Geographic Concentrationv3 - Andrew.cmu.edu

advertisement

Preliminary Results – Please Do Not Cite

Geographic Concentration in the U.S. Retail and Wholesale Sectors

Shawn D. Klimek*

Center for Economic Studies, U.S. Bureau of the Census

and

The Pennsylvania State University

David R. Merrell**

Center for Economic Studies, U.S. Bureau of the Census

and

Carnegie-Mellon University

November 8, 1999

__________________

We would like to thank seminar participants at the Center for Economic Studies for very

helpful suggestions. All conclusions here are those of the authors and do not represent

the opinions or official findings of the U.S. Bureau of the Census.

*Center for Economic Studies, U.S. Bureau of the Census, 4700 Silver Hill Road Stop

6300, Washington Plaza II Suite 211, Washington D.C. 20233-6300

(sklimek@ces.census.gov)

**5000 Forbes Avenue, Carnegie-Mellon University, H. John Heinz III School of Public

Policy and Management, Census Research Data Center, Room 238, Pittsburgh, PA 15213

(dmerrell@andrew.cmu.edu).

I.

Introduction

When looking at the economic landscape, one can point to a number of instances

where it appears that industries locate in the same geographic regions. High technology

industries seem to be located in Silicon Valley, automobiles in Detroit, financial

industries in New York and Chicago, and tires in Dayton—to give a few examples. In

the past, these stories of geographic industrial concentration have been taken as a rule of

thumb and were not given a lot of attention in the economics literature since Marshall

(1920).

More recently, however, interest has rekindled on the subject, and a good deal of

attention has focused on the geographic concentration of industries. Krugman (1991)

makes the case that this sort of concentration may be the general rule rather than an

exception—that the agglomeration of industries is more than merely a set of examples

that one can point out such as Silicon Valley. Rather, this sort of agglomeration of

industries could be the source of the increasing returns that models of international trade

and economic growth have at their core.

This renewed interest in the geographic concentration of industries seeks to explain

why agglomeration exists in the first place. Some of this attention focuses on the role

that technological spillovers play in industry concentration. Glaeser, Kallal, Scheinkman,

and Schleifer (1992) examine the role of technological spillovers in the growth of cities.

They find evidence that spillovers between industries may be more important than

spillovers within an industry. They also find evidence that competition and economic

diversity supports employment growth while specialization damages growth. Jaffe,

Trajtenberg, and Henderson (1993) provide evidence of technological spillovers using

patent citation data. This work also finds evidence of the geographic localization of

spillovers and finds further that these spillovers can be quite large and significant.

Other recent work takes a step back to examine not why these sorts of

agglomerations exist, but rather whether or not they are real. Ellison and Glaeser (1997)

examine U.S. manufacturing data for 1987 and ask the question: “How concentrated are

manufacturing industries?” Using a model of location choice that incorporates spillovers,

the authors derive measures of geographic concentration. These indices control both for

the size distribution of manufacturing plants and for the size distribution of the

geographic areas. Using these indices, the authors find that nearly all industries in their

study exhibit some degree of geographic concentration. Additionally, the authors find

that there is evidence of co-agglomeration of industries in the sense that there appears to

be location choices hinging on the upstream-downstream relationships among businesses.

In related work, Dumais, Ellison, and Glaeser (1997) treat the location of

manufacturing plants as a dynamic process. The idea is that the entry, exit, expansion,

and contraction of manufacturing plants will also affect measures of geographic industrial

concentration. Using the Census Bureau’s Longitudinal Research Database, these

authors find that the location choices of new plants and the differentials in the growth

rates of plants tend to reduce levels of geographic concentration in U.S. manufacturing.

Additionally, they find that the exit of plants tends to increase agglomeration.1

Virtually all of the research focusing on the agglomeration of industries uses data

on the manufacturing sector. In this paper, we extend the literature on geographic

concentration by measuring the agglomeration and co-agglomeration in the U.S.

wholesale and retail sectors in 1992. Together, these two sectors account for about as

much economic activity as manufacturing. In 1997, the wholesale and retain sectors

accounted for about 15% of all economic activity in the United States; in the same year,

manufacturing accounted for roughly 17% of economic activity. The shear size of the

wholesale and retail sectors makes them important to understand. Using a newly

constructed dataset containing the statistical universe of wholesale and retail

establishments, we use the Ellison-Glaeser geographic concentration indices to examine

patterns of agglomeration within and across the industries in these two sectors—using

calculations from the manufacturing sector as a benchmark.2

Our contributions are threefold. First, little is know about geographic concentration

outside of the manufacturing sector. In the spirit of Ellison and Glaeser, this paper

simply takes a step back to answer the primitive question: do establishments in the U.S.

wholesale and retail sectors tend to be geographically concentrated? We use the same

measures in manufacturing as a benchmark. Second, we focus on the co-agglomeration

of industries in retail and wholesale. To do this we calculate measures of coagglomeration for all possible combinations of industries and examine the distribution of

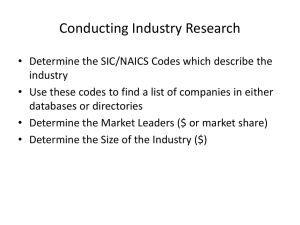

these measures. Third, the foundation of the U.S. statistical program has been the

Standard Industrial Classification (SIC) system. However, after 1997 all economic

census data will be collected under the new North American Industrial Classification

System (NAICS). The conversion to NAICS represents a significant change in the way

economic census data are collected and reported. This paper uses data from the 1992

1

Maurell and Sedillot (1999) use indices similar to Ellison and Glaeser (1997) to examine the geographic

concentration of French manufacturing plants. These authors find that patterns of geographic concentration

in France are very similar to the patterns in the U.S. data.

Economic Census that have been converted from SIC to NAICS and provides an

introduction to the new NAICS sectors, subsectors, and industries.

In Section II, we detail the model used by Ellison and Glaeser and the measure of

geographic concentration and co-agglomeration that is derived from it. Section III

describes the data. Section IV contrasts the results for manufacturing to retail and

wholesale and details the analysis of co-agglomeration. Section V concludes.

II.

The Model

There likely are many reasons why an industry may be geographically concentrated,

but two broad motivations spring to mind. First, depending on the type of industry, some

locations may present certain natural advantages over others. For example, industries

requiring large amounts of warehousing may locate near commercial naval ports or near

major highways. Second, certain industries may tend to be concentrated because of

technological spillovers that accrue; this certainly could explain the location of the

computer industry in Silicon Valley. However, in general, it likely is the case that the

concentration of industries is some amalgam of both of these broad motivations. Glaeser

and Ellison (1997) develop a model of location choice that incorporates both of these

motivations, and from that model, indices of geographic concentration are derived. We

present a shortened version of their model below.

A. Natural Advantages

Consider a model with N business units (in this case a census establishment in the

retail or wholesale sectors) and M geographic markets, which could be at the county,

These data are maintained at the Census Bureau’s Center for Economic Studies and are collected under

the Census of Wholesale Trade and the Census of Retail Trade programs.

2

state, or some other aggregate. For some industry, the kth business unit enters that region

(i) which maximizes profits. This can be expressed as the following:

log ki log i g i 1 ,..., k 1 ki

where log ki is profit accruing to business unit k located in region i. Business unit k’s

profits are a function of log i , the profit of the “typical” firm located in region i; this

profit also is a function of observable and unobservable regional characteristics. Profit

also is a function of g i 1 ,..., k 1 --the effects of spillovers from the other k-1 business

units located in region i. Finally, profit is a function of an idiosyncratic shock for

business unit k, located in region i. We assume that that the ki are independent

Weibull random variables that also are independent of the i . Further, it should be

clear that if g i 1 ,..., k 1 0 i, then the model reduces to a standard conditional

logistic model—conditioned on the realizations of the i . Next, we impose the

following two parametric restrictions on the model:

(1)

E

1 ,..., M

i

xi

j

j

(2)

i

var

j

j

na xi 1 xi where na [0,1]

Equation (1) gives the probability of locating in region i. The parameter na is

interpreted as a measure of the importance of natural advantages in a given region. A

value of na close to zero suggests that the region does not exhibit natural advantages,

while a value near unity implies that the natural advantages of the region dominate all

other regions. In the latter case (viz., na =1), all k business units would find an optimum

by locating in that region.

Conditions (1) and (2) incorporate natural advantages into the location decisions

of businesses. Next is the incorporation of technological spillovers into the location

decision calculus. The idea is that locating near other facilities in the same industry could

represent lower transportation costs or even the transfer of knowledge across facilities.

Section II.B details how we incorporate spillovers.

B. Spillovers

Consider the following model of plant location that incorporates spillovers.

log ki log i ekl (1 u il )( ) ki

l k

The {eki} are Bernoulli random variables equal to one with probability s[0,1], and

equal to zero with probability 1-s. The variable uil is a dichotomous indicator variable

equal to one if establishment l is in region i, or equal to zero otherwise. The importance

of spillovers is captured by the probability parameter s.

C. Measures of Geographic Concentration and Co-agglomeration

For a single industry with M geographic regions (counties) and N business units

(establishments), Ellison and Glaeser use as the measure of geographic concentration,

where is defined as:

G 1 xi2 H

i

1 xi2 (1 H )

i

2

M

N

2

( si xi ) 1 xi z 2j

i 1

i 1

j 1

M

N

1 xi2 1 z 2j

i 1

j 1

M

2

where si is the share of industry employment in region i, xi is the share of total

employment in region i, and zi is the share of establishment employment of the industry.

Ellison and Glaeser show that if the models in section IIA and IIB describe plants’

location decisions, then the measure of geographic concentration is a useful measure that

has several desirable properties. First, the index can be calculated easily with the

information in our dataset. Access to the establishment level data means that each

component of the index can be calculated by aggregating up to the county or industry

level. Second, the scale of the index allows comparisons to be made to a benchmark of

“no-agglomeration” when the expected value of is equal to zero. Third, the index is

comparable across industries in which the size distribution of firms differs.

Ellison and Glaeser extend the model in Section II to examine the extent to which

industries are co-agglomerated. The measure c, defined below, shares the desirable

properties of ; to be sure, c and share the same scale.

c

r

G

H ˆ j w 2j (1 H j )

j 1

1 xi2

i

r

1 w 2j

j 1

where G

and H

(s x )

industries.

i

j

i

2

is area i's share of the aggregate employment in the r industries

w 2j H j is an establishment’s Herfindahl index of the aggregate of the r

If the measure c is equal to zero, then there are no spillovers or natural advantages

specific to the industry group; rather the natural advantages would be specific to an

industry—not the industry group. An alternative measure of co-agglomeration is :

c

w ˆ

j

j

j

If the measure is close to one, then all spillovers and natural advantages are group

specific rather than industry specific. On the other hand, a value of close to zero

implies that the industries exhibit little co-agglomeration—that spillovers and natural

advantages are industry specific and not group specific. We use the measure to analyze

to extent to which industries are co-agglomerated.3

C.

The Data

Our data come from two sources. First, we use establishment level data from the

1992 Economic Census. An establishment level observation is defined as a business or

an industrial unit located at a single physical location. Further, all establishments must

produce goods, distribute goods, or perform services.4 The Economic Census covers the

universe of retail and wholesale establishments in the United States. These observations

contain a wealth of information on the employment, sales, wages, industry and

geographic characteristics, inter alia, of business units. Second, to get information on

regional characteristics, we use data from Counties 1996. From this second source of

information, we construct total county employment for 1992. These two sources of data

To be sure, measures the strength of co-agglomerative forces relative to agglomerative forces.

This definition is not always correct. The Census Bureau sometimes splits up very large "establishments"

into several establishments, especially when the products and industries these plants produce in are quite

varied. In our analysis, we do not exclude establishments that are broken out in this way.

3

4

provide the information necessary to construct the Ellison-Glaeser geographic

concentration indices.

This paper uses data on wholesale and retail establishments in the United States that

are classified using the new North American Industrial Classification System (NAICS);

all other work of which we are aware uses the Standard Industrial Classification (SIC)

system to define an industries. There are substantial differences between the NAICS and

SIC systems. In the following paragraph, we give a brief overview of the NAICS

taxonomy.

A NAICS subsector is the three-digit code—comparable to the two-digit SIC code.

There are two more detailed breakdowns, the five-digit NAICS code with is referred to as

the NAICS industry, and the six-digit NAICS code which is referred to as the U.S.

industry. The combination of NAICS industries and U.S. industries is comparable to the

old four-digit SIC industries. Under the SIC system, there were 459 four-digit industries

in manufacturing, under NAICS that number increased to the 474. NAICS leaves the

number of wholesale industries constant at 69, and increases the number of retail

industries from 64 to 72. More importantly, NAICS redefines the boundary between the

two sectors, which results in a number of establishments moving from wholesale to retail.

Klimek and Merrell (1999) provide a very detailed discussion on the differences between

the NAICS and SIC industry classification taxonomies.

For the analysis that follows, we compute our indices of geographic concentration

using the NAICS and U.S. industries—keeping mind that these levels of aggregation

correspond to the four-digit SIC levels. For our indices of co-agglomeration between

wholesale and retail establishments, we use the sub-sector code as the industry group of

analysis.

VI.

Geographic Concentration Results

First, we describe the general results for the manufacturing sector. Assuming the null

hypothesis of s=na=0 (viz., that there are no spillovers or natural advantages that would

give rise to geographic concentration), we compare the raw concentration

G (si xi )2 to the expected value of G under the null.5 We find a comparable, but

weaker result than Ellison and Glaeser using data for 1992. Of the 469 manufacturing

industries, 433 industries have a value of G that is greater than the expected value of G.

This implies that 433 (92.3%) manufacturing industries are more geographically

concentrated that what would be expected to arise if establishments were located

randomly. In contrast, 36 (7.7%) industries are more evenly distributed than what would

be expected if establishments were located randomly. Calculating the variance of G, we

check to see if the difference is significant.6 Of the 433 manufacturing industries where

the difference between G and E[G] is positive, only 12.2% are significantly different

which suggests that there is not a lot more geographic concentration than one might expect

to arise of plants were located randomly. This is in contrast to the 82.7% found by Ellison

and Glaeser using aggregate 1987 data. For the 36 manufacturing industries where the

difference is negative, none are significant—a result similar to Ellison and Glaeser.

The results for retail and wholesale are strikingly similar. Of the 130 retail and

wholesale industries, we find that the difference is positive for 128 industries (98.5%), and

5

r

r

j 1

j 1

E[G] (1 xi2 )[ H 0 (1 w2j ) j w2j (1 H j )]

negative for just two industries (1.5%). The 128 retail and wholesale industries for which

the difference is positive, it is significantly positive for 35.2% of the industries. Like

manufacturing, when the difference is negative, it is not significantly different. So, under

the null hypothesis of “no spillovers or natural advantages,” the amount of geographic

concentration seems strikingly similar between the two sectors.

In Table 1 and Table 2, we list the fifteen most concentrated manufacturing,

wholesale and retail industries. Comparing the two tables contrasts the levels of

geographic concentration.7 Clearly, manufacturing is much more concentrated than retail

or wholesale. With the exception of Women's, Children's, and Infant's Clothing and

Accessories Wholesalers (NAICS 42233), the most concentrated manufacturing

industries have measures of that are one and in a number of cases even two orders of

magnitude larger than the measures of for the wholesale and retail sectors. The results

for manufacturing are quite reasonable in the sense that we see Silicon Valley computer

chips (NAICS 333295), Dalton, Georgia carpet manufacturing (NAICS 314110), and

Northern California wine producers (NAICS 312130) all having high levels of geographic

concentration. Although the numbers are far less dramatic than in the manufacturing

cases, our results confirm the conventional wisdom that in the retail sector, art dealers

(NAICS 45392) are concentrated and in the wholesale sector, jewelry wholesalers

(NAICS 42194) are concentrated geographically.

Table 3 and Table 4 present the other end of the distribution of geographic

concentration for manufacturing, wholesale, retail industries. These tables present the

6

The formula for var(G) is described on page 907 of Ellison and Glaeser (1997).

In these tables, the level of aggregation is different. In manufacturing, the six-digit NAICS code provides

much more detailed breakouts than the five-digit NAICS. In wholesale, the five-digit and six-digit are

identical. In retail, there are few differences between the five-digit and six-digit codes.

7

fifteen least concentrated industries. That some of these industries exhibit very slight

levels of concentration is not terribly surprising given that some of them are miscellaneous

industry groupings such as Other Major Household Appliance Manufacturing. Still,

others confirm conventional wisdom in the sense that it is believed that those industries

are not geographically concentrated—like Breweries (NAICS 312120) in manufacturing,

Department stores (NAICS 45211) in retail, and Dairy Product Wholesalers (NAICS

42243). What we do find interesting about the cross-sectoral comparisons is that the

wholesale and retail measures (in absolute terms) are still an order of magnitude (or two)

less concentrated than the manufacturing industries.

Tables 5, 6, and 7 provide our calculations of the presence of co-agglomeration in

manufacturing, retail, and wholesale (respectively) industries. In manufacturing and

retail, we use the three-digit NAICS industry group as the unit of observation, while in the

wholesale sector, we use the four-digit NAICS industry group as the unit of analysis. The

measures c and will tell us the degree to five- and six-digit NAICS industries in

manufacturing, retail, and wholesale are co-agglomerated. To be sure, c is scaled

identically to ; on the other hand measures the strength of co-agglomerative forces

relative to agglomerative forces. A value of =0 indicates that there is no coagglomeration and that the natural advantages and spillovers are industry specific.

Likewise, a value of =1 indicates that there are strong co-agglomerations and hence that

the natural advantages and spillovers are specific to groups of similar industries and not

industries themselves.

We find results similar to Ellison and Glaeser for manufacturing. That is, our

calculations indicate that there does exist some degree of co-agglomeration in

manufacturing—ranging from =0.088 in Textile Product Mills (NAICS 313) to a high of

=0.556 in Wood Products Manufacturing (NAICS 321). Retail subsectors and wholesale

industry groups, on the other hand, show markedly higher co-agglomeration than

manufacturing—with wholesale industry groups exhibiting generally more coagglomeration than retail industry groups. Retail subsectors range from a low of =0.206

in Non-store Retailers (NAICS 454) to a high of =0.760 in Clothing and Clothing

Accessory stores (NAICS 448). With the exception of the Beer, Wine, and Distilled

Alcoholic Beverage (NAICS 4228) industry group, all wholesale industry groups show

relatively larger degrees of co-agglomeration than either retail or manufacturing industry

groups. Wholesale industry groups range from a low of =-0.023 in Beer, Wine, and

Distilled Alcoholic Beverage (NAICS 4228) to a higher of =0.867 in Farm Product Raw

Materials (NAICS 4225). On balance, these calculations suggest that the natural

advantages and spillovers are to some degree group specific rather than industry

specific—though much more so in wholesale and retail than in manufacturing.

In addition to measuring geographic concentration for individual industries and

industry groups, we turn to the examination coagglomeration of pairs of industries. We

describe the distribution of ic , where i rr , rw, ww. r indicates a retail industry, and w

indicates a wholesale industry. There are 1830 pairs of retail (rr) industries. The

distribution of rrc has a median value of .0001. The maximum value is .004. On the

c

other hand, there are 2346 pairs of wholesale (ww) industries. The distribution of ww

has

a median value of .0006. The maximum value is .084. The most interesting pairs of

industries to examine are the pairs of retail industries and wholesale industries (rw).

c

There are 4209 possible rw pairs. The distribution of wr

has a median value of .0001.

The maximum value is .022. Surprisingly, there seems to be very little evidence of

coagglomeration of industry pairs within or between the retail and wholesale sectors.

The median values of the ic are very small, and even at the very top of the distribution,

few pairs of industries seem to be more than slightly coagglomerated.

VI.

Conclusion

In this paper, we present evidence on the existence of geographic concentration in the

wholesale and retail sectors. Using a newly constructed dataset containing the statistical

universe of wholesale and retail establishments for 1992, we find evidence that there is

some degree of agglomeration in these sectors—though far less than in manufacturing

industries. This suggests that natural advantages and spillovers within an industry are

less important in the location decisions for wholesale and retail establishments than for

manufacturing plants. Additionally, we find that wholesale and retail establishments are

far more co-agglomerated than manufacturing plants. This suggests that although there is

not a lot of agglomeration within individual industries, there are significant natural

advantages and spillovers within groups of similar industries. Similar to the results for

individual industries, the measures of coagglomeration for these two sectors are quite

week. Given the close buyer-seller relationship between wholesale and retail, we

expected this measure to be significantly higher, especially for industries across the two

sectors. In general, our results are support the hypothesis that retail and wholesale

industries are highly motivated to locate near the consumers of their products, and the

measures of coagglomeration and geographic concentration are an order of magnitude (or

two) smaller than in the manufacturing sector.

References

Dumais, G., Ellison, G., and Glaeser, E.L. (1997) “Geographic Concentration as a

Dynamic Process,” NBER Working Paper No. W6270.

Ellison, G. and Glaeser, E.L. (1997) “Geographic Concentration in U.S. Manufacturing

Industries: A Dartboard Approach,” Journal of Political Economy, v. 105, n. 5, pp. 889927.

Glaeser, E.L., Kallal, H.D., Scheinkman, J.A., and Schleifer, A. (1992) “Growth in

Cities,” Journal of Political Economy, v. 100, pp. 1126-1152.

Jaffe, A.B., Trajtenberg, M., and Henderson, R. (1993) “Geographic Localization of

Knowledge Spillovers as Evidenced by Patent Citations,” Quarterly Journal of

Economics, v. 108, pp. 577-598.

Klimek, S.D. and Merrell, D.R. (1999) “Industrial Reclassification from the Standard

Industrial Classification System to the North American Industry Classification System,”

Mimeo.

Krugman, P. (1991) “Increasing Returns and Economic Geography,” Journal of Political

Economy, v. 99, pp. 483-499.

Marshall, A. (1920) Principles of Economics: An Introductory Volume. 8th ed., London:

Macmillan.

Maurell, F. and Sedillot, B. (1999) “A Measure of the Geographic Concentration in

French Manufacturing Industries,” Regional Sciences and Urban Economics, v. 29, pp.

575-604.

Table 1. 15 Most Concentrated Industries in Manufacturing in 1992

NAICS

339913

339914

325110

333132

315232

333315

314110

325312

333295

336213

311311

312130

315292

336415

312210

Industry

Jewelers' Material and Lapidary Work

Costume Jewelry and Novelty Manufacturing

Petrochemical Manufacturing

Oil and Gas Field Machinery and Equipment Manufacturing

Women's and Girls' Cut and Sewn Blouse and Shirt Manufacturing

Photographic and Photcopying Equipment Manufacturing

Carpet and Rug Mills

Phosphatic Fertilizer Manufacturing

Semiconductor Machinery Manufacturing

Motor Home Manufacturing

Sugarcane Mills

Wineries

Fur and Leather Apparel Manufacturing

Guided Missle and Space Vehicle Propulsion Unit and Propulsion Unit Parts Manufacturing

Tobbaco Stemming and Redrying

H

0.22622

0.18289

0.20062

0.14495

0.13728

0.20169

0.11235

0.16002

0.15235

0.13651

0.13187

0.1196

0.10093

0.16927

0.13579

G

0.03513

0.0116

0.05349

0.01365

0.01952

0.09828

0.0115

0.06672

0.05992

0.04272

0.04375

0.0396

0.02251

0.10516

0.07023

0.19869

0.17391

0.15583

0.13344

0.12045

0.11544

0.10229

0.1002

0.09868

0.09825

0.09216

0.08359

0.0805

0.07192

0.07051

Table 2. 15 Most Concentrated Industries in Retail and Wholesale in 1992

NAICS

Industry

H

G

45392

44312

44523

45431

44832

45393

44313

45411

44711

45122

44121

44521

44522

44422

44813

Art Dealers

Computer and Software Stores

Fruit and Vegetable Markets

Fuel Dealers

Luggage and Leather Goods Stores

Manufactured Mobile Home Dealers

Camera and Photographic Supplies Stores

Florists

Gasoline Stations with Convenience Stores

Prerecorded Tape, Compact Discs, and Record Stores

Recreational Vehicle Dealers

Meat Markets

Fish and Seafood Markets

Nursery and Garden Centers

Children's and Infants' Clothing Stores

0.0005464

0.0025231

0.0014959

0.0002652

0.0012519

0.0005927

0.0007613

0.0049089

0.0000273

0.0002982

0.0010699

0.0003939

0.0011676

0.0002575

0.0005125

0.0075182

0.0066085

0.0048586

0.0032485

0.0038208

0.0030381

0.0029578

0.0070615

0.0019584

0.002203

0.0024381

0.0016698

0.002432

0.0014301

0.0016454

0.0070039

0.004121

0.0033859

0.0029965

0.0025864

0.0024572

0.0022093

0.0021903

0.0019387

0.0019137

0.0013783

0.0012828

0.001275

0.0011784

0.0011397

42233

42231

42194

42232

42234

42186

42192

42143

42141

42122

42246

42162

42199

42169

42151

Women's, Children's, and Infant's Clothing and Accessories Wholesalers

Piece Goods, Notions, and Other Dry Goods Wholesalers

Jewelry, Watch, Precious Stone, and Precious Metal Wholesalers

Men's and Boy's Clothing and Furnishing Wholesalers

Footwear Wholesalers

Transportation Equipment and Supplies (except Motor Vehicle) Wholesalers

Computer and Computer Peripheral Equipment and Software Wholesalers

Toy and Hobby Goods and Supplies Wholesalers

Photographic Equipment and Supplies Wholesalers

Home Furnishing Wholesalers

Fish and Seafood Wholesalers

Electrical Apparatus and Equipment, Wiring Supplies, and Construction Material Wholesalers

Other Miscellaneous Durable Goods Wholesalers

Other Electronic Parts and Equipment Wholesalers

Metal Services Centers and Offices

0.0015802

0.0014247

0.0018995

0.0023555

0.0089504

0.0026457

0.0048176

0.0012191

0.0080835

0.0011498

0.0017256

0.004921

0.0010158

0.0004492

0.0005439

0.10196

0.0734

0.05257

0.02681

0.02415

0.01275

0.01316

0.00906

0.01486

0.00775

0.00809

0.01117

0.00699

0.00642

0.00649

0.10092

0.07235

0.05096

0.02461

0.01542

0.01018

0.00843

0.00788

0.00689

0.00664

0.00641

0.00632

0.00601

0.006

0.00597

Table 3. 15 Least Concentrated Industries in Manufacturing in 1992

NAICS

322223

336419

325193

333311

332993

335228

311823

322122

327211

332995

337125

312120

326191

322215

323115

INDUSTRY

Plastics, Foil, and Coated Paper Bag Manufacturing

Other Guided Missile and Space Vehicle Parts and Auxiliary Equipment Manufacturing

Ethyl Alcohol Manufacturing

Automatic Vending Machine Manufacturing

Ammunition Manufacturing (Except Small Arms)

Other Major Household Appliance Manufacturing

Dry Pasta Manufacturing

Newsprint Mills

Flat Glass Manufacturing

Other Ordinance and Accessories Manufacturing

Household Furniture Manufacturing (Except Metal and Wood)

Breweries

Plastics Plumbing Fixture Manufacturing

Nonfolding Sanitary Food Container Manufacturing

Digital Printing

G

0.14846

0.10262

0.1108

0.05399

0.04284

0.08509

0.02737

0.07215

0.05176

0.16331

0.04612

0.04935

0.01364

0.04438

0.02657

H

0.16655

0.10698

0.1139

0.057

0.04529

0.08746

0.02974

0.07441

0.0538

0.1653

0.04802

0.05105

0.01525

0.04598

0.02812

-0.021385

-0.004661

-0.003487

-0.003049

-0.002477

-0.002426

-0.002359

-0.002332

-0.002137

-0.001944

-0.001867

-0.00165

-0.001586

-0.001569

-0.00153

Table 4. 15 Least Concentrated Industries in Retail and Wholesale in 1992

NAICS

INDUSTRY

H

G

45291

44411

45211

45311

45114

44412

44111

44511

45112

45113

44311

44211

44611

44419

44221

Warehouse Clubs and Superstores

Home Centers

Department Stores

Florists

Musical Instrument and Supplies Stores

Paint and Wallpaper Stores

New Car Dealers

Supermarkets and Other Grocery Stores (Except Convenience Stores)

Hobby, Toy, and Game Stores

Sewing, Needlework, and Piece Goods Stores

Appliance, Television, and Other Electronics Stores

Furniture Stores

Pharmacies and Drug Stores

Other Building Materials Stores

Floor Covering Stores

0.0010464

0.0005335

0.0001569

0.0000982

0.0006385

0.0003675

0.0000801

0.0000449

0.0003134

0.000275

0.0001434

0.000166

0.0000449

0.0000953

0.0002023

0.000966

0.000578

0.000278

0.000222

0.000769

0.000505

0.000219

0.000185

0.000458

0.000424

0.000300

0.000341

0.000234

0.000286

0.000420

-0.0000768

0.0000475

0.0001227

0.0001256

0.0001337

0.0001399

0.0001403

0.000141

0.0001465

0.0001508

0.0001583

0.0001769

0.0001903

0.0001922

0.00022

42281

42243

42114

42132

42249

42139

42185

42245

42241

42172

42242

42113

42294

42161

42111

Beer and Ale Wholesalers

Dairy Product Wholesalers (Except Dried or Canned)

Motor Vehicle Parts (Used) Wholesalers

Brick, Stone, and Related Construction Materials Wholesalers

Other Grocery and Related Products Wholesalers

Other Construction Materials Wholesalers

Service Establishment Equipment and Supplies Wholesalers

Confectionery Wholesalers

General Line Grocery Wholesalers

Plumbing and Heating Equipment and Supplies (Hydronics) Wholesalers

Packaged Frozen Food Wholesalers

Tire and Tube Wholesalers

Tobacco and Tobacco Products Wholesalers

Electrical Apparatus and Equipment, Wiring Supplies, and Construction Material Wholesalers

Automobile and Other Vehicle Wholesalers

0.0008481

0.0040736

0.0003582

0.0010916

0.0004425

0.0016305

0.0005527

0.0029584

0.00213

0.0009055

0.0015609

0.0021544

0.0060692

0.0003951

0.0009422

0.000436

0.004260

0.000637

0.001411

0.000875

0.002080

0.001021

0.003421

0.002598

0.001478

0.002236

0.002923

0.006841

0.001206

0.001832

-0.0004106

0.000204

0.0002813

0.0003251

0.0004365

0.0004581

0.0004727

0.0004769

0.0004795

0.0005794

0.0006847

0.000782

0.0008023

0.0008166

0.0008977

Table 5. Co-agglomeration in the Manufacturing Sector in 1992

NAICS Subsector

311

312

313

314

315

316

321

322

323

324

325

326

327

331

332

333

334

335

336

337

339

Subsector Name

Food Manufacturing

Beverage and Tobacco Manufacturing

Textile Mills

Textile Product Mills

Apparel Manufacturing

Leather and Allied Product Manufacturing

Wood Product Manufacturing

Paper Manufacturing

Printing and Related Support Activities

Petroleum and Coal Products Manufacturing

Chemical Manufacturing

Plastics and Rubber Product Manufacturing

Nonmetallic Mineral Product Manufacturing

Primary Metals Manufacturing

Fabricated Metal Product Manufacturing

Machinery Manufacturing

Computer and Electronic Product Manufacturing

Electrical Equipment, Appliance, and Component Manufacturing

Transportation Equipment Manufacturing

Furniture and Related Product Manufacturing

Miscellaneous Manufacturing

c

0.0007796

0.0011134

0.0061992

0.0022519

0.0060683

0.0017712

0.0024572

0.0013692

0.0012013

0.0023341

0.0011497

0.0006775

0.000808

0.0019546

0.0012297

0.0011377

0.0091815

0.000925

0.002574

0.0022254

0.0017886

0.12909

0.09942

0.44988

0.08855

0.27409

0.17066

0.55558

0.56612

0.39987

0.25006

0.06661

0.43528

0.23252

0.23956

0.3209

0.13835

0.5813

0.26285

0.15452

0.21514

0.13605

Table 6. Co-agglomeration in the Retail Sector in 1992

NAICS

441

442

443

444

445

446

447

448

451

452

453

454

Subsector Name

Motor Vehicle and Parts Dealers

Furniture and Home Furnishing Stores

Electronic and Appliance Stores

Building and Material and Garden Equipment Dealers

Food and Beverage Stores

Health and Personal Care Stores

Gasoline Stations

Clothing and Clothing Accessories Stores

Sporting Goods, Hobby, Book, and Music Stores

General Merchandise Stores

Misc. Store Retailers

Non-store Retailers

c

0.00018301

0.00013189

0.00052183

0.00012883

0.00006212

0.00014428

0.00037029

0.00040816

0.00031039

0.00010459

0.00015659

0.00037189

0.685

0.36183

0.54801

0.36029

0.22337

0.56657

0.35287

0.75964

0.49864

0.70607

0.21642

0.20636

Table 7. Co-agglomeration in the Wholesale Sector in 1992

NAICS

4211

4212

4213

4214

4215

4216

4217

4218

4219

4221

4223

4224

4225

4226

4227

4228

4229

Subsector Name

Motor Vehicles

Furniture

Lumber and Construction Materials

Professional and Commercial Equipment

Metal and Mineral

Electrical Goods

Hardware, Plumbing, and Heating Equipment

Machinery Equipment

Misc. Durable Goods

Paper and Paper Product

Apparel, Piece Goods and Notions

Grocery and Related Product

Farm Product Raw Materials

Chemical and Allied Products

Petroleum and Petroleum Products

Beer, Wine, and Distilled Alcoholic Beverage

Misc. non-durable Goods

c

0.000521

0.003543

0.000501

0.002282

0.002394

0.002086

0.00053

0.000566

0.003133

0.002009

0.050357

0.000577

0.002702

0.002086

0.000297

-0.000002

0.000352

0.62258

0.75618

0.51612

0.4764

0.40426

0.48732

0.41179

0.22522

0.27833

0.79227

0.79233

0.42155

0.86714

0.83773

0.21183

-0.0227

0.11621