Neuwahl, F.: Comparative Cost Analysis for Bulk Chemicals Based

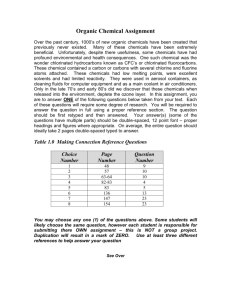

advertisement