March 2006 - Cornerstone Scripture Study

advertisement

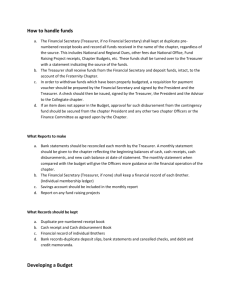

(F-6) GUIDELINES FOR HANDLING BRANCH FINANCES (Refer to pages 12-14 in the manual for a complete version.) The Cornerstone Catholic Scripture Study has a tax-exempt status. To comply with this status, it is necessary to keep accurate financial records. Teresa Johnson from the Mary Queen of Peace Branch in St. Louis is our Central Shepherding Board Treasurer who maintains the Central Cornerstone Treasury. You may contact her with questions at the following address: Teresa Johnson The Central Shepherding Board Treasurer 2126 Ballas View Drive St. Louis, MO 63122 314-984-9426; djjtaj@earthlink.net Please review the following guidelines for handling Branch finances: 1. Open and maintain a checking account bearing the name "The Cornerstone __________________ Branch" 2. Maintain an ongoing log of all income and expenses. Keep all receipts and label the specific use. (This includes petty cash transactions.) Keep a copy of your Yearend reports and income/expense logs that you forward to the Central Shepherding Board Treasurer in St. Louis for your Branch records! 3. Deposit money in checking account at the end of each weekly session. (Please keep accurate records of all deposits and withdrawals.) 4. Pay any necessary expenses your Branch incurs. Use Reimbursement Form (F-1) to document reimbursements - i.e., nametags, letters, copies, etc. (Careful records must be kept to assure our non-profit status.) NOTE: The Central Cornerstone Treasury pays for copies of lessons and commentaries for the Branches unless other arrangements have been made with the Shepherding Board. 5. At the end of (November, February, May and August) and after Branch expenses are paid, forward remaining amount to the Central Shepherding Board Treasurer. Use the F-3 Branch Quarterly Transfer of Funds Form. Keep a maximum of $100 in the Branch checking account unless an anticipated need requires additional cash reserves. (Use Monetary Advance Request Form F-9 to apply for additional funds.) Note: Social occasions may have income and expenses for each person. These may be made at the discretion of the Branch and need not be reported. (i.e. brunch, dinner, retreat, etc. for members.) (REVISED 04/11/2015) (F-6) 6. Gifts: Any monetary gift, such as gifts to priests, janitors, etc. should be taken from the Branch checking account. All host parishes should be given $150 by April 1 of each year. If the Branch is not able to cover this expense, they may request funds from the Central Shepherding Board Treasurer. At the discretion of the Branches, a special collection may be gathered and a larger donation can be given to the host parish. However, this income must be recorded in a log and accounted for in the annual report to the Central Shepherding Board Treasurer. 7. If a member wishes to make a contribution of $75 or more for the calendar year, the following steps should be taken, in order to comply with tax-exempt status: The member should write a check to The Cornerstone Catholic Scripture Study. The member's name should be noted on the deposit slip. The member should receive Tax Donor Letter (F-5) as the thank you note. One copy of this note should remain in the Branch Treasurer's file and another should be sent to the Central Shepherding Board Treasurer. 8. The Cornerstone will not provide donation receipts for cash donations under $75.00 for the calendar year. 9. The tax-exempt purchasing letter for your state should be used when making a reimbursable purchase for The Cornerstone. 10. Tax-exempt letter should not be used to purchase an item which is intended to be used as a donation to The Cornerstone. 11. If a member wishes to keep track of their donations and submit the receipts for a Tax Donor Letter (F-5) when they total $75 or more, they should submit the paperwork to their Branch Administrator/Coordinator/Treasurer with an explanation of goods donated for the Branch. (Refer to item 10 above.) You will then receive the Tax Donor Letter (F-5) from your Branch Administrator/Coordinator/Treasurer. 12. At the end of the study year and/or by April 30, a Branch financial report should be sent to the Central Shepherding Board Treasurer. Use The Cornerstone Financial Report Form (F-4). The report should also be made available to anyone requesting Branch financial information. Please call any Shepherding Board member if you need more information. One of us will contact you to review the guidelines and answer any questions. (REVISED 04/11/2015)