Option 1: Self-Regulation

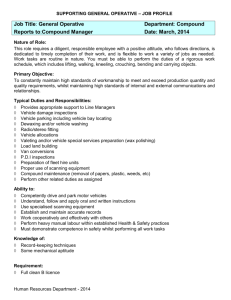

advertisement