SMALL PROJECT IMPLEMENTATION AGREEMENT and PROJECT

advertisement

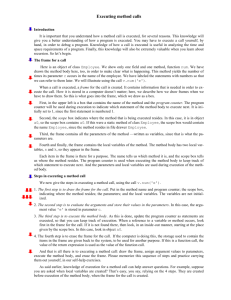

SMALL PROJECT IMPLEMENTATION GUIDELINES Twinning and Partnership Block Grant Swiss-Hungarian Cooperation Programme Only the Hungarian version is authentic! August 2012 Guidelines for Small Project Executing Agencies Twinning and Partnership Block Grant Content CONTENT ...................................................................................................................................................................2 THE PURPOSE OF THIS GUIDELINE ...........................................................................................................3 SMALL PROJECT IMPLEMENTATION AGREEMENT AND PROJECT MANAGEMENT ............4 PARTIES INVOLVED IN THE SWISS-HUNGARIAN COOPERATION PROGRAMME ......................................4 SIGNATURE OF THE SMALL PROJECT IMPLEMENTATION AGREEMENT .......................................................6 BASIC PRINCIPLES .................................................................................................................................................7 PROCUREMENT ........................................................................................................................................................7 CONTRACT MANAGEMENT .....................................................................................................................................8 1. Contracts to be concluded with the experts directly involved in the project .... 9 2. Contracts to be concluded with sub-contractors, suppliers, contractors and service providers ............................................................................................................................................................... 9 AMENDMENTS TO THE SMALL PROJECT IMPLEMENTATION AGREEMENT ................................................. 10 1. General rules concerning the amendment of the Small Project Implementation Agreement .................................................................................................................................. 10 2. Amendment to the Small Project Implementation Agreement requiring prior approval ................................................................................................................................................................................... 11 3. Amendment to the Small Project Implementation Agreement without prior approval ................................................................................................................................................................................... 11 4. Written notice .............................................................................................................................................................. 12 PUBLICITY.............................................................................................................................................................. 12 LIST OF RELEVANT LAWS AND DOCUMENTS RELATED TO THE IMPLEMENTATION OF THE PROJECTS SUPPORTED ......................................................................................................................... 13 REPORTING OBLIGATION AND PAYMENTS ......................................................................................... 15 1. PAYMENTS .................................................................................................................................................... 15 1.1 Advance payment .................................................................................................................................................. 16 1.2 Interim payment(s) ............................................................................................................................................ 16 1.3 Final payment ........................................................................................................................................................... 17 2. REPORTS ............................................................................................................................................................ 18 2.1 Interim Project Reports .................................................................................................................................. 18 2.2 Project Completion Report ........................................................................................................................... 22 3. ELIGIBLE AND NON-ELIGIBLE COSTS .............................................................................................. 23 3.1 COST TYPES, ACCOUNTING MODES ................................................................................................. 24 3.2. NON-ELIGIBLE COSTS ............................................................................................................................ 30 3.3. VAT AND OTHER TAXES ............................................................................................................................. 31 ANNEXES (SEPARATE FILE) ......................................................................................................................... 32 2 Twinning and Partnership Block Grant Guidelines for Small Project Executing Agencies The purpose of this Guideline This document assists the implementation of Small Projects by introducing the related procedures. These Guidelines were developed on the basis of the Call for Applications and the Application Guide published by the Block Grant Intermediate Body, as well as on the Framework Agreement between Switzerland and Hungary to implement the Swiss-Hungarian Cooperation Programme (hereinafter referred to as “Framework Agreement”), on the national provisions and the Small Project Implementation Agreement (hereinafter referred to as “the Agreement”) signed by the Small Project Executing Agency and the Block Grant Intermediate Body. The Guidelines are not exhaustive, certain circumstances could justify changes, and therefore, the Block Grant Intermediate Body may supplement or amend these Guidelines in matters not regulated in the Implementation Agreement, but covered by the internal procedures, reporting and implementation order of the Programme. 3 Twinning and Partnership Block Grant Guidelines for Small Project Executing Agencies SMALL PROJECT IMPLEMENTATION AGREEMENT and PROJECT MANAGEMENT Parties involved in the Swiss-Hungarian Cooperation Programme The Twinning and Partnership Block Grant (TPBG), co-financed from the Swiss-Hungarian Cooperation Programme, is implemented as a specific form of grant assistance in accordance with the Framework Agreement as well as its annexes. The overall objective of the TPBG is to encourage the development of mutual cooperation of existing or new partnerships between Hungarian and Swiss bodies, thereby contributing to the reduction of economic and social disparities between Hungary and the enlarged European Union. Grants will be awarded to Small Projects aiming among others at reinforcing cooperation, exchange of information, transfer of know-how and best practice between Hungary and Switzerland. The Block Grant Intermediate Body (IB) is responsible for the establishment of the Small Project Implementation Agreements, and will coordinate and take part in their eventual amendments. The Block Grant Intermediate Body monitors the implementation, including controlling public procurement processes, and checks the Interim Reports and the Project Completion Report, and is responsible for the disbursement of the grant to the Small Project Executing Agencies. The National Co-ordination Unit (hereinafter referred to as „the NCU”) - in accordance with Government Decree No. 348/2007 (XII. 20) - is responsible for the co-ordination of the Swiss-Hungarian Cooperation Programme in Hungary; its task is undertaken by the organizational unit appointed by the president of the National Development Agency. The Swiss Authority - the authority of the donor side, a federal authority representing and acting on behalf of the Swiss Government; in case of the Twinning and Partnership Block Grant the Swiss Agency for Development and Cooperation (SDC), on the other hand the Swiss Embassy responsible for keeping contacts with the National Coordination Unit, and the Swiss Contribution Office Budapest operating within the Swiss Embassy Swiss Contribution Office Budapest – operating within the Swiss Embassy in Budapest, responsible for keeping contacts with Hungarian institution concerning the implementation of the Swiss Contribution Small Project Executing Agency – in case of block grants a public administration, publicor private body, church institution that the parties accept and entrust with the implementation of the small project falling under the jurisdiction of the Framework Agreement. Partner: Partner shall be a Swiss public authority, any public or private non-profit body as well as any non-profit organization recognized by the Parties. Eventual Hungarian partners are also possible with non-profit character. 4 Twinning and Partnership Block Grant Guidelines for Small Project Executing Agencies Small Project: Non-profit activity carried out by the Small Project Executing Agency and supported in the framework of this Block Grant. Small Project Implementation Agreement: Contract concluded by and between the Block Grant Intermediate Body and the Applicants selected for funding by the Small Project Approval Committees. 5 Twinning and Partnership Block Grant Guidelines for Small Project Executing Agencies Signature of the Small Project Implementation Agreement This Small Project Implementation Agreement is concluded by and between the Small Project Executing Agency and the Block Grant Intermediate Body, in Hungarian, as soon as possible after the decision on the award of the grant taken by the Small Project Approval Committee, but no later than 30 days as from the date of signature of the grant approval (notification) letter. The Annexes of the Implementation Agreement are as follows: 1. Section of the Application Form governing the implementation of the project 2. Notification letter on the award of the grant signed by the Block Grant Intermediate Body 3. General conditions 4. Final budget and reporting periods 5. Partnership Agreement 6. Declaration on public procurements and contracts to be concluded 7. VAT-Declaration of the Small Project Executing Agency and its Partners 8. Financial Identification Form and sample payment claim 9. Declaration of the Small Project Executing Agency on the refund of the Grant in case of non-fulfilment of the agreement or irregular use of the grant, sample of the collect note, statement on bank accounts 10. Authenticated copy of the Specimen of Signature of the representative of the Small Project Executing Agency 11. Copy of the Registration Act or a normalized abridgement of statutes of the Small Project Executing Agency and Partners 12. Needs analysis or feasibility study, if available 6 Twinning and Partnership Block Grant Guidelines for Small Project Executing Agencies Basic principles The Small Project Executing Agencies should observe the basic principles of the Swiss Contribution - as described in their application- namely: - Transparency - Social inclusion - Equal opportunities (e.g. gender equality) - Sustainable development - Commitment by all stakeholders - Subsidiarity and decentralisation - Anti-corruption The Small Project Executing Agency shall report about the enforcement of these basic principles during on-site monitoring and in the progress reports. Procurement Procurement procedures during the implementation of small projects shall be governed by the 2003 Act CXXIX (in case of procedures launched before 1 st January 2012) and 2011 Act CVIII on Public Procurement (in case of procedures launched after 1st January 2012) for the Small Project Executing Agency and its Hungarian Partners. Special commitments related to these procurement procedures are provided for in Article 6 of the General Conditions of Small Project Implementation Agreement. For the procurement procedures within the project, the Small Project Executing Agency and its Hungarian Partner shall ensure national treatment for the tenderers and sub-contractors in their respective countries, and their experts, established in the following countries, as well as for the goods from the following countries, taking into account Article 1(3) of Act CXXIX on Public Procurement, in accordance with the joint information notice No. 8001/2007 of the Minister of Foreign Affairs, the Minister without Portfolio and the Minister of Justice. 1) Member States of the European Union: Austria, Belgium, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Poland, Portugal, Slovakia, Slovenia, Sweden, Spain, the Netherlands, United Kingdom, Romania and Bulgaria. 2) Agreement on the European Economic Area and the participation in the European Economic Area: Liechtenstein, Iceland, Norway. 3) Annex 4 to the Agreement establishing the World Trade Organisation: on the basis of the agreement on government procurement: United States, Canada, Hong Kong, China, Iceland, Israel, Japan, Korea, Liechtenstein, Norway, Singapore, Switzerland and Aruba. 4) Countries with which the European Community has an agreement: Mexico, Chile, Israel, Switzerland, the former Yugoslav Republic of Macedonia, and Croatia. 7 Twinning and Partnership Block Grant Guidelines for Small Project Executing Agencies The Small Project Executing Agency may ensure national treatment of other countries in addition to the above during public procurement procedures, however, it should provide for in the public procurement documentation before the start of the procedure, and cannot modify it at a later stage during the procedure. Please note that procurements by the Small Project Executing Agency and its Hungarian Partners can be made only in accordance with the public procurement rules in force. Procurement of supplies and services reaching the public procurement threshold and works also below the threshold are subject of ex-ante control (please see Art. 6 of the General Conditions of the Small Project Implementation Agreement). Procurements by Swiss Partner(s) are not subject of ex-ante control. Procurements and public procurement procedures shall be subject to the provisions of the Procurement Guidelines and Public Procurement Guidelines, respectively. The Small Project Executing Agency (and the Partner(s)) shall be responsible for the correctness of the procedures! The Guidelines prescribe preliminary submission of documents, before the start of the procedures please study them. Please note that provisions for procurement in this Block Grant are stricter than those of the Procurement Guide apply to the contracts concluded within the Block Grant: in case of supply and service contracts above 250.000 HUF (equivalent to 1.000 CHF), but below the public procurement thresholds the Small Project Executing Agency and Partners are obliged to collect two proposals from suppliers/service providers before the conclusion of the contract, to record them full-scape and furthermore to attach the documents to the Interim Reports. Contract management In order to implement the Small Project as awarded, contracts should be concluded with cooperating partners, and employees, sub-contractors, suppliers and various service providers involved in the project. The achievement of the project objectives depends to a large extent on the fulfillment of these contracts; therefore, one of the priorities of the project management is to ensure that contracts are well drafted (have accurate and clear definition of content, Terms of References, binding performance indicators, agreed delivery and payment deadlines, and payment terms) and to monitor their execution. These contracts, as well as the contractual terms and conditions shall be developed in accordance with the budget, and when monitoring the execution of the budget, the obligations assumed under these contracts shall be taken into account as well as funds allocated to them. Eventual changes in the amounts planned and allocated in each budget line (agreements or, in their absence, invoices or equivalent documents received, but unpaid), and in the amounts that can still be "freely" used within a budget line are to be reported monitored and to be reported. The progress and actual budget position of the contracts shall be reported. 8 Twinning and Partnership Block Grant Guidelines for Small Project Executing Agencies 1. Contracts to be concluded with the experts directly involved in the project Contracts shall be concluded with employees assuming different roles in the project, to carry out the activities and duties specified in the project outline. This contract may be an employment contract, work or service contract. These contracts should be in full compliance with the relevant laws. 2. Contracts to be concluded with sub-contractors, suppliers, contractors and service providers The procedure for granting and conclusion of contracts by the Small Project Executing Agency and its Hungarian Partners is governed by the Acts CXXIX 2003 and CVIII 2011 on Public Procurement (for procedures launched after 1st January 2012 the Act from 2011 shall apply). All special duties to be carried out during the public procurement procedures are detailed by the Public Procurement Guidelines. In case of supply and service contracts above 250.000 HUF (equivalent to 1.000 CHF), but below the public procurement threshold the collection of at least two bids is obligatory before contracting. Below 250.000 HUF (1.000 CHF) order/conclusion of the contract. no bids shall be collected before the No bids shall be collected for the accommodation of the participants of the project (but cost-effective solutions are requested, possibly at *** premises), or for travel by public transport (scheduled train, bus, plane), except the ordered (private travel), if the values exceeds 250.000 HUF (1.000 CHF). In case of supply and service contracts below threshold the Block Grant Intermediate Body does not performs ex-ante control, the contracts concluded are checked during the control of the interim and final reports In case of works contracts reaching the public procurement threshold the Block Grant Intermediate Body is obliged to carry out an ex-ante control prior the dispatch of the call for proposals and the conclusion of the contract. During this verification the following elements are checked: conformity with the Small Project Implementation Agreements as regards subject of the contract, quantity and deadlines, availability of permissions and plans the draft contract, the call for proposals, conformity of bids with the conditions set in call for proposals, draft of the decision of the contracting authority (Small Project Executing Agency or partners). Procurements made and contracts concluded by the Swiss Partner(s) are subject of the national law being in force in the Swiss Confederation. For the procurements and contracts concluded by the Swiss Partner the provisions on ex-ante controls shall not apply. The 9 Twinning and Partnership Block Grant Guidelines for Small Project Executing Agencies representative of the Swiss Partner shall attach an official statement on the compliance with the national law related to contracts financed from budgetary sources. Amendments to the Small Project Implementation Agreement 1. General rules concerning the amendment of the Small Project Implementation Agreement Grant intensity shall not be increased. The Project and the Small Project Implementation Agreement shall not be amended in such a manner that the amendment would call into question the initial aim of the grant, or would infringe the principle of equal treatment of applicants. Any amendments to the Agreement can only be made by observing the following procedures. Failure to use the appropriate procedure shall result in the rejection of the amendment. All amendments to the Small Project Implementation Agreement shall exclusively be made by means of an official letter, in writing and with the consent of the signatories of the initial Agreement or their legal successors. The reasons for the amendment may be as follows: a) b) c) d) the project objectives or results should change, a budget reallocation between activities, reallocation between budget lines within an activity, the start, finish or timing of a project execution as defined in the Small Project Implementation Agreement should change, e) any amendment to the Annexes of the Small Project Implementation Agreement should be made, f) the project budget should be increased (only in thoroughly justified case), g) the separate bank account should change (such as, change of the account-keeper financial institution), h) administrative changes (contact address, seat, closing of any bank account, change of the auditor or the project manager and/or their data, etc.), i) in the case of opening a new bank account. Types of change: 1. Modification of the Small Project Implementation Agreement requiring prior approval 2. Modification of the Small Project Implementation Agreement without prior approval 3. Written notice, only in case of change in administrative data. 10 Twinning and Partnership Block Grant Guidelines for Small Project Executing Agencies 2. Amendment to the Small Project Implementation Agreement requiring prior approval Cases: a) b) c) d) the project objectives or results should change, a budget reallocation between activities exceeds 15% (cumulative calculation) the reallocation between budget lines within an activity exceeds 100.000 HUF. the start, finish or timing of a project execution as defined in the Small Project Implementation Agreement should change, e) any amendment to the Annexes of the Small Project Implementation Agreement f) the project budget should be increased (only in thoroughly justified case) g) the separate bank account should change (such as, change of the account-keeper financial institution), Steps: The Small Project Executing Agency is required to submit in writing any amendment of the Small Project Implementation Agreement requiring prior approval by informing the Block Grant Intermediate Body about the reasons and circumstances of the amendment. Documents to be submitted: a written request by the Small Project Executing Agency in Hungarian concerning the amendment and the justification for the amendment, Format: The request shall be submitted in one copy both by mail and electronically (e-mail) to the Block Grant Intermediate Body. Deadlines: The request for any amendment requiring prior assessment shall be submitted to the Block Grant Intermediate Body at least 30 days before the amendment is envisaged to enter into force. The Block Grant Intermediate Body shall decide on the approval. No amendment under this section shall be retrospectively approved and any amendment shall be effective only after the amendment of the Small Project Implementation Agreement is signed. 3. Amendment to the Small Project Implementation Agreement without prior approval Cases a) a) if the budget reallocations between activities do not reach 15% (cumulative calculation) b) if the reallocation budget lines within an activity does not reach 100.000 HUF 11 Twinning and Partnership Block Grant Guidelines for Small Project Executing Agencies The Small Project Executing Agency shall notify the Block Grant Intermediate Body together with the submission of the respective interim report about the modification. 4. Written notice Cases: a) only administrative changes (contact address, seat, closing of any bank account, change of the auditor or the project manager and/or their data, etc.), b) in the case of opening a new bank account Steps: The Small Project Executing Agency is required to inform the Block Grant Intermediate Body about any administrative change. Format: The written notice shall specify the data to be modified and a short justification the change(s). There is no template text for this purpose. If the bank account is changed, Annex 9 to the Small Implementation Agreement shall also be amended and submitted together with the written notice. Deadlines: The Block Grant Intermediate Body should be informed, in writing, no later than within 5 working days after such a change. Publicity During the implementation of the Small Project, the Block Grant Intermediate Body pays particular attention to the implementation of the undertakings assumed in the Section C.5 (Visibility, PR) of the Application Form attached in Annex 1 to the Small Project Implementation Agreement during tendering. During project implementation, the Small Project Executing Agency is required to visualize in an appropriate manner (for example, in the reports, publications and news materials concerning the project etc. prepared during the project) that this Small Project has been funded by the Swiss Contribution. When informing the public the following basic principles shall be observed: - when wording any information or communication material (publications, information leaflets, brochures and circulars) the support provided by the Swiss-Hungarian Cooperation Programme and also the logo of the Programme shall always be indicated on the front or title page - the above basic principles are applicable to information provided electronically, as well. On the websites mention must be made of the support by the Swiss-Hungarian Cooperation Programme. - The organizers of informatory events – e.g., conferences, seminars, fairs and exhibitions - related to the implementation of the Projects shall always show the support of the Swiss-Hungarian Co-operation Programme in an unambiguous and legible way, by way 12 Twinning and Partnership Block Grant Guidelines for Small Project Executing Agencies of placing in the event halls and showing on the documents also the logo of the Programme. - The Small Project Executing Agency shall make references to the Project and the SwissHungarian Cooperation Programme in the oral information provided to members of the target group of the Project, in the training realized from the grant, as well as during contacts with the media. The Small Project Executing Agency and its partners shall refer to the funding the project received from the Swiss-Hungarian Cooperation Programme whenever there is an opportunity. The obligation to provide information in relation with the Swiss Contribution Programme, the Visibility Guidelines provides for the form of such information, in details, which is available in electronic format on the website of the National Co-ordination Unit, at: www.nfu.hu/jogszabalyi_hatter. The visibility elements of the Swiss Contribution can be downloaded from the homepage of the BGIB, from the menu “Project Implementation Guidelines” (http://www.vati.hu/index.php?page=main&menu=22605&langcode=hu). The following deviations from the Visibility Guidelines shall apply: 1. The Small Project Executing Agency shall not elaborate the Information and Publicity Plan referred to on page 1 of the Guidelines. 2. The information of opening and closing events or any milestone-activity shall not be sent to the National Coordination Unit but to the Block Grant Intermediate Body (page 2 of the Guidelines). The Guidelines must be applied by all Small Project Executing Agencies and Partners! List of relevant laws and documents related to the implementation of the projects supported - Act CXXVII of 2007 on Value Added Tax - Act C of 2000 on Accounting - Act IV of 1959 on the Civil Code of the Republic of Hungary - Act XXXVIII of 1992 on Public Finance (for projects awarded before 1st January 2012) - Government Decree no. 292/2009. (XII. 19.) on Public Finance Procedures (for projects awarded before 1st January 2012) - Act CXCV 2011 on Public Finances (for projects awarded after 1st January 2012) - Government decree 368/2011. (XII. 31.) on the implementation of the Act on Public Finances (for projects awarded after 1st January 2012) - Act CXXIX of 2003 on Public Procurement and related Government Decrees for procedures launched before 1st January 2012 (for details see the Public Procurement Guidelines) 13 Twinning and Partnership Block Grant Guidelines for Small Project Executing Agencies - Act CVIII of 2011 on Public Procurement and related Government Decrees for procedures launched after 1st January 2012 (for details see the Public Procurement Guidelines) - Government Decree no. 348/2007. (XII. 20.) on the publication of Framework Agreement concluded between the Swiss Federal Council and the Government of the Republic of Hungary concerning the implementation of the Swiss Hungarian Cooperation Programme to reduce economic and social disparities between the enlarged European Union, - Government Decree no. 237/2008 (IX. 26) on the implementation regulation of the Swiss-Hungarian Cooperation Programme, - Government Decree no. 66/2010 (III. 18.) on the publication of the Agreement concluded by exchange of letters on the amendment of the Framework Agreement between the Swiss Federal Council and the Government of the Republic of Hungary concerning the implementation of the Swiss-Hungarian Cooperation Programme to reduce Economic and Social Disparities within the enlarged European Union, entered into on December 20, 2007, - Decree no. 18/2010. (IV. 9.) of the Ministry of Foreign Affairs on the entry into force of Article 2 and 3 of Government Decree no. 66/2010. (III. 18.) on the publication of the Agreement concluded by exchange of letters on the amendment of the Framework Agreement between the Swiss Federal Council and the Government of the Republic of Hungary concerning the implementation of the Swiss-Hungarian Cooperation Programme to reduce Economic and Social Disparities within the enlarged European Union, entered into on December 20, 2007. - Government Decree 101/2012(V.18) on the publication of the amendment by exchange of letters of the Framework Agreement between the Swiss Federal Council and the Government of the Republic of Hungary concerning the implementation of the SwissHungarian Cooperation Programme to reduce Economic and Social Disparities within the enlarged European Union, entered into on December 20, 2007. - Publication of the Minister of Foreign Affairs 34/2012 (VI.25.) on the entry into force of paragraphs 2. and 3. of the government decree 101/2012 (V.18.) on the publication of the amendment by exchange of letters of the Framework Agreement between the Swiss Federal Council and the Government of the Republic of Hungary concerning the implementation of the Swiss-Hungarian Cooperation Programme to reduce Economic and Social Disparities within the enlarged European Union, entered into on December 20, 2007. 14 Twinning and Partnership Block Grant Guidelines for Small Project Executing Agencies REPORTING OBLIGATION AND PAYMENTS The Small Project Executing Agency is required to provide detailed information to the Block Grant Intermediate Body about the implementation of the Small Project. For this purpose, it is required to develop: Interim Project Report(s) and Project Completion Report in the format established by the Block Grant Intermediate Body. The starting date of obligation for reporting is the date defined under point 4.2 of the Small Project Implementation Agreement. The Interim project reports shall be prepared in accordance with the timetable defined in the Small Project Implementation Agreement (Annex 4). The deadline for submitting the Interim Project Report is the 30th day following the reporting period as per the execution timetable. The deadline for submitting the Project Completion Report is the 60th day following the completion of the project activities. These reports shall be checked ex-post during the project period, and therefore the Small Project Executing Agency has financial responsibility for the use of the assets in compliance with the agreements and legal provisions. Please note that continuous and regular updating of the financial tables during the project implementation period will significantly facilitate the compilation of these reports. The Summary table of accounts supporting the project reports shall be drawn up in Hungarian currency (HUF) (see Annex 3). The payment claim shall indicate the amount in HUF. 1. PAYMENTS The advance, interim payment(s) and the final payment shall be made in HUF. The document supporting the payment claim: the payment claim, which shall be issued using the sample form in Annex 8 to the Small Project Implementation Agreement. Payments shall be made to a separate bank account (bank account number of 3x8 digits), indicated on the financial identification form (Annex 8 to the Small Project Implementation Agreement), which is part of the Small Project Implementation Agreement. Any change related to the bank account number shall be immediately notified to the Block Grant Intermediate Body (see: Small Project Implementation Guidelines, Chapter "Amendment of the Small Project Implementation Agreement"). Funding is subject to the condition that the Small Project Executing Agency has no public debt on the date when the payment claim is submitted and when the payment is made. Should it come to the attention of the Block Grant Intermediate Body that the Small Project Executing Agency has any public debt, the payment shall be suspended until the Small Project Executing Agency confirms that is free of any public debt. 15 Twinning and Partnership Block Grant Guidelines for Small Project Executing Agencies The Block Grant Intermediate Body shall accept only project reports and payment claims submitted by the Small Project Executing Agency, and shall provide the funding requested to the Small Project Executing Agency. The Small Project Executing Agency is responsible to transfer the money to the partner. The project – except the advance payment - is based on ex-post financing, i.e. the BGIB reimburses the amount of the financially already settled costs, in line with the grant intensity defined in the small project implementation agreement (in case of 90% grant intensity 90% of the eligible project costs will be paid to the small project executing agency). 1.1 Advance payment The advance amount is regulated by Section 6.3 of the Small Project Implementation Agreement. Documents to be submitted: The disbursement of the advance payment is conditional upon the signing of the Small Project Implementation Agreement. - the payment claim form filled out (in accordance with Annex 8 to the Small Project Implementation Agreement), - proof of no public debt, - If co-financing is ensured from own contribution: the original bank statement (or a copy authenticated by the bank) confirming that availability of the co-financing, which are proportionate to the amount to be allocated as advance payment. In case of co-financing is secured by the Swiss partner only a statement must be submitted confirming the availability of the financial resources. - The documents listed above shall be issued in the name of and sent to the Block Grant Intermediate Body. Payment: The advance payment shall be disbursed within 15 days after the documents are approved by the Block Grant Intermediate Body. 1.2 Interim payment(s) The documents to be submitted shall be drawn up for the reporting periods in accordance with the execution timetable defined in Annex 4 to the Small Project Implementation Agreement. The deadline for submitting the Interim project report is the 30th day following the reporting period as per the execution timetable, sent to the address of the Block Grant Intermediate Body. Documents to be submitted: - Copies of documents supporting expenses, authenticated by authorized signatures, - Summary table of accounts (other summary tables), - Summary table of tenders and contracts - The payment claim form filled out (in accordance with Annex 8 to the Small Project Implementation Agreement), 16 Twinning and Partnership Block Grant Guidelines for Small Project Executing Agencies - Narrative report (Brief description of the implementation) After the interim report is approved: - Proofs of no public debt. The interim project reports shall be checked by the Block Grant Intermediate Body within 30 days. Should the Block Grant Intermediate Body find shortcomings, it shall ensure the possibility to remedy shortcomings only once. The Small Project Executing Agency has 15 days from the date the letter requesting the correction of shortcomings is received to submit the documents missing or revised. The 30 days of approval period by the Block Grant Intermediate Body starts again after the receipt of the requested documents and/or clarifications. The Block Grant Intermediate Body shall notify the Small Project Executing Agency about the approval of the report, and at the same time shall call for the submission of proofs in relation to the lack of public debt. Payment: The interim payment shall be due within 15 days from the date the Block Grant Intermediate Body has approved the interim project report and has received the payment claim and proof of no public debt sent by the Small Project Executing Agency. For the last interim report, the payment shall be made only after the Project Completion Report is submitted, retaining the amount specified in point 6.2.5 of the Small Project Implementation Agreement. The grant retained is transferred after the approval of the Project Completion Report. 1.3 Final payment The Project Completion Report, together with the last interim report and the final financial audit is the base for the final reimbursement. The deadline for submitting the Project Completion Report is the 60 th day following the completion of the project activity. Documents to be submitted: - Project completion report (it should be completed in English and in Hungarian) Final financial report The payment claim form filled out (in accordance with Annex 8 to the Small Project Implementation Agreement), After the last interim report is approved: - Proofs of no public debt. The Block Grant Intermediate Body shall notify the Small Project Executing Agency about the approval of the report, and at the same time shall call for the submission of proofs in relation to the lack of public debt. Payment: The final payment shall be due within 15 days from the date the Block Grant Intermediate Body has approved the Project Completion Report and has received the proof of no public debt sent by the Small Project Executing Agency. 17 Twinning and Partnership Block Grant Guidelines for Small Project Executing Agencies 2. REPORTS 2.1 Interim Project Reports The Interim Project Report (or its correction, if missing) shall be submitted in the copies as follows: Document 1. Original Summary table of accounts (other summary tables) Narrative reports and summary of tenders and contracts Invoices and supporting documents Documents confirming the payments Payment claim Proofs of no public debt These documents shall be reviewed on the date of the on-site check 2. A copy for the BLOCK GRANT INTERMEDIATE BODY 3. Electronic copy Original Original Copies authenticated by authorization signature Copies authenticated by authorization signature Original Original - - Please place the invoices and supporting documents to be attached in accordance with the order specified in the Summary table of accounts. Please endorse the original copy of the invoices or other documents justifying any economic event (for example, payrolls) by recording the following elements (do not use stickers containing these data): serial number of the invoice (according to the Summary table of accounts), “submitted for accounting in the frame of the Swiss Contribution, TPBG”, number of the Small Project Implementation Agreement, number of reporting period, amount to be charged (if not the entire amount in the invoice is settled). 18 Twinning and Partnership Block Grant Guidelines for Small Project Executing Agencies Please make a copy of the endorsed original; this copy should be authenticated by the indication or stamp “an exact copy of the original” and by the authorized signature of the organization’s official/authorized representative (please attach the authorization). All data in the copy should be clearly legible and identifiable. All documents to be submitted shall be duly authenticated. 1. Invoices and supporting documents Invoices and documents serving as invoice shall be eligible within the project, if – they are in compliance with the requirements imposed by laws, in particular, for the Small Project Executing Agency and Hungarian Partners: Act CXXVII of 2007 on Value Added Tax, Act C of 2000 on Accounting, – they are in compliance with the provisions and conditions set out in the call for proposals, only invoices issued on the basis of work contracts and orders concluded in accordance with the content of the application, which are in conformity with the budget attached to the Agreement; they are in compliance with the provisions of the guidelines, they are in compliance with the global amount specified in the budget: the eligible amount and subtotals in the invoice shall not exceed the limits set out in the budget, they are in compliance with the principles of sound financial management, in particular, with the price-to-value ratio and principle of cost-effectiveness, and the invoiced costs are indispensable for the implementation of the project, the person responsible for confirming the professional completion of the project has approved the costs as part of the Project Report, The exact name of the Small Project Executing Agency or its Swiss or Hungarian Partner(s) and the exact address specified by the Small Project Executing Agency in the Small Project Implementation Agreement are indicated on the invoice as customer and customer’s address, respectively (except for some cases: e.g.: purchase of plane ticket for foreign experts), the invoice issuer is the same as that indicated in the works, contractors and suppliers agreement attached, the date of issuance and performance of invoices, as well as the date of payment is between the dates indicated in Section 4.2 and 4.3 of the Small Project Implementation Agreement. – – – – – – – In case of foreign currency invoices, the amount in foreign currency shall be converted to HUF at the exchange rate published by the National Bank of Hungary on the date when the payment is made. Please indicate on the copy of invoice the exchange rate used and the amount in HUF to be settled. Except for invoices and documents issued in English, the invoices and attached documents shall be accompanied by a translation. As part of the settlement, pro-forma invoice shall be settled only together with the related final invoice, which is financially settled. All original invoices shall be endorsed by indicating the mandatory elements specified in Section 2.1. 19 Twinning and Partnership Block Grant Guidelines for Small Project Executing Agencies Only receipted invoices may be included in the report, and the reporting period to which an invoice can be attributed shall be determined according to the date of payment. The incurrence of costs and their connection to the Project shall be confirmed by other documents attached to the invoices, and therefore related supporting documents shall be indicated as annexes to such invoices; these documents may be as follows: Proofs of payment may be as follows: in case of cash payments: the outgoing cash document and the bank account statement confirming the withdrawal, in case of invoices paid by bank transfer: the related bank account statement. Please attach the section of the related statement, which contains the account identification data of the institution, the serial number and date of the statement and the debit note relating to an item, and the opening and closing balance. In case of group transfers, the GIRO should be submitted, as well. In principle, the date of invoice payment shall determine the reporting period in which an invoice is charged. If the transfer is made in that period, but the bank account statement about the transfer is not received until the report is submitted, the costs shall be settled in that period, and the proof of payment shall be submitted at a later stage before the report is approved by the Block Grant Intermediate Body. In exceptional duly justified situations, where the payment was made not from the bank account allocated to the project (e.g., in the case of wages), you are required to attach those bank account statements to the next report, which confirm that the abovementioned payments has been returned from the separate project bank account to the account from which the payment was made. Agreements: In case several invoices are related to the Agreement and/or during several periods, please submit the agreements filed separately. If only one invoice is related to an agreement, please attach the agreement to the said invoice. It is sufficient to submit these agreements only once, however, it is necessary to refer to them, and all amendments to these agreements should be also attached. The text of the agreements shall contain a clear reference to the connection to the Project. Proof of performance: an Acceptance Statement issued and signed by the Small Project Executing Agency or the Partner (s) certifying the eligibility of expenditures supported by invoices. Documents supporting this proof of performance may be as follows (where relevant): delivery-acceptance protocol, technical inspection certificate, delivery note, statement certifying technical performance, 20 Twinning and Partnership Block Grant Guidelines for Small Project Executing Agencies installation documents etc. In the case of invoices for small amounts (with value not exceeding HUF 50,000), the proof of performance may also be indicated on the invoice. 2. Summary table of accounts (and other summary tables) The Small Project Executing Agency shall compile the data of summary tables on the basis of the supporting documentation, which is provided in the accounting records and drawn up in accordance with the accounting and tax legislation. During the on-site check, the Small Project Executing Agency is required to ensure the check of the supporting documentation (Section 4.6 of the General Conditions of Small Project Implementation Agreement). Please use the format specified in Annex 3 to these Guidelines. The Summary table of accounts shall comprise a compilation of the invoices settled in a reporting period or other documents justifying an economic event, and the documents supporting the justification of the costs incurred in monthly breakdown, according to activities and budget headings. In the Summary table of accounts, the numbering of the invoices settled in a reporting period or other documents justifying an economic event, and the documents supporting the justification of the costs incurred shall be continuous between activities and reports, and these serial numbers shall be indicated on the copies of the invoices settled in a reporting period or other documents justifying an economic event, and the documents supporting the justification of the costs incurred. Please treat together all the documents related, which are indicated in the financial report (e.g., in the Summary table of accounts, please mark “1/a, 1/b…” the documents related to the invoice or other document justifying an economic event supporting, justifying the costs incurred, with serial number 1). The Summary table of accounts has to be filled out in HUF. In the Summary table of accounts the division of “grant” and “own contribution” part of the eligible costs shall be indicated. 3. Interim Report Form – Narrative report The format is given in Annex 2 to these Guidelines. The summary shall be prepared in Hungarian and in English, and shall include a progress report about: - the implementation of each activity, in particular, the progress of indicators, - and publicity. The supporting documentation related to the implementation shall be attached to the Interim Report (all documents related to publicity, information tables, posters, press releases, publications, brochures, websites, documents concerning other results and activities etc.). 21 Twinning and Partnership Block Grant Guidelines for Small Project Executing Agencies 4. Interim Report Form – Summary table of tenders and contracts The format is given in Annex 3 to these Guidelines. The summary shall be prepared in English, and shall include a progress report about: - public procurements, if any, - and contracts. 5. Payment claim All data should be filled out using the data relating to a period, and the request shall be signed in accordance with the Small Project Implementation Agreement. The claimed HUF amount shall comply with the amount defined based on the grant intensity falling on the Swiss Contribution according the summary table of costs The BGIB accepts only project reports and payment claims issued by the Small Project Executing Agency, the payment is made also toward this organisation. 2.2 Project Completion Report In the Project Completion Report, the Small Project Executing Agency shall provide a summary of activities carried out during the project implementation period, horizontal issues, and the amount of funding, co-funding and own resources used, in comparison to the planned budget. The template can be found in Annex 4 of this Guidelines. The Project Completion Report should be submitted together with the following documents: Document 1. A copy for the BLOCK GRANT INTERMEDIATE BODY 2. Electronic copy Project Completion Report Form (in English) Original 1. Project Completion Report The Project Completion Report shall include the following: a) the results against the overall objectives listed in the application and the Small Project Implementation Agreement, b) the analysis of outcome and effects measured against the targeted results, effects and overall objectives, c) implementation of related horizontal principles, as defined in the call for proposals, d) an analysis concerning the sustainability of the results, e) lessons learnt during implementation that may be useful in the future, f) proposals for the continuity of the Small Project. 22 Twinning and Partnership Block Grant Guidelines for Small Project Executing Agencies 3. ELIGIBLE AND NON-ELIGIBLE COSTS Basic rule: eligible costs are proportionate expenditures, which are necessary and directly related to the implementation of the Project, and having been incurred at the Small Project Executing Agency or its partners during the eligibility period. Other contributions, taxes or fees, in particular direct taxes and social security contributions on wages and salaries, shall constitute eligible expenditure only if they are genuinely and definitively borne by the Small Project Executing Agency or its partners. The starting date of the eligibility is defined in point 4.2 of the Small Project Implementation Agreement. The end date of eligibility is laid down in point 4.3. of the Small Project Implementation Agreement. In the absence of a clause to the contrary, all things created and assets purchased during the implementation of the Project, and the ownership of the reports and documents relating to them, shall be reserved for the Small Project Executing Agency or –in accordance with the terms of the Partnership Agreement its partners. The Small Project Executing Agency shall acquire any right to the things created during the Small Project in accordance with the grant award letter and the Small Project Implementation Agreement, taking into account the project objectives. In general, costs incurred during project implementation shall be eligible if the following conditions are met: The cost should be indispensable for project implementation, be stipulated in the Small Project Implementation Agreement and comply with the principles of responsible financial management, particularly the principles of value for money and cost effectiveness. Project implementation may be commenced on the date of the signing of the Grant Award Letter (starting date of the project implementation), and the implementation period must not be terminated after the end-date defined in the Implementation Agreement. The costs should incur on the Small Project Executing Agency’s or its Partner’s part during the implementation period of the Project: the issue date of the invoice, the date of performance and also financial fulfilment must be within the implementation period. Invoices paid after termination of the implementation period cannot be financed from the project. Only costs that have actually incurred on the Small Project Executing Agency’s part or its Partner and whose payment can be certified with original invoices, equivalent accounting documents and other certificates shall be eligible. No costs shall be eligible if the relevant invoices are not issued on the Small Project Executing Agency’s or the Partner’s name. The contracts concluded in line with the rules of the „Procurement Guide to Projects Supported by the Swiss-Hungarian Cooperation Programme” and the „Public Procurement Guide to Projects Supported by the Swiss-Hungarian Cooperation Programme”, as well as paid and documented in accordance with the above and the Financial Guide shall be eligible. The supplier or contractor of the concluded contract 23 Twinning and Partnership Block Grant Guidelines for Small Project Executing Agencies must not be the Small Project Executing Agency’s Partner. The Small Project Executing Agency should bear in mind that provisions stricter than those of the Procurement Guide apply to the contracts concluded within the Block Grant in Hungary: in case of contracts below the public procurement thresholds, the Small Project Executing Agency or the Partners are obliged to collect two proposals from suppliers/service providers before the conclusion of the contract, if the contract value is above 250.000 HUF (equivalent to 1.000 CHF). Exemption is the public travel and accommodation (for details please see page 9.) Only costs that are eligible within this Application Guide and are not listed among the non-eligible costs may be accounted. The unit prices used in calculating the costs must not exceed the market prices which in turn can be determined and checked with some kind of independent method. The amount unused from the planned Budget by the end of the project implementation period reduces the grant proportionately. The Block Grant Intermediate Body does not reimburse any optional extra costs. 3.1 Cost types, accounting modes 1. Personnel costs A labour contract, assignment, service contract, target specification can provide a basis for personnel costs. If the employee only deals with the project in a part of his/her working hours, the proportionate part of his/her wage may be eligible. Premium is not eligible. The personnel costs of central administrative bodies identified in the Hungarian central budget are not eligible. Under other benefits, the tax-free benefits stipulated in the relevant law as a compulsory item and prescribed in the relevant internal rules and the benefits optionally granted taxfree may be eligible up to the statutory limit. The Small Project Executing Agency or its Partner is obliged to certify the incurrence of these costs with specific accounting certificates and documents. Documents to attach: – – Labour contract / service contract: should be submitted once, for the period of the payment following the first incurrence of the cost, whereas when any subsequent reports are submitted, it is enough to refer to the contract in the corresponding column of the summary invoice statement. Additionally, new contracts or modifications should be submitted for the period of the relevant payment, and later, when new reports are being submitted, it is enough to refer to the modification of the contract in the corresponding column of the summary invoice statement. Job description, including the activities related to the Project. If the employee has already been in labour relation with the Small Project Executing Agency before commencing the Project and if this employee performs his/her duties in the Project 24 Twinning and Partnership Block Grant Guidelines for Small Project Executing Agencies within the earlier stated working hours, the existing labour contract and job description should be supplemented with the description of the project-related duties. The job description should likewise be submitted as an attachment to the first relevant Interim Report and only the modification needs to be attached to the subsequent Reports. If the total wage is not being accounted, the eligible amount should be calculated on the basis of the working hours ratio determined in the contract/job description/certificate of fulfilment. The working hours register signed by the specific person’s employer and the declaration certifying the performance of the assigned duties shall support the accounted amount. Payroll accounting sheets, when a payroll accounting system is being used at the Small Project Executing Agency or its Partner; payroll/payment list, for manual payroll accounting (please indicate, on the list, the amount of the wage/assignment fee that the Small Project Executing Agency or its Partner intends to account to the debit of the Project). A declaration by the organization (employer) on payment of employer’s and employee’s non-wage labour costs. Payment receipt, confirming the transfer of the net wage and the non-wage labour costs (bank account statement). For a cumulated bank transfer, a declaration identifying the costs under the cumulated item that should be accounted to the debit of the specific Project. Certificate of fulfilment for service contracts. Fringe benefits (e.g. meal ticket): please attach the invoice, the receipt certifying the payment and the certificate as a proof of having received the benefits. – – – – – – Please note that if the fee for an activity performed under a supply/service contract is paid against an invoice, it should not be accounted under personnel costs but in the Services line. Special rules for the reporting of personnel costs incurred at the Swiss Partner(s) - The representative of the Swiss Partner is asked to fill and submit a statement and an annex (a template approved by the BGIB) about the persons participating in the project, the incurred costs and the financial settlement. - The table shall contain the names of the experts, the short description of the activity performed in the project, the duration of the work, the unit rate of the expert fee, the total amount. - With the signature of the statement and table the representative of the Partner bears full responsibility for the correctness and genuineness of the data provided. - In case of the Swiss Partners regarding the personnel costs no additional supporting document is required. The statement and the table can be found in Annex 5 of the Guidelines. 2. Travel and foreign missions’ costs: Travel costs are eligible for using the 2nd class in public transport vehicles or, when a business or private car is being used, the travel costs shall be eligible with regard to the 25 Twinning and Partnership Block Grant Guidelines for Small Project Executing Agencies actual fuel cost, based on the kilometres covered, or the accountable fuel cost as published by the Hungarian tax authority (APEH) and a tax-free reimbursement by kilometres (amortization cost). The travel of Swiss experts or those collaborating in the Partnership Program to Hungary, and the travel of Hungarian experts or those collaborating in the Partnership Program to Switzerland, as well as the costs of local and regional travels related to event organization may all be funded. Documents to attach: - For costs of a privately-owned vehicle used in the interest of the project: o Delegation order, cash disbursement voucher or bank account statement, o Based on the travel order, the fuel price published by APEH and a flat amortization cost may be eligible; - For costs related to a motor vehicle owned by the organization: o Invoice, cash disbursement voucher, motor vehicle registration certificate; Road register: o Indicate the type of the motor vehicle, its licence number and the standard consumption. Should include the date and time of travel, the destination (travel to and from), the name(s) of the business partner(s) visited and the number of kilometres covered on public road; - - For the costs of public transport: o Travel order, invoice of the tickets, cash disbursement voucher or bank account statement, which is to underlie the advance received or the offset of the ticket. Travel of a Hungarian expert/citizen collaborating in the Partnership Program to Switzerland: – Invoice at the Small Project Executing Agency’s or the traveller’s name, – Copy of the travel ticket or the boarding card, – Certificate of disbursement. Special rules for the reporting of travel costs incurred at the Swiss Partner(s) - The representative of the Swiss Partner is asked to fill and submit a statement and an annex (a template approved by the BGIB) about the persons participating in the project, the trips/missions implemented the in the project, the incurred costs and the financial settlement. - The table shall contain the names of the persons, the date, aim, costs and other details of the trip. - With the signature of the statement and table, the representative of the Partner bears full responsibility for the correctness and genuineness of the data provided. - The Swiss Partner is asked to submit the copy of the taxi voucher (invoice), the train or bus ticket, the flight ticket and the boarding pass (and a document containing the price of the air ticket). No other document is requested for the report. The statement and the table can be found in Annex 5 of the Guidelines. 26 Twinning and Partnership Block Grant Guidelines for Small Project Executing Agencies Accommodation, meals and per diem, accompanying a delegation: Documents to attach: Documents certifying the necessity of the mission and its relation to the Project (e.g. invitation letter, travel order, agenda, attendance sheet); Invoices or accounting documents of equivalent probative value justifying the incurred costs and or other certificates authentically documenting the business event (e.g. on accommodation, the use of public transport/taxi); For per diem, a travel order including the certification of fulfilment. Per diem shall only be accounted according to the government decree 278/2005 (of 12.20.) on the Reimbursement of Meal Costs of Employees on Domestic Official Delegation, Government Decree 285/2011 on Recognized Costs Associated with Foreign Posting, the Small Project Executing Agency’s or the Partner’s internal regulations and the currently effective relevant Hungarian rules and regulations; The Swiss Party shall respect its national legislation and internal rules during the determination of costs of travels and foreign missions. Certificate of financial settlement. – – – – – Travel of a foreign partner/expert/citizen collaborating within the framework of the Twinning and Partnership Block Grant to Hungary: – Invoice at the Partner’s/expert’s name (air ticket, railway ticket), – Copy of the travel ticket or the boarding card, – Disbursement voucher (bank account statement certifying the payment of the ticket value). Please note that the cost of the service shall not be eligible upon lack of the invoice. The person organizing the trip should be warned accordingly when making preparations for the travel. Special rules for the reporting of per diems incurred at the Swiss Partner(s) - The representative of the Swiss Partner is asked to fill and submit a statement and an annex (a template approved by the BGIB) about the persons participating in the project, the accommodation, alimentation costs and per diems to be charged against the project, and the financial settlement of these costs. - The table shall contain the names of the persons, the date, aim, costs and other details of the trip. - Should the Swiss Partner have own documents for the settlement of accommodation, alimentation cost and per diems, the annex (the table) can be replaced by this, but the statement shall be signed and submitted. - With the signature of the statement and table, the representative of the Partner bears full responsibility for the correctness and genuineness of the data provided. - From the Swiss Partner no additional supporting document for the reporting the accommodation, alimentation costs and per diems is required. The statement and the table can be found in Annex 5 of the Guidelines. 27 Twinning and Partnership Block Grant Guidelines for Small Project Executing Agencies 3. Supply, works and procurement of services The costs of procurement and installation of new assets inevitably necessary for project implementation (machines, equipment, appliances), the costs of services necessary for project implementation and the costs of construction works inevitably necessary for the performance of certain activities are eligible, provided they are in direct relation with achieving the objectives of the Project. The assets connected to project management (e.g. office equipment, appliances, software, IT and communication assets) cannot be procured. The Applicant must have the infrastructure underlying implementation at its disposal. Documents to attach: – – – – – – Contracts, orders; Quotations, order. For procurements below the threshold stipulated in the Public Procurement Act, according to the Procurement Guide – obligatory to ask for three bids in every case in the Block Grant!; Documents of the public procurement, provided the asset to be procured or the construction investment service is subject to public procurement procedures; Invoice or any other certificate authentically documenting the business event; Documents certifying fulfilment (e.g. bill of lading, commissioning protocol, protocol of delivery and acceptance, tangible assets registration sheet); Certificate of disbursement. No amortization cost or depreciation is eligible. 4. Bank cost (account opening and management) Only the costs of opening and managing an appropriated bank account are eligible if the existence of a separate bank account is prescribed in the Call for Applications or in Government Decree 237/2008 (26.09.) on the Execution Order of the Swiss-Hungarian Cooperation Programme. Beside this, the transaction cost of the transfer of the grant towards the project partners is eligible. The charges of financial transactions, foreign currency/exchange conversion charges, losses and other exclusively financial costs are not eligible (except the transfer of the grant to the project partners). Documents to attach: - Bank account statement, certifying the deduction of bank costs (opening or account management) by the bank. 5. Services related to professional implementation The cost of consultancy by a notary public, technical and financial consulting, certain costs related to public procurement, insurance premiums, bookkeeping and audit costs can be accounted here. 28 Twinning and Partnership Block Grant Guidelines for Small Project Executing Agencies A precondition underlying the eligibility of audit costs is that they be ordained in the Implementation Agreement, by the National Coordination Unit or in a national regulation. If the invoiced service fee (e.g. bookkeeping) covers a whole year, only the proportionate part of the invoice covering the grant period shall be eligible. Documents to attach: – – – – – – – – – Contracts, orders; Quotations, order. For procurements below the limit stipulated in the Public Procurement Act, according to the Procurement Guide; Documents of the public procurement, provided the service to be procured is subject to public procurement procedures; Public procurement documentation compiled by the expert, if different from the above; Invoice or any other certificate authentically documenting the business event; Certificate of disbursement; Documents certifying fulfilment; Report on the expert’s completed activity; Audit Report. 6. Activities related to publicity (service, procurement) The costs of services incurring in connection with publicity/PR activities can be accounted on this line. Documents to attach: – – – – – – – – – Contracts, orders; Quotations, order. For procurements below the limit stipulated in the Public Procurement Act, according to the Procurement Guide; Documents of the public procurement, provided the service to be procured is subject to public procurement procedures; Invoice or any other certificate authentically documenting the business event; Certificate of disbursement; Documents certifying fulfilment; Report on the completed activity; Attendance sheet of the event, photos; Deposit copies published/issued. 7. Professional services The costs of professional services directly connected to the activities or inevitable for project implementation are eligible. For instance the costs of publications, studies, conferences, project events, if the entrepreneur providing the service issues an invoice (broken down to partial activities, when providing more than one activity) on these costs (and the Small Project Executing Agency designates the partial activities in an itemized invoice statement during financial settlement). Publications and studies Should indicate the total cost of the documents, including editing, translation, printing costs. 29 Twinning and Partnership Block Grant Guidelines for Small Project Executing Agencies Conferences / project events Should indicate the total cost of each event, including: rental of the site, rental of assets, translators, interpreters, and supply. The costs of accommodation, meals and travel shall only be eligible against an invoice issued by the service provider to the Small Project Executing Agency’s or its Partner’s name. 8. Other services Services related to fulfilling the obligations identified in the Implementation Agreement: Costs of activities related to information supply and publicity (e.g. production of brochures and information leaflets, communication campaigns etc.), Costs connected to the management of the public procurement procedure, Other translation cost 3.2. Non-Eligible Costs The following costs are non-eligible: Deductible VAT or other taxes, or taxes not debited on the Small Project Executing Agency or its Partner, Costs incurring beyond the eligibility period, Costs of banking and financial transactions: settlement of outstanding interests, cost of credit overdrawing, other financial administrative costs (but the fee charged for opening and managing an appropriated sub-account or a separate bank account, and the cost of transferring the grant amount to the Partner is eligible), as well as the costs of bank transfer transactions, exchange commissions and losses, Payment of commissions, dividend and profit, Acquisition of business share and shares, Costs of financial guarantees and collaterals provided by financial institutions, Penalties, fines, costs of legal actions, General costs, indirect costs, Procurements not connected to the Project, Application writing costs, Acquisition or rent of real estate and land, Amortisation cost, depreciation Contribution in kind, Part of project management costs in excess of 10% of the total project cost. 30 Twinning and Partnership Block Grant Guidelines for Small Project Executing Agencies The costs shall be considered as costs incurring in the eligibility period if disbursement, invoicing, delivery of the subject of procurement (e.g. procurement of goods and services etc.) all took place within this term. Project implementation shall comprise each step (level) from the commencement of implementation to the realization of the approved Project, including any necessary measures affecting publicity. The Small Project Executing Agency and the Swiss Partner must not have any income generated in connection with the implementation of the Small Project. 3.3. VAT and other taxes VAT which cannot be recovered by the Small Project Executing Agency according to the Hungarian/Swiss legislation, and all other levies and taxes, which are definitely charged to the Small Project Executing Agency or its Partners, can be settled within the project. According to the VAT statement, which is attached to the Small Project Implementation Agreement: If the Small Project Executing Agency or the Partner is not entitled to deduct the VAT (e.g. subject to simplified entrepreneurial tax, carrying out tax-exempt activities, exempt from VAT), the gross total amount of the project shall constitute the basis for funding. Total amount eligible = gross total amount (net total amount + VAT) If the Small Project Executing Agency is liable to VAT, who is entitled to recover the tax passed on during the sales of goods or the provision of services, the Executing Agency can recover the VAT to an extent proportionate to the funding. The basis for funding is the total amount of the project, net of the deductible or recoverable VAT, that is, the VAT deductible or recoverable by the Executing Agency in accordance with the provisions of Act CXXVII of 2007 on VAT, cannot be included in the budget of the project, among the eligible costs. Total amount eligible = net total amount If the Small Project Executing Agency is liable to VAT, and shall determine the deductible and non-deductible VAT amounts on a pro rata basis in relation to the Implementation Agreement, only the proportionally adjusted amount can be settled. In this case, the pro rata calculation shall also be attached to the settlement, and it shall include the reference year, that is, the year for which the ratio is calculated. If on the basis of reverse taxation provided for in Article 142 of Act CXXVII of 2007 on VAT, the Small Project Executing Agency is required to pay VAT as purchaser of goods or user of services, and has no right to deduct the VAT in this respect, the payment of the tax related to the invoice can be charged to the funding based on the document justifying this payment (bank account statement). 31 Twinning and Partnership Block Grant Guidelines for Small Project Executing Agencies Annexes (separate file) Annex 1: Format of the Amendment to the Small Project Implementation Agreement Annex 2: Interim Project Report Form – Narrative Report Annex 3: Excel tables to the interim reports: - Summary of invoices Summary of costs Summary of tenders and contracts Annex 4: Template of the Project Completion Report Annex 5: Statements and tables for the reporting of costs of the Swiss Partners 32