why not? What is the firm’s resource base? What are its core and distinctive competences? Consider your industry analysis from part 1. What particular challenges do these create for the firm? What opportunities do they create that the firm might be able to exploit? What internal strengths and weaknesses does the company have to meet those challenges and opportunities? Does the firm’s resource base appropriate for the strategy it’s trying to achieve? Why or why not? Overall, what are the major leadership and management issues faced by the firm? Why did you choose them, as opposed to some other set?* Part 3: Recommendations Part 3 of the assignment seeks to bring together the first two parts, and have you make recommendations to the CEO of the airline you chose to examine. The questions you need to address in this part are: Based on the external challenges and opportunities and internal leadership and management issues, what are the major problems that your firm faces? Why? Is there any specific sequence you must address the issues in?* (E.g., we must face leadership issue 3 before we can exploit opportunity 6.) What options are available for the firm to meet its most important challenges and opportunities?* How would you choose among the alternatives? What are your criteria?* What specific recommendations do you have for the CEO? Appendices for the paper You will not have adequate space in the body of your paper to conduct a detailed analysis of each question. Therefore, you will want to put the detailed analysis into your appendices. The appendices for the assignment should be detailed and complete. They should stand alone, in that I should not need to read them in conjunction with the body of your paper. In them, you need not only to conduct detailed analysis, but you also need to draw conclusions from your analysis. Those conclusions should be carried forward into the body of your paper. 2 Appendices for part 1: 1. Industry analysis – i.e., a Porter’s 5 force analysis 2. Strategic group map 3. Macro-environmental analysis:* a. Economic activity b. Law and ethics c. Diversity (demographic, cultural, and social) d. Technology e. Environmental sustainability f. Global issues and trends Appendices for part 2: 1. Strategy analysis: Complete a detailed summary of the firm’s strategy using the Hambrick & Fredrickson typology. Identify each of the 5 dimensions of strategy (arenas, vehicles, differentiators, staging, and economic logic) and summarize what they tell you about the firm’s strategy. Analyze the elements that make up each part of your firm’s strategy: business-level, corporate, cooperative, and international. 2. Financial analysis: Apply appropriate financial analysis to aid in understanding the performance profile of the firm you chose to analyze. 3. Internal analysis: Evaluate leadership and management issues faced by the firm.* 4. Resource and competence analysis: Carefully identify all the potential resources and competences possessed by the firm. Categorize them according to the VRIS scale, and identify whether they are core, distinctive, both, or neither. Appendices for part 3: 1. Analysis of problems: Identify the major problems that have emerged from the previous analysis (i.e., including parts 1&2). Be sure to identify root causes, not just poor outcomes. Categorize the problems based on severity and urgency to help identify the most important problem(s) to be addressed. Identify any temporal sequencing needed in addressing the problems.* 2. Analysis of alternatives: Identify two distinct, reasonable paths for the firm you are analyzing. Evaluate the potential effectiveness of each in solving the primary problem(s) identified above. Be sure to identify and evaluate the risks and benefits of each path with respect to external stakeholders and with respect to internal stakeholders. For each alternative, identify actions to be taken, including changes needed within management processes.* 3. Comparison of alternatives to criteria: Compare each of the alternatives you identified to the set of criteria you identified. Based on your analysis, decide which alternative seems to make the most sense. 4. Timelines. Outline the specific actions the firm would need to undertake to execute your chosen alternative. What needs to be done when? Make a plan for the next 3-4 years, including what actions need to be taken, who needs to take them, and how to know whether or not they’re working. 3 Note: Items marked with an asterisk (*) will also be used for the program-level assessment. 4